Chapter 9: Inventories: Additional Valuation Issues

advertisement

Chapter 9

page 1 of 19

Chapter 9: Inventories: Additional Valuation Issues

Course Objectives:

Review the Accounting Cycle and Financial Statements: Chapters 1-5 √

Introduce the Concept of the time value of money: Chapter 6 √

Discuss accounting for:

o Cash: Chapter 7 √

o Receivables: Chapter 7 √

o Inventory: Chapter 8 √ and 9

1) Lower of Cost or Market:

a General:

i) Definitions:

(1) Cost:

Computed using a historical cost-based method (e.g., specific identification, average cost,

FIFO, or LIFO.)

(2) Market:

ii) Reporting: Lower of Cost or Market (LCM) concept:

(1)

(2)

(3)

iii) Application of LCM: First, apply one of cost flow methods discussed in Chapter 8. Then,

apply LCM rule.

iv) Rationale for LCM: Accountants justify the departure from the ________________________

because of the ________________________. That is, the loss in inventory (cost to replace –

historical cost = loss in inventory) should be ___________ against revenues when the loss

occurs (not in the period where the inventory is sold.) This is a _______________________

approach to inventory valuation.

b

Lower of Cost or Market – Ceiling and Floor:

i) Using replacement cost is based on assumption that change in replacement cost will be directly

proportional to change in selling price.

ii) If a reduction in replacement cost does not actually represent a reduction in utility, two

additional valuation limitations are used to value ending inventory:

Chapter 9

page 2 of 19

(1)

(2)

iii) Lower of Cost or Market Rule: Inventory is valued at the lower of cost or market, where

market is limited as follows:

(1) Market should not be greater than the NRV. (This is also called the CEILING; upper

limit for market.)

(2) Market should not be less than {NRV - normal profit margin}. (This is also called the

FLOOR; lower limit for market.

(3) Rule Summarized:

(a)

(b)

(c)

c

iv) The ceiling and floor exist to prevent inventory from exceeding net selling price or being less

than net selling price less a normal profit margin.

(1) The ceiling covers obsolete, damaged, or shopworn material. It prevents overstatement of

inventories and understatement of loss in current period.

(2) The floor prevents understatement of inventory and overstatement of loss in current period.

How Lower of Cost or Market Works:

i) The amount that is compared to cost (designated market value) is always the ______________

of three amounts:

(1)

(2)

(3)

(That is, whichever of the three produces the amount that falls in the MIDDLE is the

designated market value.)

Chapter 9

page 3 of 19

ii) Example (Illustration 9-4 page 425) of determining Designated Market Value:

Food

A

B

C

D

E

Replacement

Cost

$88

$90

$45

$36

$105

NRV

(Ceiling)

$120

$100

$40

$72

$92

NRV – normal profit

margin (Floor)

$104

$70

$27.5

$48

$80

Designated

Market Value

iii) Next, we compare designated market value to cost to determine the LCM.

Food

A

B

C

D

E

Cost

$80

$100

$50

$90

$95

Designated Market Value

Final Inventory Value

iv) Note: You could work this problem using only one table. See Illustration 9-5 on page 425.

v) LCM only applies to losses in value that occur in ___________________________________.

If goods are damaged or deteriorated (i.e., outside the normal course of business), the

inventory amounts for these goods should be reduced to net realizable value. If material, these

goods may be carried in separate inventory accounts.

d

Methods of Applying Lower of Cost or Market:

i) The LCM rule may be applied in different ways:

(1)

(2)

(3)

ii) If major category or total inventory approach is selected, increases in market prices tend to

offset decreases in market prices. That is, market values higher than cost are offset against

market values lower than cost.

iii) Applying LCM on item by item basis:

(1) Most common practice.

(2) Required by tax rules (unless impractical.)

(3)

iv) Using a LCM Application:

(1) Pick method that most clearly reflects income.

(2) Once select method, consistently use this method from one period to the next.

Chapter 9

page 4 of 19

v) Example (Illustration 9-6; page 426):

Cost

Designated

market

A

B

C

Total frozen

$80

100

50

$230

$104

90

40

$234

Canned

D

E

Total canned

$90

95

$185

$48

92

$140

Lower of Cost or Market By:

Individual

Major

Total

Items

Categories

Inventory

Frozen

$415

$374

TOTAL

vi) Example (BE9-1): Presented below is information related to Alstott Inc.’s inventory.

Determine the following: (a) the two limits to market value (i.e., the ceiling and the floor) that

should be used in the LCM computation for skis; (b) the cost amount that should be used in the

LCM comparison of boots; and (c) the market amount that should be used to value parkas on

the basis of the LCM.

Skis

Historical Cost

Selling price

Cost to distribute

Current replacement cost

Normal profit margin

vii) ANSWER:

(a) Skis:

(b)

(c)

Boots

$190

$217

$19

$203

$32

Parkas

$106

$145

$8

$105

$29

$53

$73.75

$2.50

$51

$21.25

Chapter 9

page 5 of 19

viii) Example (BE9-2): Robin Corporation has the following four items in its ending inventory.

Determine the final lower of cost or market inventory value for each item.

Item

Jokers

Penguins

Riddlers

Scarecrows

ix) ANSWER:

Item

Jokers

Penguins

Riddlers

Scarecrows

Cost

$2,000

5,000

4,400

3,200

Replacement

Cost

$1,900

5,100

4,550

2,990

Cost

NRV

$2,100

4,950

4,625

3,830

Designated Market

NRV – normal

profit margin

$1,600

4,100

3,700

3,070

LCM

$2,000

5,000

4,400

3,200

x) HOMEWORK: You should now be able to do E9-1, E9-2, P9-1, and P9-10.

e

Recording “Market” Instead of Cost:

i) Direct Method: Substitutes market value for cost when valuing inventory. Thus, no loss is

reported in income statement b/c loss is buried in COGS.

ii) Indirect (Allowance) Method: Does not change cost amount. Establishes a separate contra

asset account and a loss account to record write-off.

(1) The advantage of using this method is that the loss due to market decline is shown

separately from COGS in the income statement. (Note: This is not an extraordinary item.)

Thus, COGS is not distorted.

(2) Problem arises when deciding what to do with the Allowance account in the following

year. Some accountants leave this account on the books and adjust to balance each year.

(Thus, if prices are declining, a loss is recorded. If prices are rising, recovery of a

previously recognized loss is recorded. Sometimes this is referred to as a “gain”.

However, NO actual gains are recognized. See Illustration 9-7 on page 427.) Recognition

of “gain” or loss has same effect on net income as closing allowance balance to beginning

inventory of to COGS. Recovery of the loss up to the original cost is permitted, but it

may not exceed original cost.

Chapter 9

page 6 of 19

iii) Example: The following illustrations of entries under both methods are based on the following

inventory data:

Inventory

At Cost

At Market

Beginning of the period

$65,000

$65,000

End of the period

$82,000

$70,000

Income Statement Presentation:

Direct Method: Loss is buried in COGS.

Indirect or Allowance Method: This presentation is preferable b/c it clearly discloses loss

resulting from market decline of inventory prices.

Chapter 9

page 7 of 19

The following entries assume the use of a PERIODIC inventory system:

Preliminary Closing Entry:

Direct Method (Ending Inventory Recorded at Market)

Indirect Method (Ending Inventory Recorded at Cost)

To write down inventory to market:

Direct Method:

Indirect Method:

The following entries assume the use of a PERPETUAL inventory system:

NOTE: No inventory closing entries are necessary under perpetual method; only reduction to

market is recorded.

To reduce inventory from cost to market:

Direct Method:

Indirect Method:

Chapter 9

page 8 of 19

iv) Example (BE9-3): Battletoads Inc. uses a perpetual inventory system. At January 1, 2008,

inventory was $214,000 at both cost and market value. At December 31, 2008, the inventory

was $286,000 at cost and $269,000 at market value. Prepare the necessary December 31 entry

under (a) the direct method and (b) the indirect method.

ANSWER:

(a) Direct Method:

(b) Indirect Method:

v) Homework: You should not be able to work P9-3.

f

Evaluation of the Lower of Cost or Market Rule:

i) Recognize decreases in asset value and charge to expense in period of loss in inventory value –

not in sales period.

ii) LCM leads to possible valuation inconsistencies. Inventory may be valued at cost one year

and market the next year.

iii) Using LCM leads to a conservative balance sheet. However, effect on income statement may

or may not be conservative.

iv) LCM uses a “normal profit” when calculating inventory values. Since “normal profit” is an

estimated figure based upon past experience, it is subjective and provides an opportunity to

manipulate income.

2) Valuation Bases:

a Valuation at Net Realizable Value:

i) Typically, record inventory at cost or LCM. In a FEW situations, it is okay to record

inventory at NRV even if that amount is above cost. NRV is permitted when:

(1) There is a controlled market with a quoted price applicable to all quantities. (e.g., minerals

such as rare metals and agricultural products.)

(2) No significant costs of disposal are involved.

ii) Inventories are sometimes carried at sales price less distribution costs (e.g., meat-packing

industry.)

b Valuation Using Relative Sales Value: Problems arise when goods are bought in a lump-sum

purchase (i.e., basket purchase.) The most common practice is to allocate the total cost among the

various units on the basis of their relative sales value. The relative sales value method is used in

the petroleum industry to value (at cost) the products obtained from a barrel of crude oil. (See

Illustrations 9-10 and 9-11 on page 430.)

Chapter 9

page 9 of 19

i) Example (BE9-4): PC Plus buys 1,000 computer game CDs from a distributor who is

discontinuing those games. The purchase price for the lost is $6,000. PC Plus will group the

CDs into three price categories for resale, as indicated below. Determine the cost per CD for

each group, using the relative sales value method.

Group

1

2

3

ii) ANSWER:

No. of CDs

100

800

100

Group

No. of

CDs

Sales

Price

1

100

$5

2

3

800

100

$10

$15

Price per CD

$5.00

$10.00

$15.00

Total

Sales

Price

$500

8,000

1,500

$10,000

iii) Homework: You should now be able to work E9-7 and E9-8.

c

Purchase Commitments – A Special Problem:

i) Purchase Commitments:

ii) Reporting:

(1) Not recorded by buyer if:

(a)

(b)

(2) If contract is non-cancelable, journal entries to record depend on market price changes:

(3)

Chapter 9

page 10 of 19

iii) Example (adapted from page 432): St. Regis Paper Co. signed timber-cutting contracts to be

executed in 2007 at a firm price of $10,000. The market price of the timber on December 31,

2008 dropped to $7,000.

Record the following entry:

(The unrealized holding loss would be reported in the income statement under “Other expenses

and losses.” The Estimated Liability credit balance is reported in current liabilities.

When Regis cuts the timber in March 2008:

(The company paid $10,000 for a contract worth only $7,000. The loss was recorded in the

previous period – when the price actually declined.)

If the price is partially or fully recovered before the timber is cut, the Estimated liability is

reduced. A resulting gain is then reported in the period of the price increase for the amount of

the partial or full recovery.

For example: Market price in 2008 is $8,000.

For example: Market price in 2008 is $11,000.

(Only recover the amount up to the contract price.)

However, if the market price at the time the timber is cut is $6,500, St. Regis will have to

recognize a further loss.

Chapter 9

page 11 of 19

iv) Purchasers may protect themselves from declines in market values through hedging.

Hedging: A purchaser may enter into a futures contract to sell the same quantity of the same

or similar goods at a fixed price. When a company holds a buy position in a purchase

commitment and a sell position in a futures contract in the same commodity, it will be better

off under one contract by approximately (maybe exactly) the same amount by which it is

worse off under the other contract.

v) Conflict exists about how purchase commitments should be reported: Assets/Liabilities at

time contract signed vs. recognition at delivery date.

vi) Example (BE9-5): Beavis Company signed a long-term noncancelable purchase commitment

with a major supplier to purchase raw materials in 2008 at a cost of $1,000,000. At December

31, 2007, the raw materials to be purchased have a market value of $930,000. Prepare any

necessary December 31 entry.

ANSWER:

vii) Example (BE9-6): Use the information for Beavis Company from BE9-5. In 2008, Beavis

paid $1,000,000 to obtain the raw materials, which were worth $930,000. Prepare the entry to

record the purchase.

ANSWER:

viii)

Homework: You should now be able to work E9-10.

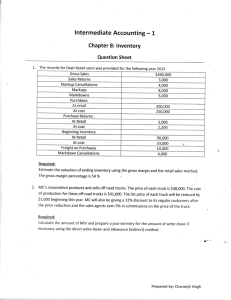

3) The Gross Profit Method of Estimating Inventory:

a General:

i) Gross Profit (or Gross Margin) Method: alternative method of verifying or determining

inventory when physical count is impractical.

ii) Used by auditors when need inventory estimation. Used when inventory records have been

destroyed.

iii) Based on three assumptions:

(1) BI + Purchases = Total goods to be accounted for.

(2) Goods not sold must be on hand.

(3) If we subtract sales (reduced to cost) from the sum of opening inventory plus purchases,

the result is ending inventory.

iv) All information needed to compute inventory at cost (except for the gross profit percentage) is

available in current period’s records. The gross profit percentage is determined by reviewing

company policies or prior period records.

Chapter 9

b

page 12 of 19

Computation of Gross Profit Percentage:

i) The gross profit percentage is usually given as a percentage of selling price.

ii) Formulas (See examples on page 435.):

(1) Cost + Gross Profit = Selling Price

Percentage _ markup _ on _ cos t

(2) Gross _ Pr ofit _ On _ Selling _ Pr ice

100% Percentage _ markup _ on _ cos t

Example:

Gross _ profit _ on _ selling _ price

100% Gross _ profit _ on _ selling _ price

(4) Because SP > Cost and GP is the same amount for both SP and Cost, GP on SP will always

be less than the related percentage based on cost. Sales may not be multiplied by a costbased markup percentage; the gross profit percentage must be converted to a percentage

based on selling price.

Evaluation of Gross Profit Method:

i) Disadvantages of the GP Method:

(1) It provides an estimate. Physical inventory must be taken once a year to verify that

inventory is actually on hand.

(2) Uses past percentages. Although past often provides answers for the future, a current rate

would be better.

(3) Be careful using a blanket gross profit rate. Different merchandise will likely have

different gross profit rates.

ii) Not acceptable for annual financial reporting purposes. Must have a physical inventory.

Permitted for interim reports (but must disclose.)

iii) Closely follows inventory method used b/c it is based on historical records.

(3) Percentage _ markup _ on _ cos t

c

d

Example (BE9-7): Big Hurt Corporation’s April 30 inventory was destroyed by fire. January 1

inventory was $150,000, and purchases for January through April totaled $500,000. Sales for the

same period were $700,000. Big Hurt’s normal gross profit percentage is 31%. Using the gross

profit method, estimate Big Hurt’s April 30 inventory that was destroyed by fire.

ANSWER:

e

Homework: You should now be able to work E9-12, E9-13, P9-4, P9-5, and E9-16.

4) Retail Inventory Method:

a General:

i) Retail Inventory Method: Observe pattern between cost and price. Then, convert price to

cost. Method is very common. Requires record kept of:

(1)

Chapter 9

page 13 of 19

(2)

(3)

ii) Retail Inventory Method Process:

(1)

(2)

(3)

iii) Example: (Illustration 9-17 on page 437.)

Cost

Beginning inventory

+ Purchases

= Goods available for sale

- Sales

= Ending inventory at retail

Retail

$14,000

63,000

$77,000

$20,000

90,000

110,000

85,000

$25,000

Ratio of cost to retail

Ending inventory at cost

b

iv) Different versions of the retail inventory method exist: the conventional (lower of average cost

or market method, the cost method, the LIFO retail method, and the dollar-value LIFO retail

method.

v) Advantage of Retail Inventory Method: can be approximated without a physical count.

Great for interim reports because it provides a fairly quick and reliable measure of inventory.

Retail Method Terminology (example on p437-438 provides good explanation of terminology):

i) Markup: (1) Additional increase in price over the original retail price (for retailers, p 437). (2)

Difference between retail and cost (p 435).

ii) Markup cancellations: Decreases in prices of merchandise that had been marked up above

original retail price.

iii) Markdowns: Decrease in price below the original sales price. Generally arise because of a

decrease in the general price level, special sales, soiled/damaged goods, overstocking, and

competition.

iv) Markdown cancellations: Markdowns are later offset by increases in prices of goods that had

been marked down.

v) Note: Neither a markup cancellation nor a markdown cancellation can exceed the original

markup or markdown.

Chapter 9

c

page 14 of 19

Retail Inventory Method with Markups and Markdowns – Conventional Method:

i) To obtain appropriate inventory, must properly treat markups, markup cancellations,

markdowns, and markdown cancellations.

ii) Example (See page 438.):

(1) Assumption A (Conventional Retail): Computes a cost ratio after markups (and markup

cancellations) but before markdowns.

(2) Assumption B (Cost Method): Computes a cost ratio after both markups and markdowns

(and cancellations.)

iii) Conventional Retail method uses assumption A only. It is designed

to_________________________________________________________________________.

To approximate the lower of cost or market, the cost-to-retail ratio must be established by

dividing the cost of goods available by the sum of the original retail price of these goods plus

the net markups. The markdowns and markdown cancellations are excluded because this gives

a better approximation of LCM. (See iv(2) below.) This approach is also called the lower of

cost or market approach or the conventional retail inventory method.

iv) Example:

(1) If markdowns are considered in the cost-to-retail ratio (assumption B), we compute the

ending inventory as:

Cost

Retail

Purchases

$10

$20

Less: Markdowns

8

Ending Inventory, retail

$12

Cost-to-retail ratio

Ending inventory at cost

This approach is the _______________________.

(2) If markdowns are not considered, the result is the ______________________________

(assumption A.)

Cost

Retail

Purchases

$10

$20

Cost-to-retail ratio

Ending inventory at cost

d

Special Items Relating to Retail Method:

i) Freight Costs (Freight-In): Add to purchases.

ii) Purchase Returns: Subtract from price at cost (i.e., purchases) and retail.

iii) Purchase Discounts and Allowances: Subtract from purchases. If allowance does not lead to

a reduction in the selling price, do not adjust the retail column.

iv) Sales returns and allowances: Subtract from gross sales.

v) Sales Discounts: Not recognized when sales are recorded gross.

vi) Transfers-in (from another department): report in same way as purchases from outside

enterprise.

Chapter 9

e

f

page 15 of 19

vii) Normal shortages (e.g., breakage, damage, theft, and shrinkage): Subtract from the retail

column because these goods are no longer available for sale. (Selling price should initially be

set to cover such shortages.)

viii) Abnormal shortages: Deduct from both cost and retail columns. Report as a special

inventory amount or as a loss.

ix) Employee discounts: Subtract from retail column in same manner as sales. Should not be

considered in cost-to-retail percentage.

x) See illustration 9-22 on page 441.

Evaluation of Retail Inventory Method:

i) Reasons to use Retail Inventory Method:

(1) Permits computation of net income without physical count of inventory.

(2) Control measure in determining inventory shortages.

(3) Can help regulate quantities of merchandise on hand.

(4) Provides insurance information.

ii) This method has an averaging effect on varying rates of gross profit. When applied to an

entire business where rates of gross profit vary among departments, no allowance is made for

possible distortion of results because of such differences.

Example (BE9-8): Bimini Inc. had beginning inventory of $12,000 at cost and $20,000 at retail.

Net purchases were $120,000 at cost and $170,000 at retail. Net markups were $10,000; net

markdowns were $7,000; and sales were $157,000. Compute ending inventory at cost using the

conventional retail method.

ANSWER:

Cost-to-retail ratio:

Ending inventory at LCM:

g

Homework: You should now be able to work E9-20, E9-22, and P9-8.

5) Presentation and Analysis:

a Presentation of Inventories:

Accounting standards require financial statement disclosure of composition of inventory,

inventory financing arrangements, and inventory costing methods used. These costing methods

must be consistently applied from one period to the next.

i) Manufacturers should report inventory composition in balance sheet or in a separate schedule

in notes.

ii) Significant of unusual financing arrangements relating to inventories may require note

disclosure.

Chapter 9

b

page 16 of 19

iii) Basis upon which inventory amounts are stated (lower of cost or market) and the method used

in determining cost (LIFO, FIFO, average cost, etc.) should be reported.

iv) Changes in accounting principle require explanatory paragraph in auditor’s report describing

change in method.

Analysis of Inventories: See pages 443-444. You are not responsible for the ratios.

6) Appendix 9A: LIFO Retail Methods:

a LIFO Retail Methods: The application of LIFO retail is made under two assumptions: (1) stable

prices and (2) fluctuating prices.

i) Stable Prices – LIFO Retail Method:

(1) Under LIFO retail method, both markups and markdowns are considered in obtaining costto-retail percentage. Since LIFO method is concerned only with additional layer (or

amount that should be subtracted from previous layer), the beginning inventory is excluded

from the cost-to-retail percentage.

(2) A major assumption of the LIFO retail method is that the markups and markdowns apply

only to the goods purchased during current period and not beginning inventory.

(3) Example: Illustration 9A-1, p 446

Cost

Retail

Beginning inventory – 2007

$27,000

$45,000

Net purchases during the period

346,500

480,000

Net markups

20,000

Net markdowns

(5,000)

Total (excluding BI)

346,500

$495,000

Total (including BI)

$373,500

540,000

Net sales during the period

(484,000)

Ending inventory at retail

$56,000

Establishment of cost-to-retail percentage

under assumptions of LIFO retail

($346,500 / $495,000 = 70%)

(4) Example: Illustration 9A-2 and 9A-3, p 446

This illustration shows that inventory is composed of two layers: the beginning inventory

and the additional increase that occurred in the inventory this period (2007). When we

start 2008, the beginning inventory will be composed of those two layers, and if an

increase in inventory occurs again, an additional layer will be added.

EI at Retail – 2007

$56,000

Layers at Retail Prices

2006

2007

Cost to Retail EI at LIFO Cost

Chapter 9

page 17 of 19

However, if the final inventory figure is below the beginning inventory, it is necessary to

reduce the BI starting with the most recent layer. For example, assume that the EI for 2008

at retail is $50,000. The computation of EI at cost is:

EI at Retail – 2008

$50,000

Layers at Retail Prices

Cost to Retail EI at LIFO Cost

(5) Example (BE9-10): Use the information for Bimini Inc. from BE9-8. Compute ending

inventory at cost using the LIFO retail method. (BI $12,000 cost and $20,000 retail; Net

purchases $120,000 cost and $170,000 retail; Markups $10,000; Markdowns $7,000; Sales

$157,000)

ANSWER:

ii) Fluctuating Prices – Dollar-Value LIFO Retail Method: Let’s now assume that the price

level of inventories changes. If the price level changes, the price change must be eliminated

because we are measuring the real increase in inventory, not the dollar increase.

See Illustration 9A-4 on page 447.

Note: This approach is essentially the dollar-value LIFO method previously discussed in Ch8.

In computing the LIFO inventory under a dollar-value LIFO approach, the dollar increase in

inventory is found and deflated to beginning-of-the-year prices. This indicates whether actual

increases or decreases in quantity have occurred. If an increase in quantities occurs, this

increase is priced at the new index to compute the value of the new layer. If a decrease in

quantities happens, it is subtracted from the most recent layers to the extent necessary.

Chapter 9

page 18 of 19

See Illustration 9A-5 on page 447.

Note: The dollar-value method determines the increase that has occurred in the inventory in

terms of base-year prices.

See Illustration 9A-6 on page 447.

Note: Before the conversion to cost takes place, layers of a particular year must be restated to

the prices in effect in the year when the layer was added.

See Illustration 9A-7 on page 448 to see the difference between the LIFO approach (stable

prices) and the dollar-value LIFO method. The difference is a result of an increase in the price

of goods, not of an increase in the quantity of goods.

iii) Subsequent Adjustments Under Dollar-Value LIFO Retail: The dollar-value LIFO retail

method follows the same procedures in subsequent periods as the traditional dollar-value

method discussed in Chapter 8.

(1) That is, when a real increase in inventory occurs, a new layer is added (Ill 9A-8, p448.)

(2) Conversely, when a real decrease in inventory develops, previous layers are “peeled off” at

price in existence when the layers were added (Ill 9A-9, p448.)

(3) As a practical matter, the selection of the retail inventory method to be used often involves

determining which method provides a lower taxable income. Although it might appear

that retail LIFO will provide the lower taxable income in a period of rising prices, such is

not always the case. LIFO will provide an approximate current cost matching, but the

ending inventory is stated at cost. The conventional retail method may have a large writeoff because of the use of the lower of cost or market approach, which may offset the LIFO

current cost matching.

Chapter 9

page 19 of 19

(4) Example (BE9-11): Use the information for Bimini Inc. from BE9-8, and assume the price

level increased from 100 at the beginning of the year to 120 at year end. Compute ending

inventory at cost using the dollar-value LIFO retail method. (BI $12,000 cost and $20,000

retail; Net purchases $120,000 cost and $170,000 retail; Markups $10,000; Markdowns

$7,000; Sales $157,000)

iv) Homework: You should now be able to work E9-25 and E9-26.

b

Changing From Conventional Retail to LIFO:

When changing from conventional retail method to LIFO retail, neither a cumulative adjustment

nor a retroactive adjustment can be made easily. Because conventional retail is a lower of cost or

market approach, the beginning inventory must be restated to a cost basis. The usual approach is

to compute the cost basis from the purchases of the prior year, adjusted for both markups and

markdowns.

See Illustrations 9A-10 and 9A-11 on page 449-450. Know journal entry at bottom of page on

page 448.

Cost _ to _ retail _ ratio

Net _ purchases _ at _ cos t

Net _ purchases _ at _ retail _ plus _ markups _ less _ markdowns