Chapter 21: Financial Statement Analysis

Assignment 21-2

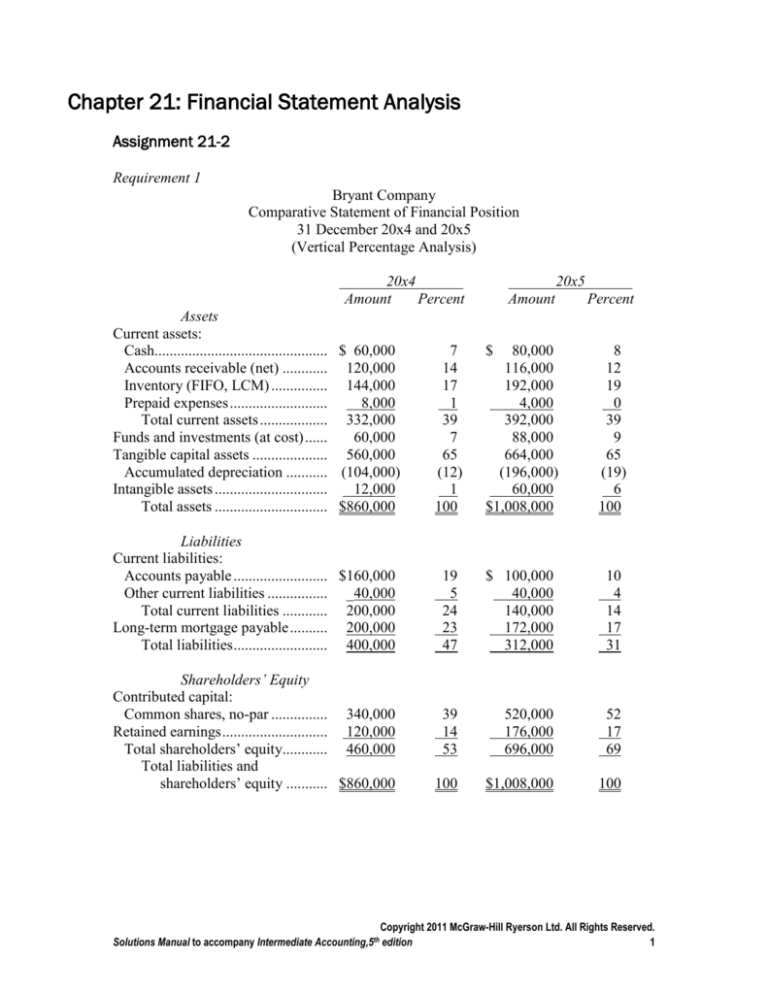

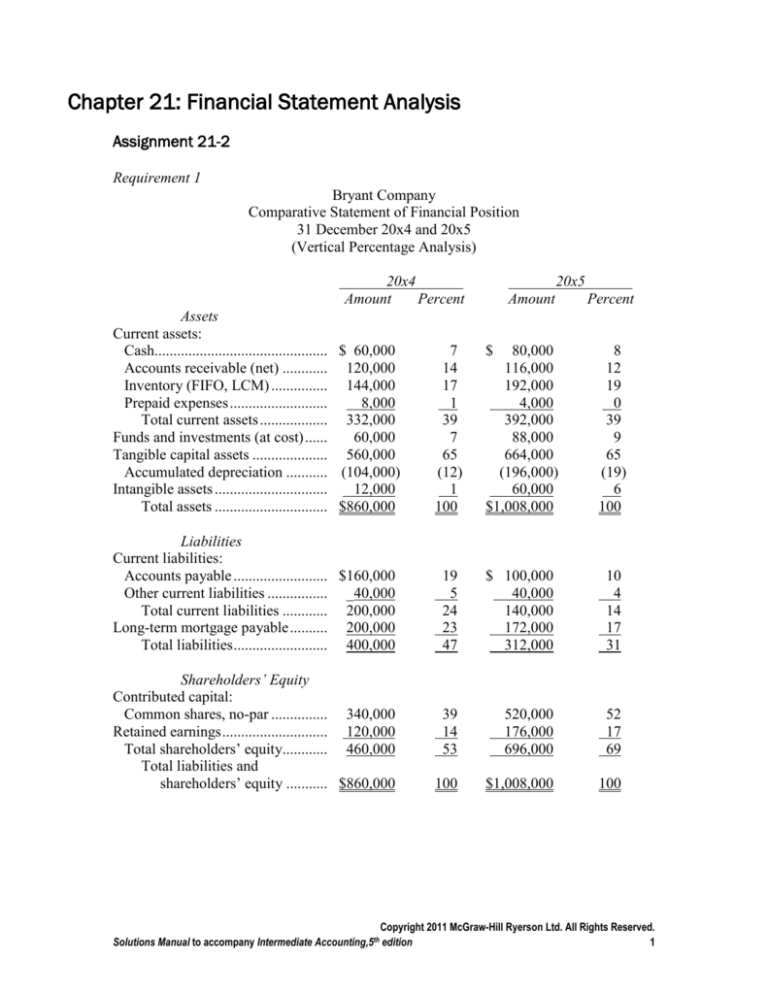

Requirement 1

Bryant Company

Comparative Statement of Financial Position

31 December 20x4 and 20x5

(Vertical Percentage Analysis)

20x4

Amount

Percent

Assets

Current assets:

Cash.............................................. $ 60,000

Accounts receivable (net) ............ 120,000

Inventory (FIFO, LCM) ............... 144,000

Prepaid expenses ..........................

8,000

Total current assets .................. 332,000

Funds and investments (at cost) ......

60,000

Tangible capital assets .................... 560,000

Accumulated depreciation ........... (104,000)

Intangible assets ..............................

12,000

Total assets .............................. $860,000

7

14

17

1

39

7

65

(12)

1

100

Liabilities

Current liabilities:

Accounts payable ......................... $160,000

Other current liabilities ................ _40,000

Total current liabilities ............ 200,000

Long-term mortgage payable .......... 200,000

Total liabilities ......................... 400,000

Shareholders’ Equity

Contributed capital:

Common shares, no-par ............... 340,000

Retained earnings ............................ 120,000

Total shareholders’ equity............ 460,000

Total liabilities and

shareholders’ equity ........... $860,000

20x5

Amount

$

Percent

80,000

116,000

192,000

4,000

392,000

88,000

664,000

(196,000)

60,000

$1,008,000

8

12

19

0

39

9

65

(19)

6

100

19

5

24

23

47

$ 100,000

40,000

140,000

172,000

312,000

10

4

14

17

31

39

14

53

520,000

176,000

696,000

52

17

69

100

$1,008,000

100

Copyright 2011 McGraw-Hill Ryerson Ltd. All Rights Reserved.

Solutions Manual to accompany Intermediate Accounting,5th edition

1

Requirement 2

Bryant Company

Comparative Statement of Financial Position

31 December 20x4 and 20x5

(Horizontal Analysis)

20x4

Assets

Current assets:

Cash..............................................

Accounts receivable (net) ............

Inventory (FIFO, LCM) ...............

Prepaid expenses ..........................

Funds and investments (at cost) ......

Tangible capital assets ....................

Accumulated depreciation ...........

Intangible assets ..............................

Total assets .............................

Liabilities

Current liabilities

Accounts payable .........................

Other current liabilities ................

Long-term mortgage payable ..........

Total liabilities .......................

Shareholders’ Equity

Contributed capital:

Common shares, no-par ...............

Retained earnings ............................

Total shareholders’ equity............

Total liabilities and

shareholders’ equity ...............

20x5

100%

100

100

100

100

100

100

100

100

133

97

133

50

147

119

188

500

117

100

100

100

100

63

100

86

78

100

100

100

153

147

151

100

117

Copyright 2011 McGraw-Hill Ryerson Ltd. All Rights Reserved.

Solutions Manual to accompany Intermediate Accounting,5th edition

2

Copyright 2011 McGraw-Hill Ryerson Ltd. All Rights Reserved.

Solutions Manual to accompany Intermediate Accounting,5th edition

3

Assignment 21-10

(a) Ratios that measure profitability

Return on long-term capital

(after tax)

Income + Interest exp. on

long-term capital, net of tax

Average LT Debt + Equity

$28 + ($4(1–.40))

$167

= .18

(or 18%)

Return on long-term capital

investment, excluding current

liabilities.

Return on assets (after tax)

Income +

Interest exp.,net of tax

Average total assets

Income – Pref dividends

Average common owners’

equity

$28 + ($4(1–.40))

$185

= .16

(or 16%)

Rate of return earned on all

assets employed

$28

$124

= .23

(or 23%)

Rate of return earned on assets

provided by owners

$28 + $4 + $20

$157

= .33

(or 33%)

Profit margin earned on each

dollar of sales

$28 + $4 + $20 + $8 = .28

(($184 + $29) +

(or 28%)

($186 + $37)) ÷ 2)

Return on invested capital

exclusive of return of capital

(depreciation)

Return on common owners’

equity

Operating margin (before tax)

Return on gross assets

(before tax)

Income + interest + income tax

Total revenue

EBIT + Depreciation

Average total assets (net) +

Average accumulated

depreciation

Solutions Manual to accompany Intermediate Accounting,5th edition

Copyright 2011 McGraw-Hill Ryerson Ltd. All Rights Reserved.

4

(b) Ratios that measure efficiency:

1.

Asset turnover

Total revenue

Total assets (average)

$157

$185

= .85 times

Efficiency of asset utilization

2.

Accounts receivable

turnover

Credit sales

Average trade receivables

$51

$21

= 2.4 times

Efficiency of collection of

accounts receivable

3.

Average collection period

of accounts receivable

365 (days)

Receivable turnover

365

2.4

= 152 days

Average number of days to

collect receivables

4.

Inventory turnover

Cost of goods sold

Average inventory

$70

$34

= 2.1 times

Number of times average

inventory was sold

Solutions Manual to accompany Intermediate Accounting,5th edition

Copyright 2011 McGraw-Hill Ryerson Ltd. All Rights Reserved.

5

(c) Ratios that measure solvency:

1.

Debt:equity

Total liabilities

Total owners’ equity

2.

Debt: total capitalization

3.

Debt: capital employed

4.

Debt: total assets

5.

Times-interest-earned

Income + interest + tax

Interest expense

$28 + $20 + $4

$4

= 13

Income available to cover

interest

6.

Times-debt-service-earned

Cash flow from

ops + interest + tax

Interest + projected debt

service costs ÷ (1 – t)

$22 + $20 + $4

$4

= 11.5

Ability to co. to service debt

charges

Long-term debt

Long-term debt + owners’

equity

Long-term debt + current liabilities

Long-term debt + current liabilities –

(liquid) current assets + equity

Total liabilities

Total assets

Solutions Manual to accompany Intermediate Accounting,5th edition

$57

$129

= .44

(or 44%)

Compares resources provided

by creditors versus owners

$45

$45 + $129

= .26

(or 26%)

Proportion of long-term capital

financed by debt

$45 + $12

$45 + $12 –

($20 + $4 + $19)

+ $129

= .40

(or 40%)

Debt burden with liquid current

assets netted out.

$57

$186

= .31

(or 31%)

Proportion of resources

provided by creditors

Copyright 2011 McGraw-Hill Ryerson Ltd. All Rights Reserved.

6

(d) Ratios that measure liquidity:

1.

Current ratio

2.

Quick ratio

3.

Defensive interval

Current assets

Current liabilities

$83

$12

= 6.9

Ability to pay liabilities with

current assets

Monetary current assets

Monetary current liabilities

$43

$12

= 3.6

Ability to pay liabilities with

liquid current assets

Monetary current assets *

Projected daily operating

expenditures

$43 = 1,427 days

11÷365

Average number of days the

company can operate with the

currently available liquid assets

* Interest + administrative expense – depreciation

Solutions Manual to accompany Intermediate Accounting,5th edition

Copyright 2011 McGraw-Hill Ryerson Ltd. All Rights Reserved.

7

Assignment 21-18

Requirement 1 (EPS calculations in thousands)

a. Basic EPS: ($898 – $401) ÷ [(380 × 1/12) + (420 × 11/12)] = $2.06

1

Preferred shares are cumulative

b. Diluted EPS: [$898 + $98(1–.30)] ÷ [417* + 401 + 502 + $403] = $1.81

* From basic calculation

Dilution tests:

1

Pref. shares $40/40=$1; dilutive

2

$98(1–.30) = $68.60; dilutive

3

Options: 40K shares issued and (40 × $16) ÷ $20 = 32 retired

c. Debt: equity: ($2,190 + $833 + $619) ÷ ($500 + $166 + $2,150 + $2,461) = 0.69

Note: deferred income tax might be classified differently: assumptions must be stated!

d. Inventory turnover : $7,620 ÷ [($2,575 + $2,110) ÷ 2] = 3.25

e. Quick: ($1,720 + $1,150 + $450) ÷ $2,190 = 1.52

f. Return on assets: (after tax) [$898 + $98(1–.30)] ÷ [($8,919 + $7,401)/2] = 11.8%

g. Return on common shareholders’ equity: ($898 – $401) ÷ $4,1802 = 20.5%

1

2

Preferred shares are cumulative.

[($2,150 + $2,461 + $166) + ($1,700 + $1,716 + $166)] ÷ 2 = $4,180

h. Accounts receivable turnover: $10,450 ÷ [($1,150 + $1,170) ÷ 2] = 9

i. Asset turnover: $10,450 ÷ [($8,919 + $7,401) ÷ 2] = 1.28

j. Return on long-term capital, after tax:

[$898 + $98(1–.30)] ÷ {[($8,919 – $2,190) + ($7,401 – $1,900)] ÷ 2} = 15.8%

k. Operating margin: ($898 + $98 + $385) ÷ $10,450 = 13.2%

Copyright 2011 McGraw-Hill Ryerson Ltd. All Rights Reserved.

Solutions Manual to accompany Intermediate Accounting, 5th edition

8