UKTI Retail & Fashion Report UAE 2009

advertisement

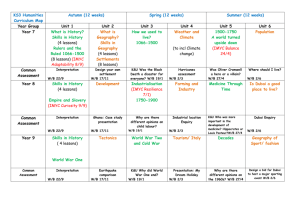

Retail Sector Report – Dubai Sector Report For Retail and Fashion Sector Dubai – United Arab Emirates Produced by: Mrs Iman Zaky, Trade and Investment Officer, Marketing Last revised: 24 February 2009 Whereas every effort has been made to ensure that the information given herein is accurate, UK Trade & Investment or its sponsoring Departments, the Departments of Trade & Industry and Foreign & Commonwealth Office, accept no responsibility for any errors, omissions or misleading statements in that information and no warranty is given or responsibility is accepted as to the standing of any firm, company or individual mentioned. www.uktradeinvest.gov.uk Retail Sector– Dubai and Northern Emirates Table of Contents OVERVIEW AND CHARACTERISTICS OF MARKET 3 OPPORTUNITIES 4 IMPACT OF THE CREDIT CRUNCH ON FASHION 6 KEY METHODS OF DOING BUSINESS 7 THE NATURE OF DOING BUSINESS IN THE RETAIL SECTOR 7 MORE DETAILED SECTOR REPORTS 8 PUBLICATIONS 8 EVENTS 8 CONTACT LISTS 9 www.uktradeinvest.gov.uk Page 2 of 9 Retail Sector– Dubai and Northern Emirates OVERVIEW AND CHARACTERISTICS OF MARKET The UAE is by far the UK’s largest export market in the Middle East and North Africa. Growth in exports 2008 showed an increase of around 30% UAE wide, with 70% of trade going to Dubai, 18% to the other Northern Emirates, and 12% to Abu Dhabi. For decades, British business has been active in the fast developing UAE market Nevertheless the UAE nowadays is witnessing the arrival of many new major British companies, like Virgin, Christie's, Harvey Nicholas, Boots and the Times newspaper, all of whom are taking advantage of the many benefits of doing business in the UAE. The absence of corporate or personal taxation, the ease of setting up and conducting business, the transport and tourism links that facilitate ease of travel and the long trade history between the UK and UAE are the major reasons for witnessing a period of increased business activities between the two markets. Historically the UK and the UAE have enjoyed a close and mutually beneficial relationship. With the present level of dialogue between the two countries' leaders, the environment is ripe for both countries to further develop the bilateral trade and investment relationship. Increasing population and rising per head household consumption will remain one of the key drivers for the growth of retail industry in the UAE. UAE has witness an increase of 145% for the past few years in the retail space due to the construction of new shopping malls. Dubai is one of seven sheikhdoms that make up the United Arab Emirates (UAE). Shopping events in Dubai (like DSS and DSF) and Dubai Duty Free (DDF) are the major contributor in the UAE retail industry, with retail sales in DDF accounted for more than 9% of total retail sales in the country in 2007. Approximately 40% of the consumers at shopping malls are tourists. Dubai aims to attract 15 million tourists by 2015, which highly indicate the potential growth for the retail sector especially in fashion and textiles. Dubai retail spending on garments and textiles is expected to reach US$ 7.5 billion by 2009. Textile industry in the MENA (Middle East & North Africa) region is expected to grow by 8% annually and reach US$ 65 billion by 2010. Recently, Dubai has enjoyed steady growth in textile imports and re-exports. March 2008 marked the launch of a $60 million Dubai Textiles City built to consolidate Dubai's $2.4 billion textile market. The project was described as the biggest of its kind in the world, under a joint venture with the Dubai-based Textile Merchants Group (TEXMAS). Goods moving through the Dubai Textile City are exempted from import duties. The Lingerie and swimwear sector in the Middle East is growing at a rapid pace to meet the demands of a fast expanding fashion retail space. UAE and Saudi Arabia are the world's top importers of lingerie. According to the statistics revealed by European Fashion and Textile Export Council (EFTEC), the two countries account for 77% of the Europe's total lingerie brand exports to the Gulf. www.uktradeinvest.gov.uk Page 3 of 9 Retail Sector– Dubai and Northern Emirates The recent globalisation in the footwear industry has seen a shift from the West to the Middle East. This is because the Middle East region and the UAE in particular is gaining immense popularity in global circles as a growing lifestyle market. The Middle Eastern economies are at their peak with consumer demand and consumption’s. Along with other sectors, the Middle East footwear and leather accessories industry is experiencing a massive boom and there is tremendous potential for further growth. To meet the high demand, the UAE imported US$ 7.6 million worth of leather footwear from Brazil in the first six months of 2008. Dubai is home to some of the largest malls in the world, offering more retail space for leather and footwear products, with a natural progression for international growth. This is the reason many international brands like Danier Leather, J.M Weston and Lamarthe Paris have opened retail outlets in Dubai. The global market for fashion accessories is US$ 800 billion, with the Middle East and Malaysia having the highest per-capita spending in this sector. According to the official census held in the UAE in 2005, the medium age of the population was found to be 27. With a young population and a rapidly changing lifestyle, the demand for fashion accessories and other related products is on the rise. Moreover, the increase in retail space offers easy access to such products, across a range of modern retail formats such as boutiques, supermarkets, department stores and convenience stores. The cosmetics and personnel care market in the UAE has grown and will continue to grow at over 8% per year in the near future. OPPORTUNITIES Dubai is rapidly emerging as a fashion capital of the region and is attracting leading international designers and fashion houses. In addition to Paris, Milan, London and New York, Dubai has now secured its status as a hub of haute couture. As a gateway to the Middle East, Dubai has an excellent infrastructure and possesses exceptional shoppers' paradise image with a focus on lifestyle. With the retail industry across the Middle East projected to exceed US$ 500 billion by 2010, opportunities for the fashion and clothing sector are immeasurable. In 2008, Dubai Infinity Holdings have launched the fashion island project. The island is called Isla Moda being built on Nakheel's manmade archipelago The World. Isla Moda is still in the conceptual design face however, Fashion icon Karl Lagerfeld has been named as the first designer to collaborate with Dubai’s Isla Moda. Lagerfeld will design 80 residential homes, which will include a limited edition line for the island. The artistic director for Chanel, whose collaborations also include Fendi and Chloe, is the first of five fashion designers to sign a contract with Dubai Infinity Holdings, the company behind the island. Isla Moda, which is set to open in 2011 will house villas, boutiques and a 250-room Hotel Moda, as well as staging fashion shows and offering a style concierge for fashion connoisseurs www.uktradeinvest.gov.uk Page 4 of 9 Retail Sector– Dubai and Northern Emirates Dubai is a cosmopolitan city, catering to a mix of nationalities. The fashion retail sector of the city is supported by a booming economy and a high purchasing power, and thus more fashion brands are seen to be moving towards this region. Dubai's GDP is projected to hit US$ 108 billion in 2015, creating more opportunities for growth and development in the fashion sector. The re-export trade in the UAE accounts for 1/3 of the country's entire trading sector, making it a haven for re-exports, after Hong Kong and Singapore. Dubai is a tax-free regional hub for the trade of garments and fashion accessories, offering many opportunities and an attractive business climate for importers and exporters from Asia, Africa and Europe. Dubai imports significantly from Japan, Taiwan and Korea in the Far East, Indonesia, Malaysia, Philippines and Thailand in the South East Asia. It is also a major re-exporter, with the total re-exports in 2008 registering a staggering US$ 19 billion. India, China, Philippines, Switzerland, Iran and the USA are some of the re-export trading partners of Dubai. Ajman, another emirate of the UAE, has also started to make its mark in the fashion and apparel industry with an ambitious free zone project. Sheikh Mohammed bin Abdullah Al Nuaimi, General Manager of Ajman Free Zone (AFZ) stated to the Oxford Business Group that AFZ has already attracted hundreds of foreign investors and is ranked first amongst the world's free zones in the number of ready-to-wear garment factories. The factories have started exporting to the GCC countries, the US, Europe and Canada. The Dubai Mall, one of the world’s largest shopping and entertainment destinations developed by Emaar Malls Group, has confirmed signing of some of the world’s leading brands in its Fashion Avenue zone. Spreading over 440,000 sq ft with its own VIP entrance, Fashion Avenue is a custom-designed area dedicated to haute couture. The Dubai Mall announced that more than 1.1 million ft² of gross leasable area at will be dedicated to new and first-time standalone stores. The mall will introduce more than 165 new retailers to the region, spanning approximately 30% of the total space. As the flagship development of Emaar Malls Group, The Dubai Mall will be one of the world's largest shopping, lifestyle and entertainment destinations, featuring more than 1200 retailers. The giant property developer of the UAE, Nakheel, plans to invest US $ 3 billion to build 5 more shopping malls in Dubai in the next five years. With the outburst in the shopping malls and multi-brand fashion outlets, the healthy growth in the garments and apparel industry of Dubai is set to accelerate. The retail explosion in the Middle East, especially Dubai, will lure more international and local brands into the region and help the franchise market grow by 25% per annum. According to industry experts, Dubai, which is leading the retail industry in the region, is expected to see a tremendous growth with the completion of mega complexes such as the Oasis Mall, Mirdiff City, Mall of Arabia and the five malls recently announced by Nakheel. www.uktradeinvest.gov.uk Page 5 of 9 Retail Sector– Dubai and Northern Emirates UKTI publishes international business opportunities gathered by our network of British Embassies, High Commissions and Consulates worldwide. These opportunities appear in the Opportunities on the relevant sector and country pages on the UKTI website. By setting up a profile you can be alerted by email when relevant new opportunities are published. New or updated alert profiles can be set in My Account on the website. IMPACT OF THE CREDIT CRUNCH ON FASHION The UAE, Dubai in particular, has been hit by the global economic downturn. Growth is predicted for 2009, however figures vary from 1.5% (EIU), to 6 % Standard and Poor's (for Dubai), to 7-11% Governor of the Central Bank of the UAE. But growth is what we are likely to see, with a stronger rally in 2010. The cut of jobs in the real estate and construction had a strong impact on people’s spending. In a recent interview with the Director General of Dubai Economic Department, Mr Sami Ahmad Dhaen Al Qamzi, Mr Al Qamzi said that wholesales and retail were the biggest contribution and major strategies sector as it contributed 37 per cent of GDP figures of 2008. He also added that they had to maintain their efforts to create more jobs and to work to support the sectors that were affected by the crisis such as the real estate sector. Lots of pipeline projects were stopped mainly in the construction and tourism sectors, which strongly affected the budget for 2009 in these sectors. The long-term economic outlook for the UAE, especially Dubai is positive but new UK companies have to be patient. Having said that the importance of building personal relationships and networking in this market cannot be overstated. It is the key to a successful entry to the market. At present, new comers to the market should focus on building relation with UAE contacts as much as possible, even if there was no immediate potential business at present. From our experience during the research work, it was very obvious that various organisations had stopped their expansion plans for at least 6-8 months www.uktradeinvest.gov.uk Page 6 of 9 Retail Sector– Dubai and Northern Emirates KEY METHODS OF DOING BUSINESS Legally foreign companies can not do any trade activity within Dubai unless they have a presence in Dubai. There are two options for setting up a presence in Dubai. Foreign companies can either establish a business entity in a free zone or at any place in Dubai in partnership with a UAE national/company. Establishing a business entity in one of the UAE's Free Trade Zones (FTZs) allows 100% foreign ownership of the enterprise, import and export tax exemptions, no limit on repatriation of profits, no corporate taxes for 50 years and no personal income taxes. Foreign Companies would be only able to trade within the free zone. Having said that, the foreign company would need UAE agent, distributor or even a reseller, who would represent them, for trading outside the free zone. Outside the free zone, it is mandatory for the company to partner with a UAE national. According to the Commercial Companies Law, the UAE national partner must own a minimum of 51% of all public and private shareholding companies and limited liability companies. The Dubai Department of Economic Development website at www.dubaided.gov.ae has information for companies wishing to set up or do business in Dubai. THE NATURE OF DOING BUSINESS IN THE RETAIL SECTOR There are two principle routes by which UK companies might enter the UAE. They can are either tie up with one of the well-known retail groups through franchise/ joint venture or wholesaling/agent agreement. Franchise agreements/ joint ventures enable the establishment of retail outlets in Dubai and Northern Emirates but it would likely involve a greater commitment from the UK Company. Tying up with the retail groups through wholesaling or agents channels may be less onerous and more suitable for UK companies who do not have their own retail stores in the UK. Other background information on doing business in United Arab Emirates can be also found on UKTI’s website. Simply go to the United Arab Emirates country page where you will find information on: Economic background and Geography Customs & Regulations Selling & Communications Contacts & Setting up Visiting and Social hints and tips www.uktradeinvest.gov.uk Page 7 of 9 Retail Sector– Dubai and Northern Emirates MORE DETAILED SECTOR REPORTS Research is critical when considering new markets. UKTI provides market research services, which can help UK companies doing business overseas including: Overseas Market Introduction Service (OMIS). Bespoke research into potential markets, and support during your visits overseas Export Marketing Research Scheme. In depth and subsidised service administered by the British chambers of Commerce on behalf of UKTI Contact your local International Trade Advisor if you are interested in accessing these services, or for general advice in developing your export strategy. When considering doing business in United Arab Emirates, it is essential to obtain legal, financial and taxation advice. For further details, please contact: Mrs Iman Zaky Trade and Investment Officer, Marketing Tel: 00971 4 3094404 Email: iman.zaky@fco.gov.uk PUBLICATIONS B2B trade magazines as follows: 1- Retail ME Magazine and its website address is: www.retailme.com 2- Retail News Magazine and its website address is: www.itp.com EVENTS UK Trade & Investment’s Tradeshow Access Programme (TAP) can help eligible UK businesses take part in overseas exhibitions. Attendance at TAP events offers significant benefits: possibilities for business opportunities both at the show and in the future chance to assess new markets and develop useful contacts grants are available if you meet the criteria UKTI staff overseas will be available to assist delegates Find out if you are eligible to apply to attend this event and more about the support UKTI can offer on the UKTI website’s Market Entry page. Details of TAP events can be found in the Events on the United Arab Emirates page. Other Market Visit Support may be available via your local International Trade Advisor. www.uktradeinvest.gov.uk Page 8 of 9 Retail Sector– Dubai and Northern Emirates CONTACT LISTS UKTI’s International Trade Advisers can provide you with essential and impartial advice on all aspects of international trade. Every UK region also has dedicated sector specialists who can provide advice tailored to your industry. You can trace your nearest advisor by entering your postcode into the Local Office Database on the homepage of our website. For new and inexperienced exporters, our Passport to Export process will take you through the mechanics of exporting. An International Trade Adviser will provide professional advice on a range of services, including financial subsidies, export documentation, contacts in overseas markets, overseas visits, translating marketing material, e-commerce, subsidised export training and market research. www.uktradeinvest.gov.uk Page 9 of 9