Rule - International Tax Review

advertisement

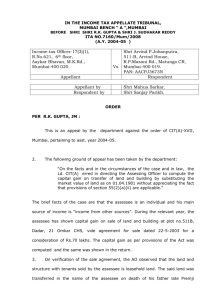

Comments Share Go Back Print Size ++ Date of decision : 12 November 2010 2010-TII-54-ITAT-DEL-TP IN THE INCOME TAX APPELLATE TRIBUNAL BENCH 'A' NEW DELHI ITA No.1433/Del/2009 Assessment Year: 2004-2005 ABHISHEK AUTO INDUSTRIES LTD 1, UNDER HILL LANE, CIVIL LINES, DELHI PAN NO:AAACA2837J Vs DEPUTY COMMISSIONER OF INCOME TAX CIRCLE-1(1), NEW DELHI R P Tolani (JM) and B C Meena (AM) Dated: November 12, 2010 Appellants Rep by: Shri Pradeep Dinodia, R K Kapoor & Ms Pallavi Dinodia Respondent Rep by: Shri Ashok Pandey, CIT-DR Income tax - Sections 92B, 92C, 92CA(1), Rule 10B(1)(e) - Transfer Pricing - Whether payment of royalty and knowhow fee under an agreement can be ignored by the Revenue while doing the TP analysis - Whether Sec 92 of Chapter X has no application for domestic transactions - whether adjustment can be made only to the international transactions and not transactions at the enterprise level which include domestic transactions - Whether comparability is most efficient when it involves the transactions of the tested party itself. The assessee company is engaged in manufacturing of car seat belts in technical collaboration with M/s. Takata of Japan. Assessee imports CKD kits from Takata and then carries out a manufacturing process by adding certain indigenous raw materials and finishes the car seat belts. This manufacturing process is carried out with the technical know-how received from Takata. The finished seat belts are then supplied to the car manufacturers such as Maruti, Honda, Tata etc. The assessee had international transactions with Takata in respect of purchase of raw materials, purchase of machines, payment of royalty and technical know how and interest on loan. On a reference, the TPO did not draw any adverse inference relating to purchase of machinery and payment of interest. However, with respect to payment of royalty and knowhow, he held the same to be nil in view of the fact that no transfer of technology or know how has taken place, that the price of know how and royalty is bundled in the price charged for the supply of material and the fact that expenses have been incurred on expatriates which the assessee was under no obligation to incur. As for the purchase of raw materials, the assessee had submitted that the raw materials components are not available with any other supplier because these are developed by Takata Group and hence, it was difficult to ascertain arm's length price of these products. The assessee therefore submitted comparative analysis of Gross Profit rates of various types of seat belts manufactured from the materials supplied by other suppliers, which are being supplied by the assessee company to its parties visà-vis seat belts manufactured from the materials supplied by the foreign collaborators. Assessee claimed that it is earning a higher rate of gross profit on the seat belts manufactured from the materials under transfer pricing purview as compared to the seat belts manufactured from the materials supplied by the other suppliers. So, it was argued that the price paid for the material imported from the foreign collaborator, may be accepted by the tax authorities. It was submitted that the assessee procured the materials from its foreign collaborator under agreement of collaboration and this material could not be obtained from any other source. The A.O, however, was of the opinion that TNMM was the right method for transfer pricing analysis. He used the assessee as tested party and took the Profit Level Indicator as the ratio of net margin computed in relation to sales. The TPO identified six companies to be comparable companies and based on the data, worked out their net operating margins at 9.21% on the average. As the assessee's net operating margin on overall basis was 4.56%, the AO made a downward adjustment of the purchase. Aggrieved, the assessee preferred appeal to the CIT(A) who however, enhanced the addition in respect of international transactions to 10.74% average operating margin using updated data. Aggrieved, the assessee appealed to the Tribunal. It was pleaded that CIT (A) had erroneously added Rs.1.10 crores on account of technical fee as the same was never debited to profit and loss account as such and was actually capitalized by the assessee. By allocating entire payment of technical know-how fee of Rs.1.10 crores to AE segment, CIT(A) computed the PLI from AE segment at 1.86% and from non-AE segment at 2.88%. It was pointed out that the margin in the AE transactions is much higher than the margins in its local business. As per revised chart furnished by assessee by excluding the capital payment of Rs.1.10 crores which has been capitalized in its books of accounts under the Companies Act as well as under the Income Tax Act, the operating profit of sales in the AE transaction segment would be 10.495% as against 2.88% in the totally domestic segment in which there is no international transaction .Moreover, the net margins worked out by CIT(A) in the six companies are not correct and as per data filed which is collected from ROC , the margins are much lower than the one calculated both by the TPO and the CIT (Appeals). Having heard the parties, the Tribunal held that: + it is a settled proposition of the law that legally binding agreements between unrelated parties cannot be disregarded without assigning any cogent reasons thereto. In this case it has not been imputed that agreements were ingenuine or sham, rather they are duly approved by RBI and other regulatory agencies. It is also a settled proposition that commercial transactions are in the domain of the businessman and Income Tax Department cannot intervene in realm of intricacies of commercial expediencies involved in these arrangements. In this case if the assessee had not entered into joint venture agreement with Takata, it would not have been able to make any sales whatsoever using their technology and raw material and the machines supplied by them. The very existence of this business in AE segment depended upon the joint venture agreement. In such circumstances, the TPO and the CIT (Appeals) were not correct in disregarding this agreement without assigning any cogent reasons; + the TPO in his order has accepted the international transactions of purchase of machinery from the AE, however, an inference has been drawn that assessee was competent to make independent use of such machinery. Assessee has met this finding that machineries were imported to manufacture the assembly line for manufacturing of seat belts for which the technical know-how fee and foreign technicians were also deputed by the AE. Whenever international transactions of such nature are undertaken, it is a combination of technical know-how, royalty, technical assistance through the deputation of expat employees on the rolls of the person obtaining the technical know-how. There is merit in assessees submissions that merely by importing machinery, it cannot be said that the assessee would become competent to make use of such machinery; + the provisions of Chapter X Section 92C deal with international transactions only and not with transactions which have no international cross border element at all. Therefore, the basis of making the adjustments on the enterprise level is not correct. What should have been taken is the sale to domestic parties using Takata technology and Takata raw material . The segment that was to be looked at was the international segment, that is, domestic sale using foreign technology and foreign raw material; + the best comparability can be of the transactions of the tested party itself. If the tested party without the use of the imported technology and imported raw material can make additional margins, then it would be a case which may require an adjustment, but in this case the international transactions have demonstratively boosted the profits . As per calculations of the CIT (Appeals), as corrected by an error on account of technical know-how fee which was not claimed as revenue expense, the segment which did not have the benefit of foreign technology and foreign raw material had an operating profit to sales margin at 2.88%, whereas the segment which had this benefit had a margin of 10.49%. It is obvious that the transactions are at arm's length and no adjustments are called for; + taking external comparables as given by the TPO and the CIT (Appeals) and by looking at the average PLI calculated by the CIT (Appeals) in his order of 10.74% and if it is reduced by 5% thereof, it will come to 10.20. This will be the PLI after adjustment as per the Proviso to Section 92C. This, in any case, is less than the PLI of the Takata transactions of the assessee which is 10.49%. Therefore even if the work done by the authorities below is upheld and adjust it by 5% and then compare it with the international transactions, the PLI of the tested party is higher than the PLI worked out by the TPO and the CIT(Appeals). Assessee's appeal allowed Cases followed Electrobug Technologies Ltd. v. ACIT Development Consultants v. DCIT Sony India Pvt. Ltd. v. DCIT (2010-TII-39-ITAT-DEL-TP) (2008-TII-03-ITAT-KOL-TP) (2008-TII-08-ITAT-DEL-TP) Customer Services India (P) Ltd. v. ACIT (2009-TII-08-ITAT-DEL-TP) ORDER Per: R P Tolani (JM): This is assessee's appeal. Following grounds are raised:"1) On the facts and the circumstances of the case and in law, the Ld. CIT(A) has erred in confirming the following actions of the Ld. Assessing Officer (a) Making an addition of Rs.3,18,89,975/- on account of Difference in “Average net operating margin” of the comparable companies as against the assessee's “Net operating margin”, using the TNMM method for determining the Arms Length Price. AND (b) In applying such difference to make an adjustment on the Total sales of the assessee, including Non-international transactions, whereas Section 92 is applicable only to international transactions, as given in Section 92B of the Income Tax Act, 1961, while completely ignoring the submissions repeatedly made by the assessee in this regard. 2) On the facts and the circumstances of the case and in law, the Ld. CIT(A) has erred in confirming the action of the Ld. Assessing Officer in holding that the amount paid to the ASSESSEE for royalty and technical now how should be Nil. 3) On the facts and the circumstances of the case and in law, the Ld. CIT(A) has erred in confirming the action of the Ld. Assessing Officer in applying the TNMM method, whereas the Cost plus method was the most appropriate method for determining the Arms Length Price and also ignoring the Internal Comparable between International and Non-International transactions for the Cost plus method submitted by the assessee. 4) On the facts and the circumstances of the case and in law, the Ld. CIT(A) has erred in ignoring and in not giving the assessee the benefit of the fact that No adjustment has been made in the assessee's Transfer pricing assessment for the next Asst. Year, 2005-06, where the facts and circumstances were absolutely the same. 5) The order of the Ld. CIT(A) is bad in law and on the facts of the case and is based on the surmises and conjectures only and without considering the facts and submissions made.” 2. Brief facts are that the assessee company is engaged in manufacturing of car seat belts in technical collaboration with M/s. Takata of Japan. Assessee imports complete knock down Kits (CKD) from Takata and then carries out a manufacturing process by assembly on these CKD Kits, by adding certain indigenous raw materials and finishes the car seat belts. This manufacturing process by assembly is carried out with the technical know-how received from Takata. The finished seat belts are then supplied to the car manufacturers such as Maruti, Honda, Tata etc. 2.1. The Assessing Officer referred the assessee's case to Transfer Pricing Officer (TPO) for determination of Arm's Length Price (ALP) under sec. 92CA(1) of the Income-tax Act, 1961. Before TPO the assessee submitted comparative analysis of Gross Profit rates of various types of seat belts manufactured from the materials supplied by other suppliers, which are being supplied by the assessee company to its parties vis-à-vis seat belts manufactured from the materials supplied by the foreign collaborators. Assessee claimed that it is earning a higher rate of gross profit on the seat belts manufactured from the materials under transfer pricing purview as compared to the seat belts manufactured from the materials supplied by the other suppliers. Assessee company filed statutory audit report pleading that since it earned considerable profits by selling the seat belts procured from outside India as compared to the selling of seat belts manufactured in India, so the price paid for the material imported from the foreign collaborator, report may be accepted by the tax authorities. 2.2. The assessee procured the materials from its foreign collaborator under agreement of collaboration, this material could not be obtained from any other source. The company had fixed its sale prices after taking into consideration the cost of materials and the higher rate of gross profit in comparison to the other types of seat belts. 2.3. The TPO however, did not agree with the assessee's working and made the additions by adopting net operating margin of 9.21% by holding that comparable enterprises performing broadly similar functions, operations and risks by following average working:Sl.No. Name of the Company 1. Clutch Auto Ltd. 2. Net sales during F.Y.2003-04 (in crores) Net operating profit F.Y. 2003-04 (in crores) Net Operating profit margin (%) 75.30 7.13 9.46 NRB Beadings Ltd. 210.95 31.95 15.14 3. Rane (Madras) Ltd. 201.66 23.39 11.58 4. Sona Kaya Steering Systems Ltd. 281.47 20.20 7.17 5. Talbros Engineering Ltd. 22.95 1.51 6.57 6. Bharat Gears Ltd. (Auto Motive Segement) 92.69 4.95 5.34 Average 9.21% 2.4. As the appellant's net operating margin on overall basis was 4.56% as against 9.21% for the comparables adopted by the TPO, accordingly AO made a downward adjustment by Rs.3,18,89,975/- to the international transaction. 3. Aggrieved, the assessee preferred first appeal where the detailed submissions were made. The CIT(A) however, enhanced the addition in respect of international transactions to 10.74% average operating margin by following observations:“15. In view of the above discussion, I hold that the following 6 comparables chosen by the TPO are correct for making comparability analysis for determining the arm's length price for the international transactions comparing payment for raw material, royalty and technical know-how. 15.1. The average operating margin of the following comparables is 10.74%, the details of which were communicated to the appellant vide this office letter dated 20.01.2009, during the appellate proceedings. Therefore the same is considered for determining the arm's length price of the international transaction. S.No. Name of the Company Net Operating profit margin (%) 1. Clutch Auto Ltd. 6.73 2. NRB Beadings Ltd. 27.05 3. Rane (Madras) Ltd. 13.12 4. Sona Koyo Steering Systems Ltd. 12.40 5. Talbros Engineering Ltd. -0.22 6. Bharat Gears Ltd. (Auto Motive Segement) 5.34 Average 10.74 Computation of the Arm's Length Price of the International transaction is arrived at as under: Net sales of the appellant (as per TPO's order) Rs.68,76,63,661 Net operating profit (as per TPO's order) Rs. 3,14,43,848 Average Net operating margin of the comparables Net Operating margin the appellant should have earned. Downward adjustment required to the international transaction relating to raw material, royalty and technical knowhow 10.74% Rs.7,38,55,057 (10.74% of Rs.687663661) Rs.4,24,11,209 (Rs.7,38,55,057 minus Rs.3,14,43,848) 15.2 Since already held that the TPO was correct in holding the value of international transaction for royalty and technical know-how to be NIL, hence no separate adjustment is made for it and it is deemed to be included in the overall adjustment of Rs.4,24,11,209 determined above. Accordingly, the total taxable income of the assessee needs to be enhanced by this amount.” 4. Aggrieved, the assessee is in appeal before us. An additional ground of appeal has been filed requesting that the figure of Rs.3,18,89,975/- is actually Rs.4,24,11,209/- as the CIT (Appeals) has made enhancement to the addition made by the A.O. Assessee took the figure of Rs. 3,18,89,975/inadvertently as against Rs.4,24,11,209/- as finally retained by CIT(A). The learned DR has no objection to the same consequently we permit to amend this figure at Rs.4,24,11,209/-. 5. Ld. Counsel for assessee Shri Dinodia adverted to the Transfer Pricing reports filed by assessee and TPO and contends that assessees working of Arms Length Price ALP was based on following disclosures: “1.1 The assessee Abhishek Auto Industries Limited (AAIL) is engaged in manufacturing safety seat belts for automobiles and is supply to OEM's like Maruti Udyog Ltd., Honda Siel Cars India Ltd., Tata Motors Ltd., Swaraj Mazda and Hindustan Motors Ltd. AAIL has a technical & financial collaboration with Takata Asia Pte Ltd., Singapore. This collaboration provides technology for new seat belts coming. AAIL is also doing business of Window regulators (Power & manual) for Cars and supply to Tata Motors and Hindustan Motors. AAIL buys seat belt components from Takata, assemble them and sell to Honda and Maruti Udyog. AAIL's total equity capital is 13,00,000 shares, of which 70% is being held by Indian Shareholders and balance 30% is held by Takata's group. 1.2 The major international transactions reported in Form No.3CEB are as under: S.No. Description of transaction Method Value (in Rs.) 1. Purchase of Raw Material None 8,27,84,638/- 2. Purchase of machines None 33,27,876/- 3. Payment of Royalty None 16,09,505/- 4. Fee for Technical Knowhow None 1,10,00,000/- 5. Interest on loan None 10,26,843/- Purchase of Raw Material “During the previous year, certain transactions for purchase of raw material has been entered into with M/s. Takata Asia Pte Ltd. an associated enterprise. These purchases have been made for specifically designed product as per requirement of Car manufacturer, developed with the help of technology provided by TAKATA”. “The products can be consumed in particular cars only and raw material required for assembling these products are to be sourced from Takata only. The raw materials components are not available with any other supplier because these are developed by Takata Group. Hence, it was difficult to ascertain arm's length price of these product”. Purchase of Machines “During the previous year, certain transactions for purchase of Plant & Machinery has been entered into with M/s Takata Asia Pte Ltd. an associated enterprises (holding 30% shares in the company). These machines are required for manufacturing of products designed and developed by Takata and the machines are not available in the open market. Therefore it was difficult to ascertain the arm's length price of these machines”. Payment of Royalty and Know-how “In 2000-2001, the company entered into a technical collaboration agreement with Takata Asia Pte Ltd. for development of Safety Seat Belt for various new models of car manufacturer. All the Government approvals have already been obtained by the company. The technical fee and royalty amount is being paid by the company as per agreement only. Hence, the question of determining arm's length price does not arise”. Interest on Loan “The amount of US$218,000.00 was borrowed in 2002. The balance 70% was contributed by Indian promoters. This project was very important for the growth of the company and has resulted in doubling the turnover of the company. To fund this project, the company explored bank finance also, but the cost of bank borrowing was 14%. Therefore, the company opted for 8% rate charged by TAKATA”. 5.1. The TPO however proceeded to determine the arm's length price on an assumption that assessee has failed to do so, although the assessee in response to his queries submitted the comparative G.P. ratio of AE. and nonAE segment during the course of hearing. 5.2. TPO with respect to royalty has failed to consider assessees categorical submissions that: a. The assessee has paid the technical fee and royalty amount as per agreement only, hence the question of determining Arm's Length Price does not arise. During the course of proceedings, the assessee has filed photocopy of collaboration agreement, copy of profile of Takata, its AE. b. A note on determination of ALP was also filed mentioning: “We are engaged in manufacturing and supplying Safety Seat belts for automobiles to all OEMs in India like Maruti Udyog Ltd., Honda Siel Cars Ltd., Tata Motors Ltd., Hindustan Motors Ltd., and Sawarj Mazda Ltd. In 2000, AAIL entered a technical collaboration with Takata Asia Pte Ltd., Singapore (previously known as Automotive Safety System Pte Ltd), a subsidiary of Takata Corporation, Japan. Takata Asia also holds 30% equity shares in Abhishek Auto Industries Ltd. (AAIL). Takata has developed seat belt for HONDA SIEL CAR INDIA LTD and MARUTI EXPORT MODEL. These are specifically designed seat belts for particular Model of Car and can't be used in other Cars. Abhishek Auto, buys this material from Takata and does some assembly work and supply to Honda and Maruti. Initially, the prices are fixed according to purchase price from Takata and later on foreign exchange fluctuations are adjusted by the Honda and Maruti for these products. Takata has developed seat belts for HONDA's all model and Maruti Export Model. Their product is guaranteed by Takata. AAIL is only doing some assembling work under the supervision of Takata's Japanese staff stationed in AAIL. Any failure of product is the responsibility of Takata.” 5.3. Vide submissions dated 22-08-2006, assessee furnished a note on functions performed as under: “The technical collaboration is for technology for new models seat belt. Whenever, any car manufacturer like Honda plans to launch a new model, they give all specifications, drawing, design etc. to Abhishek and the same is forwarded to Takata which has all R&D facility in house. Takata develops seat belt suitable to Honda and gives final quotation of seat belt to Abhishk which is forwarded to Honda. Once Seat belt and rates are approved by Honda, production schedules are received from Honda on monthly basis. Accordingly, AAIL procure the materials from Takata, assemble them in India and supply to Honda.” 5.4. The TPO failed to consider assessees submissions and held that a formal agreement between the appellant and the associated enterprise cannot be the basis for determining the arm's length price of the transaction. Relying on some judgments of US courts TPO held that: “4.8 To, Sum up the arm's length price is ‘international transaction' of royalty and know how is treated as Nil for the following reason which have been discussed above. (i) No transfer of technology or know how has taken place. (ii) The price of know how and royalty is bundled in the price charged for supply of material. (iii) Expenses have been incurred on expatriates, which the assessee was under no obligation to incur.” 5.5. The TPO there after held that the most appropriate method was the Transaction Net Margin Method (TNMM) in accordance with Rule 10B(1)(e), the Profit Level Indicator (PLI) would be the ratio of net margin computed in relation to sales. He treated the appellant company as a tested party. The TPO used the PROWESS data base to identify potential comparable companies. After completing what he considered the appropriate screening process, in par 5.7 he identified six companies to be comparable companies and based on the data worked out their net operating margins at 9.21% on the average. 5.6. The appellant's margins have been calculated by TPO in para 5.8 of his order as under:“Computation of net operating margin of the assessee 5.8 From the balance sheet and P&L account filed by the assessee the following emerges: Net Sales : Rs.68,76,63,661/- Profit before tax : Rs. 1,91,17,090/- Other income : Rs. 16,10,614/- Financial expenses : Rs.1,39,37,372/- Net operating profit : Rs.3,14,43,848/- (Profit before tax – Other income + Financial expenses) Net operating margin : 4.56% Net operating profit at Arm's Length margin = 9.21% of 68,76,63,661/= Rs.6,33,33,823/-.” 5.7. Ld. Counsel contends that TPO thus concluded in his order as under: “5.9 Accordingly, at Arm's Length the assessee company was required to obtain a net operating margin of 9.21% over sales which translates into Rs.6,33,33,823/-. The net operating profit of the assessee is Rs.3,14,43,848/- accordingly the value of ‘international transaction' related to purchase of raw material and machines needs to be adjusted downward by an amount of Rs.3,18,89,975/- which is the difference of net operating margins at Arm's Length i.e. Rs.6,33,33,823/- and the net operating margins of the assessee i.e. Rs.3,14,43,848/-. 5.10 Accordingly, the value of ‘international transaction' relating to purchases of raw materials is determined at Rs.5,08,94,663/-. 6. In the earlier part of this order, the Arm's Length :Price of the ‘international transaction' related to payment of royalty and know how has been determine at Nil Value. Accordingly, the net profit margin needs to be re-adjusted to take into account the Nil value of royalty and know how related expenses. The total expenses under these two heads of expenses re Rs.1,26,09,505/-. Accordingly, the adjustment to the value of purchase of goods is restricted to Rs.1,92,80,470/-. So that the cumulative adjustment remains at Rs.3,18,89,975/-.” 5.8. TPO did not draw any adverse inference relating to purchase of machinery and payment of interest. 5.9. In first appeal, the CIT (A) accepted facts that- the appellant was performing full-fledged manufacturing activity and accepted the TPO's comparables and that TNMM method is the most appropriate method, however he changed the PLI of the comparables by up-dating the data which brought the net operating margin to sale to 10.74%. Assessee supplied the break up as under, which is placed on PB-I page 106: 2003-04 2003-04 2003-04 Total Takata Others (In Rs.) (In Rs.) (In Rs.) Mode of Bifurcation Operating A Income Sales 687,663,661 127,465,091 560,198,570 Total 687,663,661 127,465,091 560,198,570 559,732,341 95,274,997 464,457,344 Actual Personnel Expenses 9,140,467 881,520 8,258,947 Actual Freight Outward 4,194,340 196,743 3,997,597 Actual Exchange Difference 3,878,089 2,028,519 1,849,570 Actual Bad Debts Written Off 3,962,923 - 3,962,923 Actual 43,925 - 43,925 Royalty 1,689,980 1,689,980 - Actual Testing Expenses 2,886,620 563,871 2,322,749 Actual Other Expenses 44,287,717 8,209,155 Operating B Expenses Raw Material Consumed Loss on Sale/ discarded fixed assets Total 36,078,562 Proportionate 629,816,402 108,844,785 520,971,617 Operating C Profit 57,847,259 18,620,306 39,226,953 Operating Profit as a percentage of Operating D Income 8.41% 14.61% 7.00% Operating Profit/Total E cost 9.18% 17.11% 7.53% 5.10. CIT(A) made adjustments which are mentioned in his order as under: “8.6 When the information given in the above table is compared with the audited financial statements provided by the appellant it is found that the total expenses allocated between the two segments was Rs.62,98,16,402 vis-à-vis the total expenses of Rs.67,01,57,185. On the perusal of the schedule of the profit and loss account it is noticed that the difference is on account of non-allocation of the following expenses: a) Technical know-how payment made to Takata amounting to Rs.1,10,00,000. b) Depreciation amounting to Rs.2,64,03,411. c) Finance expenses amounting to 1,39,37,372. The above expenses also need to be allocated to both the segments either on the basis of some allocation key or if they are directly attributable to a particular segment. 8.7 On the perusal of the nature of the international transactions undertaken by the appellant it is noticed that the payment of technical know-how fee is for manufacturing Takata based products only. Thus the technical know-how payment needs to be allocated to the segment pertaining to sales made of Takata products. The depreciation charged on the fixed Assets is to be allocated on the basis of the turnover of these segments. As for the financial expenses, they primarily pertain to interest expenses which are non-operating in nature. However the bank charges of Rs.18,79,136 needs to be allocated to both the segments on the basis of the turnover. 8.8 Based on the above, the revised segmental calculation of the internal segments is provided below: Particular Expense already allocated Total (in Rs.) Takata (in Rs.) Others (in Rs.) 62,98,16,402 10,88,44,785 52,09,71,617 Details Allocation of expenses not done by the appellant Depreciation Bank Charges :Payment of Transfer Total Expenses Sales Operating Profit 2,64,03,411 48,94,126 2,15,09,285 18,73,136 3,48,315 15,30,820 1,10,00,000 1,10,00,000 - 1,62,42,441 2,30,40,105 66,90,98,948 12,50,87,226 54,40,11,722 68,76,63,661 12,74,65,091 56,01,98,570 1,85,64,713 23,77,865 1,61,86,848 1.86% 2.88% OP/Sales If the above segmental computation is to be considered for the purpose of benchmarking the international transaction of the appellant then the margin earned by the appellant from the AE business is lower than the margin earned by the appellant in the domestic business, hence if the appellant's submission is to be considered then the transactions of the appellant would not adhere to the arm's length standard.” 5.11. Ld counsel contends that in para 8.6 CIT (A) has found comparison of financials with internal comparable in para 8.5, a difference of Rs.4.03 crores was noted on account of which this difference had arisen, i.e. (a) Technical know-how fee Rs.1.10 crores. (b) Depreciation Rs.2.64 crores. (c) Financial Expenses Rs.1.39 crores. This becomes Rs.5.13 crores 5.12. It is pleaded that CIT (A) has erroneously added Rs.1.10 crores on account of technical fee as the same was never debited to profit and loss account as such and was actually capitalized by the assessee. Therefore in any case difference may be attributed to only of items (b) and (c) above. By allocating entire payment of technical know-how fee of Rs.1.10 crores to AE segment, CIT(A) computed the PLI from AE segment at 1.86% and from non-AE segment at 2.88%. This according to ld counsel is incorrect as the appellant never claimed payment of technical know-how fee of Rs.1.10 crores in its profit and loss account since the same was capitalized. 5.13. Even though CIT(A) rejected internal comparable and held that in the absence of internal comparable, TNMM is the most appropriate method by following observations in para 8.9 of his order:“Hence in the absence of any internal comparable TNMM is the most appropriate method to compare the company wide margins earned by the appellant with external comparables undertaking similar manufacturing activities.” 5.14. In view of the above calculations, the CIT (Appeals) enhanced the addition as calculated by him on page 25 para 15.1 of his order to Rs.4,24,11,209/-. 5.15 Ld. counsel canvassed following points before us: A. Written agreements which are duly executed by parties based on commercial expediency cannot be disregarded without giving any cogent reasons reliance is placed upon the following judgments:i) Azadi Bachao Andolan – 263 ITR 706 SC = (2003-TII-02-SC-INTL); ii) CIT v. Gillette Diversified Operations (Pvt) Ltd. [2010] 324 ITR 226 (Del) = (2010-TIOL-396-HC-DEL-IT) (iii) CIT v. Walfort Share & Stock Brokers (P) Ltd. [2010] 233 CTR 42 (SC) = (2010-TIOL-47-SC-IT) (iv) Sony India v. DCIT [2008] 114 ITD 448 (Del) (relevant para 100, page 520) = (2008-TII-08-ITAT-DEL-TP) No finding has been given that agreements are non-genuine or sham. The agreements have been duly approved by the Ministry of Commerce, Department of Industrial Policy and Promotion, SIA, of 2 nd December 2000 wherein the foreign collaboration agreement was approved by the Government of India including the payment of royalty and lump-sum technical know-how fee. The business with Takata and the sale of seat belts could not have taken place at all without this joint venture agreement with Takata Japan. This duly executed and approved agreement lays the foundation stone of the business and whether the appellant should conduct his business at all and whether it should enter into a joint venture agreement at all is the decision of the businessman. The TPO cannot step into intricacies of business expediency and hold that assessee need not have entered into this agreement at all and, therefore, not paid any technical know-how fee or royalty to Takata i.e. the A.E. B. Findings that royalty was being paid in the purchase price of the raw material was incorrect as the formula for payment of royalty was net of imported raw material purchased and for this references is made to the calculations for payment of royalty which are contained in paper book at page 69 demonstrating that out of the sale amount total landed cost of material has been reduced and on the net selling price royalty has been calculated at 5% of the net selling price. Therefore, the TPOs action to completely disregard the royalty paid is not incorrect. C. OECD Guidelines and US case law are based on the domestic law of the countries they represent whereas as far as India is concerned Chapter X dealing with international transactions and transfer pricing is a complete code in itself and therefore there is no need for any external aids in interpretation of the Indian statute. The judges of the Apex Court and various other High Courts and the Tribunals specifically dealt with almost every situation in Indian perspective and the law in India is well settled on most of the propositions involved in this case. Royalty agreement duly executed and approved by the Government of India should not have been disregarded completely by the authorities below. D. Ld counsel supports his case on the of assessment orders in assessees own case for subsequent years, i.e. assessment year 2005-06 and 2006-07 along with TPO's orders which show that the TPO as well as the AO have accepted the existence of this joint venture agreement and have not proposed any additions either on account of royalty payment or on account of purchase of raw materials in the subsequent years. D. Only international transactions are covered by Chapter X on transfer pricing regulations and the transactions which have no international transaction element are not amenable to adjustments and for this proposition he has cited the following authorities:(i) IL Jin Electronics v. ACIT [2010] 36 sot 227 (relevant para on page 230) = (2010-TII-07-ITAT-MUM-TP). (ii) DCIT v. Starlight 2010–TII–28–ITAT-MUM-TP. (iii) Twinkle Diamond v. ACIT 2010–TII–09–ITAT-MUM–TP. (iv) Addl. CIT v. Tej Diem [2010] 130 TTJ 570 (Mumbai) = ( 2010-TII-27-ITATMUM-TP). 5.16. It will be seen that the operating profit on sales for the international transactions with TAKATA give a PLI of 10.495% which is higher than both the workings by the TPO of 9.21% and by the CIT (Appeals) of 10.74% - 5% = 10.27 for which he has invoked the safe harbour rule. Since the lump-sum transfer of royalty has been capitalized by the appellant in the fixed assets and depreciation thereon has been claimed CIT(A)'s table will have to be reworked after excluding the amount of Rs.1.10 crores on account of technical know-how fee. Ld. Counsel furnished the revised working which is placed on record, the same is as under: Particular Total (in Rs.) Takata (in Rs.) Others (in Rs.) Expense already allocated (A) 62,98,16,402 10,88,44,785 52,09,71,617 Details Allocation of expenses not done by the appellant Depreciation 2,64,03,411 48,94,126 2,15,09,285 18,73,136 3,48,315 15,30,820 NIL NIL - 2,82,76,547 52,42,441 2,30,40,105 Total 65,80,92,949 Expenses (C = A+B) 11,40,87,226 54,40,11,722 68,76,63,661 12,74,65,091 56,01,98,570 2,95,70,712 1,33,77,865 1,61,86,848 10.495% 2.88% Bank Charges :Payment of Transfer Total (B) Sales ( D ) Operating Profit (E = D – C) OP/Sales 5.17. Ld counsel canvassed third proposition that in accordance with the transfer pricing regulations ± 5% should be allowed as per Proviso 92C of the Income Tax Act and for this proposition he has relied upon the following authorities:(i) Electrobug Technologies Ltd. v. ACIT [2010] 37 sot 270 (Del.) = (2010- TII-39-ITAT-DEL-TP) (ii) Development Consultants v. DCIT [2008] 23 SOT 455 (Del.) (Relevant para on page 457) = (2008-TII-03-ITAT-KOL-TP) (iii) Sony India Pvt. Ltd. v. DCIT [2008] 114 ITD 448 (Del.) (relevant page 571 para 163.4) = (2008-TII-08-ITAT-DEL-TP) (iv) Customer Services India (P) Ltd. v. ACIT 2009–TIOL–424–ITAT-Delhi = (2009-TII-08-ITAT-DEL-TP) 5.18. The next proposition canvassed by Mr. Dinodia is with regard to internal CUP as the comparable method for testing the appellant's transactions with its associated enterprise. It is pointed out that paras 8.5 and 8.8 of the CIT (Appeals) order show that the margin in the AE transactions by the appellant is much higher than the margins in its local business. As per revised chart furnished by assessee by excluding the capital payment of Rs.1.10 crores which has been capitalized by the appellant in its books of accounts under the Companies Act as well as under the Income Tax Act, the operating profit of sales in the AE transaction segment would be 10.495% as against 2.88% in the totally domestic segment in which there is no international transaction. In both these segments, the product manufacturing processes are the same. In the other segment the turnover is Rs.56.02 crores as against turnover of Rs.12.74 crores in the AE segment. All the sales of the appellant company are to domestic, non related parties only, there is no export sales. The only difference in the Takata segment is the use of technology of Takata and the raw material is also imported from them. Normally in a transfer pricing regulation, this should be tested on the fact that where Takata transactions are leaving a lower operating profit than the non- Takata transactions and in this case the operating profit in Takata transactions is much more than the transactions in the non- Takata transactions. Therefore, according to ld. counsel, this internal comparable available in the appellant company itself should not have been disregarded by the TPO and the CIT (Appeals). 5.19. The next proposition is that the net margins worked out by CIT(A) in the six companies on page 24 of order are not correct, as per data filed which is collected from ROC by the appellant, the margins are much lower than the one calculated both by the TPO and the CIT (Appeals). A revised working of 3 comparable companies is furnished (annexure ‘C') on record, it supports assessee. 6. Ld. CIT D.R. Shri Ashok Pandeny in reply relied upon the orders of the TPO and the CIT (Appeals) and alternatively pleads that if new data with regard to the comparables is to be taken into account, then the matter should be restored back to the file of the TPO to re-work the margins of the comparables as per data collected from the ROC and filed by the appellant during the course of hearing. 7. In rejoinder Mr. Dinodia submitted that on the same set of comparables, the TPO and the AO have accepted both the royalty as well as purchase of raw materials to be at arm's length price for assessment year 2005-06 and assessment year 2006-07. Copies of TPO's orders as well as the assessment orders have been filed in the paper book. There is no point of sending the matter back because even if revised data is not considered and the error committed by CIT (Appeals) in working out the margins on AE segment and non-AE segment is corrected by removing the amount of Rs.1.10 crores of technical know-how fee, the results show that the assessee's transactions are at an arm's length and no additions are required to be made because AE segment gives margin of 10.495% and non-AE segment gives margins of only 2.88%. An appeal should not be set aside in routine manner as it results in multiplicity of proceedings and in this case the mistakes being manifest can be corrected without taking the efforts of further set aside. 8. We have carefully perused the record and considered the submissions of both the parties. It is a settled proposition of the law that legally binding agreements between unrelated parties cannot be disregarded without assigning any cogent reasons thereto. In this case it has not been imputed that agreements were non genuine or sham, rather they are duly approved by RBI and other regulatory agencies. It is also a settled proposition that commercial transactions are in the domain of the businessman and Income Tax Department cannot intervene in realm of intricacies of commercial expediencies involved in these arrangements. In this case if the assessee had not entered into joint venture agreement with Takata, it would not have been able to make any sales whatsoever using their technology and raw material and the machines supplied by them. The very existence of this business in AE segment depended upon the joint venture agreement which has been duly approved by the Government of India in accordance with law. In such circumstances, we are of the view that TPO and the CIT (Appeals) were not correct in disregarding this agreement without assigning any cogent reasons except challenging the commercial need for such arrangement which is in the domain of the businessman and not of the Revenue authorities. 8.1. We have observed that the TPO in his order has accepted the international transactions of purchase of machinery from the AE however an inference has been drawn that assessee was competent to make independent use of such machinery. Assessee has met this finding that machineries were imported to manufacture the assembly line for manufacturing of seat belts for which the technical know-how fee and foreign technicians were also deputed by the AE. Whenever international transactions of such nature are undertaken, it is a combination of technical know-how, royalty, technical assistance through the deputation of ex-pat employees on the rolls of the person obtaining the technical know-how. There is merit in assessees submissions that merely by importing machinery, it cannot be said that the assessee would become competent to make use of such machinery. Technical know-how and technical assistance was needed for the use of machinery under the normal circumstances. 8.2. It has not been disputed that provisions of Chapter X Section 92C deal with international transactions only and not with transactions which have no international cross border element at all. Therefore, the basis of making the adjustments on the enterprise level by taking Rs.68.76 crores as the base is not correct. What should have been taken is the sale to domestic parties using Takata technology and Takata raw material amounting to Rs.12.74 crores. The segment that was to be looked at was the international segment, that is, domestic sale using foreign technology and foreign raw material. As given by the appellant, the operating profit margin on AE sales is 10.49% whereas in the domestic sales segment it is only 2.88%. Proposition that only international transactions have to be looked at has also been approved by various Benches of the Tribunal which have been cited by the appellant and are not disputed by the learned CIT (DR) and no contrary judgment has been cited before us on this proposition. We, therefore, accept this second proposition also that only international transactions are to be taken into account while calculating the arm's length price. 8.3. Similarly, the next proposition i.e. as per Proviso to 92C to adjust net margin with ± 5% is also well settled by various Tribunal judgments which we respectfully concur with, this proposition also has not been challenged by the learned D.R. and while making adjustments based on statistical analysis some sort of safe harbour percentage must be there before making any additions. Respectfully following the judgments of the Tribunals, we accept this plea of the assessee. 8.4. The next proposition of using internal comparables also in our view helps the case of the assessee, to take it outside the scope of making any adjustment. Apart from relying on the judgments cited by the appellant, in our opinion, the best comparability can be of the transactions of the tested party itself. If the tested party without the use of the imported technology and imported raw material can make additional margins, then it would be a case which may require an adjustment, but in this case the international transactions have demonstratively boosted the profits of the appellant. As per calculations of the CIT (Appeals), as corrected by an error on account of technical know-how fee which was not claimed as revenue expense, the segment which did not have the benefit of foreign technology and foreign raw material had an operating profit to sales margin at 2.88%, whereas the segment which had this benefit had a margin of 10.49%. It is obvious that the transactions are at arm's length and no adjustments are called for. 8.5. Taking external comparables as given by the TPO and the CIT (Appeals) and by looking at the average PLI calculated by the CIT (Appeals) in para 15.1 of his order of 10.74% and if we reduce 5% thereof, it will come to 10.20%, i.e. 10.74 - 5% = 0.537. If this is reduced from 10.74, it will come to 10.20. This will be the PLI after adjustment as per the Proviso to Section 92C. This, in any case, is less than the PLI of the Takata transactions of the appellant which is 10.49%. Therefore even if we uphold the work done by the authorities below and adjust it by 5% and then compare it with the international transactions, then again there is no need, in our opinion, to make any adjustment as the PLI of the tested party, i.e. the appellant, is higher than the PLI worked out by the TPO and the CIT(Appeals). 8.6. The alternate plea of ld. D.R. about setting aside the issue is not worthy of acceptance. Even if we ignore the ROC data mistakes and comparables are clear and glaring. We have dealt with all the angles and assessment cannot be set aside unless there are adequate reasons to do so. 8.7. In view of all the foregoings, we have no hesitation in holding that the addition of Rs.4,24,11,209/- made by the CIT (Appeals) deserves to be deleted. A.O. is directed to delete the this addition. 9. In the result the appeal is allowed. (Order pronounced in open court on 12.11.2010.) (DISCLAIMER: Though all efforts have been made to reproduce the order correctly but the access and circulation is subject to the condition that Taxindiainternational (TII) is not responsible/liable for any loss or damage caused to anyone due to any mistake/error/omissions.)