Draft Taxation Ruling

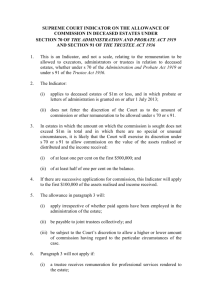

advertisement

Draft Taxation Ruling TR 2004/D24 FOI status: draft only – for comment Page 1 of 23 Draft Taxation Ruling Income tax: application of the Australia/New Zealand Double Tax Agreement to New Zealand Resident Trustees of New Zealand Foreign Trusts Contents Para What this Ruling is about 1 Date of effect 4 Ruling 5 Explanation 9 Alternative views 90 Examples 92 Your comments 97 Detailed contents list 98 Preamble This document is a draft for industry and professional comment. As such, it represents the preliminary, though considered views of the Australian Taxation Office. This draft may not be relied on by taxpayers and practitioners as it is not a ruling for the purposes of Part IVAAA of the Taxation Administration Act 1953. It is only final Taxation Rulings that represent authoritative statements by the Australian Taxation Office. What this Ruling is about 1. This draft Ruling deals with the question of the residency status of a trustee of a trust established under the domestic law of New Zealand under the Australia/New Zealand Double Tax Agreement (the NZ Agreement) where the trustee: is a resident in New Zealand in their personal capacity (non-trustee capacity); and under New Zealand domestic law is only assessed, in their trustee capacity, on the portion of the trust net income that is derived from sources in New Zealand. Class of person/arrangement 2. This draft Ruling deals with New Zealand trusts that are in receipt of income from non-New Zealand sources where: the trustees of the trusts are residents in New Zealand in their personal capacity for the purposes of New Zealand domestic law; the settlors of the trusts are not residents in New Zealand at any time during the income year; the trusts are neither superannuation funds nor testamentary or inter vivos trusts where the settlor died resident in New Zealand (at any time); and no beneficiary is absolutely entitled to that income. Draft Taxation Ruling TR 2004/D24 Page 2 of 23 FOI status: draft only – for comment 3. This Ruling does not apply to trustees who are trustees of a corporate unit trust (within the meaning of section 102J of the Income Tax Assessment Act 1936 (ITAA 1936)) or public trading trusts (within the meaning of section 102R ITAA 1936). Date of effect 4. It is proposed that when the final Ruling is issued, it will apply both before and after its date of issue. However, the final Ruling will not apply to taxpayers to the extent that it conflicts with the terms of settlement of a dispute agreed to before the date of issue of the final Ruling (see paragraphs 21 and 22 of Taxation Ruling TR 92/20). Ruling 5. New Zealand resident trustees of trusts described in paragraph 2 are not, in their capacity as trustees, resident in New Zealand for the purposes of the NZ Agreement. 6. The relevant person for the purposes of the NZ Agreement is the trustee (and not the trust). 7. Article 4(2) provides that a person is not a resident of a Contracting State where they are liable to tax in that State in respect of income from sources in that State only. It is considered that in applying Article 4(2) to these trustees we look to how they are taxed in their capacity as trustees in New Zealand. 8. The trustees, in their capacity as trustees, are taxed in New Zealand only on income from sources in New Zealand. For this reason, they are not a treaty resident in respect of the trust income. Therefore, the NZ Agreement does not affect Australia’s right to tax the Australian source income to these trustees under sections 98, 99 or 99A of the ITAA 1936. Explanation New Zealand foreign trusts 9. Under New Zealand income tax law, a trustee of a New Zealand trust is, in some circumstances, taxed in respect of income from New Zealand sources only. Such trusts are known colloquially as ‘New Zealand foreign trusts’. 10. There has been an increase in the use of New Zealand foreign trusts by Australian residents as a vehicle for cross border tax planning. These arrangements seek to take advantage of the absence of taxation under New Zealand domestic law on non-New Zealand source income of the trust. Draft Taxation Ruling TR 2004/D24 FOI status: draft only – for comment Page 3 of 23 11. New Zealand foreign trusts have been marketed to Australian residents as a tax effective offshore trust structure which allows tax free accumulation of income and capital in an offshore entity. They may be used as a business entity, to provide retirement benefits or as a pre-migration trust. They may also be used as a treaty shopping vehicle to seek to take advantage of particular features in New Zealand’s double tax treaties. 12. Australia’s laws contain a number of integrity provisions which will effectively prevent Australian residents using these structures to avoid Australian tax. For example: (a) the New Zealand trustee may be assessed on the Australian source income of the trust under Division 6 of Part III of the ITAA 1936, where no beneficiary is presently entitled; (b) the Foreign Investment Fund provisions contained in Part XI of the ITAA 1936 may apply to attribute income to an Australian resident beneficiary in respect of their interest; (c) Australian residents may be deemed to be presently entitled to a share of the net income of the trust under section 96B of the ITAA 1936; (d) the transfer pricing provisions contained in Division 13 of Part III of the ITAA 1936 can be applied to prevent profit shifting; (e) in some cases, Australian resident participants may be considered to be trustees (though not formally appointed) under the definition of ‘trustee’ in section 6 of the ITAA 1936, making the trust a resident trust estate; (f) where an Australian resident has settled the trust or has otherwise transferred property (including money) or services to the New Zealand foreign trust, the transferor trust provisions contained in Division 6AAA of Part III of the ITAA 1936 can apply to attribute the net income (or part thereof) to that Australian resident; and (g) Part IVA of the ITAA 1936 may also apply. 13. This Ruling is concerned with how the NZ Agreement applies to certain arrangements and as such whether the trustee can be assessed on Australian source income under Division 6. 14. The central issue is whether the trustees of these New Zealand foreign trusts are residents in New Zealand for the purposes of the NZ Agreement and as such entitled to benefits under that Agreement. This is because the NZ Agreement may impact on Australia’s domestic tax laws. For example, if the trustee is deriving business profits from Australian sources and the NZ Agreement applies, Australia will only have a taxing right where the trustee is carrying on business in Australia Draft Taxation Ruling TR 2004/D24 Page 4 of 23 FOI status: draft only – for comment through a permanent establishment.1 Conversely, if the NZ Agreement does not apply, Australia’s domestic taxing rights are unaltered by the Agreement and the trustee can be assessed under Division 6. Similarly, if the NZ Agreement applies, it may restrict the rate that Australia can tax certain income as the country of source. For example, Australian source dividends paid by a resident of Australia to which a resident in New Zealand is beneficially entitled can only be taxed in Australia at a maximum of 15%. Taxation of Trust Income to the Trustee – domestic law 15. In order to explain the operation of the NZ Agreement in this context it is first necessary to examine the domestic law position both in Australia and in New Zealand. Australian domestic law 16. Division 6 of Part III of the ITAA 1936 contains the general assessment provisions relating to income derived through a trust estate. As a general rule, where a present entitlement exists, the beneficiary who is presently entitled is assessed on the relevant share of the net income of the trust estate. The trustee is assessed on that portion of net income to which no beneficiary is presently entitled (that is, on accumulated income). There are exceptions to the rule, in particular where a beneficiary is presently entitled but is a non-resident. The relevant provisions of Division 6 for the purposes of this Ruling are sections 95, 96, 98, 99 and 99A.2 17. Subsections 98(3) and (4) apply where there is a beneficiary who is presently entitled to a share of net income and is a non-resident at the end of the year of income. The trustee of a trust estate is assessed and liable to pay tax on so much of that share of net income that is attributable to when the beneficiary was a resident (wherever arising) and on so much of that share of net income that is attributable to sources in Australia when the beneficiary was not a resident. These provisions apply to both resident and non-resident trust estates. 18. Sections 99 and 99A also impose liability on the trustee in respect of the net income (defined in subsection 95(1)) of a ‘resident trust estate’ or a ‘non-resident trust estate’ to which no beneficiary is presently entitled. However, in the case of non-resident trust estates, only that part of the net income derived from Australian sources is assessable in the hands of the trustee (see subsections 99(4), 99(5), 99A(4B) and 99A(4C)). Therefore, the concept of a resident or non-resident trust estate is used to determine whether the trustee is assessed on a worldwide basis or on Australian source income only. 1 2 See Article 7(1). A special regime applies to superannuation funds under Part IX of the ITAA 1936. Draft Taxation Ruling TR 2004/D24 FOI status: draft only – for comment Page 5 of 23 19. Subsection 95(2) defines the term ‘resident trust estate’ for the purposes of Division 6 as a trust estate is a ‘resident trust estate’ where: a trustee of the trust estate was a ‘resident’ at any time during the income year; or the ‘central management and control’ of the trust estate was in Australia at any time during the income year. 20. A non-resident trust estate is defined in subsection 95(3) as a trust estate that is not a resident trust estate. 21. An element of the definition refers to whether the trustee is or is not a ‘resident’ of Australia. Therefore, it is necessary to apply the definition of ‘resident’ in subsection 6(1) of the ITAA 1936 to the circumstance of the trustee. This requires reference to circumstances personal to the trustee (that is, circumstances not necessarily related to the trust relationship and administration of the trust) to determine residency and differs depending on whether the trustee is an individual or a company. Where there are no resident trustees it is then necessary to consider, under paragraph 95(2)(b), whether the trust estate is centrally managed and controlled at any time in Australia. 22. Once the residence of the trust estate is determined, the net income on which the trustee is assessed is then calculated ‘as if the trustee were a taxpayer in respect of that income and were a resident’.3 The important point is that once the residence of the trust estate has been ascertained, the liability to tax is then imposed upon the trustee without further regard to the trustee’s actual personal residency. 23. Section 995-1 of the Income Tax Assessment Act 1997 (ITAA 1997) also contains a definition of ‘resident trust for CGT purposes’. In relation to trusts that are not unit trusts, the definition of resident trust for capital gains tax (CGT) purposes is essentially the same as that contained in subsection 95(2). Section 995-1 replaced, for CGT purposes, the terminology of ‘resident trust estate’ and ‘resident unit trust’ contained in section 160H of the ITAA 1936. These concepts were used to apply the taxing provisions contained in section 160L which applied Part IIIA to the trustee of a resident trust estate or of a resident unit trust (see in particular former subparagraphs 160L(1)(a)(ii) and 160AL(2)(a)(ii)). Again, it is noted that the concepts of residence are applied to the trust relationship in order to ascertain the income subject to tax at the trustee level. The new terminology of ‘resident trust’ reflects the popular usage of the term ‘trust’ to convey an entity type personality. However, in Part 3-1 of the ITAA 1997, it is clear that the capital gain or loss is made by the trustee, not the trust (see for example, subsection 104-170(4)). 3 See definition of ‘net income’ in subsection 95(1). Draft Taxation Ruling TR 2004/D24 FOI status: draft only – for comment Page 6 of 23 New Zealand domestic law 24. The Income Tax Act 1994 (New Zealand) deals with income accumulated in a trust4 in a broadly similar manner to the ITAA 1936 though there are some notable differences. Subsection HH 4(1) imposes on a trustee an income tax liability on the taxable income of the trustee in respect of trust income which has not vested absolutely in a beneficiary or which has not been paid to or applied for the benefit of a beneficiary.5 The liability is calculated as if the trustee was an individual beneficially entitled to the trustee income.6 25. Subsection HH 4(3B) provides an exception in respect of income derived from sources outside of New Zealand. This exception applies where: the trustee is a resident in New Zealand; the trustee derives income from a source outside of New Zealand; at no time during the relevant income year was a settlor of the trust a resident in New Zealand; and the trust is neither a superannuation fund nor a testamentary or an inter vivos trust where a settlor of the trust died as a resident in New Zealand (at any time). 26. A trustee who meets these conditions will not be assessed in respect of that part of the accumulated trust income derived from sources outside New Zealand. 27. This is in contrast to the position under Australian law where income is accumulated in a trust. If a trustee is a resident of Australia then the trust estate is a ‘resident trust estate’ within the meaning of subsection 95(2). As such, the trustee will be assessed on the relevant part of the net income derived from all sources. Under Australian law the residence of the settlor is irrelevant in this respect. Purpose of the NZ Agreement and how it interacts with domestic law 28. The NZ Agreement is contained in Schedule 4 to the International Tax Agreements Act 1953 (the Agreements Act). The purpose of the NZ Agreement, as with all Tax Treaties, is twofold: 4 (a) to avoid double taxation; and (b) to prevent fiscal evasion. That is, income which does not vest absolutely in interest in a beneficiary or is paid to or applied for the benefit of a beneficiary within 6 months of the end of the income year. 5 See definition of ‘trustee net income’ in section OB 1. 6 See subsection HH 4(1) Income Tax Act 1994. Draft Taxation Ruling TR 2004/D24 FOI status: draft only – for comment Page 7 of 23 29. The first is achieved by allocating or distributing taxing rights over specified items of income between the country of residence and the country of source and/or by requiring relief to be given for tax paid in the other country. In respect of some items of income, the tax treaties may allocate taxing rights to both countries but impose a restriction on the amount of the income that can be taxed by the country of source. The second purpose is achieved by features such as limiting a person’s treaty entitlement in certain circumstances (for example dual residents) and the exchange of information. 30. The residence of a person is a key factor in determining the tax treaties scope of application. The concepts of both a ‘person’ and a ‘resident’ are of central importance to the operation of tax treaties. Residence of a person determines: whether or not the treaty applies; how the treaty applies in cases of dual residence; and how the taxing rights are distributed between the country of residence and the country of source. 31. Australia’s tax treaties broadly follow the same formula and determine residence: firstly by reference to the domestic law of each Contracting State; then secondly, if the person is considered to be a resident of both Contracting States, the tax treaties will generally contain a set of tie-breaker provisions that assign residency to one Contracting State only for the purposes of the tax treaties on the basis of specified criteria such as permanent home or place of effective management; and finally, the tax treaty may contain a further criterion that the person is only considered to be a resident of a Contracting State for the purposes of the tax treaty if they are taxed in that Contracting State on income from worldwide sources. 32. For ease of explanation where a person is a resident under the domestic law this will be referred to as ‘domestic residence’. In contrast a reference to ‘treaty residence’ is where the person is considered to be a resident of the Contracting State for the purposes of the tax treaty. 33. Thus, in the NZ Agreement, Article 1 provides that: This Agreement shall apply to persons who are residents of one or both of the Contracting States. [emphasis added] Draft Taxation Ruling TR 2004/D24 FOI status: draft only – for comment Page 8 of 23 34. Article 4(1) of the NZ Agreement defines the term ‘resident’ for the purposes of the treaty. It provides that: For the purposes of this Agreement, a person is a resident of a Contracting State: (a) in the case of New Zealand, if the person is a resident in New Zealand for the purposes of New Zealand tax; and (b) in the case of Australia, if the person is a resident of Australia for the purposes of Australian tax. 35. The combined effect of Article 1 and Article 4(1) is that in order to obtain the benefits under the treaty the entity in question must be a ‘person’ who is either a resident in New Zealand or a resident of Australia under the respective domestic law of the two Contracting States. 36. Article 4(2) specifies that a person is not a resident of a Contracting State if they are ‘liable to tax in that State in respect only of income from sources in that State’. Therefore, it is not sufficient that the person have a domestic residence. The person must also be liable to tax in respect of income from all sources in order to attain treaty residence under the NZ Agreement. 37. Subsection 4(1) of the Agreements Act provides that, subject to subsection 4(2) of the Agreements Act, the ITAA 1936 and the ITAA 1997 are incorporated and should be read as one with the Agreements Act. Further, subject to limited exceptions, the provisions of the Agreements Act have effect notwithstanding anything inconsistent with the provisions of the ITAA 1936 or the ITAA 1997 (see subsection 4(2)). This means that in the case of an inconsistency between a provision in a tax treaty and a provision in either the ITAA 1936 or the ITAA 1997, the tax treaty prevails where the exceptions do not apply. 38. The combined effect of subsections 4(1) and 4(2) is that where an Article of the treaty prescribes the extent of Australia’s taxing rights, it has effect for the purposes of the ITAA 1936 and ITAA 1997. Australia’s taxing rights are therefore subject to the application of the tax treaty. If the tax treaty applies, it may operate to remove Australia’s taxing right over the Australian source trust income. Consequently, whether a New Zealand trustee can be assessed on the Australian source income under sections 98, 99 and 99A will depend, at least in some circumstances, on whether the NZ Agreement applies. Application of the NZ Agreement to New Zealand foreign trusts 39. A trustee of a New Zealand foreign trust who is a resident in New Zealand under the Income Tax Act 1994 (New Zealand) in their personal capacity is not a treaty resident by reason of Article 4(2) in their capacity as trustee. The NZ Agreement does not therefore apply to the income derived by the trustee in their trustee capacity. This conclusion has been reached on the basis that the NZ Agreement Draft Taxation Ruling TR 2004/D24 FOI status: draft only – for comment Page 9 of 23 applies to the trustee and the trust income on the basis that the trustee is a separate person in relation to the trust income as compared to the trustee in respect of their personal income. 40. The discussion as to why these trustees are not treaty residents under the NZ Agreement is separated into two parts: the first part deals with whether the trustee or the trust is the relevant person (paragraphs 42 to 59); and the second part discusses the proviso in Article 4(2) (paragraphs 60 to 82). 1. Who or what is the person – the trustee or the trust? 41. As discussed above, before the treaty can apply, there needs to be a ‘person’ who is a resident. In relation to accumulated trust income, the potential constructs that can be the relevant person are the trustee or the trust.7 In determining the meaning of the term ‘person’ it is relevant to look to: the definition in the NZ Agreement; the definition in the domestic law; and the context of the NZ Agreement itself. Definition under the NZ Agreement 42. The term ‘person’ is defined in Article 3(1)(j) of the NZ Agreement to include an individual, a company and any other body of persons. Article 3(1)(j) is modelled on Article 3(1)(a) of the OECD Model Tax Convention on Income and on Capital (the ‘Model Convention’). The OECD commentary to the Model Convention (the OECD commentary) relevant to that Article states in paragraph 2: The definition of the term person given in subparagraph (a) is not exhaustive and should be read as indicating that the term ‘person’ is used in a very wide sense.8 43. Absent from the definition is a specific reference to either a trust estate or a trustee of a trust estate. However, the definition of person, being an inclusive definition, is capable of meaning more than what is stipulated in Article 3(1)(j). In order to determine the scope of the remainder of the definition, reference can be had to Article 3(3). This Article provides that undefined terms shall have the meaning which they have under the law of the relevant State from time to time unless the context otherwise requires.9 7 Where there is a beneficiary presently entitled to trust income, the beneficiary may also be the appropriate person. 8 As to the relevance of using the OECD Model Taxation Convention’s Commentaries, see paragraphs 101 to 105 of TR 2001/13. 9 See Avery Jones et al ‘The Interpretation of Tax Treaties with Particular Reference to Article 3(2) of the OECD Model – I’ British Tax Review, 1989, 14, p. 21. Draft Taxation Ruling TR 2004/D24 Page 10 of 23 FOI status: draft only – for comment Domestic meaning of ‘person’ 44. The ITAA 1936 contains a definition of the term ‘person’ in subsection 6(1). It is also inclusive and only specifically refers to a company. Similarly, the Acts Interpretation Act 1901 defines ‘person’ and expressions used to denote persons as including ‘a body politic or corporate as well as an individual’.10 As with the definition under the NZ Agreement, neither definition makes specific reference to a trust or a trustee. 45. The Macquarie Dictionary (3rd Revised Edition) provides that a ‘person’ is ‘any human being or artificial body of people, having rights and duties before the law.’ That is, it is an entity that has a legal personality. 46. Under these definitions, a trustee is clearly a person. A trustee will be either an individual or a company. The question that remains therefore is whether the ‘trust’ can also be a ‘person’. 47. In identifying whether a relationship amounts to a trust, Australian courts have looked to the nature of the obligations and duties undertaken or imposed in relation to the holder of the legal title of the property. That is, they look at the relationship between the legal owner, beneficial owner and the property.11 48. The authors of Principles of the Law of Trusts describe a trust as: …an obligation enforceable in equity which rests on a person (the trustee) as owner of some specific property (the trust property) to deal with that property for the benefit of another person (the beneficiary) or for the advancement of certain purposes.12 49. The Butterworths Legal Dictionary similarly defines a trust as (in equity): A device by which one person holds property for the benefit of another person. A trust imposes a personal obligation upon a person (trustee) to deal with property for the benefit of another person or class of persons (beneficiary) or for the advancement of certain purposes, private or charitable. [emphasis added]. 10 Paragraph 22(1)(a). For example see FC of T v. Harmer & Ors 90 ATC 4672 at 4675 per Northrop J, at 4679-4680 per Wilcox and Lee JJ; confirmed on appeal to the High Court 91 ATC 5000; Registrar of the Accident Compensation Tribunal (Vic) v. FC of T 93 ATC 4835 at 4,842 per Mason CJ, Deane, Toohey and Gaudron JJ; In re Scott [1948] SASR 193 at 196 per Mayo J: ‘Strictly it [ a trust] refers to the duty or the aggregate accumulation of obligations that rest upon a person described as a trustee’. Quoted with approval in JW Broomehead (Vic) Pty Ltd (In liq) v. JW Broomehead Pty Ltd & Ors (1985) 9 ACLR 593 at 626-627 per McGarvie J; see also Case A62 69 ATC 342 at 349-350. 12 HAJ Ford & WA Lee, Principles of the Law of Trusts, LBC Information Services, 1996, 3rd ed, at paragraph [1000]. 11 Draft Taxation Ruling TR 2004/D24 FOI status: draft only – for comment Page 11 of 23 50. These descriptions and the approach of the Australian courts illustrate that: a trust is properly described as an obligation or a device; and the relevant persons are either the trustee or the beneficiary. 51. A trust, in a legal sense, is not a person within the ordinary meaning of the word. The term ‘trust’ is used to convey the concept of legal title to property being held for the benefit of another. A ‘trust’ does not itself have rights and duties before the law and does not fit within the ordinary meaning of ‘person’. It is the beneficiary and the trustee who have rights and duties. The word ‘trust’ describes these rights and duties but a ‘trust’ is not a person in its own right. A trust is similarly not a body of persons, though it does represent a relationship between a body of persons.13 52. However, in a popular sense, trusts are often spoken of as being a type of entity, as opposed to a mere relationship, capable of deriving income, incurring expenses and generally interacting with other legal persons. This use of the term trust is recognised in subsection 960-100(1) of the ITAA 1997. Paragraph 960-100(1)(f) defines, for the purposes of the ITAA 1997, an entity to mean, among other things, a trust.14 The note to that subsection provides: The term entity is used in a number of different but related senses. It covers all kinds of legal person. It also covers groups of legal persons, and other things, that in practice are treated as having a separate identity in the same way as a legal person does. 53. While the note is not expressly directed at trusts, it nonetheless recognises that not everything taken to be an entity in section 960-100 is a legal person. In specific recognition of the lack of legal personality, subsection 960-100(2) provides that a trustee of a trust ‘is taken to be an entity consisting of the person who is the trustee, or the persons who are the trustees’. This allows any obligations to be imposed on or rights to be conferred on the trustee where legal personality is required. This would appear to be in recognition that a trust is not capable of discharging a liability. Thus, while section 960-100 treats a trust as being more than an obligation attached to property, it falls well short of statutorily ascribing to the concept of a trust a legal personality. 13 Note that Article 2 of the Hague Convention on the Law Applicable to Trusts and on their Recognition defines a trust as ‘the legal relationships created … by a person, the settlor, when assets have been placed under the control of a trustee for the benefit of a beneficiary or for a specified purpose’. 14 By way of contrast, section 8AAZA of the Taxation Administration Act 1953 defines as entity to mean: (a) a company; (b) a partnership; (c) a person in a particular capacity of trustee; (d) a body politic; (e) a corporation sole; (f) any other person. Draft Taxation Ruling TR 2004/D24 Page 12 of 23 FOI status: draft only – for comment 54. Under domestic law therefore, a trust is not a person. While there are aspects of the domestic law which treats a trust as having a personality, a trust is not invested with a sufficient degree of personality by tax law or otherwise such that the trust becomes a person in its own right. Does the context require otherwise? 55. Article 3(3) (the undefined terms provision) provides that terms take their domestic law meaning unless the context otherwise requires. Paragraph 75 of TR 2001/13 explains that, in this regard, context includes everything listed in Articles 31 and 32 of the Vienna Convention (that is, treaty context) and further includes, among other things, the domestic tax environment. 56. As established above, under Australian domestic law, a trust is not a person, the trustee is the person. Moreover, under neither Australian nor New Zealand tax law are trusts recognised as ‘persons’ or separate legal entities (with the exception of certain unit trusts). Under both, it is either the beneficiaries or the trustees that are assessed to tax and not the trust. In general, treating the trustee as the person is consistent with the domestic tax environment of both Australia and New Zealand which, in the absence of a beneficiary capable of being taxed, impose the liability to tax on the trustee.15 57. This is also consistent with the words in the NZ Agreement itself. Article 3(2) of the NZ Agreement deems a trustee who is subject to tax in relation to dividends, interest or royalties as being beneficially entitled to the dividends, interest and royalties for the purposes of Articles 10, 11 and 12. The Article makes it clear that the trustee can benefit from the reduced rates of tax available under the NZ Agreement where the trustee and not the beneficiary is taxed on the income. This supports the view that the trustee is the ‘person’ for the purposes of the Agreement because the treaty benefits accrue to the trustee and not to the trust. 58. Given that the term person is only inclusively defined in Article 3, there is nothing inconsistent with either the domestic law or the NZ Agreement itself in treating the trustee as the person. In fact, given that it is the trustee which is recognised as the taxable entity at domestic law, it is a more seamless approach to also recognise the trustee as the person for the purpose of the NZ Agreement. 15 In particular, section 96 of the ITAA 1936 refers to ‘the trustee’ not being liable to pay income tax upon the income of the trust estate except as provided by the ITAA 1936. In New Zealand law, subsection HH 4(1) of the Income Tax Act 1994 refers to the ‘the trustee’ being required to satisfy the relevant income tax liability. Draft Taxation Ruling TR 2004/D24 FOI status: draft only – for comment Page 13 of 23 2. Application of Article 4(2) 59. Having ascertained that the trustee is the person and on the assumption that the trustee of the New Zealand Foreign Trust is a resident in New Zealand16 within the meaning of Article 4(1) of the NZ Agreement, the next step is to determine whether Article 4(2) applies. 60. Two issues arise: whether Article 4(2) applies looking solely to the tax liability of the trustee as trustee; and whether it is within the spirit and intent of Article 4(2) to apply the Article to New Zealand Foreign Trusts. Whether Article 4(2) applies by reference solely to the tax liability of the trustee as trustee 61. The alternative arguments are that the trustee is: (a) not resident by reason of Article 4(2) because, in their capacity as trustee, they are taxed on New Zealand source income only; or (b) a resident because the trustee, in respect of its personal income, is liable to tax on worldwide income.17 62. The NZ Agreement refers to ‘a person is a resident’ and ‘a person is not a resident’. In an ordinary sense, a person would generally be understood to be a non-divisible entity. However, the domestic law of both Australia and New Zealand tax the trustee in respect of trust income as a separate taxpayer. Under both Australian and New Zealand law, assessments made in respect of the trustee in their personal capacity and in their capacity as a trustee are independent and in no way does one tax liability depend on or refer to the other. In fact, for the purposes of the rate of tax imposed on the net income assessed to the trustee it is irrelevant what type of entity the trustee is (corporate or individual). For example, under both 16 Note that this does not mean we consider that it is necessarily the case that the New Zealand trustee will be a resident in New Zealand for the purposes of Article 4. Section OE 1 of the Income Tax Act 1994 contains the definition of a resident of a person other than an individual. Section OE 2 of the Income Tax Act 1994 contains the definition of a resident company. Subsection OE 2(1) provides: A company is resident in New Zealand within the meaning of this Act if: (a) it is incorporated in New Zealand; or (b) it has its head office in New Zealand; or (c) it has its centre of management in New Zealand; or (d) control of the company by its directors, acting in their capacity as directors, is exercised in New Zealand, whether or not decision making by directors is confined to New Zealand. 17 See Prebble J, ‘Accumulation Trusts and Double Tax Conventions’, British Tax Review, 2001, 69, at pp. 72-74. Draft Taxation Ruling TR 2004/D24 FOI status: draft only – for comment Page 14 of 23 regimes a corporate trustee can be assessed at marginal rates applying to individuals.18 63. Therefore, for Australian and New Zealand tax purposes, a person who is a trustee can be two different taxpayers in these differing capacities. This is expressly recognised in Australian domestic law in subsection 960-100(3). Subsection 960-100(3) provides that: A legal person can have a number of different capacities in which the person does things. In each of those capacities, the person is taken to be a different entity. 64. The note to that subsection provides: Example: In addition to his or her personal capacity, an individual may be: sole trustee of one or more trusts; and one of a number of trustees of a further trust. In his or her personal capacity, he or she is one entity. As trustee of each trust, he or she is a different entity. The trustees of the further trust are a different entity again, of which the individual is a member.19 65. A number of treaty commentators support the view that a person can act in different capacities and that a trustee in the capacity of trustee is a different person from the trustee in their personal capacity. In an article on the treatment of trusts under the OECD Model Convention, J F Avery Jones et al accept that a trustee in their capacity as a trustee can be a person for the purposes of the OECD Model Convention.20 The authors point to a number of instances in US, Canadian and English case law in which it has been held that a trustee in their capacity as such can be a ‘person’.21 66. The English cases cited therein indicate that a trustee in that capacity is a ‘person’ in the ordinary meaning of that word.22 This supports the view that a trustee in that capacity is a ‘person’ for income tax purposes separate from the person they are for the purposes of ascertaining their personal tax situation. 18 For example see subsection 98(1) ITAA 1936 and subsection HH 4(1) Income Tax Act 1994 which deems a trustee to be an individual. 19 The concept that a trustee is a different taxpayer in respect of their personal capacity and in their trustee capacity dates back to the Income Tax Assessment Act 1915. Subsection 26(1) then provided that ‘where [the trustee] derives income beneficially, he shall be separately assessed for that income, and for the income of which he is trustee, unless for any reason he is liable to be jointly assessed independently of this section’. 20 Avery Jones et al, ‘The Treatment of Trusts Under the OECD Model Convention – II’, British Tax Review, 1989, 65, at pp. 65-66 and p. 76. 21 See footnotes 90-93 of that article. 22 See in particular Inland Revenue Commissioners v. Crawley [1987] STC 147 at 154 ‘…a trustee in relation to income accruing to him as a trustee of a given trust is clearly a ‘person’…’. Research has not revealed any Australian consideration of this decision and the others cited in the Avery Jones article. Draft Taxation Ruling TR 2004/D24 FOI status: draft only – for comment Page 15 of 23 67. An alternative argument which has been put is that the focus of the tax treaties is on the taxpayer and not items of income. As such, there is no basis within the tax treaties to argue that a taxpayer can be a resident for some purposes and not for others. This being the case, the trustee must be treated as a non-divisible person.23 68. Under this view if the person (in whatever capacity) is liable to tax on at least some types of foreign source income then they are a resident for all treaty purposes, including in their capacity as trustee.24 If accepted, the exclusion in Article 4(2) would not apply because the trustee would, in their personal capacity, be taxable in respect of worldwide income and thus would be liable to tax on at least some non-New Zealand source income (if derived). 69. However, when applying the NZ Agreement to trust income, regards needs to be had to how the trustee is assessed under both Australian and New Zealand law. The complete separation for tax purposes of the assessments in respect of the trustee in their capacity as trustee and in their other capacity cannot be ignored. For this reason, it is more appropriate to treat the trustee separately when applying the NZ Agreement.25 70. It is also argued that there is nothing in the NZ Agreement that expressly allows a person to be a resident in one capacity and not another. Whilst this may be the case, there is nothing that expressly disallows it and such a view is more in keeping with the spirit of the NZ Agreement. 71. Given the manner in which trust income is assessed to the trustee at domestic law, Article 4(2) should be applied on the basis of whether the trustee in the capacity as trustee is liable to tax on worldwide income. As such, how the trustee is taxed in their non-trustee capacity is irrelevant for these purposes. Whether it is within the spirit and intent of Article 4(2) to apply the Article to New Zealand Foreign Trusts 72. The equivalent to Article 4(2) in the 1992 OECD Model Convention is in the second sentence in Article 4(1) of the Model Convention. The OECD commentary in relation to this Article provides that at paragraph 8: In accordance with the provisions of the second sentence of paragraph 1, however, a person is not considered a ‘resident of a Contracting State’ in the sense of the Convention if, although not domiciled in that State, he is considered to be a resident according to the domestic laws but is subject only to a taxation limited to the income from sources in that State or to capital situated in that State. That situation exists in some States in relation to individuals, e.g. in 23 Prebble J, at 73-74. See Prebble J, ‘Accumulation Trusts and Double Tax Conventions’. 25 Note that subsection 960-110(3) ITAA 1997 provides that ‘A person can have a number of different capacities in which the person does things. In each of those capacities, the person is taken to be a different entity’. 24 Draft Taxation Ruling TR 2004/D24 Page 16 of 23 FOI status: draft only – for comment the case of foreign diplomatic and consular staff serving in their territory. According to its wording and spirit the provision would also exclude from the definition of a resident of a Contracting State foreign-held companies exempted from tax on their foreign income by privileges tailored to attract conduit companies. This, however, has inherent difficulties and limitations. Thus it has to be interpreted restrictively because it might otherwise exclude from the scope of the Convention all residents of countries adopting a territorial principle in their taxation, a result which is clearly not intended. 26 [emphasis added] 73. The second half of the OECD commentary was added in to the OECD commentary in 199227 as a result of an OECD working party’s report on conduit companies.28 That report considered the issue of treaty shopping through the use of conduit companies. On page 9 of that report the working party refers to specific anti-avoidance provisions in the 1977 Model Convention precluding persons otherwise not entitled to treaty benefits from gaining them via the use of a conduit company. They refer to the Model Convention equivalent of Article 4(2) and essentially restate the above OECD commentary. 74. The report and the OECD commentary identify at least two categories of persons to which the exclusion in Article 4(1) of the Model Convention would apply (foreign diplomatic and consular staff and conduit companies). When determining what other category of persons would also be treated as non-residents by reason of the exclusion, the OECD commentary warns that caution should be exercised to ensure the exclusion is not extended too far. The OECD commentary makes it clear, for example, that residents of countries that adopt a territorial principle of taxation should not be considered to fall within the exclusion. 75. It could be argued that Article 4(2) should be limited to the two categories mentioned in the exclusion in the OECD commentary. New Zealand trustees taxed on New Zealand source income only, not being a corporate conduit type situation, would not fall within the exclusion. 76. The rationale for treating conduit companies as being within the exclusion is that they could be used as a vehicle for persons not intended to benefit from the treaty. The OECD commentary refers to the ‘wording and spirit’ of the Article and finds that treating such companies as non-residents is clearly within both. 77. There are parallels between conduit companies and the treatment of these trusts in New Zealand. In both cases foreign income flows through the vehicle to foreign owners through an entity that is not taxed in the jurisdiction. Both Australia and New Zealand tax their residents on a worldwide income basis. The treatment of 26 The High Court in Thiel v. FC of T 90 ATC 4717 approved the use of the commentaries to the Model Convention as supplementary material under Article 32 of the Vienna Convention. 27 The Revision of the Model Convention, adopted by the OECD Council on 23 July 1992. 28 Double Taxation Conventions and the Use of Conduit Companies, adopted by the OECD Council on 27 November 1986. Draft Taxation Ruling TR 2004/D24 FOI status: draft only – for comment Page 17 of 23 New Zealand Foreign Trusts is an exception to this general worldwide income approach and falls squarely within the type of situation that Article 4(2) was intended to cover. 78. It is clearly within the wording and would also be within the ‘spirit’ of Article 4(2) to treat as non-residents trustees of New Zealand trusts who are taxed on their New Zealand source income only. An Australian resident deriving Australian source income through a New Zealand foreign trust should not be able to use the treaty to get a result of double non-taxation. 79. In setting out two circumstances where the exclusion would apply and saying it was to be interpreted restrictively the OECD did not intend that those were to be the only two circumstances in which the exclusion should be applied. Rather, the OECD expresses caution in applying the exclusion lest it be applied to circumstances that are not within its ‘spirit’. 80. This view is consistent with that contained in Taxation Ruling TR 97/19 in which the Commissioner accepts that the exclusion applies to a wider category of persons than the conduit company and consular service situations listed in the OECD commentary. TR 97/19 discusses the application of the tax treaty between Australia and China to residents of Hong Kong. The Ruling concludes that the taxes imposed on Hong Kong residents are not covered by the treaty as they are not imposed by the Central People’s Government of China, nor are the Hong Kong taxes ‘identical or substantially similar’ to the taxes imposed by the Central People’s Government of China. However, the Ruling goes on to state that even if this view is not accepted and consequently Hong Kong is treated as part of the territory of China for the purposes of the tax treaty, Hong Kong residents would not be residents of China under the treaty because of Article 4(2).29 This is because, as residents of China, people residing in the Hong Kong Special Administrative Region are taxed on income from sources in Hong Kong only30 and as such they are not residents of China for the purposes of the treaty (see paragraph 41). 81. Similarly, Norfolk Island and Cocos (Keeling) Islands residents who are generally subject to Australian tax on Australian source income only are not residents of Australia for the purposes of the NZ Agreement by reason of Article 4(2). There is therefore a clear intention that the Article is not restricted to the two categories mentioned in the OECD commentary. 82. There is an alternative view based on the meaning of the phrase ‘liable to tax’ that Article 4(2) does not exclude trustees of New Zealand foreign trusts from the definition of resident. Under this view, a resident is still liable to tax (on worldwide income) even though they are not actually subject to tax because of, for example, an exemption that provides they are not taxable on foreign source income. Thus the phrase ‘liable to tax’ is being used in 29 Article 4(2) of the Australia/China Agreement is substantially similar in its wording to Article 4(2) of the NZ Agreement. 30 Note that China adopts a worldwide basis of taxation (and not a territorial basis). Draft Taxation Ruling TR 2004/D24 Page 18 of 23 FOI status: draft only – for comment contradistinction to the phrase ‘subject to tax’. The first refers to the overarching treatment of residents as being prima facie assessable to the fullest extent provided for by the laws of the country of residence and the second refers to what the resident is actually taxable on.31 83. We note that while Article 4(1) in the OECD Model Convention uses the phrase ‘liable to tax’, the commentary (paragraph 8), uses the phrase ‘subject to tax’ to explain the Article. This suggests that the OECD does not see such a distinction within the context of Article 4(1). Furthermore, in his commentary on the second sentence in Article 4(1) of the OECD Model Convention, Klaus Vogel states that the restriction in the second sentence ‘primarily refers to individuals who under the domestic law of a State are deemed to be residents… but whose taxation is limited there to income from sources, or capital situated, in that State’32 (emphasis added). 84. We further note that if the phrase ‘liable to tax’ in Article 4(2) of the NZ Agreement was given the operation contended for under the alternative view, it would have very little, if any, practical effect. Article 4(2) only operates once a person has been found to be a domestic resident. As a domestic resident they are, without specific restriction or exemption, liable to tax on worldwide income and as such Article 4(2) could never, under the alternative view, operate to exclude them. 85. Therefore, Article 4(2) of the NZ Agreement, the equivalent to the second sentence in Article 4(1) of the OECD Model Convention, operates to exclude from the definition of ‘resident’ those persons who are residents under domestic law but who are not subject to tax on foreign source income. As noted above, this has to be applied restrictively to ensure that only those residents that fall within the wording and spirit of the provision are excluded. 86. This is consistent with the approach adopted in TR 97/19 and with the long standing treatment of Norfolk Island residents. An interpretation in accordance with the alternative view would mean that all Norfolk Island residents (being liable to tax as a resident of Australia but not subject to tax on foreign source income by reason of section 24F of the ITAA 1936) were residents under the tax treaties. It is See Ward DA et al, ‘A Resident of a Contracting State for Tax Treaty Purposes: A Case Comment on Crown Forest Industries’, (1996) 44 Canadian Tax Journal 408, see in particular pages 419 and following. Note that this article is focussing on the Canada-United States Tax Convention which defines a resident in Article IV as ‘any person who, under the laws of that State, is liable to tax therein by reason of his domicile, residence, place of management, place of incorporation or any other criterion of a similar nature’. The structure of this Article is fundamentally different to the structure of the Article defining a resident in the NZ Agreement. The authors of the article were therefore primarily concerned with examining whether a person with the same connecting characteristics to a State as other residents should also fall within the definition of resident despite concessions/exemptions that limited the income which they were taxable on. This is contrasted to the NZ Agreement which defines residence by reference to the domestic law of each State and then carves out from that group a set of residents liable to tax on domestic source income only. 32 K Vogel, Klaus Vogel on Double Taxation Conventions Kluwer Law, 1997, 3rd ed, at 233, paragraph 31. 31 Draft Taxation Ruling TR 2004/D24 FOI status: draft only – for comment Page 19 of 23 considered that this would be an unintended outcome and the alternative view is not therefore an interpretation which is in accordance with Australia’s understanding of the wording and spirit of the Article. 87. Even accepting in certain circumstances that a resident who would be subject to tax on worldwide income had it not been for specific exemptions or concessions is nonetheless still liable to tax, we nonetheless do not consider a New Zealand trustee of a New Zealand foreign trust would be ‘liable to tax’ in the relevant sense. A trustee of a New Zealand foreign trust is only taxed on New Zealand source income because of the lack of jurisdictional nexus with New Zealand which would warrant imposing tax on foreign source income. It is because of this inherent lack of jurisdiction that the income is excised from the trustee taxable income under subsection HH 4(3B) rather than because of a specific concession or exemption given to a resident who would otherwise bear full liability to tax. For this reason, we do not consider that such a trustee is ‘liable to tax’ in New Zealand on worldwide income. Conclusion on whether a trustee is a resident for the purposes of the treaty 88. A New Zealand trustee taxed only on New Zealand source income under subsection HH 4(3B) is not considered to be a resident in New Zealand under Article 4 of the treaty. In respect of non-New Zealand source trust income, New Zealand do not consider that there is a sufficient jurisdictional nexus to tax the income effectively treating the trustee in that regard as a non-resident. Therefore, such trustees fall within the ‘spirit’ of the exclusion. This interpretation is consistent with the OECD commentary, the working party report and Taxation Ruling TR 97/19. Impact on Division 6 89. As the trustee of a trust described in paragraph 2 is not a resident in New Zealand for the purposes of the treaty, the treaty does not have any application when determining whether Australia has a right to tax the Australian source income. Therefore, where the whole or part of the net income of the trust estate consists of Australian source income, Australia is able to tax that income to the trustee where the conditions in sections 98, 99 or 99A are met without regard to the NZ Agreement. Alternative views 90. On the issue of who or what is the relevant person, the alternative view is that the ‘trust’ is the ‘person’ for all purposes of the NZ Agreement. Under this view, the trustee would be merely the collection point from whom the tax in respect of the trust’s income is collected. Draft Taxation Ruling TR 2004/D24 FOI status: draft only – for comment Page 20 of 23 91. Nonetheless, even if our view that the trustee is the person is incorrect, we do not consider that this changes the ultimate outcome. This is because the ‘trust’, in the circumstances outline in paragraph 2, would still not be a resident in New Zealand for the purposes of the NZ Agreement. The trust would still only be taxed in New Zealand on income from sources in New Zealand and would therefore not be a resident in New Zealand by reason of Article 4(2). Examples 92. ABC Pty Ltd, a resident in New Zealand, is the trustee for the EFG Trust. Mr S, a resident of Hong Kong (and not in New Zealand), is the sole settlor of the trust. The EFG Trust is not a superannuation fund nor a testamentary trust or an inter vivos trust where any settlor died resident in New Zealand. 93. EFG trust derives $1 million from sources in New Zealand and $2 million of business profits which has an Australian source. The EFG Trust does not carry on business in Australia through a permanent establishment in Australia. 94. No beneficiary of the EFG Trust is presently entitled or absolutely entitled to any of the income derived by the EFG Trust. 95. ABC Pty Ltd, in respect of the trust income, is liable to tax in New Zealand on the New Zealand source income only under subsection HH 4(3B) of the Income Tax Act 1994. Therefore, it is not, in its capacity as trustee, a resident in New Zealand for the purposes of the NZ Agreement by reason of Article 4(2). As such, the NZ Agreement does not affect Australia’s taxing rights in respect of the Australian source income. 96. ABC Pty Ltd, in its capacity as trustee, is therefore liable to be assessed in respect of the income attributable to sources in Australia under subsection 99A(4C). Your comments 97. We invite you to comment on this draft Taxation Ruling. Please forward your comments to the contact officer by the due date. Due date: 24 January 2005 Contact officer: Danielle Allen E-mail address: Danielle.Allen@ato.gov.au Telephone: 08 8208 1840 Facsimile: 08 8208 1198 Address: GPO Box 800 Adelaide SA 5001 Draft Taxation Ruling TR 2004/D24 FOI status: draft only – for comment Page 21 of 23 Detailed contents list 98. Below is a detailed contents list for this draft Taxation Ruling: Paragraph What this Ruling is about 1 Class of person/arrangement 2 Date of effect 4 Ruling 5 Explanation 9 New Zealand foreign trusts 9 Taxation of Trust Income to the Trustee – domestic law 15 Australian domestic law 16 New Zealand domestic law 24 Purpose of the NZ Agreement and how it interacts with domestic law 28 Application of the NZ Agreement to New Zealand foreign trusts 39 1. Who or what is the person – the trustee or the trust? 41 Definition under the NZ Agreement 42 Domestic meaning of ‘person’ 44 Does the context require otherwise? 55 2. Application of Article 4(2) 59 Whether Article 4(2) applies by reference solely to the tax liability of the trustee as trustee 61 Whether it is within the spirit and intent of Article 4(2) to apply the Article to New Zealand Foreign Trusts 72 Conclusion on whether a trustee is a resident for the purposes of the treaty 88 Impact on Division 6 89 Alternative views 90 Examples 92 Your comments 97 Detailed contents list 98 Commissioner of Taxation 24 November 2004 Draft Taxation Ruling TR 2004/D24 Page 22 of 23 Previous draft: Not previously issued as a draft Related Rulings/Determinations: TR 92/20; TR 97/19; TR 2001/13 Legislative references: - AIA 1901 22(1)(a) - TAA 1953 8AAZA - TAA 1953 Pt IVAAA - ITAA 1915 26(1) - ITAA 1936 6 - ITAA 1936 6(1) - ITAA 1936 24F - ITAA 1936 Pt III Div 6 - ITAA 1936 95 - ITAA 1936 95(1) - ITAA 1936 95(2) - ITAA 1936 95(2)(b) - ITAA 1936 95(3) - ITAA 1936 96 - ITAA 1936 96B - ITAA 1936 98 - ITAA 1936 98(1) - ITAA 1936 98(3) - ITAA 1936 98(4) - ITAA 1936 99 - ITAA 1936 99(4) - ITAA 1936 99(5) - ITAA 1936 99A - ITAA 1936 99A(4B) - ITAA 1936 99A(4C) - ITAA 1936 Pt III Div 6AAA - ITAA 1936 102J - ITAA 1936 102R - ITAA 1936 Pt III Div 13 - ITAA 1936 Pt IIIA - ITAA 1936 160H - ITAA 1936 160L - ITAA 1936 160L(1)(a)(ii) - ITAA 1936 160L(2)(a)(ii) - ITAA 1936 Pt IVA - ITAA 1936 Pt IX - ITAA 1936 Pt XI - ITAA 1997 Pt 3-1 - ITAA 1997 104-170(4) - ITAA 1997 960-100 - ITAA 1997 960-100(1) - ITAA 1997 960-100(1)(f) - ITAA 1997 960-100(2) - ITAA 1997 960-100(3) - ITAA 1997 960-110(3) - ITAA 1997 995-1 - International Tax Agreements Act 1953 4(1) FOI status: draft only – for comment - International Tax Agreements Act 1953 4(2) International Tax Agreements Act 1953 Sch 4 International Tax Agreements Act 1953 Sch 4 Art 1 International Tax Agreements Act 1953 Sch 4 Art 3 International Tax Agreements Act 1953 Sch 4 Art 3(1)(j) International Tax Agreements Act 1953 Sch 4 Art 3(2) International Tax Agreements Act 1953 Sch 4 Art 3(3) International Tax Agreements Act 1953 Sch 4 Art 4 International Tax Agreements Act 1953 Sch 4 Art 4(1) International Tax Agreements Act 1953 Sch 4 Art 4(2) International Tax Agreements Act 1953 Sch 4 Art 7(1) International Tax Agreements Act 1953 Sch 4 Art 10 International Tax Agreements Act 1953 Sch 4 Art 11 International Tax Agreements Act 1953 Sch 4 Art 12 International Tax Agreements Act 1953 Sch 28 Art 4(2) Income Tax Act 1994 (NZ) HH 4(1) Income Tax Act 1994 (NZ) HH 4(3B) Income Tax Act 1994 (NZ) OB 1 Income Tax Act 1994 (NZ) OE 1 Income Tax Act 1994 (NZ) OE 2 Income Tax Act 1994 (NZ) OE 2(1) Case references: - Case A62 69 ATC 342 - FC of T v. Harmer & Ors 90 ATC 4672; (1990) 21 ATR 623 - Harmer and Others v. FC of T (1991) 66 ALJR 89; (1991) 104 ALR 117; (1991) 91 ATC 5000; (1991) 22 ATR 726; (1991) 173 CLR 264 - In re Scott [1948] SASR 193 - Inland Revenue Commissioners v. Crawley [1987] STC 147 - JW Broomehead (Vic) Pty Ltd (In liq) v. JW Broomehead Pty Ltd & Ors (1985) 9 ACLR 593 - Registrar of the Accident Compensation Tribunal (Vic) v. Draft Taxation Ruling TR 2004/D24 FOI status: draft only – for comment - FC of T 93 ATC 4835; (1993) 26 ATR 353; (1993) 178 CLR 145 Thiel v. FC of T 90 ATC 4717; (1990) 21 ATR 531; (1990) 171 CLR 338 Page 23 of 23 - - Other references: - Butterworths Legal Dictionary - Double Tax Conventions and the Use of Conduit Companies (adopted by the OECD Council on 27 November 1986) - Jones, A et al, ‘The Interpretation of Tax Treaties with Particular Reference to Article 3(2) of the OECD Model – I’ [1989] BTR 14 - Jones, A et al, ‘The Treatment of Trusts under the OECD Model Convention – II’ [1989] BTR 65 ATO references NO: 2004/10228 ISSN: 1039-0731 - - HAJ Ford & WA Lee, Principles of the Law of Trusts, LBC Information Services, 1996, 3rd ed Macquarie Dictionary, 3rd Revised Edition Prebble J, ‘Accumulation Trusts and Double Tax Conventions’ [2001] BTR 69 K Vogel, Klaus Vogel on Double Tax Conventions, Kluwer Law, 1997, 3rd ed Ward, DA et al, ‘A Resident of a Contracting State for Tax Treaty Purposes: A Case Comment on Crown Forest Industries’ (1996) 44 Canadian Tax Journal 408