Ricardo Model

advertisement

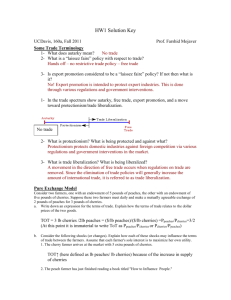

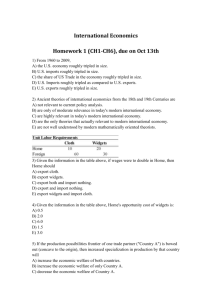

BA 187 – International Trade Ricardo and Comparative Advantage: The Classical Model of Trade 1 Issues in International Trade Initial attempt to understand two of the important issues in trade theory. Gains from Trade Pattern of Trade Use insight of Adam Smith about different advantages in production across countries. Focus on comparative, rather than absolute, advantage as source of pattern & gains from trade 2 Classical Model Assumptions Fixed endowment of labor in each country. Labor completely mobile within a country. Labor completely immobile between countries. Commodity value determined by labor content. Technology fixed but differs across countries. Prod’n costs constant, do not depend on quantity. Full employment of labor, perfect competition. No tariffs or transportation costs. Two country, two commodity world. 3 Constant Cost Technology Cloth Wine Autarky PC/PW England 10 hrs/yd 12 hrs/bbl 5/6W : 1C Portugal 8 hrs/yd 6 hrs/bbl 4/3W : 1C Ricardo (1817) viewed mutual gains from trade possible based on comparative advantage. Example above Portugal has absolute advantage in both goods, but trade still possible as England is relatively more productive in cloth than wine. 4 Absolute vs. Comparative Advantage Absolute Advantage – A country has an absolute advantage in good X if one unit of labor produces more X than is produced by one unit of labor in the other country. Comparative Advantage – A country has an comparative advantage in good X if its opportunity cost of X in terms of Y is less than in the other country In previous example Portugal has an absolute advantage in both goods but a comparative advantage in wine. 5 Opportunity Costs and Advantage Comparative advantage arises from differing opportunity costs across countries. – With total labor fixed, producing more of one good (Cloth) means producing less of other good (Wine). – Tradeoff is opportunity cost and differs between the two countries. England – 1 more unit of cloth requires giving up 5/6 unit of wine. Portugal – 1 more unit of cloth means giving up 4/3 units of wine. England’s comparative advantage is producing cloth, while Portugal’s comparative advantage is in producing wine. 6 Ricardian Comparative Advantage Assume each country has 120 units of labor. Table shows all feasible combinations of cloth and wine for each country in autarky. England Labor in Portugal Cloth Wine Cloth Wine Cloth 0 12 120 hrs 0 15 3 1/3 8 80 hrs 6 2/3 10 6 2/3 4 40 hrs 13 1/3 5 10 0 0 20 0 7 Gains from Trade Now trade opens with terms of trade England Autarky Labor England Trade at in 1W : 1C equal to 1W:1C Cloth England specializes. Produces only cloth. Wine Cloth Wine Cloth England exports 0 12 120 hrs 0 12 cloth to Portugal in exchange for imports 3 1/3 8 120 hrs 4 8 of wine. At least as well off 6 2/3 4 120 hrs 8 4 as in autarky. Same results for 10 0 120 hrs 12 0 Portugal. Mutual gains from trade. 8 Relative Wages Assume unit of cloth & unit of wine sell for $12. After trade: – English workers specialize in cloth, receive $1.20/hr ($12 for 10 hrs work) – Portuguese workers specialize in wine, receive $2.00/hr ($12 for 6 hours work) Relative wage of English workers is 60% of that of Portuguese workers. – Note English workers are: 50% as productive as Portuguese workers in wine and 80% as productive as Portuguese workers in cloth Relative wage lies between these two productivities. 9 BA 187 – International Trade Visualizing Comparative Advantage 10 Visualizing Comparative Advantage Rather than rely on numerical examples can develop model visually to demonstrate results. Technology: (Constant Costs) – aLX = # units of labor for 1 unit of X. (a*LX for foreign) – aLY = # units of labor for 1 unit of Y. (a*LY for foreign) – aLXqX + aLYqY = Ltotal (a*LXq*X + a*LYq*Y = L*total) Tastes: – Each country possesses community indifference curves, UH for Home and UF for foreign. – Maximize utility subject to production constraints determined by technology and labor endowment. 11 Equilibrium in Autarky Y Y Home Foreign L*/a*LY L/aLY aLX/ aLY < a*LX /a*LY aLX AF aLY UF AH UH L/aLX X L*/a*LX X 12 Prices, Wages & Production Prices, Wages, & Production – Let PX and PY be the price of each good. – Perfect competition implies wage to worker equals value of output produced, PX/aLX or PY/aLY – Labor mobility implies: If PX/aLX > PY/aLY, or equivalently when PX/ PY > aLX /aLY then economy produces only X. If PX/aLX < PY/aLY, or equivalently when PX/ PY < aLX /aLY then economy produces only Y. – In autarky, economy must produce both goods so relative prices of goods must equal their relative unit labor requirements, i.e. px = PX/ PY = aLX /aLY. 13 Potential Gains from Trade Y Y Home L*/a*LY Foreign QF L/aLY CF CH AF U’F U’H UF AH UH QH L/aLX X L*/a*LX X 14 Equilibrium and Trade Equilibrium occurs at relative price that makes the two triangles equal Y Y Home Foreign L*/a*LY QF Foreign Exports L/aLY AF CH CF U’F U’H Home Imports UF AH UH QH L/aLX Home Exports X L*/a*LX X Foreign Imports 15 Determining Terms of Trade How can we determine exactly what the relative price will be in equilibrium with trade? Terms of trade for a country: – Ratio of the price of its export commodity to the price of its import commodity. – In our example, terms of trade for Home are PX/PY, and PY/PX for Foreign. Number of analytical tools to determine the equilibrium relative price ratio with trade. K&O focus on Relative Demand and Supply analysis. 16 Relative Demand and Supply Relative analysis focuses on ratio of prices PX/PY & ratio of total quantities (qX+ q*X)/(qY+ q*Y). Relative Demand: – Rise in PX/PY makes X more expensive relative to Y. – Substitution away from X towards Y, leads to downwardsloping Relative Demand Curve, RD. Relative Supply: – – – – If PX/PY < aLX /aLY : no Good X produced. If PX/PY = aLX /aLY : Home produces X as demanded. If a*LX /a*LY > PX/PY > aLX /aLY : Home specializes in X. If PX/PY > a*LX /a*LY : Both Home & Foreign produce X. 17 Relative Demand and Supply Relative Price of X PX/PY a*LX/a*LY RS 1 aLX/aLY RD 2 RD’ (L/aLX)/(L*/aLY) Relative Quantity of X (qX+ q*X)/(qY + q*Y) 18 BA 187 – International Trade Summary of Results from the Classical Model of Trade 19 Results of Trade Mutual Gains from Trade – Trade enlarges the range of consumption choices for each nation over autarky. Absolute vs. Comparative Advantage – Gains arise from specializing in producing goods in which have a comparative (not absolute) advantage. Trade & Specialization – Expect trade to lead nation to specialize in prod’n. Relative Wages – What matters for trade is relative wage versus relative labor productivities. 20 Shortcomings of Ricardo Model Classical approach has serious shortcoming, in that it assumes rather than explains comparative advantage. Classical model does not explain why labor productivities differ between nations. It is these differences which are the source of comparative advantage. Ignores how relative resource endowments change as countries grow (constant costs assumption). Benefits of trade come from more efficient use of domestic resources through specialization. Specialization can have negative aspects if it results in a lopsided pattern of growth within a developing country. May produce an export enclave rather than a well-balanced economy. 21 Statements to Address Productivity & Competitiveness “Free trade is beneficial only if your country is strong enough to stand up to foreign competition.” Pauper Labor “Foreign competition is unfair and hurts other countries when it is based on low wages.” Exploitation “Trade exploits a country and makes it worse off if its workers receive much lower wages than workers in other countries.” Specialization “There cannot be distinct roles within Mercosur, with one country producing primary products while another is industrialized” Fernando de la Rita, Presidential Candidate Argentina 22 BA 187 – International Trade Appendix: Small Country vs. Large Country Gains from Trade 23 Does Trade Exploit Small Nations? Examine effects of opening trade between a large economy and a small economy. (Think NAFTA) Is it true that the large nation will use its economic clout to exploit the small nation? Next slide examines this case. – SC = Small Country, LC = Large Country – Begin with both nation’s in autarky, ASC and ALC. – Open trade, change relative prices to find equilibrium (equal trade triangles) between the countries. – Equilibrium with trade (Consumption, Production) given by (CSC, QSC) and (CLC, QLC) Surprising results for Small vs. Large Country. 24 Large/Small Country Y Small Country = SC Large Country = LC QL LC production point with trade C LC Exports LC consumption point in autarchy & trade CL CS C C SC Imports AS ULC U’SC C SC consumption point with trade QSC X LC Imports SC Exports 25 Summary of Small vs. Large Country Small Economy – Receives maximum gains available by opening trade. – As a price-taker, it trades at the relative prices set by the large economy. – Completely specializes in good for which it has the comparative advantage. Large Economy – Receives no gains from trade with small nation. – No change in its production constraint. – Produces both goods after trade, though more of good in which it has comparative advantage. 26 BA 187 – International Trade Extensions to the Classical Model of Trade 27 Adding Money to Ricardo So far have dealt with trade in terms of barter of one good for another. How to move to monetary economy? Domestic value of good found as PX = W•aLX Link economies through exchange rate. e = # units of foreign currency per unit domestic currency Put price of good in common terms (foreign currency) – Domestic Country: PX = aLX •W•e – Foreign Country: P*X = a*LX •W* Trade occurs based on differences in money prices 28 Example of Money & Ricardo Wage/hr Labor req. for Cloth Price of Cloth Labor req. for Wine Price of Wine England £1 /hr 1 hrs/yd £1 3 hrs/bbl £3 Portugal 0.6 esc./hr 2 hrs/yd 1.2 esc. 4 hrs/bbl 2.4 esc. Assume Exchange Rate of 1 escudo:£1 – – – – Cheaper to buy cloth in England, buy wine in Portugal. Consistent with relative labor efficiency ( ½ < ¾ ) Terms of trade for England PCloth/PWine = 1/2.4 If trade not balanced, then specie flows to country with trade surplus. Raises prices & wages, offsets trade. 29 The Export Condition Monetized version of Classical trade model. – Country exports any product it can produce most inexpensively, given wage rate & exchange rate. Export Condition – Cost conditions necessary for country to export a good. PX = aLX W e < a*LX W* = P*X or a*LX/ aLX > We/W* – In a monetized world, ability to export depends not only on relative labor efficiency but also on relative wage rates and the exchange rate. – Establishes limits on wage rates and/or exchange rate for trade to take place between countries. 30 Wage and Exchange Rate Limits Trade in a two-good, two country world requires each country produce one good more cheaply. This imposes limits on wage rates & exchange rates for trade to occur. Wage Rate Limits (assumes e = £1:1escudo) – In previous example, England loses export market in cloth if English wage rises to £1.2/hr or higher. – England gains export market in wine if it wage falls to £0.8/hr or lower. Exchange Rate Limits (assumes wages fixed) – Similar logic dictates that at if EXR rise to 1.2 esc/£1 or higher England loses export market in cloth. – England gains export market in wine if it EXR falls to 0.8esc./ £ 1 or lower. 31 Trade in Multi-Commodity World Cloth Wine Bread a*LC/aLC > a*Lw/aLw > a*LB/aLB > Relative Wages Cheese [We/W*] > a*LCh/aLCh > Tools Pots a*LT/aLT > a*LP/aLP Home Exports Home Imports Foreign Imports Foreign Exports Pattern of trade in multi-commodity world depends on relative labor requirements versus ratio of relative wages. Also can see effects of change in exchange rate or relative wages on the pattern of trade. Finally trade flows equalized by changes in relative wage rates due to flows of gold or exchange rate changes. 32 Effects of Change in Relative Wages Cloth Wine a*LC/aLC > a*Lw/aLw > Relative Wages [We/W*] > Bread Cheese a*LB/aLB > a*LCh/aLCh > Tools Pots a*LT/aLT > a*LP/aLP Home Exports Home Imports Foreign Imports Foreign Exports Increase in Home wage rate, decrease in Foreign wage rate, or rise in exchange rate (home currency more valuable) Makes home country goods more expensive, reduces the number of goods exported by the home country. Again any imbalance in trade flows will be equalized by changes in relative wage rates due to flows of gold or exchange rate changes. 33 Determining the Relative Wage Relative Wage , We/W* RS RD = Relative Derived Demand for labor RS = Relative Supply of labor, L/L* a*LC/aLC Cloth Wine (We/W*)eq Bread Cheese Tools RD Relative Quantity of Labor L/L* 34 Evidence on Comparative Advantage MacDougall (1951) – Looked at ratio of labor productivity US vs. UK plotted against export volume ratio, US vs. UK. – Found that higher relative productivity for US vs. UK associated with higher export volume for US vs. UK in that industry. – In addition found that relative productivity above relative wage associated with higher export volume. – Similar results obtained by Balassa(1963) and Stern (1962) 35