collateralized mortgage obligations

advertisement

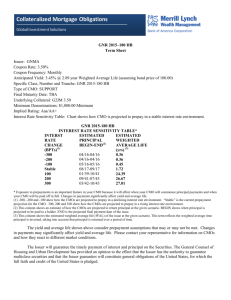

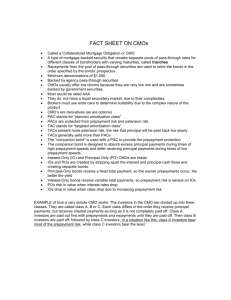

e d u c a t i o n b o o k l e t CMOs Introduction to c ol l at er a l i z ed m ortg a g e obl ig at ion s STOCKCROSS® F I N A N C I A L S E RV I C E S collateralized mortgage obligations Definition Collateralized Mortgage Obligations (CMOs) are securities composed of a pool of mortgages and issued to the public. The CMO is set up as an entity that owns the mortgages in its portfolio. From the pool, the CMO creates tranches, individual bonds that are sold to investors. CMOs are pass-through certificates so, as mortgages are repaid, investors receive their portion of the payment. The simplest way to think of a CMO is to create a mock CMO with one mortgage. For example, a homeowner takes out a mortgage for $500,000 paying 5%. This could be split into 500 $1000 bonds (tranches) paying 4.75% with 0.25% used to cover administrative costs. Risks Prepayment Risk: If interest rates fall and homeowners refinance, the CMO will be paid off. The investor is then left to reinvest at lower market interest rates. Extension Risk: The average mortgage is 30 years (10 years average refinance) meaning that a CMO is a long-term investment. If interest rates rise and people don’t refinance, the investor’s money will be tied up for a longer time period while they could potentially be receiving a higher rate elsewhere. Credit Risk: If homeowners default on their mortgages, no payment will be made. Thus, there is limited upside (interest payment) with a chance of great loss including all money. Credit risk can be reduced by purchasing tranches of CMOs that only invest in insured mortgages. Tranches Sequential (Time) Tranches: Structured so that the owner of the first (senior) tranche receives principal payment first. This provides more certainty of payment for early tranches and greater risk for later tranches. Z Tranche: Often used with Sequential Tranches. A Z Tranche does not pay any principal or interest to investors until all other tranches are paid off in full. Parallel Tranching: Each tranche receives equal payments. These may be split into interest-only or principal-only tranches. Planned Amortization Class (PAC) and Target Amortization Class (TAC): Aim to create more certainty by using support tranches if prepayment occurs too early. Credit Tranching: The junior-most holder is the first to take a loss on principal. Developing these tranches helps protects more senior holders unless default rates escalate. controlling credit risk Agency CMOs Agency CMOs generally only invest in mortgages that are covered by separate insurance, providing protection to the investor in case of defaults. Overcollateralization Generally used for lower-quality mortgages. The value of tranches is less than the collateral value of the underlying mortgage pool, assuming some percentage of default. This protects only to the extent the default rate is assumed. Spread In this case, tranches pay a lower rate than mortgages, while the difference is held in escrow in case of default. summary CMOs consist of tranches offered to investors as a way of investing in a pool of mortgages. Depending on the specific mortgages underlying the CMO or a specific tranche, risks can vary greatly. It is important to fully understand how a particular tranche of a CMO will affect your risk and if it can meet your objectives. Fun Facts The first Collateralized Mortgage Obligation was created in 1983. Today, many Collateralized Mortgage Obligations exist with a variety of tranches and mechanisms to meet the needs of investors able to participate in high and moderate risk vehicles. s t a n d b e h i n d t h e s h i e l d Disclaimer Information about the investment products contained in this booklet is solely for informational purposes and does not constitute a specific recommendation of either an offer to sell or the solicitation of an offer to buy any investment. Any specific investment terms are indicative only and may not reflect an actual investment that is, or will be, available for purchase from StockCross Financial Services, Inc. The information herein is not, and is not intended to be, a complete discussion of all material information you should know about any investment or investment class. You should carefully read the relevant prospectus and related supplements or other offering documents prior to making a purchase. You should not rely on the information contained in this presentation in connection with the purchase of any investment product. There shall be no sale of the investments discussed herein in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction. The investments or strategies referenced do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be determined for each individual investor. It is your responsibility to verify any information contained in this booklet before making any investment decision. 800.225.6196 www.StockCross.com StockCross Financial Services, Inc. 9464 Wilshire Blvd. Beverly Hills, CA 90212 Member FINRA SIPC Est. 1971