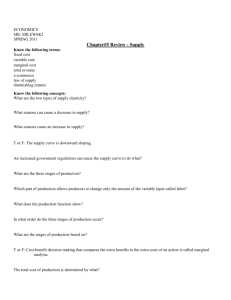

Micro-Economics - Rift Valley University

advertisement