DAVMUN 2011 ECOSOC AGENDA: MONEY LAUNDERING AND

advertisement

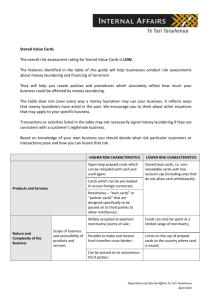

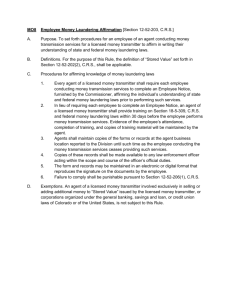

DAVMUN 2011 ECOSOC AGENDA: MONEY LAUNDERING AND TAX EVASION DESCRIPTION OF THE COMMITTEE The United Nations Economic and Social Council is one of the six principal organs of the UN, established under the United Nations Charter in 1945. It coordinates the economic, social, and related work of the 14 UN specialized agencies, functional commissions and five regional commissions. In addition, it receives reports from 11 UN funds and programmes. It consists of 54 members which are elected by the General Assembly. ECOSOC is the central forum for discussing international economic and social issues. It also formulates policy recommendations addressed to Member States and the United Nations system. Its main objectives are: 1. Promote higher standards of living, full employment, and economic and social progress; 2. Identify solutions to international economic, social and health problems; 3. Facilitate international cultural and educational cooperation; and 4. Encourage universal respect for human rights and fundamental freedoms. The ECOSOC can make or initiate studies and reports on these issues. It also has the power to assist the preparations and organization of major international conferences in the economic, social and related fields. Further, the ECOSOC can facilitate a coordinated follow-up to these conferences. The Council's purview extends to over 70 per cent of the human and financial resources of the entire UN system. BACKGROUND ON MONEY LAUNDERING I. MONEY LAUNDERING: A. What is Money Laundering (ML)? According to financial action task force (FATF): Money laundering is the practice of disguising the origins of illegally-obtained money. Ultimately, it is the process by which the proceeds of crime are made to appear legitimate. The money involved can be generated by any number of criminal acts, including drug dealing, corruption, accounting fraud and other types of fraud, and tax evasion B. Various aspects of money laundering: Tax evasion – An illegal practice where a person, organization or corporation intentionally avoids paying his/her/its true tax liability. Those caught evading taxes are generally subject to criminal charges and substantial penalties. Drug Trafficking – Drug traffickers seek to transform the monetary proceeds from their criminal activity into revenue with an apparently legal source. This is known as money laundering. Terrorist financing – It is the collection or the provision of funds for terrorist purposes. In the case of ML, the funds are always of illicit origin, whereas in the case of terrorist financing, funds can stem from both legal and illicit sources. The primary goal of individuals or entities involved in the financing of terrorism is therefore not necessarily to conceal the sources of the money but to conceal both the funding activity and the nature of the funded activity. In both cases, the actor makes an illegitimate use of the financial sector. An effective antimoney laundering (AML)/counter financing of terrorism (CFT) framework must therefore address both risk issues: it must prevent, detect and punish illegal funds entering the financial system and the funding of terrorist individuals, organizations and/or activities. Corruption – Both corruption and money laundering are of great concern for the IMF. Anti-corruption and AML work are linked in numerous ways. ML schemes make it possible to conceal the unlawful origin of assets. Corruption is a source of ML as it generates large amounts of proceeds to be laundered. Corruption may also enable the commission of a ML offense and hinder its detection, since it can obstruct the effective implementation of a country's judicial, law enforcement and legislative frameworks. c. Magnitude of the problem – Recent reports show that the estimated amount of money laundered globally in one year is 2 - 5% of global GDP, or $800 billion - $2 trillion in current US dollars. In accordance with police statistics, a 30% increase in the number of cases of money laundering was reported in Sweden for 2010. In 2011, in an investigation into the suspected laundering of more than GBP 200 million, 15 people were arrested across England. Such evidence underlines the seriousness of the problem governments have pledged to address. C. Stages of Money Laundering: Money-laundering is broken down into a three-stage process: PLACEMENT: initial entry of the funds into the financial system. This involves moving the funds away from direct association with the crime. It can often be the riskiest stage, potentially raising greatest suspicion. The placement stage both relieves the criminal from holding such large funds and places the funds into a legitimate financial arena. LAYERING: moving funds through a series of transactions to conceal their origin. This involves a series of transactions designed to take the focus off of the large, lump sum of money that has just entered the financial system. Intricate and internationally focused, this stage often results in the launderer moving funds across country borders. He/she puts the funds into a series of financial options and markets overseas and keeps them constantly moving to divert others’ attention and focus. In countries with weak legislation, launders more easily can move the funds without detection. INTEGRATION: regaining possession of the funds. At this stage, the laundered money is returned to the criminals involved. But, this time, it appears to have been obtained from legal, legitimate sources. What was once cash placed into the system has now been moved through a series of financial operations and can now be used by the criminals for any purpose. D. Methods of Money Laundering: The crime of money laundering can be realized in many ways: Illegal money import - The smuggler himself, eventually by making use of a messenger or by international transport brings physically the dirty money to a foreign country where the regulation of money market is less developed and/or the legislation prefers the banking secret. Thereafter, as a result of different financial transactions, the money is mixed with the money of legal origin. Smurfing - A team of couriers (nominal partner) place small amount deposits every day in financial institutions. All deposits are below the amount which would call the attention of the banks (value below report limit). When the money is drawn later on, the origin can be certified with the documents belonging to it. Overpayment on tax account: As a result of "incidental procedure error", the private person or the company effects an overpayment of considerable amount to the competent tax office. Then after observation of the error - following filling in of a self-control form - the overpayment is retransferred by the tax office to the bank account of the tax payer, and the origin of money is already certified. Self-financing Loan: The "client" places the dirty money in a foreign country or in a financial haven. After that he transfers the money to a bank in any other country, and then applies for a loan at his own bank, the guaranty, collateral being the deposited money. The bank grants the loan, which will be invested into properties, companies respectively into different financial instruments. In case of any suspicion arisen (e.g. sudden richness) the person concerned can refer without fear to the bank loan. This technique can exploit the different countries' regulations concerning banking secret. Underground/alternative banking Some countries in Asia have well-established, legal alternative banking systems that allow for undocumented deposits, withdrawals and transfers. These are trust-based systems, often with ancient roots, that leave no paper trail and operate outside of government control. This includes the hawala system in Pakistan and India and the fie chen system in China. Shell companies These are fake companies that exist for no other reason than to launder money. They take in dirty money as "payment" for supposed goods or services but actually provide no goods or services; they simply create the appearance of legitimate transactions through fake invoices and balance sheets. Investing in legitimate businesses Launderers sometimes place dirty money in otherwise legitimate businesses to clean it. They may use large businesses like brokerage firms or casinos that deal in so much money it's easy for the dirty stuff to blend in, or they may use small, cash-intensive businesses like bars, car washes, strip clubs or check-cashing stores. These businesses may be "front companies" that actually do provide a good or service but whose real purpose is to clean the launderer's money. This method typically works in one of two ways: The launderer can combine his dirty money with the company's clean revenues -- in this case, the company reports higher revenues from its legitimate business than it's really earning; or the launderer can simply hide his dirty money in the company's legitimate bank accounts in the hopes that authorities won't compare the bank balance to the company's financial statements. II. MONEY LAUNDERING IMPACTS DEVELOPMENT: A. Background: The IMF is concerned about the possible consequences of money laundering and the financing of terrorism on its members' economies and financial systems. These include risks to the soundness and stability of financial institutions and financial systems, increased volatility of international capital flows, and a dampening effect on foreign direct investment. Money laundering and terrorist financing activities can undermine the integrity and stability of financial institutions and systems, discourage foreign investment, and distort international capital flows. Money launderers exploit both the complexity inherent in the global financial system as well as differences between national anti-money laundering laws and systems, and they are especially attracted to jurisdictions with weak or ineffective controls where they can move their funds more easily without detection. In an increasingly interconnected world, problems in one country can quickly spread to other countries in the region or in other parts of the world. B. The Financial Sector: Money Laundering undermines domestic capital formation Money Laundering erodes financial institutions: Banks, equity markets, and non-bank financial institutions (NBFIs), such as insurance companies, are a favoured means of laundering illicit funds both internationally and within developing countries. The development of sound, reliable banks and NBFIs is a crucial element in overall economic development: indeed, such institutions have come to be recognized as essential for such development and—particularly in developing countries—customer trust is fundamental to the growth of sound financial institutions. Money laundering activity increases the probability that individual customers, or the institution itself, will be defrauded by corrupt individuals within the institution. The possibility is even greater in a developing country that criminal interests can eventually control an entire financial institution. Developing country financial regulation and supervision tends to be less rigorous than that in developed countries, which themselves have problems with criminal penetration of institutions or lower-level fraud. Money laundering weakens the financial sector's role in economic Growth : Confidence and reputation play a special role in developing economies' financial systems. Money laundering's negative impact on economic growth is of particular concern in a developing-country context for at least 2 reasons. First, in many of these countries the largest, most sophisticated financial institutions have historically relied heavily on public funds rather than private deposits. Second, financial institutions in developing countries are often undergoing a transition from being state-owned to private-investor ownership and control. Even outside the realm of anti-money-laundering efforts, developing countries may be unable to gain full access to international economic resources as a result of money laundering problems. C. The Real Sector: Money Laundering depresses Growth Money laundering distorts investment and depresses productivity: Criminal organizations can transform productive enterprises into sterile investments (investments that do not generate additional productivity for the broader economy) by operating them for the purposes of laundering illicit proceeds rather than as profit-maximizing enterprises responsive to consumer demand and worthy of legitimate investment capital. Commitment of the economy's resources to sterile, as opposed to productive, investments (or to normal consumption expenditures that drive productive investments through higher demand) ultimately reduces the productivity of the overall economy. Money laundering facilitates corruption and crime at the expense of economic development: Money laundering reduces criminals' cost of crime, thereby increasing the level of crime. An efficient money-laundering channel is a key "input" to crime because the financial proceeds from crime are less valuable to the criminal (in a sense, an "unfinished product") than are laundered funds. Higher crime and corruption reduces economic growth. The damaging economic effects of corruption facilitated by money laundering are particularly acute in the public sector in many developing countries because of the larger role the government often plays in providing goods and services. D. The External Sector: Money Laundering distorts capital and trade flows Outbound flows: facilitating illicit capital flight The obvious effect of illicit capital flight is to worsen the scarcity of capital in developing countries. Money laundering can be seen as a key element in illicit capital flight from throughout the developing world. Each of the major episodes of rapid, large -scale illicit capital flight from developing (and transition) countries has been facilitated with identifiable centres of money laundering activity. Inward capital flows: depressing foreign investment A large body of economic research shows that a high incidence of ML activity deters inward portfolio investment and foreign direct investment to developing economies. The effect of extensive money laundering in a developing country is in many ways more serious because of the special benefits, such as technology, labour skills and know-how, and immediate access to international distribution channels, which such foreign resources bring to developing economies. Trade: distorting prices and content A money laundering technique that does not directly involve the financial system or expenditures in the real domestic economy is the use of inaccurate pricing of imports or exports to hide the transfer of funds during the layering process within what appears to be a value -for -value transaction. When such transactions are extensive, the impact on a country's entire external sector can be substantial. In other words, the demand for foreign exchange was being inflated by money-laundering activities using trade channels, thus driving up the "price" of foreign exchange, which is the exchange rate. III. CASES OF MONEY LAUNDERING: A. France - Beginning in late 2001, French authorities launched a series of investigations into officials of France’s leading banks in connection with fraud, tax evasion, and money laundering. According to press reports, “thousands of French cheques, some of them stolen, were ‘endorsed’ or signed over to new beneficiaries before being cashed at money-changers in Israel”, and then the proceeds were returned to France through correspondent banking relationships. The amounts involved exceeded $70 million. B. Germany - Since its bankruptcy in 1995, Dusseldorf prosecutors have been investigating 10 former employees of a private bank, BVH, on "suspicion of fraud, disloyalty and money laundering". It has now been alleged that the bank laundered funds in the form of bogus credits, and redirected them to a firm believed to have belonged to Osama Bin Laden's Al-Qaida network. C.U.S.A In 1996, Harvard-educated economist Franklin Jurado went to prison for cleaning $36 million for Colombian drug lord Jose Santacruz-Londono. People with a whole lot of dirty money typically hire financial experts to handle the laundering process. It's complex by necessity: The whole idea is to make it impossible for authorities to trace the dirty money while it's cleaned. IV. INTERNATIONAL RESPONSE: A. The United Nations: The Vienna Convention: In 1988, the UN, through the United Nations Drug Control Program (UNDCP) initiated the United Nations Convention Against Illicit Traffic in Narcotic Drugs and Psychotropic Substances (Vienna Convention), an international agreement to combat drug trafficking and money laundering. The convention defines the ML and calls upon countries to criminalize the activity. The Palermo Convention: In 2000, the UN adopted The International Convention Against Transnational Organized Crime (Palermo Convention). The Convention focuses on criminalizing money laundering, establishing regulatory regimes to deter and detect all forms of money laundering, authorizing the cooperation and exchange of information among administrative, regulatory, law enforcement and other authorities and promote international cooperation. International Convention for the Suppression of the Financing of Terrorism(1999) Security Council Resolution 1373(2001) Global Programme against Money Laundering The Counter-Terrorism Committee B. The Financial Action Task Force on Money Laundering: Formed in 1989 by the G-7 countries, the FATF is an intergovernmental body whose purpose is to develop and promote an international response to combat money laundering and the financing of terrorism. FATF is a policy-making body, which brings together legal, financial and law enforcement experts to achieve national legislation and regulatory AML and CFT reforms. The following are its primary functions: Monitoring members’ progress in implementing anti-money laundering measures. Reviewing and reporting on laundering trends, techniques and countermeasures. Promoting the adoption and implementation of FATF anti-money laundering standards globally. FATF has adopted a set of 40 recommendations, The Forty Recommendations on Money Laundering (The Forty Recommendations), which constitute a comprehensive framework for AML and are designed for universal application by countries throughout the world. C. The Basel Committee on Banking Supervision: The Basel Committee on Banking Supervision (Basel Committee) was formed in 1974 by the central bank governors of the Group of 10 countries. It formulates broad supervisory standards and guidelines and recommends statements of best practices on a wide range of bank supervisory issues. Three of the Basel Committee’s supervisory standards and guidelines concern money laundering issues. Statement of Principles on Money Laundering Core Principles for Banking Customer Due Diligence D. International Association of Insurance Supervisors(1949) E. International Organization of Securities Commissioners F. The Egmont Group of Financial Intelligence V. CRITICAL THINKING: 1. What is the difference between money laundering and terrorist financing? 2. What factors are considered by law enforcement when it assesses whether or not an institution or its personnel are guilty of aiding and abetting money laundering? 3. What is the history of money-laundering in your country? 4. Have there been any major events of illicit fund transfer to or out of the country? 5. What sources of illicit funds are of particular concern? 6. What percentage of your country’s annual income is laundered money, in comparison with other nations? 7. Has your country’s economic system been harmed by money-laundering? 8. How has it affected inflation rates and the value of money within your country’s financial system? 9. What measures has your country taken to curb money-laundering and terrorist financing, both domestically and internationally? What steps can your country still take? 10. How does the global illicit drug trade affect your country’s economy? 11. Of the amount of money associated with the drug trade, how much of that is laundered? 12. Has your country been directly affected by terrorist acts? If so, what does your country know about the ways terrorists have gained their funding? 13. Has your country been accused of obstructing cooperation on the issue? 14. Is your country sufficiently equipped to implement obligations? VI. TERMS AND CONCEPTS: 1. Paper trail- Documents (as financial records) from which a person's actions may be traced or opinions learned. 2. Dirty Money- Goods or money obtained illegally. 3. Inflation- A continuing rise in the general price level usually attributed to an increase in the volume of money and credit relative to available goods and services. 4. Typologies- The various techniques used to launder money or finance terrorism. 5. Reputational Risk - the potential that adverse publicity regarding a bank’s business practices and associations, whether accurate or not, will cause a loss of confidence in the integrity of the institution. 6. Operational risk- the potential for loss resulting from inadequate or failed internal processes, people and systems, or external events. 7. Legal risk - the potential for law suits, adverse judgments, unenforceable contracts, fines and penalties generating losses, increased expenses for an institution, or even closure of such an institution. 8. Concentration risk - the potential for loss resulting from too much credit or loan exposure to one borrower. 9. Front companies- business enterprises that appear legitimate and engage in legitimate business but are, in fact, controlled by criminals. 10. Safe harbour laws - laws that protect financial institutions and employees from criminal and civil liability when reporting suspicious transactions to competent authorities in good faith. 11. Financial Intelligence Unit - A central, national agency responsible for receiving (and, as permitted, requesting), analysing, and disseminating to the competent authorities, disclosures of financial information (i) concerning suspected proceeds of crime, or (ii) required by national legislation or regulation, in order to counter money laundering. 12. Domestic money-laundering flows- Illegal domestic funds are laundered within the developing country's economy and reinvested or otherwise spent within the economy. 13. Inbound funds - for which the predicate crime occurred abroad, are either initially laundered ("placed") abroad or within the developing country, and ultimately are integrated into the developing economy. 14. Outbound funds - they typically constitute illicit capital flight from the developing economy, do not return for integration in the original economy. 15. Flow-through funds- they enter the developing country as part of the laundering process and largely depart for integration elsewhere, thus playing little or no role in the economy itself. 16. Fei Chen- Or flying money, an invention of the Chinese. The process works as follows: e.g. the dirty money is deposited in a gold shop in Hong Kong - for which the owner gets an over stamped dollar note. Later on this is presented at a moneychanger in the Chinatown of an American city and the owner gets his cash which can be further covered through new transactions. 17. Hawalah Network - An informal value transfer system based on the performance and honour of a huge network of money brokers, which are primarily located in the Middle East, North Africa, the Horn of Africa, and South Asia. The system works as the market is two-directional. That is, there are persons in both countries who have large amounts of cash surplus (organised criminals, terrorists) and who are ready to pay in a big way for the possibility to make use of a paper free banking system. 18. Customer Due Diligence - Adequate due diligence on new and existing customers in order to protect financial institutions and ensure a high degree of transparency. The basic steps of CDD measures are the appropriate identification of a customer and/or beneficial owner, the verification of the identity of the customer or beneficial owner, as well as the collection of information on the customer's purpose and nature of the business relationship. 19. Fictitious negotiable instruments- Are instruments that have been fraudulently produced and have no underlying or intrinsic value. They are negotiated, often with supporting fraudulent documentation to underwrite loans or to be sold to individual investors, pension funds, or retirement accounts. 20. Predicate Crimes- crimes whose proceeds are laundered. VII. RECOMMENDATIONS WHILE FORMULATING A RESOLUTION: 1. Analysing the level of efficiency of the conventions and resolutions already put in place by the UN and other decision-making bodies. 2. Looking at the amount of money delegated to money-laundering investigations and deciding whether to increase or decrease that amount. 3. The possibility of developing further investigations into high-profile companies and/or investors who might be laundering money and facilitating the financing of terrorism. 4. More closely monitoring paper trails left by those involved in the laundering of money. 5. Finding innovative ways to, at any point, infiltrate the three-stage process associated with money laundering. VIII. LINKS FOR FURTHER RESEARCH: 1. http://www.unodc.org/unodc/en/money-laundering/programmeobjectives.html?ref=menuside 2. http://www.unodc.org/unodc/en/moneylaundering/introduction.html?ref=menuside 3. http://www.unodc.org/unodc/en/money-laundering/links.html 4. http://www.unodc.org/unodc/en/money-laundering/InstrumentsStandards.html?ref=menuside 5. http://www.imf.org/external/np/leg/amlcft/eng/aml1.htm#customer 6. http://www.unodc.org/unodc/en/money-laundering/globalization.html 7. http://www.imf.org/external/np/leg/amlcft/eng/aml4.htm#antimoney 8. http://www.unac.org/en/link_learn/monitoring/susdev_bodies_crime.asp 9. http://www.un.org/en/ecosoc/docs/2004/resolution%202004-29.pdf 10. http://www.imf.org/external/np/ml/2001/eng/021201.pdf