Fines Guidelines - Competition and Consumer Protection Commission

advertisement

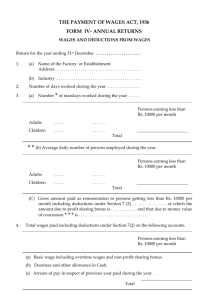

Contents Part I COMPETITION AND CONSUMER PROTECTION COMMISSION 1. Short title and Commencement 2. Definitions 3. Basis for issuing fines Part II GUIDELINES FOR ISSUANCE OF FINES: OUTLINING PRINCIPLES AND PRACTICES FOR ISSUANCE OF FINES UNDER THE COMPETITION AND CONSUMER PROTECTION ACT, NO. 24 OF 2010 2014 General Provisions Offences and Penalties 4. Offences punishable by fines under the Act 5. Determining the amount of penalty 6. Calculation of penalty 7. Aggravating and Mitigating factors 8. Procedure in imposing a financial penalty and date of payment COMPETITION AND CONSUMER PROTECTION ACT 2010: GUIDELINES FOR ISSUANCE OF FINES POLICY OBJECTIVE The policy objective of these guidelines on the issuance of fines is to; a. To impose fines which reflect the seriousness of the violation b. To ensure that fines deter future behavior or others from contravening the Act; particularly part III, IV, VII and VIII and ensure compliance with the law. c. To raise awareness of the law. PREAMBLE This Guideline on fines is hereby established to set forth the manner in which fines to be issued by the Commission will be determined by the Commission. These guidelines are not a substitute for the Act and the regulations. They may be revised from time to time, should need arise. The examples in these guidelines are for illustrative purposes only and should not be taken as exhaustive. In applying these guidelines, the facts and circumstances of each case will be considered. Persons in doubt about how they and their commercial activities may be affected by the Act may wish to seek legal advice. Purpose These Guidelines are issued subject to the Competition and Consumer Protection Commission Act, No. 24 of 2010 (the Act) and the Competition and Consumer Protection (General) Regulation no. 97 of 2011 (the Regulations) made there under and shall apply to the extent that they are not inconsistent with both as well as any other written law. The Competition and Consumer Protection Commission (the Commission) in accordance with Section 84 of the Act is mandated to issue Guidelines with respect to the effective implementation of provisions of the Act. Specifically, Section 84 (1) of the Act states that- PART I GENERAL 1. Short Title Competition & & commencement (1) In the exercise of its functions under this Act, the Commission may make such guidelines as are necessary for the better carrying out of the provisions of this Act. 2. Definition These Guidelines may be cited as the Consumer Protection Commission Guideline on Issuance of Fines 2014 and shall come into force on the date of their publication pursuant to section 84(2) of the Competition and Consumer Protection Act, No. 24 of 2010 (‘the Act’). Definitions For purposes of These Guidelines, any word or phrase to which a meaning has 2| COMPETITION AND CONSUMER PROTECTION ACT 2010: GUIDELINES FOR ISSUANCE OF FINES been assigned in the Act shall have such meaning. 4. Offences punishable by fines under the Act (i) 3. Basis for Issuing Fines (i) The Commission is empowered by the Act to remedy any conduct that violates the Act as determined in its investigations and in some cases to impose financial penalties on enterprises or individuals in violation of the Act. (ii) Sanctions or penalties are actions taken to address a violation of the Act. This document describes the principles the Commission will follow in taking both these different forms of action with regards to issuance of fines. (iii) A fine payable under the Act is deemed to be a debt due to the state and shall be summarily receivable as a civil debt. (iv) The aim of these Guidelines are to provide for consistency, fairness and certainty in the issuance of fines. (ii) All offences punishable under the Act including Section 9, section 10, section 16, section 21, section 37, section 46, section 47, section 48, Section 49, Section 50, Section 51, Section 52, Section 55, all provide for offences punishable by financial penalties to be imposed by the Commission without recourse to any court or arbiter unless on appeal. With regard to Cartel activities, the fines to be imposed will be the highest due to the seriousness of the conduct, preceding such fines may be conviction for criminal culpability by a Court of Competent jurisdiction. Involvement of an association of enterprises (e.g. a trade or professional association) in violation of section 9 and 10 of the Act may result in financial penalties being imposed on such Association, its members or both. Where the violation by an Association of enterprises relates to the activities of its members, the penalty shall not exceed 10 percent of the sum of the turnover of the business of each member of the Association of 3| COMPETITION AND CONSUMER PROTECTION ACT 2010: GUIDELINES FOR ISSUANCE OF FINES enterprises in Zambia, active on the market affected by the violation. 5. potential offenders and persons who might be considering activities contrary to these sections’ prohibitions. The assessment of an appropriate penalty to be imposed for all types of violations will depend on the facts of each case. Determining the amount of penalty (i) (ii) The Act empowers the Commission to impose administrative penalties including fines up to a maximum of ten per cent of turnover for specific violations. (vi) Turnover will be calculated from the latest audited accounts or the turnover of its year in which the violation took place. Where there are no audited accounts available, management’s accounts may be utilised. (iii) Where management accounts are used, the turnover will be adjusted by an amount not exceeding five (5) per cent before imposition of the fine. (iv) The Commission as a matter of principle will impose higher fines on violations of section 9(cartels), Section 10, section 50 and section 52 (public policy). The violations of other sections will depend on the prevalence and negative impact the conduct has on society. (vii) (v) This is aimed at deterring not only the infringing enterprises but also other A financial penalty imposed by the Commission under the Act will be calculated taking into consideration the following: (a) the turnover of the enterprise in Zambia in the last business/financial year (b) Adjustments to reflect other relevant factors such as aggravating or mitigating factors (an upward adjustment for aggravating factors and a downward adjustment for mitigating factors) (c) A maximum of 10% of the turnover of the enterprise in Zambia in the last business/financial year Note that the Commission’s leniency policy provides substantial reductions 4| COMPETITION AND CONSUMER PROTECTION ACT 2010: GUIDELINES FOR ISSUANCE OF FINES in, or complete immunity from, financial penalties, for enterprises coming forward with information about violations related to restrictive agreements. Details are set out in the Commission’s Leniency program. 6. the annual Zambian turnover of each of the parties. (iii) By its clear prohibition of restrictive agreements and unfair trading, and the penalty regime in place, the Act establishes the principle that violations of the Act are costly to business. A fine should not be seen merely as part of the normal costs and risks of doing business; it should be punitive in nature. Consequently, the Commission will normally expect to set a fine at a level well above any assessment of damage to customers, or in the case of collusive agreements, a level above the excess profits made by the parties to the collusive agreement. (iv) The starting point of each financial penalty will be the base to be determined by the gravity of the offence (which is represented by “B”). Thereafter, each repeat offence will carry an additional punitive percentage of 0.5%. The formula for calculating the penalty is therefore as follows: Calculation of penalty (i) (ii) In general, the Commission regards violations of all Sections of the Act as serious, however violations of Section 9, Section 10, Section 50 and Section 52 are particularly the most serious violations of the Act. The greater the damage to customers of the colluding enterprises, resulting from the increase in price over levels that would otherwise have obtained, the larger the penalty to be imposed by the Commission. The Commission starts by considering the scale of the individual enterprise’s contravention, however, with respect to mergers, the market coverage of the enterprises to be merged is not relevant to the various failures listed in section 37 of the Act, which are failures of an enterprise to submit to the relevant procedures. The Commission considers that the only reasonable scaling factor is Bi + 0.005(n-1) (v) In the case of unfair trading practices, it is noted that the majority of offences are 5| COMPETITION AND CONSUMER PROTECTION ACT 2010: GUIDELINES FOR ISSUANCE OF FINES carried out by MSMEs. While it is the objective of the financial penalty to punish and deter offenders it is noted that the use of a baseline percentage would mean that while one enterprise would be fined a small amount another would only be fined a larger amount for the same offence. This may lead to the failure of the enterprises especially where the gravity of harm is minimal i.e. such as in the case of display of disclaimers under Section 48 of the Act. The baseline penalties shall vary depending on the gravity of the offence and the total fine applicable shall be capped for specific offences based on the turnover of enterprises. Table 2 below illustrates how fines for offences provided for under Part VII of the Act will be determined. Table 2: Determination of Fines for offences under Part VII of the Act Offence Unfair practice Baseline Fine trading 0.5% turnover Applicable Cap of False or misleading representation K1,000 turnover K10,000 K3,000 for turnover above K10,000 up to K100,000 K10,000 for turnover above K100,000 up to K500,000 K30,000 for turnover above K500,000 up to K1m A cap of K50,000.00 for turnover in excess of K1m Price Display Unfair Term Display Disclaimer Contract of Re-introduction of 0.1% turnover of 1% of turnover for below K20,000 No cap 6| COMPETITION AND CONSUMER PROTECTION ACT 2010: GUIDELINES FOR ISSUANCE OF FINES ensuring the violation; recalled product on the market (vi) 7. (i) In assessing the amount of financial penalty to be imposed, the Commission will consider the following aggravating and mitigating factors. (ii) the repeated violation (i.e. having previously violated the same provision of the Act ) by the same enterprise or other enterprise in the same group in Zambia (e) Prevalence of the alleged offence, i.e. whether the conduct is widespread and the application of a sanction is likely to have a wide deterrent effect; (f) Whether the alleged offender has demonstrated resistance by being obstructive or defiant towards the Commission ; (g) The number of years the offender has been engaged in the prohibited conduct; The aggravating factors include: (a) role of the enterprise as a leader in, or an instigator of the infringement; (b) involvement in or awareness of the infringing conduct by directors and senior management as defined in the organogram of the party under consideration who knew or ought reasonably to have known that conduct in issue constituted anti-competitive behaviour. (iii) retaliatory or other coercive measures taken against other enterprises including leniency applicants aimed at (c) of (d) Note that for every offence repeated there will be an addition of 0. 5% of turnover added to the base fine. Aggravating and Mitigating Factors continuation Mitigating factors include: (a) role of the enterprise, for example, that the enterprise was acting under duress or pressure; (b) the alleged offender has not been the subject of previous enforcement action on similar conduct; (c) the alleged offender is willing to accept lesser enforcement options e.g. give undertakings, enter into consent agreement; 7| COMPETITION AND CONSUMER PROTECTION ACT 2010: GUIDELINES FOR ISSUANCE OF FINES (iii) (d) the alleged offender has cooperated with the Commission in providing information and evidence which enables the enforcement process to be concluded more effectively and/ or speedily; (e) termination of the violation as soon as the Commission intervenes. (f) Offence/s committed by the offender as a result of a genuine and/or innocent mistake. 8. An appeal against a fine shall not operate as a stay. Therefore an appeal will not suspend the obligation to pay the penalty or to submit necessary information to the Commission such as financial statements or volume of sales for purposes of calculating a fine unless there is a lawful order to this effect. Procedure in imposing a financial penalty and date of payment (i) When the Commission makes an order imposing a penalty on an enterprise, such order shall be in writing, shall specify the offence, the factors the Commission took into consideration in arriving at the amount to be paid and the date before which the penalty is required to be paid. (ii) The date specified in an order imposing a penalty shall not be a date before the end of the period within which an appeal against the order of Commission may be brought under the Act. 8|