New Truth in Lending/Regulation Z Rules for

Open-End Credit

Presentation to Payday Loan Bar Association

November 4-6 2009

Jeremy T. Rosenblum

Ballard Spahr LLP

1735 Market Street, 51st Floor

Philadelphia, PA 19103-7599

215.864.8505

rosenblum@ballardspahr.com

Copyright © Ballard Spahr LLP. All rights reserved.

DMEAST #11907025 v3

Barbara S. Mishkin

Ballard Spahr LLP

1735 Market Street, 51st Floor

Philadelphia, PA 19103-7599

215.864.8528

mishkinb@ballardspahr.com

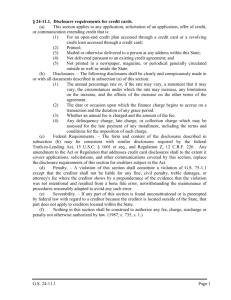

NEW TRUTH IN LENDING/REGULATION Z RULES FOR OPEN-END CREDIT

I.

Background

A.

On May 22, 2009, the Credit Card Accountability Responsibility and Disclosure Act of

2009 (“Credit Card Act”) was signed into law. The Credit Card Act established new

substantive and disclosure requirements for open-end credit, other than home equity

credit lines, subject to the Truth in Lending Act (“TILA”).

B.

In response to the Credit Card Act and prior developments, the Federal Reserve Board

(“Board”) has published a series of final or proposed changes to Regulation Z and the

Official Staff Commentary to Regulation Z.

1.

January 2009 Final Regulation Z Rule, 74 Fed. Reg. 5244 (Jan. 29, 2009). The

effective date of this rule is currently July 1, 2010. This rule includes changes to

Regulation Z implementing amendments to TILA that were part of the Bankruptcy

Abuse Prevention and Consumer Protection Act of 2005.

2.

Clarifications to January 2009 Final Regulation Z Rule, 74 Fed. Reg. 20784

(May 5, 2009).

3.

July 2009 Regulation Z Interim Final Rule, 74 Fed. Reg. 36077 (July 22, 2009).

This rule implements provisions of the Credit Card Act that became effective on

August 20, 2009.

4.

October 2009 Proposed Regulation Z Rule, 74 Fed. Reg. 54124 (Oct. 21, 2009).

This proposal is intended to implement the provisions of the Credit Card Act that

become effective on February 22, 2010. The Board has announced that it plans

to make February 22, 2010 the effective date not only for the final rule pursuant

to this proposal but also for provisions of the January 2009 Final Regulation Z

Rule that are affected by the Credit Card Act. Additionally, the Board has

indicated that it is considering whether to also move up to February 22, 2010 the

effective date of provisions of the January 2009 Final Regulation Z Rule that are

not directly affected by the Credit Card Act. Those provisions include the new

tabular and other formatting requirements for certain disclosures discussed

below.

5.

Still to be issued by the Board are Regulation Z changes to implement the

provisions of the Credit Card Act that become effective on August 22, 2010.

Those provisions deal with the reasonableness and proportionality of penalty

fees and charges and the re-evaluation of rate increases.

C.

The comment period for the October 2009 Proposed Regulation Z Rule ends on

November 20, 2009. It is anticipated that the Board will act very quickly to adopt a final

or interim final rule after the close of the comment period.

D.

The new requirements and limitations described in this outline apply to all open-end

credit other than home equity credit lines. Additional new requirements and limitations

apply only to a “credit card account under an open-end (not home secured) consumer

credit plan.” (See Sections III.B.4 and VII.A-E below.)

1.

DMEAST #11907025 v3

Regulation Z defines a “credit card” “as “any card, plate, or other single credit

device that may be used from time to time to obtain credit.” 12 C.F.R.

§226.2(a)(15)(i).

2.

II.

III.

As newly defined by Regulation Z, a “credit card account under an open-end (not

home-secured) consumer credit plan” is any credit account accessed by a “credit

card” other than a credit card that accesses a home equity credit line or an

overdraft line of credit accessed by a debit card. 12 C.F.R. §226.2(a)(15)(ii).

a.

Debit cards onto which advances are loaded are not “credit cards” and

accordingly are not subject to the application disclosure requirements set

forth at 12 C.F.R. §226.5a nor the new requirements applicable to a

“credit card account under an open-end (not home-secured) consumer

credit plan.”

b.

Debit cards that can access an overdraft credit line at the point of sale

are “credit cards” subject to the application disclosure requirements set

forth at 12 C.F.R. §226.5a but will not be subject to the new

requirements applicable to a “credit card account under an open-end (not

home-secured) consumer credit plan.”

Account-Opening Disclosures (Effective July 1, 2010) The Credit Card Act and the new

proposal revise the disclosures that must be given at or prior to the time a new credit card

account under an open-end (not home-secured) consumer credit plan is opened. Most

importantly, these disclosures will include a table, in a rigidly prescribed form, containing a

summary of key account terms. 12 C.F.R. §226.6(b). (See Exhibit A).

A.

The required tabular disclosures include, to the extent applicable, the APR; specified

variable-rate information; any potential penalty rate; fees for issuance, availability or

opening of the plan; fixed finance and minimum interest charges; the grace period or a

prescribed statement under the heading “Paying Interest” if no grace period is provided;

and cash advance fees, late payment fees, over-the-limit fees and returned payment

fees.

B.

Disclosures which must appear directly below the table include the balance computation

method and a billing error rights reference. 12 C.F.R. §226.6(b)(2).

C.

The APR and fee or percentage amounts that are required to be included in the table

must be in bold text. In addition, there is a requirement that certain disclosures be given

in a minimum of 10-point font. Since the scope of this requirement is unclear, we

recommend that a minimum of 10-point font be used for the entire table and the

disclosures immediately below. 12 C.F.R. §226.6(b)(1)(i); Comment 5(a)(1)-3.

D.

Certain charges “imposed as part of” the credit plan are not required to be disclosed in

the account-opening disclosures and instead can be disclosed orally or in writing at any

time before the consumer agrees to pay the charge or becomes obligated to pay the

charge. 12 C.F.R. §226.5(b)(1)(ii). An example is a fee for a pay-by-phone service.

Periodic Statements

A.

Timing Requirements (Effective August 20, 2009)

1.

Statements for all non-home equity open-end credit must be mailed or delivered

at least 21 days before the “payment due date” and the date on which any grace

period expires. 12 C.F.R. §226.5(b)(2).

2.

At first blush, this requirement appears very problematic for any open-end credit

programs where the creditor desires to require multiple payments each month

(for example, bi-weekly payments) or where the creditor does not want to wait

DMEAST #11907025 v3

2

potentially close to two months before receiving the first payment. However, the

Regulation Z Commentary provides that the “payment due date” is “the date by

which the creditor requires the consumer to make the required minimum periodic

payment in order to avoid being treated as late for any purpose….” Comment

5(b)(2)(ii)-3. Thus, a creditor can require payments (or arrange for automatic

payments) prior to the “payment due date,” as defined in the Commentary.

B.

3.

If the 21-day requirement is not met, a creditor may not treat a payment as late

for any purpose or collect any finance or other charge based on the consumer’s

failure to make a payment by the due date during the 21-day period following the

mailing or delivery of the statement. Treating a payment as late for any purpose

includes increasing the APR as a penalty or reporting the consumer as

delinquent to a consumer reporting agency. Comment 5(b)(2)(ii)-1. It would also

include imposing a late fee, initiating collection attempts, terminating, suspending

or reducing the credit line or taking other adverse action on account of late

payment.

4.

At the behest of the credit union industry, a bill recently passed the House of

Representatives that would amend TILA to limit the 21-day rule to credit cards.

Thus, there is reason to hope that the 21-day rule will soon be a problem of the

(recent) past for creditors providing non-credit card open-end credit.

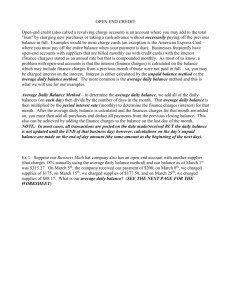

Content Requirements (Effective July 1, 2010)

1.

Charges must be grouped together in separate categories. Finance charges

based on periodic interest rates must be described as “Interest Charges” and all

other charges must be shown under heading “Fees.” Separate totals for interest

and fees must be shown for the statement period and the calendar year to date.

12 C.F.R. §226.7(b)(6). (See Exhibit B).

2.

The balance to which a periodic rate was applied and an explanation of how the

balance was determined must be shown using the term “Balance Subject to

Interest Rate.” For commonly used balance computation methods identified in

Regulation Z, a creditor has the option, in lieu of providing an explanation on the

statement, to identify the method on the statement and provide a toll-free number

for the consumer to call to obtain the explanation. 12 C.F.R. §226.7(b)(5).

3.

If an account has a balance subject to a deferred interest program, the date by

which the balance must be paid in full to avoid finance charges must be shown

on the front of the statement for the two billing cycles immediately preceding the

billing cycle in which such date occurs (unless the deferral period is shorter than

two billing cycles). 12 C.F.R. §226.7(b)(14). (See Exhibit C).

4.

DMEAST #11907025 v3

a.

As noted below, two-cycle billing is now prohibited for a credit card

account under an open-end (not home-secured) consumer credit plan.

This method of billing allowed creditors to provide a grace period on new

transactions and to recapture finance charges that could not be

assessed prior to the time that the consumer failed to qualify for the

grace period.

b.

Deferred interest disclosures can be used to produce the same

economic result as two-cycle billing.

The most difficult periodic statement requirements apply solely to statements for

credit card accounts under an open-end (not home-secured) consumer credit

3

plan. For such accounts, periodic statements must include the payment due

date, the amount of any late payment fee and elaborate disclosures about the

effect of only making minimum payments, including a minimum payment warning

and an estimate of how long it would take to repay the balance if only minimum

payments are made. 12 C.F.R. §226.7(b)(11), (12).

5.

IV.

Under the new rules, disclosure of an effective or historical APR will no longer be

required.

Subsequent Disclosures (Effective February 22, 2010)

A.

B.

Change-in-Terms Notices

1.

For a “significant change in account terms” or an increase in the required

minimum payment on any non-home equity open-end credit, a creditor generally

must provide written notice of the change at least 45 days prior to the effective

date of the change or increase. A “significant change in account terms” is

defined to mean a change in any term required to be disclosed as part of the new

tabular account-opening disclosure. 12 C.F.R. §226.9(c)(2)(i), (ii).

2.

The notice must include specified information, including a summary of the

changes, the effective date of the change and, if the change being disclosed is

an increase in the APR, the balances to which the increased APR will apply. 12

C.F.R. §226.9(c)(2)(iv)(A).

3.

The summary must be in a tabular format (except for a summary of any increase

in the minimum payment) using headings similar to the account opening table. If

the notice is provided on or with a periodic statement, the information required to

be included in the notices must be disclosed on the front of a statement page. If

the notice is not included on or with a periodic statement, the required

information must be disclosed on the front of the first page of the notice or

segregated on a separate page from other information given with the notice. 12

C.F.R. §226.9(c)(2)(iv)(C). (See Exhibit D).

4.

A minimum of 10-point font is required for the tabular format. Since the scope of

this requirement is unclear, we recommend that a minimum of 10-point font be

used for the entire table. Comment 5(a)(1)-3.

5.

No advance notice is required before a decrease in credit limit can take effect.

However, advance notice of the decrease is required before an over-the-limit fee

or a penalty rate can be imposed solely as a result of the consumer exceeding

the new lower limit. The notice must be provided orally or in writing at least 45

days before imposing the over-the-limit fee or penalty rate. This effectively gives

the consumer 45 days to cure an over-the-limit balance and avoid a fee or

penalty rate for an overlimit situation created by a reduction in the credit limit. 12

C.F.R. §226.9(c)(2)(vi).

Rate Increase Notices

1.

Separate notice requirements apply where a rate increase is not due to a change

in terms but instead is due to delinquency or default or another event specified in

the original contract.

2.

The creditor must provide written notice of the increase at least 45 days prior to

the effective date of the increase. 12 C.F.R. §226.9(g)(1), (2).

DMEAST #11907025 v3

4

V.

VI.

3.

Notice of the rate increase must include specified information, including: (a) a

statement that the default or penalty rate has been triggered; (b) the date on

which the new rate will apply; (c) the circumstances under which the penalty or

default rate will cease to apply or that the new rate will remain in effect

indefinitely; and (d) a statement indicating the balances to which the delinquency,

default or penalty rate will apply. 12 C.F.R. §226.9(g)(3)(i). (For credit card

accounts under an open-end (not home-secured) consumer credit plan, rate

increases generally may not be applied to certain pre-existing or recent balances.

See Section VIII.B below.)

4.

If the notice is provided on or with a periodic statement, the information required

to be included in the notice must be in a tabular format and disclosed on the front

of a statement page, above any change-in-terms notice provided on the same

statement. If the notice is not included on or with a periodic statement, the

required information must be disclosed on the front of the first page of the notice.

12 C.F.R. §226.9(g)(3)(ii).

5.

A minimum of 10-point font is required for the tabular format. Since the scope of

this requirement is unclear, we recommend that a minimum of 10-point font be

used for the entire table. Comment 5(a)(1)-3.

6.

A creditor may impose an increased penalty rate for exceeding a newlydecreased credit limit without having to first send a change in terms notice

followed by a second notice when the rate increase is triggered by sending a

single notice at the time of the credit limit decrease. 12 C.F.R. §226.9(g).

Payments (Effective February 22, 2010)

A.

For all forms of non-home equity open-end credit, creditors must treat a payment

received by 5 p.m. on the due date as timely whether the payment is received by mail,

electronically, by telephone or in person. 12 C.F.R. §226.10(b)(2)(ii).

B.

If the payment due date on any non-home equity open-end credit is a day on which the

creditor does not receive or accept payments by mail, the creditor may not treat a

payment received by any method on the next business day as late for any purpose.

However, if the creditor receives or accepts payments made on the due date by methods

other than by mail, it is not required to treat payments made by such other methods on

the next business day as timely. 12 C.F.R. §226.10(d).

Advertising (Effective July 1, 2010)

A.

The terms that trigger additional disclosures in an advertisement for any form of nonhome equity open-end credit include negative terms such as “no interest” or “no annual

fee.” Comment 16(b)(1)-1.

B.

Advertisements of credit to finance the purchase of goods or services that state a

minimum monthly payment must include the total of payments and the amount of time

needed to pay the balance if only the minimum payments are made. 12 C.F.R.

§226.16(b)(2).

C.

An advertisement may not state that an APR is “fixed” or use a similar term to describe

the APR unless the creditor specifies a time period that the rate is fixed and unless the

creditor will not increase the rate or the rate will remain in effect unconditionally during

this period. 12 C.F.R. §226.16(f).

DMEAST #11907025 v3

5

VII.

VIII.

D.

Advertisements of promotional rates offered to new or existing accounts must disclose

when the promotional rate ends and the APR that will apply after the end of the

promotional period. 12 C.F.R. §226.16(g).

E.

For deferred or waived interest offers, an advertisement must state the deferred or

waived interest period with equal prominence and in close proximity to each deferred

interest triggering term. Examples of such terms are “no interest,” “no payments,”

deferred interest” and “same as cash.” The advertisement must also state in immediate

proximity to each such trigger term that the balance must be paid in full by the end of the

deferred or waived interest period, using the phrase “if paid in full.” The advertisement

must also include in a prominent location closely proximate to the first use of a deferred

interest triggering term a statement that the consumer will be charged interest from the

date the consumer became obligated for the balance of the transaction if the balance or

transaction is not paid within the deferred or waived interest period and that interest can

be charged from the date the consumer became obligated for the transaction if the

consumer defaults before the end of the deferred or waived interest period. 12 C.F.R.

§226.16(h).

Marketing to College Students (Effective February 22, 2010)

A.

Creditors may not offer any tangible items to college students as an inducement to apply

for open-end credit if the offer is made on a college campus, near a college campus or at

a college-sponsored or college-related event. 12 C.F.R. §226.57(c).

B.

Issuers of credit card accounts under an open-end (not home-secured) consumer credit

plan must consider the consumer’s ability to make the required minimum payments. In

addition, such issuers are prohibited from opening such an account for a consumer who

is less than 21 years old unless the underage consumer has submitted a written

application and either provided a cosigner, guarantor or joint applicant able to pay or has

the independent ability to repay. 12 C.F.R. §226.52.

Credit Card UDAP Provisions

A.

In January 2009, the Board, the Office of Thrift Supervision and the National Credit Union

Administration published final rules to prohibit certain credit card practices as unfair or

deceptive practices under the Federal Trade Commission Act. 74 Fed Reg. 5498 (Jan.

29, 2009) (“FTC Act Rule”). Clarifications to the FTC Act Rule were published on May 5,

2009. 74 Fed. Reg. 20804. The Credit Card Act amended TILA to include substantially

all of the requirements of the FTC Act Rule. As a result, in the July 2009 Regulation Z

Interim Final Rule and the Oct. 2009 Proposed Regulation Z Rule, the Board

incorporated the requirements of the FTC Act Rule with proposed amendments as

necessary to make them conform with the Credit Card Act. One such requirement is the

new timing requirement for periodic statements described above in Section III.A. which

was incorporated in the July 2009 Regulation Z Interim Final Rule and currently applies to

all open-end credit. The following requirements of the FTC Rule, incorporated in the

October 2009 Proposed Regulation Z Rule, apply only to credit card accounts under an

open-end (not home-secured) consumer credit plan.

B.

Restrictions on Rate and Fee Increases. 12 C.F.R. §226.55.

1.

DMEAST #11907025 v3

With limited exceptions, such as increases due to the expiration of certain

promotional rates, an increase in an index used in a variable rate formula or a

payment delinquency of at least 60 days, rates or fees may not be increased

during the first year after an account is opened.

6

C.

D.

E.

2.

Except when the consumer is more than 60 days delinquent, rate or fee

increases due to a change in terms or the imposition of a penalty rate or fee may

not apply to existing balances or to transactions that occurred within 14 days of

when notice of the increase was provided.

3.

If an APR or fee is increased based on a payment delinquency of more than 60

days, the card issuer must reduce the APR or fee to the APR or fee that applied

before the increase if it receives six timely minimum payments beginning with the

first payment due after the effective date of the increase. The reduced rate or

APR must be applied to existing balances or transactions that occurred within 14

days of when notice of the increase was provided.

4.

The card issuer must allow a consumer to repay a balance protected from a fee

or rate increase using a method that is no less beneficial to the consumer than

one of the following: (a) the method that applied to the account before the

increase; (b) an amortization period of at least five years; or (c) a minimum

payment that includes a percentage of the balance which is no more than twice

the percentage required before the increase.

Required Allocation of Excess Payments. 12 C.F.R. §226.53.

1.

The amount of a payment greater than the required minimum payment must be

allocated first to the balance with the highest APR and then to other balances in

descending order based on the applicable APR.

2.

However, if there is a balance subject to a deferred interest program, the excess

amount must be allocated first to that balance during the two billing cycles

immediately preceding the end of the deferred interest period.

No Double-Cycle Billing. 12 C.F.R. §226.54.

1.

Finance charges may not be imposed on balances for days in previous billing

cycles as a result of the loss of a grace period.

2.

However, this limitation can potentially be avoided by treating new charges as

deferred interest.

Limits on First-Year Fees. 12 C.F.R. §226.52.

1.

During the first year of an account, a card issuer may not charge any fees (other

than late fees, returned payment fees and over-the-limit fees) that total more than

25% of the initial credit limit.

2.

This limitation expands the fees subject to the UDAP limit and would apply to

cash advance fees.

DMEAST #11907025 v3

7

IX.

Civil Liability

A.

The Credit Card Act significantly increased individual TILA statutory damages for nonhome equity open-end credit violations. 15 U.S.C. §1640(a)(2)(A)(iii). Currently, the

statutory damages available in an individual action equal twice the finance charge with a

minimum of $100 and a maximum of $1,000. Effective February 22, 2010, the available

statutory damages are increased to twice the finance charge with a minimum of $500 and

a maximum of $5,000. A court is also authorized to award “such higher amount as may

be appropriate in the case of an established pattern or practice” of non-compliance.

Statutory damages in class actions remain capped at the lesser of $500,000 or 1% of the

creditor’s net worth. 15 U.S.C. §1640(a)(2)(B).

B.

Several of the new Regulation Z requirements implement Credit Card Act requirements

applicable generally to non-home equity open-end credit other than home equity credit

lines implement amendments to TILA made by the Credit Card Act that similarly apply to

all open-end credit other than home equity credit lines. Those requirements are the 21day rule for mailing periodic statements (Section III. A above), the 5 p.m. payment cutoff

time (Section V.A above), and the prohibition on marketing inducements to college

students (Section VII above.). Violations of those requirements would give rise to TILA

statutory damages.

C.

The Board has elected to apply certain of the new Regulation Z requirements to all nonhome equity open-end credit even though the corresponding TILA amendments apply by

their terms only to credit card accounts under an open-end (not home-secured) consumer

credit plan. Such requirements include the 45-day advance notice requirement for a

change-in-terms or a rate increase (Section IV above) and the requirement for crediting

payments when the due date falls on a day on which the creditor does not receive or

accept payments by mail (Section V.B above.) While violations of these requirements in

connection with such credit card accounts would give rise to statutory damages, it could

be argued that violations of those requirements in connection with other open-end credit

would only give rise to actual damages because the requirements are not mandated by

TILA.

D.

Certain new Regulation Z requirements, applicable generally to all non-home equity

open-end credit, do not result from changes to TILA but instead result from a

comprehensive review of Regulation Z launched by the Board in 2004. Those

requirements include the new account-opening disclosures (Section II above) and the

new content requirements for periodic statements (Section III.B above.) Whether

violations of these requirements give rise to statutory damages is beyond the scope of

this outline.

DMEAST #11907025 v3

8

EXHIBIT A

DMEAST #11907025 v3

EXHIBIT B

DMEAST #11907025 v3

EXHIBIT C

G-18(H) – Deferred Interest Periodic Statement Clause

[You must pay your promotional balance in full by [date] to avoid paying accrued interest charges.]

DMEAST #11907025 v3

EXHIBIT D

DMEAST #11907025 v3