Supplementary access arrangement information

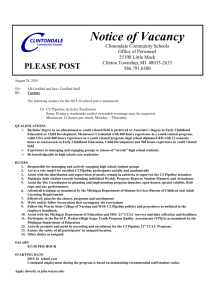

advertisement