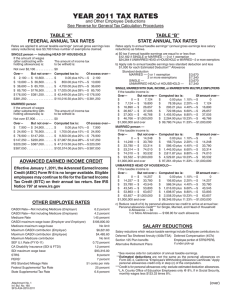

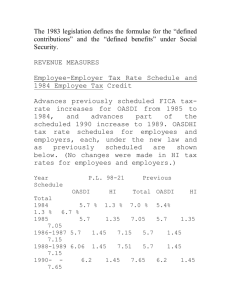

20-Jan-15 Year Maximum taxable earnings OASDI tax rate [2] HI tax

advertisement

![20-Jan-15 Year Maximum taxable earnings OASDI tax rate [2] HI tax](http://s3.studylib.net/store/data/008737622_1-9c9a9f87a888df5096400a73b940d298-768x994.png)

20-Jan-15 Historical Social Security Tax Rates [1] Year Maximum taxable earnings OASDI tax rate [2] HI tax rate [3] Year Maximum taxable earnings OASDI tax rate [2] HI tax rate [3] 14,100 15,300 16,500 17,700 22,900 9.9% 9.9% 9.9% 10.1% 10.16% 1.8% 1.8% 1.8% 2.0% 2.1% 1937 1938 1939 3,000 3,000 3,000 2% 2% 2% - 1975 1976 1977 1978 1979 1940 1941 1942 1943 1944 3,000 3,000 3,000 3,000 3,000 2% 2% 2% 2% 2% - 1980 1981 1982 1983 1984 25,900 29,700 32,400 35,700 37,800 10.16% 10.7% 10.8% 10.8% 11.4% 2.1% 2.6% 2.6% 2.6% 2.6% 1945 1946 1947 1948 1949 3,000 3,000 3,000 3,000 3,000 2% 2% 2% 2% 2% - 1985 1986 1987 1988 1989 39,600 42,000 43,800 45,000 48,000 11.4% 11.4% 11.4% 12.12% 12.12% 2.7% 2.9% 2.9% 2.9% 2.9% 1950 1951 1952 1953 1954 3,000 3,600 3,600 3,600 3,600 3% 3% 3% 3% 4% - 1990 1991 1992 1993 1994 51,300 53,400 55,500 57,600 60,600 12.4% 12.4% 12.4% 12.4% 12.4% 2.9% 2.9% 2.9% 2.9% 2.9% 1955 1956 1957 1958 1959 4,200 4,200 4,200 4,200 4,800 4% 4% 4.5% 4.5% 5% - 1995 1996 1997 1998 1999 61,200 62,700 65,400 68,400 72,600 12.4% 12.4% 12.4% 12.4% 12.4% 2.9% 2.9% 2.9% 2.9% 2.9% 1960 1961 1962 1963 1964 4,800 4,800 4,800 4,800 4,800 6% 6% 6.25% 7.25% 7.25% - 2000 2001 2002 2003 2004 76,200 80,400 84,900 87,000 87,900 12.4% 12.4% 12.4% 12.4% 12.4% 2.9% 2.9% 2.9% 2.9% 2.9% 1965 1966 1967 1968 1969 4,800 6,600 6,600 7,800 7,800 7.25% 7.7% 7.8% 7.6% 8.4% 0.7% 1.0% 1.2% 1.2% 2005 2006 2007 2008 2009 90,000 94,200 97,500 102,000 106,800 12.4% 12.4% 12.4% 12.4% 12.4% 2.9% 2.9% 2.9% 2.9% 2.9% 1970 1971 1972 1973 1974 7,800 7,800 9,000 10,800 13,200 8.4% 9.2% 9.2% 9.7% 9.9% 1.2% 1.2% 1.2% 2.0% 1.8% 2010 2011 [4] 2012 [4] 2013 2014 106,800 106,800 110,100 113,700 117,000 12.4% 10.4% 10.4% 12.4% 12.4% 2.9% 2.9% 2.9% 2.9% 2.9% 2015 118,500 12.4% 2.9% Notes: Amounts for 1937-74 and for 1979-81 were set by statute; all other amounts were determined under automatic adjustment provisions of the Social Security Act. Before 1989, the tax rate on self employed persons was less than the combined tax rate on employers and employees. For 1991, 1992 and 1993, the upper limits on earnings subject to HI taxes were $125,000, $130,200 and $135,000 respectively. The upper limit was repealed by the Omnibus Budget Reconciliation Act of 1993. [1] The tax rate refers to the combined rate for employers and employees. [2] OASDI refers to the "Old-Age, Survivors, and Disability Insurance" program. [3] HI refers to Medicare's Hospital Insurance program. [4] For 2011 and 2012, the OASDI tax rate on wages for employees and self-employed individuals is reduced from 6.2% to 4.2%. The OASDI tax rate on employers remains at 6.2%. Sources: Social Security Administration, http://www.ssa.gov/OACT/COLA/cbb.html and http://www.ssa.gov/OACT/ProgData/taxRates.html, last accessed January 20, 2015.