CHAPTER 3

advertisement

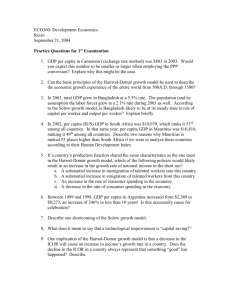

CHAPTER 3 Empirical Applications of Neoclassical Growth Models Mankiw, Romer and Weil (MRW) Approach: Gregory Mankiw, David Romer and David Weil (1992) tested Solow model with empirical data. They saw that it performed well, but they suggested that it would fit the data even better if they modify the model to include HUMAN CAPITAL. They changed the production function as: Y K AH 1 where A is again technological progress that grows exogenously with g. What is the difference with the Solow model is the variable H. This is called human capital, level of skills that a worker has. Agents in this economy spend part of their time to accumulate new skills. If they spend u units of time to accumulate new skills, then we can express human capital as: H eu L Where ψ is a constant. Notice that if individuals do not accumulate HC, then u = 0 and H = L, we get the old Solow model with technology. With u > 0, a given amount of unskilled labor L yields more output by learning new skills. You can think of u as the years of schooling that a person gets. Then, an additional year of schooling increases the level of human capital by ψ percent: dH dH / du eu L H du H If ψ is equal to 0.1, then an additional year of schooling increases HC by 10%. This formulation matches the labor economists’ finding that an additional year of schooling increases the wages by 10% on average. The capital accumulation equation is the same as before: K sY K If we write the production function in per capita terms, Y K AH , 1 y k Ah 1 where h H eu , L y Y K , k L L To solve this model, we need a steady-state variable. We can define a steady-state capital per effective labor by dividing k by Ah: ~ k k , Ah y ~ y then we get the Ah same production function formula as before: ~ ~ y k The capital accumulation equattion can also be written in tildas: K sY K , K Y s , K K ~ k K ~ ng k K as before, since h does not change over time. We assume that u is constant across time (not across countries). Theerefore the derivation is the same as the case without human capital. ~ ~ k s~ y (n g )k Notice that the two equations that describe motion of the state varai bles are identical as the Solow model with technology. Therefore, the same diagrams can be drawn and ~ the same results can be found. We can solve for the steady-state by plugging in k 0 as: ~ s k n g 1 1 and s ~ y n g 1 This implies that y can be written as: s y * (t ) ~ y * Ah n g 1 A(t )h Notice that steady-state output per capita grows with the same rate as technology, since h is constant over time. Therefore rich countries are rich because they have a high saving rate, low population growth rate, high level of technology (A), and they allocate a larger amount of their time to accumulating new skills: their u is high. Since h H eu , this means they have a larger human capital. Remember to L interpret u as average years of schooling in a country. So countries with a more educated labor force will be richer with this extension of the Solow model. (I) MRW tested their data witth this approach. Their method included expressing income levels in values relative to US for simplicity. They denote income per capita relative to the US values in hats, like yˆ * TUR y*TUR sˆ 1 ˆ ˆ Ah y*US zˆ Where z n g d . They drew a diagram comparing actual levels of income per capita with predicted steady- state levels found from (I). If the Solow model extended with human capital is a good model, then we must see that all the countries are close to the 45-degree line. SHOW FIGURE 3.1. Assumptions in calculating predicted values: 1. technology levels are assumed to be the same across countries, which is not very plausible, 2. growth rates of technology across countries assumed to be the same, 3. g + d = 0.075 for all countries. Only n varies. α = 0.3, ψ = 0.1, u is average years of education in a country. Convergence Phenomenon: Do the Poor Countries Catch Up? Some economists have suggested that poor countries grow faster than rich countries so that the gap between them is getting smaller over time. This is called CONVERGENCE. Do we observe convergence in the world? William Baumol (1986) presented some evidence that support convergence. First, CHECK FİGURE 3.3. We can actually observe that there IS CONVERGENCE between US, UK, Germany and Japan. Their per capita GDP is getting close to each other as Japan and Germany is catching up to US and UK. Baumol’s second piece of evidence is on FIGURE 3.4. This plots 16 countries’ per capita GDP in 1885 on the horizontal axis and their growth rate btw years 1885-1994. The convergence hypothesis suggests that the countries that were poorer at 1885 should grow faster and the countries that were rich then should grow slower. The figure shows a strong negative relationship so it supports convergence hyp. However, Bradford Delong (1988) wrote a strong criticism of Baumol’s evidence. Delong showed that the sample of countries selected by Baumol is BIASED. Because these countries are today’s richest industrialized countries. Then, by definition, countries that have failed to converge and that are poor today DID NOT enter Baumol’s sample. The sample does not include countries such as Argentina, Portugal, Chile, Ireland and Spain. When Delong included those countries on the same graph, he obtained a FIGURE SUCH AS THIS IN HIS PAPER. Notice that this graph does not show a negative relationship anymore. Delong concludes that convergence hyp. is not supported by evidence. But it seems that the convergence hypothesis is supported when we look at OECD countries only. FIGURE 3.5 SHOWS OECD economies’ GDP per worker in 1960 versus their growth rate btw 1960-97. The Figure shows a strong negative relationship. However, when we include all of the world’s economies, convergence hyp. does not hold anymore. Figure 3.6 SHOWS that there is a lack of convergence for the world. In summary, we observe convergence among industrialized countries that have similar characteristics (OECD, EU, etc.). We do not observe convergence among countries that have very different characteristics (African countries do not converge). These characteristics are: levels of technology, levels of investment, rates of population growth. Therefore, there is convergence among countries that have the same steady-state. This is consistent with the Solow model’s prediction. FIGURE 3.7 ILLUSTRATES this point. If Initially Behind starts with a low capital per effective labor than Initially Ahead, then IB grows faster than IA during the transition period. The convergence hypothesis can be expressed as: Economies that are far below their steady-states should grow faster than economies that are close to their steady-states. Then, how do we explain the absence of convergence when all the countries of the world is considered? We explain the absence of convergence by understanding that all of the countries have different levels of steady-state output per capita. For example, African countries have SMALLER steady-state levels of output per capita compared to European countries. If we calculate the steady-state levels of per capita GDP for each country, and then check how far their actual GDP are from their steadystate, we can test the convergence theory. If the theory is true, then we should see a positive relationship between the amount of deviation from steady-state in 1960 and the growth rate between 1960-1997. Countries that are far away from their steadystate should grow faster. Mankiw, Romer and Weil (1992) and Barro and Sala-i Martin (1992) have done this and presented as FIGURE 3.8. On the horizontal axis, they show the ratio of 1960 actual GDPPC to the predicted steady-state GDPPC for each country. They call this deviation from steady-state. If this number is small, this means the country is FAR from its steady-state. BE CAREFUL, because MORE deviation means a SMALLER number on this graph. For example, Korea’s actual GDPPC was one fourth of its steady-state GDPPC in 1960. Then the theory says that Korea must grow FAST in its transition to the steady-state. This is called CONDITIONAL CONVERGENCE. We are testing the convergence theory conditional on each country’s own steady-state. Income Distribution in the World: Is it Getting Better or Worse? Are incomes in the world converging together or the distribution is getting worse? FIGURE 3.9 shows the ratio of GDP of the 5th richest country in the world to the GDP of 5th poorest country. It seems that the income distribution is getting more uneven as time passes. This is the case especially after 1990s. Lant Pritchett (1997) reports that the ratio of GDP of the richest country to the GDP of the poorest country in 1870 was 8.7. The same ratio in 1990 was 45.2. The richest country had an average income that is 45.2 times the income in the poorest country. What is your reaction to such uneven income distribution? Do you think the World or Turkey should do something about it? What can Turkey do? Figure 3.10 shows x percent of 110 countries in the world that has an income less than or equal to the y percent of US income. We can see that there is some improvement in income distribution for the countries that had income above 8% of US income in 1960. This constitutes about 67% of the countries. The situation got worse for countries that were poorer than 8% of US income. BE CAREFUL WITH THE GRAPH that the percentages do not take into account the population quantities. In this graph, Switzerland and India are counted as 1. They are not weighted for population size. In fact, if we take populations into consideration, the graph would show much worse distribution. It seems this graph is underestimating unfair income distribution in the world!!!