UCDavis Department of Economics

advertisement

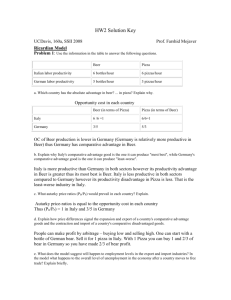

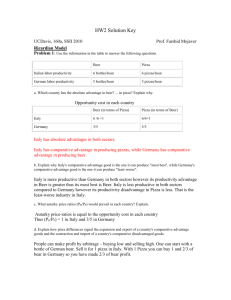

HW1 Solution Key UCDavis, 160a, Fall 2011 Some Trade Terminology 1- What does autarky mean? No trade 2- What is a “laissez faire” policy with respect to trade? Hands off – no restrictive trade policy – free trade Prof. Farshid Mojaver 3- Is export promotion considered to be a “laissez faire” policy? If not then what is it? No! Export promotion is intended to protect export industries. This is done through various regulations and government interventions. 1- In the trade spectrum show autarky, free trade, export promotion, and a move toward protectionism/trade liberalization. No trade 2- What is protectionism? What is being protected and against what? Protectionism protects domestic industries against foreign competition via various regulations and government interventions in the market. 3- What is trade liberalization? What is being liberalized? A movement in the direction of free trade occurs when regulations on trade are removed. Since the elimination of trade policies will generally increase the amount of international trade, it is referred to as trade liberalization. Pure Exchange Model Consider two farmers, one with an endowment of 5 pounds of peaches, the other with an endowment of five pounds of cherries. Suppose these two farmers meet daily and make a mutually agreeable exchange of 2 pounds of peaches for 3 pounds of cherries. a. Write down an expression for the terms of trade. Explain how the terms of trade relates to the dollar prices of the two goods. TOT = 3 lb cherries /2lb peaches = ($/lb peaches)/($/lb cherries) =Ppeaches/Pcherries=3/2 (At this point it is immaterial to write ToT as Ppeaches/Pcherries or Pcherries/Ppeaches) b. Consider the following shocks (or changes). Explain how each of these shocks may influence the terms of trade between the farmers. Assume that each farmer's sole interest is to maximize her own utility. 1. The cherry farmer arrives at the market with 5 extra pounds of cherries. TOT↑ (here defined as lb peaches/ lb cherries) because of the increase in supply of cherries 2. The peach farmer has just finished reading a book titled "How to Influence People." TOT↑ because the peach seller can increase demand for his peach 3. Damp weather causes mold to grow on 40% of the peaches. TOT↑ because supply of peaches goes down 4. News reports indicate that cherry consumption can reduce the risk of cancer. TOT decreases because the demand for cherries GOES UP Feenstra Ch1 Problems 1. Figures 1-2 and 1-7 rely on data from the year 2006, and Figure 1-6 relies on data from 2005, to map worldwide trade, migration, and foreign direct investment. Updated data for migration and foreign direct investment were not available at the time of writing this chapter, but are available for worldwide trade. In this question you are asked to update the numbers for world trade shown in Table 1-1. a. Go to the World Trade Organization website at www.wto.org and look for their trade data under “Resources” and “Statistics.”1 Look for the most recent edition of their International Trade Statistics publication, then go to the Excel spreadsheet under “World trade developments” and then look under “Trade by Region” and find the Excel spreadsheet with “Intra- and Inter-regional Merchandise Trade.” Print out this table. If you cannot find the website or spreadsheet, use the 2009 table for “Intra-and Interregional Merchandise Trade,” which is printed below: Table I.4 : Intra- and inter-regional merchandise trade, 2009 Origin North America South and Central America Destination Europe Value World 2026 437 5105 North America 769 128 292 South and Central America 115 120 90 Europe 366 75 3620 Commonwealth of Independent States (CIS) 23 5 239 Africa 66 9 149 Middle East 60 5 76 Asia 627 95 641 Share of regional trade flows in each region's total merchandise exports World 16.6 3.6 41.9 North America 48.0 8.0 18.2 South and Central America 25.0 26.1 19.6 Europe 7.3 1.5 72.2 Commonwealth of Independent States (CIS) 5.2 1.1 52.9 Africa 17.1 2.4 38.8 Middle East 8.7 0.7 11.0 Africa Middle East 311 9 6 147 391 28 13 162 510 49 11 154 3197 324 96 426 12178 1602 459 5016 87 1 4 57 7 45 34 102 14 12 107 163 63 85 357 1846 452 384 690 3575 2.6 0.6 1.3 2.9 3.2 1.8 2.8 3.2 4.2 3.1 2.5 3.1 26.3 20.2 20.8 8.5 100.0 100.0 100.0 100.0 19.2 0.3 0.5 1.6 11.7 4.9 3.2 3.0 15.5 13.9 22.2 51.8 100.0 100.0 100.0 CIS Asia World Asia 17.5 2.7 Share of regional trade flows in world merchandise exports World 16.6 3.6 North America 6.3 1.1 South and Central America 0.9 1.0 Europe 3.0 0.6 Commonwealth of Independent States (CIS) 0.2 0.0 Africa 0.5 0.1 Middle East 0.5 0.0 Asia 5.2 0.8 17.9 1.6 2.8 4.6 51.6 100.0 41.9 2.4 0.7 29.7 2.6 0.1 0.0 1.2 3.2 0.2 0.1 1.3 4.2 0.4 0.1 1.3 26.3 2.7 0.8 3.5 100.0 13.2 3.8 41.2 2.0 1.2 0.6 5.3 0.7 0.0 0.0 0.5 0.1 0.4 0.3 0.8 0.1 0.1 0.9 1.3 0.5 0.7 2.9 15.2 3.7 3.2 5.7 29.4 b. From this table, what is the total amount of trade within Europe? What percentage is this of total world trade? Answer: $3,620 billion, which is 29. 7% of the world total c. What is the total amount of trade (in either direction) between Europe and North America? Add that to the total trade within Europe, and calculate the percentage of this to the world total. Answer: $(366+ 292) = $658 billion. Adding that to intra-European trade, we obtain ($658+$3,620)/$12178=35% of the world total. d. What is the total amount of trade within the Americas (i. e., between North America, Central America, South America, and within each of these regions)? What percentage is this of total world trade? Answer: $(769+128+115+120) = $1,132 billion, or 9. 3% of the world total e. What is the total value of exports from Europe and the Americas and what percentage is this of the world total? Answer: $(1,602 + 459 + 5016) = $7,077billion, or 58. 1% of the world total f. What is the total value of exports from Asia, and what percentage is this of the world total? Answer: $3575 billion, which is 29.4% of the world total g. What is the total value of exports from the Middle East and the Commonwealth of Independent States2 and what percentage is this of the world total? Answer: $(690+452) = $1,142 billion, which is 9.4% of the world total h. What is the total value of exports from Africa, and what percentage is this of the world total? Answer: $384 billion, which is 3.2% of the world total i. How do your answers to (b) through (h) compare with the shares of worldwide trade shown in Table 1-1? Answer: The shares computed in (b) through (h) are quite similar to Table 1. 1. Both are within one percentage point of Table 1-1. 2. The quotation from Federal Reserve Chairman Ben Bernanke at the beginning of the chapter is from a speech that he presented in Jackson Hole, Wyoming, on August 25, 2006, entitled “Global Economic Integration: What’s New and What’s Not?” The full transcript of the speech is available at http://www/federalreserve.gov/newsevents/speech/bernanke20060825a.htm. Read this speech and answer the following questions: a. List three ways in which international trade today is not that different from the trade that occurred before World War I. Answer: i) Physical distance is the same. ii) New transportation methods allow for more trade. iii) Governments foster open trade, as well as financial flows. iv) Some groups are opposed to free trade. v) The range of goods that are tradable has broadened. b. List three ways in which international trade today does differ from the trade that occurred before World War I. Answer: i) Intra-industry trade has increased. ii) Information and communication technologies permit trade in services. iii) Scale and pace of growth in trade is faster. iv) Core-periphery pattern is no longer relevant. v) Fragmentation of production processes has occurred. vi) Capital markets are more mature, and gross flows are larger. Ricardian Model Problem 1: Use the information in the table to answer the following questions. Beer Pizza Italian labor productivity 6 bottles/hour 6 pizzas/hour German labor productivity 5 bottles/hour 3 pizzas/hour a. Which country has the absolute advantage in beer? ... in pizza? Explain why. Opportunity cost in each country Beer (in terms of Pizza) Pizza (in terms of Beer) Italy 6 /6 =1 6/6=1 Germany 3/5 5/3 Italy has absolute advantages in both sectors. b. Explain why Italy's comparative advantage good is the one it can produce "most best", while Germany's comparative advantage good is the one it can produce "least-worse". Italy is more productive than Germany in both sectors however its productivity advantage in Beer is greater thus its most best is Beer. Italy is less productive in both sectors compared to Germany however its productivity disadvantage in Pizza is less. That is the least-worse industry in Italy. c. What autarky price ratios (PB/PP) would prevail in each country? Explain. Autarky price-ratios is equal to the opportunity cost in each country Thus (PB/PP) = 1 in Italy and 3/5 in Germany d. Explain how price differences signal the expansion and export of a country's comparative advantage goods and the contraction and import of a country's comparative disadvantaged goods. People can make profit by arbitrage – buying low and selling high. One can start with a bottle of German bear. Sell it for 1 pizza in Italy. With 1 Pizza you can buy 1 and 2/3 of bear in Germany so you have made 2/3 of bear profit. e. What does the model suggest will happen to employment levels in the export and import industries? In the model what happens to the overall level of unemployment in the economy after a country moves to free trade? Explain briefly. In Germany employment in Beer (its export sector) goes up, and it goes down in Pizza. The opposite happens in Italy. That is employment in Pizza (its export sector) goes up and in Beer goes down. Assuming free and costless movement of labor there will be no unemployment. Problem 2 a. Definition 1 opportunity cost of producing X is the amount of Y forgone to produce one extra unit of X. Opportunity Cost of producing good X in the Home country: aLX/aLY = 1/(1/2) = 2 units of Y. Opportunity Cost of producing good X in the Foreign country: aLX*/aLY* = (1/4)/1=1/4 units of Y. b. Relative price of good X at Home in autarky: In perfect competition wages are set to price * marginal productivity of labor, thus wages in the X and Y industries are set to X = PX/aLX Y = PY/aLY As described in lecture, this implies that in a diversified perfectly competitive equilibrium, we must have that PX/aLX = PY/aLY PX/PY = aLX/aLY PX/PY =1/(1/2) =2 Similarly for Foreign: PX*/PY* = (1/4)/1 = 1/4 c. In order to be able draw the PPF we need to know how the available resources can be distributed over the production of X and Y. This is given by L = QX . aLX + QY . aLY rewriting this expression, we get QY = L/ aLX - (aLX /aLY)QX, which is a linear equation with Y y-intercept L/aLY and slope aLX/aLY. So for Home QY = L/aLY - (aLX /aLY)QX, QY = 1000/(1/2) – (1/2)QX QY = 2000 – 2QX and for Foreign QY* = L*/ aLX* - (aLX */aLY*)QX*, QY* = 1000/1 – (1/4)/1QX* QY* = 1000 – 1/4QX* PPF’s Under Autarky