Capital gains - E

advertisement

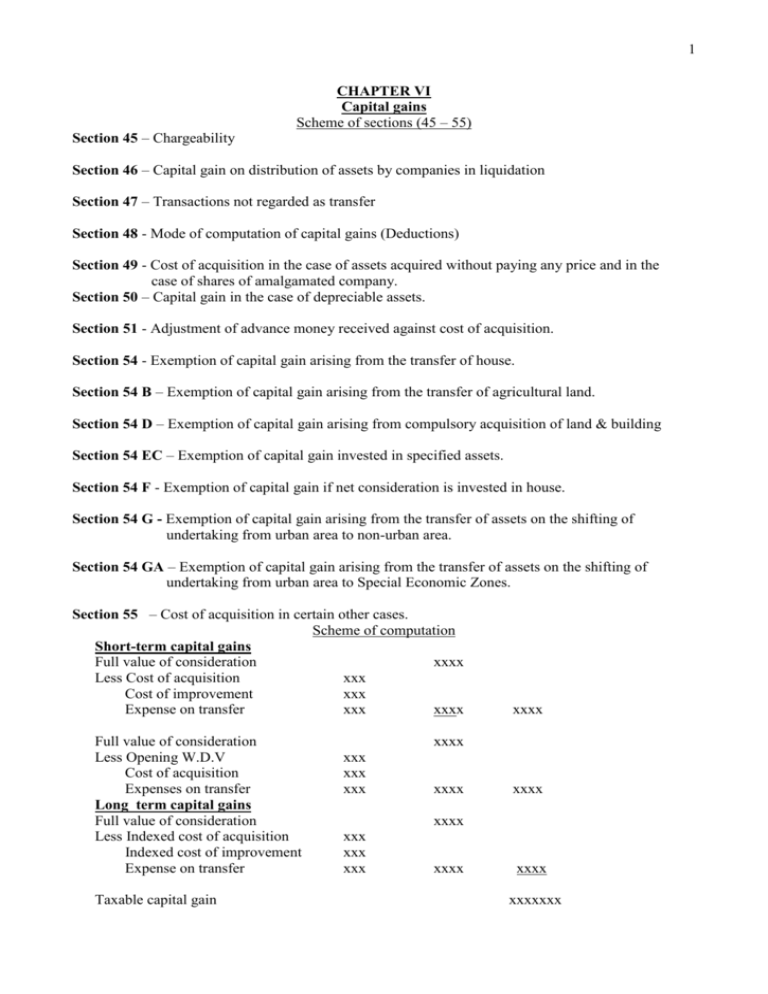

1 CHAPTER VI Capital gains Scheme of sections (45 – 55) Section 45 – Chargeability Section 46 – Capital gain on distribution of assets by companies in liquidation Section 47 – Transactions not regarded as transfer Section 48 - Mode of computation of capital gains (Deductions) Section 49 - Cost of acquisition in the case of assets acquired without paying any price and in the case of shares of amalgamated company. Section 50 – Capital gain in the case of depreciable assets. Section 51 - Adjustment of advance money received against cost of acquisition. Section 54 - Exemption of capital gain arising from the transfer of house. Section 54 B – Exemption of capital gain arising from the transfer of agricultural land. Section 54 D – Exemption of capital gain arising from compulsory acquisition of land & building Section 54 EC – Exemption of capital gain invested in specified assets. Section 54 F - Exemption of capital gain if net consideration is invested in house. Section 54 G - Exemption of capital gain arising from the transfer of assets on the shifting of undertaking from urban area to non-urban area. Section 54 GA – Exemption of capital gain arising from the transfer of assets on the shifting of undertaking from urban area to Special Economic Zones. Section 55 – Cost of acquisition in certain other cases. Scheme of computation Short-term capital gains Full value of consideration xxxx Less Cost of acquisition xxx Cost of improvement xxx Expense on transfer xxx xxxx Full value of consideration Less Opening W.D.V Cost of acquisition Expenses on transfer Long term capital gains Full value of consideration Less Indexed cost of acquisition Indexed cost of improvement Expense on transfer Taxable capital gain xxxx xxxx xxx xxx xxx xxxx xxxx xxxx xxx xxx xxx xxxx xxxx xxxxxxx 2 45(Chargeability): Any profit and gain arising from the transfer of a capital asset effected in the previous year shall, save as otherwise provided under section 54, be chargeable to tax under the head capital gains and shall be deemed to be the income of the previous year in which the transfer took place. Note: - Here capital asset means property of any kind held by the assessee whether or not connected with his business or profession but excluding the following. 1. Stock-in – trade, raw materials or consumable stores held by the assessee for the purpose of his business or profession. 2. Personal effects (movable property) like wearing apparel, motorcar, electric appliances, furniture etc. excluding ornaments and jewellery held for personal use. 3. Gold bonds and special bearer bonds issued by the Govt. 4. Gold deposit bonds issued under the Gold deposit Scheme 1999. 5. Agricultural land in India excluding those situated within the jurisdiction of an urban local self Govt. like municipality, cantonment board etc. having a population of 10000 or more as per the last census. Agricultural land situated within 8 K.ms from the local limits of a municipality etc. in respect of which the Central Govt. has issued a notification also will be a capital asset. A transfer in this purport includes sale, exchange, and relinquishment of asset, extinguishment of any right in an asset or the compulsory acquisition of any right in an asset under law. The following transactions are also deemed as transfer u/s 45(2) and give rise to taxable capital gain. 1. Conversion of capital asset into stock-in-trade. 2. Handing over the possession of an immovable property in part performance of a contract for the transfer of that property. 3. Transfer of rights in immovable properties through the medium of co-operative societies, companies etc. 4. Transaction involving the transfer of membership of a group housing society, company etc. which has the effect of transferring or enabling the enjoyment of any immovable property or any right therein. 5. Transfer of capital asset by a person to firm/AOP/BOI of which he is or becomes a partner/member. 6. Transfer of capital asset by a firm etc. to a partner/member on the dissolution of the firm/AOP/BOI. 7. Enhancement of compensation on compulsory acquisition of capital asset. 8. Sale of units purchased for deduction u/s 80CCB (Mutual fund units). Gain or loss arising from the transfer of long-term capital asset is known as LTCG/LTCL. Gain or loss arising from the transfer of short-term capital asset is known as STCG/STCL. Short-term capital asset is one, which is held by the assessee for not more than 36 months immediately preceding the date of its transfer. Long-term capital asset is one, which is held by the assessee for more than 36 months. But in the case of shares in companies, listed securities, mutual fund and UTI units the period will be 12 months instead of 36 months. The distinction between LTCG and STCG is very important for taxation purpose. Because LTCG qualifies for concession-tax treatment under Income Tax Act. 46(Capital gain on distribution of assets by companies in liquidation): 1. The company, for the purpose of capital gain tax, shall not regard such distribution as transfer. So any profit or gain arising from such transfer cannot be taxable as capital gain but there are certain conditions. (i) The transfer of capital asset must be in specie. (ii) Distribution must be in the course of liquidation. (iii) Distribution must be to the registered shareholders. 3 2. If a shareholder receives any money/asset from the company on its liquidation, he shall be liable to pay tax on capital gain in respect of money so received or market value of asset received. 47(Transactions not regarded as transfer); 1. Transfer of assets on the partition of HUF. 2. Transfer of assets under a gift, will or irrevocable trust. 3. Transfer of assets by a parent company to a subsidiary company or 4. Transfer of assets by a subsidiary company to a parent company; provided in both these cases the recipient company is an Indian company and the parent company holds 100% share capital of the subsidiary company. 5. Transfer of assets on the amalgamation of companies provided the amalgamated company is an Indian company. 6. Transfer of shares on the amalgamation of companies provided at least 25% of the share holders of the amalgamating company continue to remain shareholders in the amalgamated company and such transfer does not attract tax on capital gain in the country in which the amalgamating company is incorporated. 7. Transfer of shares in an Indian company by a foreign company to another foreign company in pursuance of a scheme of amalgamation between the two foreign companies. 8. Transfer of assets of historical importance to a museum, archives or national gallery or arts. 9. Any transfer by way of conversion of bonds, debentures, debenture stock or deposit certificates in any form of a company into shares or debentures of that company. 10. Transfer of bonds or shares referred to in section 115AC (i) i.e. units purchased in foreign currency, if such transfer is made outside India by a NRI to another non-resident. 11. Transfer of membership of a recognized stock exchange in India by a non-company to a company before 1.1.99 in exchange of shares of the company. 12. Transfer of land by a sick company that is managed by its workers’ co-operative society. 13. Transfer of capital asset by a firm or sole proprietary concern to a company in connection with the succession of business by the company, subject to certain conditions. 14. Any transfer in a scheme for lending, of any security to the borrower, subject to the guidelines of SEBI. 15. Any transfer of capital asset/shares held in an Indian company, in a demerger by the demerged company to the resulting company. 16. Any transfer of shares by the resulting company, in a demerger to the shareholders of the demerged company. 17. Any transfer of capital asset under a scheme of reverse mortgage. 48(Mode of computation of capital gain): Computation of STCG Full value of consideration - (Cost of acquisition + Cost improvement + Expenses on transfer) Computation of LTCG Full value of consideration – (Indexed cost of acquisition + Indexed cost improvement + Expenses on transfer) Note: - Provision regarding indexation of cost of acquisition and cost of improvement are not applicable to mutual fund units, debentures and bonds but are applicable in the case of indexed bonds issued by Govt. Indexed C/A = Cost x C.I.I for the year in which the asset is sold C.I.I for the first year in which the asset was held or C.I.I. on 1.4.81 whichever is later. Indexed C/I = Cost of improvement x C.I.I. for the year in which asset is sold C.I.I. for the year in which improvement to asset took place C.I.I. means the index, as the Central Govt. may, having regard to 75% of the average rise in consumer price index for urban non-manual employees for that year, notified in this behalf. 4 Computation capital gain (ST & LT) in the case of transfer of shares/debentures held by nonresidents in an Indian company. Step 1. Convert FVC, CA, and expenses on transfer into the same foreign currency in which investments were initially made and compute capital gain in such foreign currency. Step 2. Convert the capital gain computed into Indian currency. The benefit of indexed cost of acquisition and indexed cost of improvement shall not be available to non-residents, on LTCG for the transfer of shares or debentures of an Indian company. The conversion and reconversion should be made at prescribed exchange rate. The prescribed exchange rates are the following. For converting FVC, CA and expenses on transfer into the foreign currency, use average exchange rate. For converting capital gain into Indian currency, use buying rate on the date of transfer. Average exchange rate means average of the telegraphic transfer buying rate and telegraphic transfer selling rate of the foreign currency. Average of these rates on the date of acquisition of the securities is taken for converting CA. For converting FVC and expenditure on transfer average of these rates on the date of sale is taken. Illustration: An NRI remitted $ 60,000 to India on 26.10.07 and bought 50,000 shares in an Indian company @ Rs. 13 per share. These shares are sold on 9.9.10 @ Rs. 28 per share. Exchange rates were – On 26.10.07 – Buying rate $ 1 = Rs. 18.40 Selling rate $ 1 = Rs. 19.30 On 9.9.10 - Buying rate $ 1 = Rs. 25.90 Selling rate $ 1 = Rs. 26.40 Full value of consideration = 50000 x 28 = 14,00,000 = 1400000 = $ 53537 (26.15 = 25.90 + 26.40) 26.15 2 Cost of acquisition = 50000 x 13 = 6,50,000 = 650000 =$ 34483 (18.85 = 18.40 + 19.30) 18.85 2 Capital gain =$ 19054 = 19054 x 25.90 = Rs. 4,93,499 49(C.A in the case of assets................ and shares of amalgamated company): 1. In the case of assets acquired without paying any price the CA will be the cost at which the previous owner acquired the assets plus cost of any improvement. 2. The CA of shares in an amalgamated company received in consideration for shares in the amalgamating company will be the CA to the assessee of the shares in that amalgamating company. 50(Capital gains in the case of depreciable assets): Where diminishing balance method of depreciation is followed 1. When one or more assets (but not all) are transferred from the block of assets: Where the FVC received on the transfer of one or more assets from a block exceeds the aggregate of the following amounts such excess shall be deemed as STCG. WDV of the block at the beginning of the previous year, Cost of any asset acquired during the year in respect of which same rate of depreciation is chargeable, and Expenses on transfer. Implication: - No LTCG. If there is no excess there is no STCL also. Balance will be the WDV of the block for the next year. 2. When entire assets of the block are transferred and the block ceased to exist:The difference between the FVC and (Block WDV + Cost of new asset purchased in the previous year + Expenses on transfer) may be STCG/STCL. Implication: - No LTCG or LTCL. 5 Where straight-line method of depreciation is followed (50A) In the case of an undertaking that claims depreciation under straight - line method, following are the relevant provisions. 1. Capital gain on assets subjected to straight-line method of depreciation has to be computed as per the provisions of section 48 and not as per that of section 50. 2. Rules regarding short-term / long-term differentiation based on the period of holding of asset by the transferor are also applicable in the case of such assets. 3. Indexation of long -term assets is also applicable in their case. 4. Cost of acquisition (For the purpose of indexing etc.) shall be the adjusted amount of W.D.V. (Called Cost of acquisition W.D.V.). If asset is long-term, the cost of acquisition to be indexed shall be this cost. Adjustment of W.D.V. is done by adding the amount of balancing charge with W.D.V., if there is balancing charge or by deducting terminal depreciation from the W.D.V., if there is terminal depreciation. 5. Provision regarding half depreciation in the case of assets used for less than 180 days during the previous year is also applicable in the case of such assets. If the asset is short term a) When sale price exceeds the W.D.V but does not exceed the purchase cost, the difference between sale price and W.D.V. shall be treated as business income and called balancing charge. Difference between sale price and ‘Cost of acquisition W.D.V’ may be taken as STCG /STCL. b) When sale price exceeds the purchase cost difference between sale price and ‘Cost of acquisition W.D.V.’ shall be S.T.C.G. Depreciation hitherto written off (difference between cost and W.D.V.) shall be balancing charge. c) When sale price is less than W.D.V. the difference between W.D.V and sale price shall be allowed as terminal depreciation. Difference if any, between sale price and ‘Cost of acquisition W.D.V.’ may be taken as S.T.C.L Note: - In all the above cases cost means Cost of Acquisition W.D.V., i.e., W.D.V. minus terminal depreciation or W.D.V. plus balancing charge as the case may be. Illustrations: Purchase cost Rs.10, Depreciation hitherto written off Rs. 2, therefore, opening W.D.V. Rs. 8. Sale price Case (i) Rs.9, Case (ii) Rs. 12 and Case (iii) Rs.7. Case (i) Cost 10 Depreciation 2 W.D.V 8 Sale price 9 Net result +1 Case (ii) Cost 10 Depreciation 2 W.D.V 8 Sale price 12 Net result +4 Case (iii) Cost 10 Depreciation 2 W.D.V 8 Sale price 7 Net result -1 Here, since sale price exceeds W.D.V. but does not exceed cost, the difference between sale price and W.D.V. , i.e., Re. 1, is balancing charge. Difference between sale price (9) and Cost of acquisition W.D.V (8+1 =9) is nil. So no STCG / STCL. Here, since sale price exceeds cost, depreciation hitherto written off (2) is balancing charge. Difference between sale price (12) and Cost of acquisition W.D.V (8 +2=10), Rs.2 is STCG. Here, since sale price is less than W.D.V. the difference is terminal depreciation, i.e. Re1. Difference between costs of acquisition W.D.V. (8-1=7) and sale price (7) is nil. So no STCG/STCL. 6 If the asset is long-term a) When sale price exceeds the W.D.V. but does not exceed the cost, the difference between sale price and W.D.V. shall be balancing charge. The difference between indexed cost of acquisition W.D.V. and sale price shall be treated as LTCG / LTCL. b) When sale price exceeds the purchase cost, depreciation hitherto written off shall be balancing charge. Difference between sale price and indexed cost of acquisition W.D.V shall be LTCG. c) When sale price is less than the W.D.V. the difference between W.D.V. and sale price shall be allowed as terminal depreciation. Difference if any, between indexed cost of acquisition W.D.V. and sale price shall be treated as LTCL. Note: - In all the above cases cost means Cost of Acquisition W.D.V., i.e., W.D.V. minus terminal depreciation or W.D.V. plus balancing charge as the case may be. Illustrations: Purchase cost Rs.10 in 2000-01, Depreciation hitherto allowed Rs.2, therefore opening W.D.V Rs.8 Sale price Case (i) Rs.9, Case (ii) Rs.12 and Case (iii) Rs.7. Case (i) Cost 10 Depreciation 2 W.D.V 8 Sale price 9 Net result +1 Here, since sale price exceeds W.D.V. but does not exceed cost, the difference between sale price and W.D.V. , i.e., Re. 1, is balancing charge. Cost of acquisition W.D.V is ( 8+1) = 9. It has to be indexed and compared with sale price for finding LTCG/LTCL. Indexed C.A W.D.V = 9/406 x 632 = 14.00 Sale price = 9. Therefore, LTCL = 5.00 Case (ii) Cost 10 Depreciation 2 W.D.V 8 Sale price 12 Net result +4 Here, since sale price exceeds cost, depreciation hitherto written off (2) is balancing charge. C.A.W.D.V is (8+2) = 10. It has to be indexed and compared with sale price. Indexed C.A.W.D.V.= 10/406 x 632 = 15.56. Sale price = 12. Therefore, LTCL = 3.56. Case (iii) Cost 10 Depreciation 2 W.D.V 8 Sale price 7 Net result -1 Here, since sale price is less than W.D.V. the difference between them shall be terminal depreciation , i.e. Re1. C.A.W.D.V.is (8-1) =7. It has to be indexed and compared with sale price. Indexed C.A.W.D.V.= 7/406 x 632 = 10.89. Sale price = 7. Therefore, LTCL = 3.89. 51(Adjustment of advance money received against cost of acquisition): Where any capital asset was on any previous occasion the subject of negotiation for its transfer, any advance money received and retained by the assessee in respect of such negotiation shall be deducted from the cost or WDV or fair market value, as the case may be, in computing the cost of acquisition. Note: - Here such advance should be deducted before indexing. 54(Exemption........house): Any LTCG arising to an individual or HUF on the transfer of a residential house or land appurtenant thereto will be exempted from tax if the assessee has invested the amount of capital gain in purchasing another house within a period of one year before or two years after the transfer or in constructing a house within a period of three years after the date of transfer. In this case only that part of the capital gain, which is reinvested, will be exempted. Aside, the new house should not be transferred within a period of 3 years from the date of its purchase or construction. If transferred, while taking the cost of acquisition of that transfer, previously exempted capital gain will be deducted from the cost of acquisition. Where the amount of capital gain is not fully utilized by the assessee for the purchase or construction of new house before the date of filing the income 7 tax return, balance amount may be deposited before the due date for furnishing the return, in an account opened in a public sector bank under Capital Gains Account scheme 1988. The amount already utilized for the purchase or construction of the new house together with the amount so deposited will then be exempted. However, the amount deposited must be utilized for the purchase or construction of a new house within the period stipulated. Otherwise, the unutilised amount of deposit will become taxable in the previous year in which the period of 3 years from the date of transfer of the original house expires. 54B (Exemption.......... agricultural land): Any capital gain arising to an individual assessee on the transfer of an agricultural land situated in an urban area which was being used for agricultural purposes by him or his parents for a period of 2 years immediately preceding the date of transfer will be exempted from tax if the assessee has invested the amount of capital gain in purchasing another agricultural land within a period of 2 years from the date of transfer. Only that part of the capital gain, which is reinvested, will be eligible for exemption. The newly purchased agricultural land should not be transferred for 3 years from the date of purchase. If transferred......(see u/s 54). Provision as to deposit of unutilised amount of capital gain under CGDS 1988 is applicable here also. As per section 10(37) capital gain on transfer of agricultural land situated in urban area shall be exempted if the following conditions are satisfied. a) The land is owned by an individual or HUF. ii) The land was, in the two years immediately preceding the date of transfer being used by the assessee for cultivation. iii) The transfer is by way of compulsory acquisition under any law, and iv) The income arises from the compensation for such transfer on or after 1.4.2004. 54D (Exemption..... compulsory acquisition of land and building) Any capital gain arising to any assessee from the compulsory acquisition under any law, of any land and building which was being used by the assessee for the purpose of his business for a period of 2 years immediately preceding the date of acquisition will be exempted from tax if the assessee has reinvested the amount of capital gain in purchasing another land or building within 3 years of the acquisition. Only that part of the capital gain, which is reinvested, will be eligible for exemption. The newly purchased land and building should not be transferred for a period of 3 years from the date of purchase. If transferred....(.See section 54). Provision as to deposit of unutilised amount of capital gain under CGDS 1988 is applicable here also. 54EC (Exemption of capital gain invested in specified asset): Any LTCG arising to any assessee from the transfer of any asset will be exempted from tax if the assessee invests the capital gain in long term specified asset (any bond redeemable after 3 years issued by NABARD or by the National Highways Authority of India or Rural Electrification Corporation Ltd. or National Housing Bank or Small Industries Development Bank of India). The new asset should be purchased within 6 months from the date of transfer of original assets. The amount of capital gain actually invested subject to a maximum of rupees 50,00,000 will be exempted. The new assets should not be transferred or converted into money within 3 years from the date of purchase. If transferred or converted previously exempted capital gain shall be chargeable to tax as LTCG in the year of transfer or conversion. 54F (Exemption.....invested in house): Any LTCG arising to an individual or HUF from the transfer of any capital asset (other than residential house in respect of which exemption is available u/s 54) will be exempted from tax if the assessee has invested the net consideration within one year before or two years after the date of transfer on purchasing or within 3 years after the date of transfer in constructing another residential house. This exemption is not allowed if the assessee acquires another house (other than the one for the purpose of fulfilling the requirements of this section) within 3 years after the sale of the asset. Where the full amount of net consideration is not reinvested, only proportionate amount of capital 8 gain will be exempted. The newly purchased or constructed house must not be transferred for 3 years. If transferred, previously exempted capital gain will become taxable in the year of that transfer as LTCG. Gain or loss from the second transfer will always be short term. Where only a part of the asset is transferred only proportionate capital gain shall be chargeable to tax. Provision as to deposit of unutilised amount of net consideration under CGDS 1988 is applicable here also. 54G (Exemption....shifting of industrial undertaking from urban area to non-urban area): Any capital gain arising to any assessee from the transfer of machinery, plant, land or building in the course of shifting of an industrial undertaking from urban area to non-urban area shall be exempted if the assesses has invested the capital gain within a period of one year before or three years after the date of transfer in purchasing new plant, machinery, land or building or in constructing new building. Only that part of the capital gain, which is utilized in the purchase or construction, is exempted. The asset thus purchased must not be transferred for a period of 3 years. If transferred.........(see u/s 54). Provision as to deposit of unutilised amount of capital gain under CGDS 1988 is applicable here also. 54GA (Exemption…………..shifting of industrial undertaking from urban area to SEZs): Any capital gain arising to any assessee from the transfer of machinery, plant, land or building in the course of shifting of an industrial undertaking from urban area to Special Economic Zones shall be exempted if the assesses has invested the capital gain within a period of one year before or three years after the date of transfer in purchasing new plant, machinery, land or building or in constructing new building. Only that part of the capital gain, which is utilized in the purchase or construction, is exempted. The asset thus purchased must not be transferred for a period of 3 years. If transferred.........(see u/s 54). Provision as to deposit of unutilised amount of capital gain under CGDS 1988 is applicable here also. Notes: As per section 54 H, in case there is transfer of asset due to compulsory acquisition under any law and the assessee does not receive the compensation awarded for such acquisition on the date of such transfer, the period available for depositing / investing the amount u/s 54,54B, 54D or 54F in relation to such compensation shall be reckoned from the date of receipt of such compensation. When exemptions under section 54F and under another section are to be claimed, in respect of sale of one asset (For example, when agricultural land is sold and proceeds invested in another agricultural land and also in a house, 54B and 54F exemptions can be claimed), while taking the amount of net consideration (denominator figure) for the purpose of calculating 54F exemption, amount of exemption already allowed under that other section need not be reduced. The amount of investment in house (numerator figure) and amount of capital gain (multiplier figure) also not reduced. When exemption under section 54F is to be claimed in respect of sale of more than one long-term asset (other than house) assessee can decide an order of priority regarding the investment of net consideration in the new house. This would be beneficial to him. He has to calculate the percentage of capital gain to net consideration in the case of each of the asset sold. The asset having highest percentage of capital gain to net consideration must be given priority. If amount invested in the new house is more than the net consideration of one asset the balance investment is to be taken up next from that asset whose percentage of capital gain to net consideration is next highest and so on. From the total amount of investment in the new house, while calculating the amount of exemption under each section, amount of the preceding investment must be reduced. 55(Cost of acquisition in certain other cases): - 9 1. When the capital asset, other than depreciable asset became the property of the assessee before 1.4.81, cost of acquisition of the asset may at the option of the assessee be either the actual cost of acquisition or fair market value on 1.4.81. 2. Where the capital asset became the property of the previous owner before 1.4.81, cost of acquisition of the same may at the option of the assessee be either the cost of acquisition to the previous owner or fair market value of the asset on 1.4.81 3. Cost of shares/debentures/stock in a company received on consolidation, subdivision or conversion of shares/debentures in that company shall be the cost to the assessee of the original shares, debentures or stock. 4. Where cost of acquisition of the previous owner cannot be ascertained, fair market value on the date of acquisition by the previous owner will be taken as the cost of acquisition. 5. Cost of acquisition of goodwill of a business is taken to be the purchase price of goodwill if goodwill was purchased from a previous owner and taken to be nil in other cases. No cost of improvement for goodwill. 6. Cost of acquisition of right shares shall be the price paid for them. In the case of right shares acquired before 1.4.81 actual cost or fair market value on 1.4.81 whichever is higher is taken. 7. Cost of acquisition of bonus shares shall be taken to be nil. Cost of acquisition of bonus shares allotted before 1.4.81 is their fair market value on 1.4.81. 8. Cost of acquisition of right to produce, manufacture or process any article, tenancy rights, stage carriage permits, loom hours etc. shall be (i) when purchased from previous owner- the purchase price and (ii) in other cases – nil. Special points 1. LTCG is not taxed at normal schedule rate, but at a flat rate of 20%. If the long term asset is listed securities or units of UTI / Mutual fund or zero coupon bonds, tax payable on LTCG shall be (i) 10% of LTCG computed without indexing the cost of acquisition or (ii) 20% of LTCG computed after indexing the cost of acquisition whichever is less. If the LTCG is one arising from the transfer of equity shares or units of equity oriented funds, and if Securities Transaction Tax has been paid on such LTCG, no further tax is imposed on them under income tax. If securities transaction tax has not been paid, the provision applicable to long term listed securities/ UTI units/ MF etc. explained above will be applicable. 2. Deduction u/s 80 will not be available in respect of LTCG. In the case of individuals/HUFs if ‘balance total income’ is less than the exemption limit, the LTCG will be reduced by such amount by which total income falls short of exempted limit and on the balance LTCG tax will be calculated at the flat rate. 3. Short- term capital loss can be set-off intra head in the year in which it is incurred. But that cannot be set off inter-head. It can be carried forward for 8 assessment years and set-off against any capital gain. LTCL cannot be set off against STCG. Inter-head set-off also not permitted in the case of LTCL. But it can be carried forward for 8 assessment years and set-off against LTCG. 4. Where total income of an assessee includes STCG from transfer of equity shares in a company or units of equity oriented funds, on such STCG tax will be charged at 15% + education cess @ 3% on the amount of income tax. This provision is applicable only on those transfers of shortterm equity shares etc. effected after the date of enforcement of Securities Transaction Tax and only if such tax has been paid. If Securities Transaction Tax has not been paid, such STCGs will be taken along with other incomes and taxed accordingly. From such STCGs deductions u/s 80 are not allowed. If the ‘balance total income’ of an assessee is less than the basic exemption, the assessee can make good the difference amount required to reach at the basic exemption from such STCG. Then on the balance amount of such STCG tax shall be charged at a flat rate of 15%. rupak.manikath@yahoo.com