RE-8-304 Real Estate Workbook

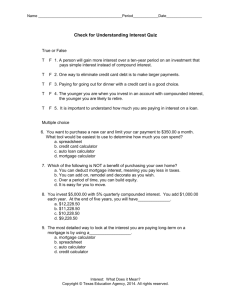

advertisement