Thailand's Approach to Government Procurement in 2012

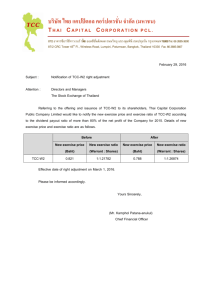

advertisement