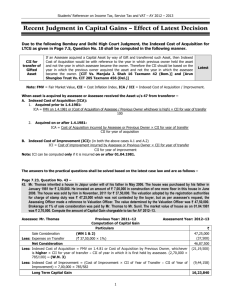

Computing of Indexation

advertisement

Report No. PF / HT / 070708 / 458 07th July’ 2008 Computing of Indexation We have in the last coverage learnt what capital year to such previous year, by notification in the official gains are. As we at Karvy feel that there is no limit gazette, specified in this behalf. Mode a) Assets acquired for knowledge, we are making a small attempt in directly by the assessee himself: The cost of acquisition making you more informed about the indexation shall be the amount which the assessee has paid to provisions under capital gains chapter. acquire that asset. Indexation in case will be done as: Indexed cost of acquisition means an amount which Cost of acquisition bears to the cost of acquisition the same proportion the year of acquisition. X CII of the year of transfer/ CII of as cost inflation index for the year in which the asset is transferred bears to the cost inflation index Mode b) Asset acquired from the previous owner n any for the first year in which the asset was held by the mode given u/s 49(1): In this case, the cost of assessee or for the year beginning on 1-4-1981 acquisition is taken as the cost to the previous owner which ever is later and it is this cost which will have to be indexed. For the Cost Inflation Index, in relation to a previous year, purpose of indexation the year in which the asset was means such index as the central government may, first held by the assessee (not the previous owner) is to having regard to 75% of a average rise in the be considered. The indexation will be done as under: consumer price index for urban non-manual employees for the immediately preceding previous For more information contact: Pradeep Kumar S. Murugavel.A Email: pradeep.s@karvy.com amurugavel@karvy.com : +91 40 23312454 Ext: 304 Cost of acquisition to the previous owner X CII of the year of transfer/ CII of the year in which the asset is first held by the assessee. currency by a non resident. • Indexed cost of improvement: Indexed cost of improvement means an amount which bears to the cost of improvement the same portion as When is indexed cost not considered? cost inflation index for the year in which the • Transfer of bonds and debentures other than capital indexed bonds issued by the government. • Transfer of shares or debentures acquired by asset is transferred bears to the cost inflation index for the year in which the improvement to asset took place. • Any expense or improvement before 1-4-1981 is to be completely ignored. Therefore, cost of a non resident in foreign currency in an improvement only after 1-4-198, by the assessee Indian company. should be indexed. However, if the asset is • Transfer of undertaking or division in a slump sale. • Transfer of units of Unit Trust of India or Mutual Fund covered u/s 10(23D) purchased in foreign currency by overseas financial organization also known as offshore funds. • Transfer of foreign exchange asset by a non resident Indian. • Transfer of securities by FII. acquired by the assessee from the previous owner in any mode given u/s 49 (1), the expenses on improvement incurred by the previous owner after 1-4-1981 will also have to indexed. • Capital expenditure on improvement after 1-41981 X CII of year of transfer/CII of the year in which the improvement was made by the assessee or previous owner. • Transfer of Global Depository Receipt purchased in foreign currency by an We shall in the future releases get more clarity individual resident in India and employee on other implications involved n computing of an Indian company. capital gains. • Transfer of Global Depository Receipt or bonds of an Indian company or share or bonds of a public sector company sold by the government and purchased in foreign Disclaimer The information and views presented in this report are prepared by Karvy Stock Broking Limited. The information contained herein is based on our analysis and upon sources that we consider reliable. We, however, do not vouch for the accuracy or the completeness thereof. This material is for personal information and we are not responsible for any loss incurred based upon it. While acting upon any information or analysis mentioned in this report, investors may please note that neither Karvy nor Karvy Stock Broking nor any person connected with any associate companies of Karvy accepts any liability arising from the use of this information and views mentioned in this document. This report is intended for a restricted audience and we are not soliciting any action based on it.