Reading 53 利率期限结构和波动性 1. Review of term structure: 1

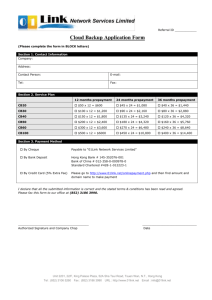

advertisement

Reading 53 利率期限结构和波动性 1. Review of term structure: 1) Yield to maturity — yield curve; 2) Spot rate — spot rate curve (利率期限结构); 3) forward rate (利率远期合约). 2. Expectation theory (how to interpret forward rate?): 1) Pure expectation theory: f0(T1, T2) = E0(T1, T2) a) Interpretation: the expected return for investment horizon (0, T1) is the same, regardless of the maturity T1 or T2. b) Drawback: 忽略了利率风险。由于债券 T2 利率风险大于 T1 (longer maturity),故要 求更多的风险溢价。 2) Liquidity preference theory: f0(T1, T2) = E0(T1, T2) + liquidity (risk) premium maturity↑ → premium↑. 3) Preferred habitat theory: the risk premium can be positive or negative to induce market participants to shift their preferred habitat. 3. Yield curve risk: 1) Partial duration: 设债券价格: P = P(r1, … ri, …rm), 其中 ri 为不同期限的 spot rate, 则 partial duration (D1, …Di, … Dm), 其中 Di = - 1/P * (әP / әri); 对期限为 i 的贴现债券: Di ≈ i, Dj = 0 (i ≠ j); 债券价格变化: dP = Σ ((әP / әri) * dri), 或 dP /P = -Σ(Di * dri); 若 dr1 = … = drm = dr, 则 effective duration D = - 1/P * (dP / dr) = ΣDi. 2) Partial duration for a portfolio: 设 portfolio: P = ΣPj, Pj 为第 j 种债券的总价值, 则 Di = - 1/P * (әP / әri) = - 1/P *Σ(әPj / әri) = ΣwjDji, wj 为第 j 种债券价值比. 4. Yield volatility: 1) Yield volatility = sd(Δr / r): a) 在利率模型中,利率相对变化而非利率本身服从正态分布; b) 利率风险的衡量:久期—敏感性, 波动率—可能性。 2) Historical yield volatility: Yield on day t: yt → relative change in yield: (yt – yt-1) / yt → continuous compounding: xt = ln(yt / yt-1) → yield volatility = sd(x1, … xt) → annualized yield volatility = daily volatility * (number of days in a year)1/2. Reading 54 含权债券的估值 1. Yield spread: 1) Benchmark interest rate: a) Benchmark market: treasury market, specific bond sector with a given rating or issuer; b) Benchmark curve: yield curve, spot rate curve. 2) Spread measures: a) Nominal spread: 基于 yield curve; b) Zero-volatility spread (ZS): 基于 spot rate curve; c) Option-adjusted spread (OAS = ZS – option cost): 基于 interest rate tree. 注:若 interest rate tree 基于 treasury market, 则 OAS 反映 credit risk + liquidity risk; 若 interest rate tree 基于特定发行者市场,则 OAS 只反映 liquidity risk. 2. Binomial model (复习期权定价): 1) Binomial interest rate tree: 推导(不要求) :贴现债券的价格过程树 → 利率过程树;二叉树的测度应保证贴现 债券价格过程为鞅(这里设所有分支鞅测度 q = 1/2) 。 注:Interest rate for valuation = benchmark interest rate + OAS. 2) Determining the value at a node (backward induction): 设二叉树 (r, V) → (rH, VH + C) or (rL, VL + C), V 为债券价值,C 为息票利息, 则:V = 1/2 * ((VH + C) / (1 + r) + (VL + C) / (1 + r)). 3. Valuing bonds with embedded options (复习美式期权定价): 1) Callable bond: 设含权债券价格 Vt, 执行价格 P, 与之类似的不含权债券价格为 Vt’, 则:Vt = min(Vt’, P). Value of a call option = V0’ – V0, interest rate volatility ↑, value of option ↑, V0↓. 2) Putable bond: Vt = max(Vt’, P), Value of a put option = V0 – V0’, interest rate volatility ↑, value of option ↑, V0↑. 3) Floater (浮动利率债券): Vt = VT; Capper floater (带有利率上限的浮动利率债券). 4. Analysis of convertible bonds: 1) Basic features of convertible bonds: Call options on the stock (conversion ratio) + call options on the bonds (usually). 2) Traditional analysis a) Conversion value of bonds = market price of stock * conversion ratio; Market price of bonds = market conversion price (转换平价)* conversion ratio; Market price of bonds ≥ max(conversion value, straight value (option free)). b) Premium over common stock: Market conversion premium (转换升水) = market conversion price – market stock price; Market conversion premium ratio = market conversion premium / market stock price; Premium payback period = premium / ((Coupon / conversion ratio) – stock dividend); c) Premium over straight value = market price of bonds / straight value – 1. 3) Option-based valuation approach: two factor model (movement of stock price and interest rate). Reading 55 按揭贷支持债券 (MBS) 1. Residential mortgage loans (复习 amortization structure): Mortgage payment = mortgage balance * mortgage rate = interest + scheduled principal; ΔMortgage balance = scheduled principal. 2. Mortgage passthrough security: 1) Mortgage pool: a) Weight of outstanding balance in the pool; b) Weighted average coupon rate (WAC) and weighted average maturity (WAM). 2) Securitization: a) Mortgagor (borrower) < mortgage loan> mortgage holder (lender) <mortgage-backed security> investor; b) Coupon rate on passthrough security (passthrough rate) = WAC (mortgage rate) – servicing fees; (按月支付的声明年利率) WAC—paid buy borrower, passthrough rate—got by investors . c) 回报期 Average life (years) = Σ(t * principal paid at time t) / (12 * total principal); 其中 Principle paid at time t = scheduled principle + prepayment. 3. Prepayment and prepayment risks: 1) Measuring prepayment: a) Historical prepayment rate: Single month mortality rate (SMM)t = prepayment in month t / (beginning mortgage balance in month t – scheduled principal payment in month t), (prepayment 所占比例); Conditional prepayment rate (CPR)t = 1 – (1 - SMMt)12, (annualized rate). b) Project prepayment: PSA benchmark 100PSA: CPRt = 6% * (t / 30) = 0.2% * t if 1 ≤ t < 30 or 6% if t ≥ 30; nPSA = n / 100 * 100PSA; SMMt 的估计: t → CPRt → SMMt. 注:t 为从 mortgage pool 建立开始计的月份数。 2) Prepayment risk: a) If contract rate > current mortgage rate, prepayment ↑ (through refinancing). b) Contraction risk: interest rate ↓ 时, 债券价格↑, 但 prepayment ↑, average life ↓ (久期↓), 增幅小于 option-free 债券. c) Extension risk: interest rate ↑ 时, 债券价格↓, 但 prepayment ↓, average life ↑, 跌幅大于 option-free 债券. 4. Collateralized mortgage obligations (CMO): 1) Concepts: a pool of passthrough securities (collateral); distribute the cash flows (and prepayment risks) among different bond classes (tranches); cannot eliminate prepayment risk. 2) Sequential-pay tranches: a) Payment rule: the principal of each tranche (but not interests) is sequentially paid. b) Risk characters: Short-term tranche: shorter average life than the collateral, against extension risk; Long-term tranche: longer average life than the collateral, against contraction risk. 3) Accrual tranches: a) Payment rule: the interests received by accrual tranches are used to pay off the principal balance of other tranches until other tranches are paid off (同时 accrual tranche balance ↑). b) Risk characters: for accrual tranches: average life ↑, reinvestment risk ↓ (no reinvestment risk until all other tranches are paid off), no impact on prepayment risk. 4) Floating rate tranches: a) Floater tranches (balancing B1): coupon rate = float interest rate + P; Inverse floater tranches (B2): coupon rate = K – L * float interest rate; 满足:B1 * (float interest rate + P) + B2 * (K – L * float interest rate) = (B1 + B2) * fixed interest rate of collateral. 注意:K, L 对所有 float rate 恒成立,由此可解得(K, L). 利率范围:floater — [P, K / L + P]; inverse floater — [0, K]. b) Risk characters: against interest rate risk, no impact on prepayment risk. 5) Structured interest only tranches (structured IO): Structured IO tranches: receive no principal not only excess interests; Other tranches: at least one other tranche’s coupon rate is set below the collateral’s coupon rate so that excess interests can be generated; Notional amount of structured IO tranches = Other tranches’ par value * excess interest rate / coupon rate of IO tranches (used to determine interests but not paid to holders as principal). 6) Planned amortization class tranches (PAC tranches): Principal payment schedule of PAC (collar): min(nPSA, mPSA), (n < m); 注:按 nPSA 的支付开始小于按 mPSA 的支付,后大于之。 设 actual payment xPSA: a) If n < x < m (within the band), payment on xPSA > payment on min(nPSA, mPSA): PAC tranches: fixed payment schedule and average life, no prepayment risk; Support tranches: receive excess principal prepayment, higher prepayment risk; 注:Support tranches 必须有足够的本金来保护 PAC tranches. 若 support tranches 先 于 PAC tranches 偿清,则 PAC tranches 将直接面临 prepayment risk. b) If x > m: support tranches 可能先被偿清, PAC 有 contraction risk, 但小于 collateral. c) If x < n: PAC 支付不足, 有 extension risk,但小于 collateral (因为 PAC 将先于 support tranches 被偿清,此时就相当于 sequential-pay CMO). 7) Sequential-pay PAC tranches: prepayment risk: short-term tranches < long-term tranches. 5. Stripped mortgage-backed securities: 1) Two tranches: principal-only class (PO), interest-only class (IO), 与 structured IO 比较. 2) PO strips: if interest rate ↑ Prepayment ↓ + value of cash flow ↓ → value of PO strips ↓. 3) IO strips: if interest rate ↑ (Prepayment ↓ → interests ↑) + value of cash flow ↓ → value of IO trips 先↑后↓. 6. Mortgage-backed security market: 1) Family residential mortgage-backed security: a) Agency-securities (Ginnie Mae, Freddie Mac, Fannie Mae); b) Non-agency-securities (need credit enhancement). 2) Commercial mortgage-backed security (CMBS): based on loans on income-producing property. MBS: the lender has recourse to the borrower if default; CMBS: the lender can only get the proceeds from the sale of the property if default. Reading 56 资产支持债券 (ABS) 1. Asset-backed security: 1) Securitization of loan assets: Borrower <loan> servicer / seller <loan asset> issuer (SPV) <pooling → ABS> investor. 2) Amortizing assets: loans with amortization structure; composition of loans in the pool doesn’t change (no new loans added). a) Home equity loans (for residual property): similar to mortgage loans but for credit impaired borrowers; prepayment is sensitive to interest rate. b) Manufactured housing loans (for manufactured homes): prepayment is not sensitive to interest rate due to the small loan balance, high depreciation and low credit quality). c) Auto loans (for automobiles): prepayment is not sensitive to interest rate. 3) Non-amortizing assets (e.g. credit card receivables): only a minimum payment is required; the loan may be reduced or increased. Revolving structure of ABS backed by non-amortizing assets: a) In lockout period, principals received are not paid to ABS holders but reinvested; composition of loans will change; no prepayment risk. b) After lockout period, the loans can be paid by amortization structure or bullet payment structure. 2. Risks and structures of ABS: 1) Credit risk: a) The collateral may not have a stable value as real property; b) The loan may not be guaranteed by government agency. Prepayment tranching Senior tranches 2) Credit tranching Senior support tranches Subordinated / junior tranches (credit protection) a) Credit tranching: credit losses are absorbed by subordinated tranches first. b) Prepayment tranching (shift interest mechanism): In the early years, prepayments should be allocated to the senior tranches at a higher proportion to maintain the credit protection provided by the subordinated tranches. 3. Credit enhancement: 1) External enhancement: guarantees from third parties. The credit quality of an issue can’t be higher than the credit of the third-party guarantor. 2) Internal enhancement: a) Senior / subordinated structures. b) Overcollateralization: collateral balance > ABS balance. The credit losses can be absorbed by the overcollateralization first, and then allocated to subordinated tranches. c) Excess spread: collateral interests > ABS interests. The credit losses can be repaid by reserved interests. 4. Collateralized debt obligations (CDO): 1) Concepts: CDO is an ABS that is collateralized by a pool of debt obligation, including corporate bonds, loans, MBS and other ABS. 2) Structure: a) Senior tranches: receive floating-rate payment by using swap; b) Subordinate tranches: receive fixed rate payment; c) Equity tranches: provide credit and prepayment protection. 3) Motivations for creating CDO: a) Arbitrage driven: the spread between return on the collateral and the funding costs. b) Balance-sheet driven: lender remove assets (and credit risk) from the balance sheet. Reading 58 MBS 和 ABS 的估值 1. Yield spread measures: 1) Cash flow yield (bond equivalent yield) = 2 * ((1+monthly CF yield)6 - 1); Nominal spread = cash flow yield – YTM with equal average life. 注:CF 的预测必须要包含对 prepayment 的假设. 2) Zero volatility spread (Z-spread): spread added to Treasury spot rate. Nominal spread and Z-spread is only suitable for bonds without significant prepayment option (credit card ABS, auto loan ABS). 3) Option adjusted spread (OAS) = Z-spread – option cost; Option cost > 0 for prepayment option, volatility ↑ → option cost ↑, Z-spread ↑; OAS: credit risk, liquidity risk and modeling (assumption) risk; complexity of security↑ → liquidity risk ↑, modeling risk ↑. 2. OAS evaluation: 1) Determination of OAS: Monte Carlo simulation: 令 P = EQ(CF(r), r = benchmark + OAS); Path dependency: the CF (and outstanding balance) at a time point not only depends on the interest rate at that time but also on the historical path of interest rate, so binomial model is not suitable. 2) Comparison of OAS: for a given effective duration, Higher OAS → relatively undervalued, lower OAS → relatively overvalued. 注:Higher effective duration → higher OAS (liquidity risk), 并不一定反映错误定价。 对含权债券的比较必须使用 OAS. 3. Interest risk: 1) Effective duration: ED = (P- - P+) / 2P0Δr; P- and P+ are calculated by Monte Carlo simulation. 2) Effective convexity: EC = (P- - P+) / 2P0(Δr)2; ΔP / P ≈ -ED * Δr + EC * (Δr)2: EC ↑, interest risk ↓ (分 Δr > 0, Δr < 0 讨论). 3) Other duration measures: a) Cash flow duration: P- and P+ are calculated by discounted CF method; Limitation: the prepayment rate is constant for a given interest rate. b) Coupon curve duration: P- and P+ are the market prices of securities with coupon rate r – Δr and r + Δr, respectively; Limitation: such securities may not exist. c) Empirical duration: regression between historical price and interest rate; Limitation: assumption changes can distort the results.