Q4 2014 Wealth Management Service Adventurous portfolio

advertisement

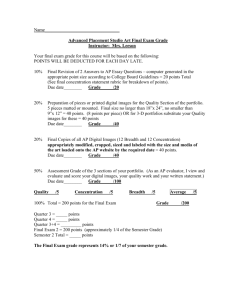

February 2015 Quarterly Report Adventurous Model Portfolio Adventurous Model Portfolio - Quarterly Commentary – Q4 2014 Key Facts The Model Portfolio Service for Avidity Wealth Management was established in October 2010. Asset allocation is provided by Avidity Wealth Management and sourced from Ibbotson. Morningstar OBSR populates the asset allocation with funds it considers appropriate and attractive as a result of its in-depth, qualitatively-driven research process. The objective is to deliver outperformance in each of the asset classes of the Portfolio over the long term. Investment Objective The investment objective, as provided by Ibbotson, is as follows: This Adventurous Portfolio is appropriate for investors who have both a high tolerance for risk and a long investment time horizon. The main objective of the Adventurous Portfolio is to provide high growth for the investor's assets without providing current income. Portfolios in this range may have substantial fluctuations in value from year to year, making this category unsuitable for those who do not have an extended investment horizon. Asset Allocation1 Performance from 31/12/2008 – to quarter end Emerging Markets Equity 9.0% Fix ed Interest 2.0% Asia ex Japan Equity 7.0% Japan Equity 6.0% 1As North America Equity 16.0% Property 5.0% Cash* 2.0% UK Equity 38.0% Europe Equity 15.0% at 30/06/2014 *Cash may be held in a money market fund or in a cash deposit. The Fidelity Cash fund is used in this model for the purpose of generating a performance track record for the Model Portfolio. The Custom Benchmark used to measure performance has been amended to better reflect the performance from fund selection over time. The new passive custom benchmark effectively populates Ibbotson’s strategic asset allocation with trackers, except for direct property where due to the lack of a passive option, the ABI UK Direct Property (Life) sector average is used as a proxy, and cash where LIBOR is used as a proxy. As at the end of the quarter the benchmark is composed of the following: 2% Markit iBoxx GBP NonGilts, 38% FTSE All Share, 15% FTSE World Europe ex UK, 16% MSCI North America, 9% MSCI Emerging Markets, 7% MSCI AC Pacific ex Japan, 6% MSCI Japan, 5% ABI UK Direct Property (Life) and 2% BBA LIBOR GBP 3 Months. Please refer to the information in the footer below regarding performance. The performance chart shows the cumulative returns of the Model Portfolio and the Custom Benchmark, assuming a starting value of 100. Recommended Changes Asset allocation: There has been no change to the asset allocation since Ibbotson’s update in May 2014. Fund selection: There has been no change to fund selection this quarter. Performance – Portfolio Constituents to 31/12/2014 The table below shows the performance of the overall Portfolio, on a model basis only, together with the performance of the passive custom benchmark. It also shows the performances of the underlying funds that currently feature in the Portfolio and relevant indices. The shaded rows show the performances of the constituent parts of the Portfolio. Fund Avidity - Adventurous Weight (%) Please be aware that this Model Portfolio does not incorporate any fund changes that are recommended in this document, i.e. it shows the positioning as it stood throughout the quarter and before any asset allocation and/or fund selection changes suggested at the end of the quarter. The performances shown are those of the retail share classes. Mstar OBSR Analyst Rating 2014(%) 2013 (%) 2012 (%) Since Inception Annualised (%) 2.60 4.4 18.73 10.29 11.60 2.02 5.30 17.85 10.31 10.52 2.60 4.77 14.74 10.25 10.15 1.45 -1.11 22.99 12.99 13.17 Gold 1.54 0.01 28.78 10.56 16.01 -6.09 23.31 18.20 14.82 14.98 13.81 100.0 CB Adventurous Portfolio IMA OE Flexible Investment** Q4 2014 (%) UK Equity 38.0 AXA Framlington UK Select Opportunities 6.0 BlackRock UK Special Situations 5.0 Gold 3.05 CF Woodford Equity Income 8.0 Bronze 3.64 Investec UK Special Situations 6.0 Gold -0.55 -1.23 25.76 M&G Recovery 5.0 Bronze -3.04 -9.59 14.13 8.71 9.75 Old Mutual UK Alpha 8.0 Silver 2.91 1.24 31.13 22.78 14.48 0.58 1.18 20.81 12.30 12.14 FTSE All Share Europe Equity 15.0 1.12 0.48 25.67 17.88 8.54 Henderson European Selected Opps 8.0 Silver 0.17 2.56 26.57 20.35 9.19 Jupiter European Special Situations 7.0 Silver 2.21 -1.66 27.32 17.00 8.95 FTSE Europe ex UK -0.53 0.16 25.18 17.82 7.91 10.22 19.89 30.92 4.85 16.70 10.87 17.58 26.25 5.34 15.93 Silver 9.43 21.36 30.41 7.96 15.91 Silver 10.82 20.45 28.67 4.95 15.00 9.10 20.76 29.93 10.91 15.98 North America Equity 16.0 Baillie Gifford American 6.0 Bronze HSBC American Index 5.0 JPM US Equity Income 5.0 S&P 500 Emerging Markets Equity 9.0 -3.59 -0.67 -1.23 17.97 11.72 Lazard Emerging Markets 4.5 Silver -3.25 0.79 -2.76 15.62 11.23 M&G Global Emerging Markets 4.5 Bronze -5.69 -3.50 -1.98 15.99 -0.72 3.90 -4.41 13.03 MSCI EM (Emerging Markets) 10.37 Asia Dev ex Japan Equity 7.0 4.48 10.13 0.48 14.20 Fidelity South East Asia 4.0 Bronze 5.84 9.51 2.62 14.20 13.24 Schroder Asian Alpha Plus 3.0 Silver 2.66 10.81 -2.13 22.41 18.73 3.18 7.81 2.00 16.70 13.15 0.64 3.24 23.41 3.48 6.14 0.64 3.24 23.41 3.48 6.14 1.09 2.68 24.67 2.82 4.36 2.63 7.43 -3.73 1.72 MSCI AC Far East ex Japan Japan Equity 6.0 Schroder Tokyo 6.0 Gold Topix Fixed Interest 2.0 Fidelity Strategic Bond 2.0 2.63 8.50 1.30 11.85 9.14 IMA OE £ Corporate Bond 3.43 9.83 0.58 13.32 8.27 Markit Boxx GBP NnGit TR 4.35 12.20 0.87 13.04 8.56 3.37 13.71 4.21 -1.58 3.58 3.37 13.71 4.21 -1.58 3.58 4.40 19.31 10.90 2.35 8.39 0.03 0.09 0.07 0.17 0.24 0.14 0.54 0.52 0.99 0.89 Property 5.0 Threadneedle UK Property Trust 5.0 Silver n/a IPD UK All Property Monthly Cash* 2.0 Fidelity Cash 2.0 ICE LIBOR GBP 3 Mnths 0.03 n/a Data is sourced from Morningstar Direct. Please be aware that adjustments to previously reported data can occur. This can be due to factors such as changes to tax treatments, income distributions, pricing or updated information from third parties.**The IMA sector averages have been included for information purposes only, as per the request of Paradigm. The Model Portfolio is managed without reference to these peer groups. *Cash may be held in a money market fund or in a cash deposit. The Fidelity Cash fund is shown here for the The estimated weighted yield of the Portfolio, based upon the most recently published yields as at the time of purpose of generating a performance track record for the Model Portfolio. writing, was 1.60%. Source: Morningstar Direct. Executive Summary Market Summary The fourth quarter witnessed increased market volatility, with the major features being the sharp fall in the oil price and disappointing global growth as the second-half improvement in economic growth was not as high as expected. The solid rebound in US consumption was not strong enough to outweigh the weather-related problems of the first quarter. Japan’s economy slipped back into a technical recession as the economy slowed further than expected after the consumption tax hike. Elsewhere, Europe continued to struggle with France and Italy the main disappointments. Looking at markets, the fourth quarter was very volatile. Most equity markets corrected by between 5-10% at the start of the quarter, followed by a sharp rally up until 5/12 by when the MSCI World index had hit at an all-time high and was nearly 9% ahead year-to-date. In the six or so trading days that followed, however, equity markets succumbed to another bout of instability encompassing a sharp 7% decline in the EU and UK and a 5% decline in the MSCI World index. Another rally ensured such that by year-end most equity markets had rebounded by another 5% or so. Overall, the US equity market again outperformed others markets, in particular the UK, Europe and EM. Fixed income markets also experienced rising volatility although overall the trend of falling sovereign bond yields that prevailed all year continued. 10-year gilt yields finished the year at 1.76%, a decline of 67bp over Q4. Longer duration assets typically outperformed, as evidenced by long-dated government bonds beating corporate bonds and within credit high yield underperformed. Portfolio Performance Summary Over the quarter, the Adventurous Portfolio comfortably outperformed its passive custom benchmark. Since inception, the Portfolio is well ahead of its custom benchmark, meaning that fund selection has added value. Within the equity portion, relative performance was boosted by the UK, US, Europe ex UK and Asia ex Japan equity fund blends which all outperformed their respective benchmarks. At the overall sector level, the underweight to the energy sector was beneficial to most fund blends. The property allocation produced solid absolute returns but continued to hamper returns from a relative sense as the IPD index remains a high hurdle to beat for active managers. Market Outlook Please note Morningstar OBSR is not mandated to tactically adjust the asset allocation of the Portfolio, so the below views are included for information purposes only. Looking ahead, expectations are for improving growth in 2015, in part due to the anticipated continuation and, in the case of Japan and Europe, extension of accommodative monetary policy, the continued reduction of fiscal drag and rising real household purchasing power due to lower energy prices. According to the IMF, falling energy prices could boost world GDP by between 0.3%-0.7% during the course of 2015. As business and consumer confidence remain very supportive, there is upside to most commentators’ current forecasts of 3% 2015 global GDP growth. Equity valuations are far from being cheap in most parts of the world and earnings growth largely needs to come through to sustain current valuations. Stronger global growth in 2015 and largely accommodative monetary and fiscal policy round most parts of the globe should remain positive for risk assets. We expect bonds to underperform equities in the medium term although numerous risks also remain to that more positive outlook and markets are likely to remain volatile; divergent monetary policies could lead to greater financial market volatility, stagnation in Europe may well continue and concerns over financial instability in China remain. Market Summary Economic Background Financial Market Background Although the dramatic 40% or so collapse in crude oil prices was the key macro event in Q4, so far, the economic impact has been felt more keenly in inflation figures while the effect on global growth has proven more difficult to divine. Indeed, economic reports published in October and November and survey data for December suggest headline Q4 global GDP growth may have eased back to around 3.3% from last quarter’s 3.7%, but this follows very strong headline Q3 growth from the world’s two largest economies, the US and China, that isn’t about to be repeated. Unsurprisingly, the 40% collapse in crude oil prices had a marked impact on financial markets throughout Q4. Together with another key continuing trend, further substantial US dollar gains, this generated considerable volatility in all financial markets as investors assimilated these significant moves. In general, decent returns were recorded by all asset classes, with the natural exception of commodities, although there were substantial differences within them. The pace of Q4 US GDP growth is unlikely to match the 5.0% recorded in Q3, but underlying trends in consumer spending (68% of US GDP) remain robust and above trend growth of near 3.0% is generally forecast. In contrast to the consumer, business spending has slackened somewhat in recent months, possibly in response to the stronger dollar, easing global demand and lowered capex in the oil sector. While an improvement on the prior quarter, the fragility of the euro area economy was exposed once gain as Q3 GDP growth disappointed growing at just a 0.6% p.a. rate. At nearly 30% of the euro area, Germany was the main culprit as GDP barely advanced. Even so, underlying trends were brighter with much of the weakness due to inventory drawdowns. General estimates are for a modest euro area improvement in Q4 with annualised growth of around 0.8% expected. Aided by an ongoing upturn in consumer spending and a flat inventory contribution, a far stronger quarter is predicted for Germany, with GDP growth accelerating to about 1.5%, supported by 2.0% growth in Spain but with both France and Italy probably contributing next to nothing. The Q3 UK GDP report, while recording 3% p.a. growth, also revised earlier quarterly figures substantially lower. They were all reduced with Q2, for example, growing at a 3.3% p.a. rate instead of the previously reported 3.7%. Weaker PMI data, especially in manufacturing and construction, suggested a slowing economy earlier during Q4, but more recent retail sales data indicates growth being around 2.5%, within the range expected as the quarter began. Of all the major developed market economies, it is perhaps Japan that disappointed the most through mid-year. Three months ago Q3 GDP growth had been forecast to accelerate strongly following Q2’s massive sales tax driven collapse but, with the latest revisions, GDP contracted another 1.9% in Q3, albeit final demand was ahead over the quarter. Once again recovery is forecast with 3% or so pencilled-in for Q4, led by net exports but supported by accelerating consumer spending and a sizeable upturn in business investment. Snap elections returned Mr. Abe to power with the mandate to pursue his economic policies and, just before year end, the government outlined a sizeable targeted stimulus package and confirmed previously announced corporate tax cuts. Following stronger than expected Chinese Q3 GDP growth of 8.0% p.a., weaker economic reports across most sectors and through much of the quarter, led to Q4 GDP growth forecasts easing to around 7.0%. This deceleration largely reflects the central government’s policies aimed at slowing fixed investment growth in real estate and manufacturing sectors with oversupply issues. Given the ongoing collapse in the oil price through the quarter, it is no surprise that GDP forecasts have differed markedly throughout EM with, naturally enough, downward revisions in Russia and Brazil leading EMEA and Latam estimates lower. Even so, Q4 forecasts for other major countries within those regions such as Mexico, Turkey and Poland are generally little changed and only the main oil producers have experienced sizeable downward revisions to GDP. Ex China, Asia Pacific has many more diverse influences and so far has seen only limited revisions to Q4 growth. Deflation continues to gather far more media mentions that inflation as the massive fall in oil prices has fed through into ever lower headline inflation. Understandably, the euro area was the first of the major countries to announce a monthly fall in prices, to -0.2% y/y in December, but it should be noted that, so far, core inflation (i.e. ex food and energy) is little changed from the growth rates of a year ago in most countries/regions, including the euro area. Divergent monetary policy trends remained a key feature through the quarter with the ECB and BOJ committed to boosting growth and inflation. The BOJ launched QQE2 at the end of October, significantly adding to both bond and other asset purchases, while the ECB has effectively promised QE will be introduced at its 22nd January meeting. While the Federal Reserve still favours the June meeting to announce a rate hike as it did when the quarter began, the timing for the BOE’s first move has been deferred to Q4 2015 at the earliest, according to money market futures. It was an extraordinarily volatile quarter for fixed income markets. It began with a “flash crash” in yields in October that saw 10-year US Treasuries yields spike downwards by nearly 40bp intra-day before immediately recovering. By mid-November US yields were back up again at 2.4% but even favourable economic news was unable to prevent yields trending ever lower. The ongoing collapse in oil prices, falling inflation expectations and a sizeable equity retreat generated a flight to safety that saw yields subside to 1.80% by mid-December. Trends in all the main government markets were fairly similar with yields declining across the curve put particularly at the long end. Gilt returns were exceptionally strong over the quarter, especially index-linked. Riskier bonds generally underperformed main governments, including EU peripheral markets, corporate bonds and emerging market debt. Indeed, US high yield indices suffered considerably from the ongoing rout in oil and gas junk bonds that resulted in an overall 0.7% loss over the quarter. Corporate bonds generally performed better in the UK and Europe but still underperformed local government bonds. EMD also recorded losses in Q4 following a near 3% decline in December with spreads ballooning as the dollar surged. Equity market volatility picked up sharply in Q4 to its highest quarterly average for two years and was accompanied by periods of significant weakness. Indeed, the MSCI World Equity index suffered two downturns in excess of 5% and it was mostly due to the ongoing strength of US markets that equities rose at all. Even so, by quarter end, the world index was just below its all-time high. Perhaps the biggest disappointment for UK investors was local market performance. The FTSE 100 index closed nearly 1% down over the quarter although performance was skewed by heavy falls in energy and mining stocks. Such distortion is shown by the 50th percentile stock in the index which rose by 5.1% over the quarter. In contrast, in sterling terms, the S&P 500 was nearly 9% ahead over Q4, by far the best performing major index. TOPIX also performed strongly but only at the expense of yen weakness. In general, emerging markets had a fairly tough time, the exception being local Chinese stockmarkets with the Shanghai Composite index soaring 20% on a massive increase in volumes. In terms of sectors, the impact of the collapsing oil price was demonstrated by energy being at the foot of the sector tables in all major markets, while consumer discretionary headed the global rankings. Q4 was another dire quarter for commodities with a 33% slump in the energy sector. The slide in the crude oil price really accelerated once OPEC decided at its November meeting to leave production quotas unchanged, ensuring that production elsewhere would have to be cut before the price could stabilise. Metals prices also weakened and it was only the agricultural sector that was able to record positive returns as wheat and corn prices escaped from their own sizeable bear markets. UK commercial property returns edged down again in Q4 but to a still very creditable 4.4% compared to 4.7% in Q3, according to IPD data. Offices and industrials both returned annualised gains well in excess of 22% but retail, the largest sector, continued to lag. Performance Summary Overall Based upon the Morningstar Direct Portfolio Management module, on a model basis the Adventurous Portfolio returned 2.60% over the quarter, and outperformed its custom benchmark, which returned 2.02%. The Model Portfolio’s return remains ahead of that of the passive custom benchmark since inception in January 2009, meaning that fund selection has added value since launch. Property The strong performance of UK commercial property continued in the final quarter of 2014. Rental values are now playing a more important role as the rate of capital growth slows. As 2014 progressed there was increasing evidence that market strength was broadening into secondary property and outside of London. Office and industrial sectors continued to lead, with the retail sector lagging although continuing to produce good absolute returns. The property fund holding outperformed the IPD UK All Property index over the quarter. It is pleasing to see better performance from Threadneedle UK Property which has continued to benefit from the recovery in secondary property values. As we have previously indicated, it is difficult for openended direct property funds to keep up in a rising market when the reference index does not bear the significant costs of transacting physical property and also is not required to hold cash in order to manage inflows and outflows. Our primary aim in the selection of property funds is to ensure that the funds are managed by well-resourced and experienced teams as it is not possible to avoid the challenges and practical realities of managing an open-ended fund in an extremely illiquid asset class. Please see below for more information on the fund’s approach and Q4 performance. Threadneedle UK Property Trust As expected, the fund lagged the IPD UK All Property Monthly index over the period. In an environment of strongly recovering capital values it is unlikely for a daily dealing fund to beat the market given the liquidity requirement and therefore the sizeable cash exposure. Strong yield compression, witnessed from a variety of properties, contributed well over the quarter. The fund’s low vacancy rate bolstered performance over the period. The fund’s cash exposure continues to be detrimental to returns given the current point in the property cycle combined with interest rates standing firm at historic lows. This is in keeping with other daily dealing open-ended direct UK property funds. We believe the fund to be an appropriate holding for direct commercial property exposure, with a greater focus on high yielding assets than many of its peers. Fixed Interest Higher quality bonds again outperformed over the fourth quarter, as has been the case for much of the year. Indeed, despite contrary expectations at the start of the year, 2014 was an excellent year for most government bond markets, with longer duration bonds producing exceptional returns. That said, the fourth quarter was characterised by significant volatility. Global growth concerns triggered a mini yield crash on 15 October which saw US 10-year treasury yields plummet by 34bps in a matter of hours. Yields remained repressed in November, but favourable economic news in early December nudged yields higher. Later in the month the continued oil price fall, falling inflation expectations and a sizeable equity retreat once more generated a flight to safety. With this environment, it was no surprise that high yield indices lagged somewhat, especially energy dominated US high yield, which suffered a significant sell-off. In an environment of falling government bond yields, the fixed income allocation delivered a solid positive return that was however behind recognized bond indices as the Fidelity Strategic Bond tends to hold notable exposure in high yield debt. Please see the below comments for more information on the Q4 performance and approach of each of the funds recommended for the Portfolio. UK Corporate Fidelity Strategic Bond Well ahead of the diverse sector average. The fund benefited from higher interest sensitivity and dedicated gilts exposure as bond yields fell and sovereigns outperformed credit. Lower high yield and financials exposure than peers helped. Credit selection in high yield was positive, as defensive sectors protected on the downside. We perceive this fund to be a more balanced proposition than many of the more credit-oriented funds in the strategic bond sector. It is managed loosely around a strategic framework that incorporates meaningful exposure to gilts and corporate bonds as well as higheryielding credits. This diversification can dampen volatility in times of stress. Equities Equities generally produced positive returns for investors over the fourth quarter, but volatility was high and there was significant disparity across geographical regions and sectors. The UK market suffered from its high exposure to both energy and mining stocks and therefore lagged global indices. The US again led world equity markets, as has been the case for much of the last three years, and for sterling investors returns were further bolstered by dollar strength such that the S&P 500 index returned 9% over the quarter. Further monetary easing ensured the TOPIX produced the highest quarterly gains but only at the expense of sizeable yen depreciation. While Asian equities generally followed the US market higher, many commodity producing emerging markets were hurt by the collapsing oil price, most notably Russia and Brazil. The energy sector was far and away the worst performing over the quarter; in contrast, consumer facing stocks (both discretionary and staples) tended to outperform. On the equity side, the UK equity fund blend outperformed the FTSE AllShare index, with all funds except M&G Recovery outperforming significantly. A general underweight to the energy sector helped at the overall fund blend level, and the recently introduced CF Woodford Equity Income and Old Mutual UK Alpha funds also had a good start. The laggard remained M&G Recovery, which was impacted by negative stock selection across a number of sectors, and we continue to monitor the fund carefully following a prolonged period of underperformance, in particular the level of outflows and potential related liquidity constraints. On the US equity side, the fund blend was helped by the relative outperformance from both Baillie Gifford American and JPM US Equity Income. The Europe ex UK fund blend also performed well, helped by Jupiter European Special Situations. Elsewhere, Fidelity South East Asia was a strong contributor as it benefited from strong stock selection across the board and an underweight to energy. On the negative side, the emerging markets funds both underperformed the index due primarily to their exposure to underperforming Russia and Brazil. Please see the below comments for more information on the Q4 performance and approach of each of the funds recommended for the Portfolio. UK AXA Framlington UK Select Opportunities Outperformed the index but lagged peer group. Stock selection was positive, most notably in both consumer services and consumer goods. Mid cap bias helped. The fund is a diversifying holding within the UK blend, given its all-cap mandate and growth focus. Positioning and performance can vary materially from the benchmark but the manager has shown an ability to navigate the portfolio successfully through different market cycles. Performance Summary BlackRock UK Special Situations Outperformed the index and peer group. Stock selection was positive, most notably in both consumer services and consumer goods. Underweight to oil & gas sector and exposure to house builders helped. Mid cap bias added value. The fund benefits from an experienced manager and tried and tested approach. The fund is managed with a high-conviction approach and tends to have a mid and small-cap bias, which means its positioning and performance may vary materially from the benchmark. CF Woodford UK Equity Income Substantially outperformed the index and peer group. The considerable underweight to energy drove outperformance over the quarter. Stock selection in financials and healthcare was also beneficial. The fund is managed by Neil Woodford, who has been successfully managing UK equity income funds since 1988 and is one of the longest serving managers within the industry. He invests in companies that he thinks are undervalued but can sustain dividend growth over the medium term. Short term relative performance can be volatile as a result of the manager’s macro views, however, he has demonstrated an excellent long-term track record in the management of income portfolios, particularly in downmarkets. Investec UK Special Situations Underperformed both FTSE All-Share index and peer group over quarter. Stock selection hurt performance, notably large holdings of Royal Dutch Shell and BP. Short position on S&P500 detracted. The manager of the fund is one of very few genuinely contrarian investors and the courage of his convictions has been tested at various times in the past. Given his contrarian approach, investors do need to be prepared for performance and risk outcomes that can differ from that of the market, but the fund works well within a blend as it typically provides style diversification. M&G Recovery Significantly underperformed the index and peer group. Bias to higher risk names and in particular an allocation to AIM-listed stocks hurt returns again. Stock selection across a broad range of sectors detracted, most notably within energy and materials. Among the key culprits were holdings in Nostrum Oil & Gas, Kenmare Resources and First Quantum Minerals. This fund is managed by a very experienced fund manager who has honed a well-versed investment process. The fund has a specialist mandate with portfolio construction built around companies at different stages of development, from early stage to maturity. This framework ensures a balance of different stocks in the portfolio, which typically moderates overall risk characteristics. We regard the fund as an attractive long-term holding for portfolios within a blend of UK equity funds, although given the specialist nature of the mandate and a high degree of business risk in the portfolio, investors should be prepared for some volatility in relative performance. Old Mutual UK Alpha Outperformed the index and peer group. Overweight and stock selection in consumer discretionary contributed (Taylor Wimpey, Home Retail, Debenhams). Energy underweight a positive; IAG also benefited from oil price drop. The fund is managed in a relatively unconstrained manner through a focused portfolio of high conviction holdings. The manager is prepared to take a long-term stance and to counter market consensus, which can impact negatively on relative performance for extended periods of time. However, we believe the outperformance delivered by his approach over the long term compensates for this additional relative risk. We recommend this fund as part of a blend of UK equity funds. Europe Henderson European Selected Opportunities Outperformed the index but underperformed peer group. Stock selection added value whereas sector allocation had a small negative impact on performance. Overweight to consumer goods and underweight to oil and gas were beneficial. Overweight in healthcare and underweight in industrials contributed negatively. The fund offers investors exposure to a large-cap biased portfolio of European stocks. The manager’s focus is on companies with attractive earnings track records and the ability to surprise in the future. The investment approach is relatively pragmatic employing top-down and bottom-up disciplines. The fund is attractive for use as a large cap orientated fund with the manager keen to maintain a competitive position within the peer group. Jupiter European Special Situations Outperformed the index and peer group. Positive stock selection across a wide range of sectors, in particular within telecoms (Numericable and Altice). Sector allocation was also positive: overweight to consumer services and underweight to oil & gas helped the most. The manager is a bottom-up stock picker who nevertheless invests with a strong awareness of the macro environment. This top-down analysis serves as a roadmap for fund positioning and overall portfolio risk, making the fund suitable as a key member within fund blends, in our view. From a stock selection point of view, whilst he is willing to invest in value opportunities, the manager has a bias towards growth companies. The manager is prepared to consider opportunities across the market-cap scale but tends to have a large-cap bias. Performance Summary North America Baillie Gifford American Comfortably outperformed the index and the peer group. An underweight energy position proved beneficial on the back of a falling oil price. Stock selection helped, with names such as First Republic Bank and Harley-Davidson recovering well. The philosophy and process that underpins this fund is long-standing and highly disciplined. The portfolio tends to be concentrated and encompasses some high-conviction holdings. The approach, combined with the manager’s ability to take a significant degree of stock-specific risk tends to result in performance variability compared to the index but it has reaped rewards over the long term. We recommend this fund as part of a broader US equity blend. HSBC American Index Broadly in line with the index and outperformed the peer group. A passive offering has been selected to balance the active funds in the portfolio and should help keep the risk characteristics of the fund blend in keeping with the underlying benchmark. JPM US Equity Income Outperformed its benchmark and the peer group average. Stock selection across a number of sectors, particularly within the energy and industrials sectors, contributed most to the outperformance. The overweight to utilities and an underweight position in materials, combined with good stock selection within it, also buoyed relative returns. The fund is one of the few equity income offerings in the North American sector. It is managed by two experienced individuals who have been managing money in a value/income style for many years. Unlike some other income propositions, this fund tends to be exposed broadly to the market with representation across most or all sectors. Therefore we expect the fund's risk and return characteristics to be in keeping with the market, notwithstanding the fact that it is likely to demonstrate greater resilience in falling market conditions whilst struggling to keep pace with strongly rising, growth-led market conditions. The fund can be an interesting diversifying holding within a blend of US equity funds and/or is appropriate for investors seeking a yield from this market. Japan Schroder Tokyo Underperformed the index and slightly underperformed the peer group. Detractors to fund performance included stock selection in chemicals and construction as well as the fund’s overweight position in resourcerelated stocks via holdings in trading companies. In particular, the holding in Mitsui & Co suffered on the back of the fall in the oil price. The manager adopts a flexible investment approach and tries to be forward looking with a preference for investing in companies where he believes the market has taken an overly negative short-term view. His disciplined approach to valuations and fundamentals also enables him to have a good grasp of market sentiment, which we feel is very considered. Combined with his desire to control the level of portfolio risk, this approach makes the fund an attractive portfolio holding. Asia ex Japan Fidelity South East Asia Outperformed the index and peer group. Stock selection drove outperformance over the quarter, particularly within information technology. In particular, Taiwan Semiconductor Manufacturing, the fund’s largest overweight position, was a strong contributor. Stock selection within consumer staples further boosted relative returns. In terms of sector allocation, an underweight exposure to energy was beneficial. The fund manager follows a growth-at-a-reasonable-price (GARP) investment approach, whilst including some restructuring and turnaround stories at the margin. Since taking over the portfolio in January 2014, the manager has reduced the number of holdings to around 100 stocks and imposed a clear bias to the information technology sector. Consumer-led positions are also preferred, such as the car manufacturers Brilliance China Automotive and Hyundai. Schroder Asian Alpha Plus Behind the index and the peer group. The underperformance was mainly due to negative stock selection and the underweight exposure to China. Stock selection in financials also hurt due to lack of exposure to Chinese banks. The underperformance was partially offset by the fund’s underweight position in Korea and off-benchmark position in India. The manager's focus on valuation provides a robust framework and reference point to help inform his investment decisions. His unconstrained approach, with the potential for significant country and sector divergences from the index, nevertheless means that its performance profile is likely to incorporate a high degree of variability relative to the benchmark over shorter time periods. The fund is therefore usually used as one part of a broader blend of Asia Pacific ex Japan funds. Emerging Markets Lazard Emerging Markets Outperformed the index and peer group. Stock selection in Brazil, Taiwan, Thailand and Turkey boosted returns; lack of exposure to Brazilian oil major Petrobras was a key contributor. The fund’s overweight to South Africa and underweight positions in Malaysia, Mexico and Korea benefited returns. Underweights to energy and materials were other key contributors. The fund offers investors diversified exposure to emerging market regions. The approach has a quality bias, notably through a focus on return on equity and the calibre of company management. This means that stocks are typically held for the medium-term and as such the fund is likely to struggle in momentum driven markets or those driven by a few sectors. The portfolio construction method is flexible and ensures the managers are not constrained to buying high-yielding stocks. We believe this flexibility makes the fund appropriate for an emerging markets allocation due to its total return prospects with a bias to yielding stocks. M&G Global Emerging Markets Significantly underperformed the index and peer group. As was the case in Q3, the fund’s holdings in Russia, in particular Sberbank, detracted the most. Stock selection in China also hurt. The manager believes that the philosophy of investing in companies with sustainable returns on capital in excess of their cost of capital will produce attractive long-term returns. He is willing to deviate from the benchmark in constructing a portfolio of such stocks, investing on a long-term time horizon. As a result, relative performance should be expected to exhibit a level of volatility but we believe the fund is an attractive long-term holding which often incorporates value and a midcap biases compared to the benchmark and peers. Outlook Economic Outlook Financial Market Outlook Although 2014 global growth is set to disappoint early year expectations for a third successive year, hope springs eternal amongst forecasters and, once again, a stronger 2015 is predicted. Concerns remain that the oil price decline could engender a damaging deflationary spiral and there are obvious casualties among commodity producing nations. However, most observers agree with the IMF view that it is “a shot in the arm for the global economy” potentially producing “a gain for world GDP between 0.3 and 0.7 percent in 2015.” Overall, global GDP is predicted to grow by 3.0% in nominal exchange rate terms and by 3.4% on a PPP basis. From a regional perspective, the US economy is expected to be by far the biggest contributor to the global upswing and, should it grow by the generally foreseen 3%, it will account for nearly half of the estimated increase in world output. The bulk of the rest is likely to be provided by other developed markets as aggregate emerging market growth is being undermined by the ongoing structural slowdown in China. The general economic background encompassing stronger forecast global growth, falling inflation, exceedingly low borrowing costs across the yield curve together with a commitment from central banks to continue supporting growth, would generally be considered a fairly decent background for financial markets, albeit favouring riskier assets such as equities. Unfortunately, investors also face greater geopolitical instability, wild gyrations in commodities and currencies, potential event risk and higher levels of volatility, while Fed tightening also awaits both equity and bond markets. US GDP is forecast to grow at around a 3.0% p.a. pace in Q4 led by strong consumer spending and a similar pattern is forecast for 2015 overall. Rising wage and salary income, falling unemployment, the boost from the decline in the price of gasoline and growing consumer confidence should all support a faster pace of household spending. In contrast, the contribution from business capital spending is set to be diluted by the likelihood of a very sizeable downturn in oil and gas investment. With headline inflation having morphed into headline deflation and a sufficiently fragile euro area economy, the ECB is due to introduce its own QE programme later this month. Looking forward, this only adds to a number of growth tailwinds, including a further fading of fiscal austerity, sizeable euro depreciation, collapsing oil prices, lower borrowing costs and easing credit conditions, while business surveys have already turned positive in recent months. Following expectations of a near 1% GDP growth in Q4, a faster pace is forecast for 2015, within a 1.2-1.5% range. A number of national elections pose an added layer of political risk this year, however, with the first in Greece later this month perhaps the most problematic. Following some recent “official” downward revisions to prior UK growth figures, more recent data has shown consumer spending continuing to accelerate, a factor that should support stronger growth in 2015. Until Q4, consumption lagged but, with unemployment continuing to fall, both nominal and real wage growth at last beginning to pick-up and a significant boost from lower oil prices, household spending should be the key contributor to near 3% expected GDP growth for 2015. A good deal of uncertainty, however, is being generated by the May General Election as the polls and bookies both forecast a “hung parliament”. The prospect of prolonged political gridlock may affect UK business investment, despite revived consumer confidence and some of the lowest borrowing costs on record. In Japan, following the mid-year recession, GDP is forecast to rebound and accelerate to around 1.5% in 2015, driven by a turnaround in consumption, stronger global growth and the much weaker oil price. The Chinese economy has slowed to around a 7% pace in Q4, principally due to weakness in areas targeted by the government as part of its strategy to rebalance the economy. To prevent too fast a deceleration, however, the authorities are aiming to stabilise growth via accelerating infrastructure projects and further monetary easing. Full year 2015 forecasts centre around 7.0% following an estimated 7.4% last year. Revisions to GDP forecasts have differed markedly across EM as the oil price has collapsed. EMEA and Latam forecasts have suffered from downward revisions to Russia and Brazil with some estimates now suggesting the Russian economy could contract by 15% in Q1 and 5% over the year, while growth in Brazil could well stall. In contrast, Asia Pacific ex China forecasts show stronger growth in 2015 led by an accelerating Indian economy, stronger global growth, the boost from lower oil prices, lower inflation and in some instances declining interest rates. The ongoing collapse in oil prices has likely ensured that deflation will predominate over inflation in headline figures through much of next year. It must be remembered, however, that the 80% or so of CPI (or other national equivalent) i.e. core inflation, is expected to be little changed. Using the US as an example, the year on year headline CPI rate is projected to be negative over the first three quarters of 2015 and to be 0.2% in Q4 2015; in contrast, the quarterly core inflation rate is generally forecast to remain fairly steady at around 1.8% y/y. This is essentially “good” deflation that is being determined almost entirely by energy price declines. Although this is expected to be a difficult year for investors to navigate, the economic cycle still has several years to run and none of the usual imbalances that typically end US expansions and derail bull markets are on the near horizon. It should be noted, however, that equity valuations in the US, the lead market, are already at high levels while, near term, US earnings are under pressure from downward revisions to oil-related companies. More interestingly, both the euro area and Japan are at much earlier stages of economic recovery and also have stronger prospective earnings growth and much lower valuations. Near term, however, the EU markets face potential turbulence from upcoming Greek elections. The UK is a difficult call and will have to rely on a rebound in oil prices and commodities to outperform while the General Election provides an uncertain background. As for EM, potential returns are also difficult to quantify but at least EM Asia looks set for further decent gains. A better than expected economic recovery would support small caps and a modest pro-cyclical tilt towards IT and consumer discretionary is favoured. Other themes include higher-yielding stocks with growing dividends in such a low bond yield environment. Fixed income markets present a conundrum with government bonds continuing to be priced extremely expensively relative to fundamentals. Also, given the distortions to headline inflation from collapsing oil prices, core inflation should perhaps be a better guide to underlying inflationary trends. Bond yields could fall further near term but this would only help the case for stronger growth and the Fed already views the headline inflation downturn as transitory. It is difficult to believe 10-year Treasury yields will begin with a 1 when the Fed starts raising rates whether at mid-year or later. US GDP growth of perhaps 3-3½%, a 5% unemployment rate and rising wage rates would sit fairly uncomfortably with current 1.90% yields and once again most forecasters expect 10-year yields in the US to be in excess of 2.5% by year end. With 2015 returns expected to be minimal, government bonds are underweighted. Although returns from both investment grade and high yield may well exceed those from governments, liquidity risks persist while it is difficult to effectively price the risk in either oil junk bonds or stocks for that matter, until a clearer outlook prevails. The ongoing oil price collapse remains the lead story in commodity markets with the basic issues being oversupply and OPEC intent on maintaining its market share. The price needs to be sustained at levels that lower production, particularly of US shale oil. Crude prices in the $40’s could well succeed in achieving this and US producers have begun idling drilling rigs. A sharp rally is expected later in the year as oil demand should strengthen on weak prices at a time of accelerating global growth and a peak in seasonal demand in the second half. Having produced a spectacular near 20% gain in 2014, the consensus expects a moderation in UK commercial property returns this year. 2014 capital value growth was exceptional for both offices and industrials while retail sorely lagged and, with little sign of any major improvement in this largest sector, office and industrials are unlikely to repeat near 25% total returns. The UK economy enters 2015 in good shape but the May General Election adds some uncertainty. With further yield compression to come, money flows still strong, much easier borrowing conditions, a high starting yield and improving occupier demand, however, another good year is in prospect, although IPD returns may be somewhat closer to 10%. The dollar has continued its bull run into the new year and the currency is now heavily overbought being accompanied by extreme investor positioning. Whilst a near-term correction is likely, fundamentals, newsflow and momentum should remain in its favour, especially against the euro. Yen and euro weakness are part of their central bank’s policy prescription while sterling still appears overvalued, especially with the likelihood of political risk building ahead of the elections. While it is unwise to generalise, most EM currencies are unlikely to outperform the dollar but there are many that could generate gains against the other major currencies.