International Loans and Current Account Advances Policy

advertisement

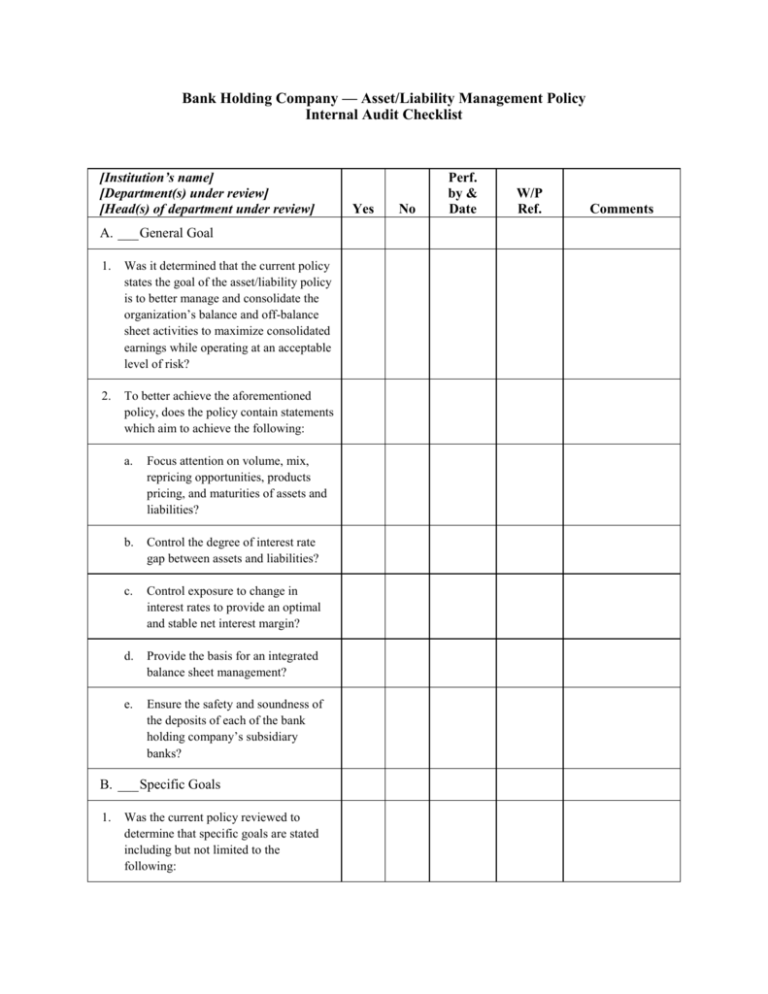

Bank Holding Company — Asset/Liability Management Policy Internal Audit Checklist [Institution’s name] [Department(s) under review] [Head(s) of department under review] A. ___ General Goal 1. Was it determined that the current policy states the goal of the asset/liability policy is to better manage and consolidate the organization’s balance and off-balance sheet activities to maximize consolidated earnings while operating at an acceptable level of risk? 2. To better achieve the aforementioned policy, does the policy contain statements which aim to achieve the following: a. Focus attention on volume, mix, repricing opportunities, products pricing, and maturities of assets and liabilities? b. Control the degree of interest rate gap between assets and liabilities? c. Control exposure to change in interest rates to provide an optimal and stable net interest margin? d. Provide the basis for an integrated balance sheet management? e. Ensure the safety and soundness of the deposits of each of the bank holding company’s subsidiary banks? B. ___ Specific Goals 1. Was the current policy reviewed to determine that specific goals are stated including but not limited to the following: Yes No Perf. by & Date W/P Ref. Comments a. Consistently achieve a consolidated pretax return on average assets about 1.25 percent? b. Maintain a cumulative gap position within 10 percent for calculated time frames of overnight, six months, one year, and two years? c. Maintain a consolidated ratio of net interest income to average assets of 2 percent? d. Maintain a consolidated leverage ratio of 4 percent or more? e. Maintain a consolidated ratio of tier 1 capital to risk-weighted assets of 4 percent and a consolidated total capital to risk-weighted assets ratio of 8 percent? C. ___ Authority 1. Has the board reviewed the current policy and delegated day-today operating authority to senior executive officers at both the holding company and bank levels? 2. At the holding company level does policy require the formal management asset/liability committee meet no less than monthly? D. ___ Risk Management 1. Has the board reviewed their policy concerning the various types of risk and the correlating management techniques respective to each risk? 2. With regards to the aforementioned risk, have the following types of risk and the appropriate means in which to handle a situation within each type of risk been reviewed, should it arise? a. Credit risk. Impacting earnings or capital due to an obligor’s failure to meet the terms of a loan and or investment, or otherwise failing to perform as agreed. Credit risk can occur at any time an institution relies on another party, issuer, or borrower’s performance. b. Interest rate risk. Addressing the potential adverse impact to the organization’s capital or earnings arising from movement in interest rates. Interest rate risk evaluation must take into consideration the impact of complex hedging strategies or products that become illiquid; potential impact on loans or investments due to earnings reduction of the actual investments per changes in interest rates; or ability to sell assets in the portfolio due to significant changes in interest rates. c. Liquidity risk. Addressing the risk to earnings or capital arising from a bank holding company or individual bank’s inability to meet its obligations when they come due without incurring unacceptable losses. Liquidity risk includes also the inability to manage unplanned decreases or changes in funding sources, or failure to recognize or address changes in market conditions that affect the ability to liquidate assets quickly and with minimal loss in value. d. Price risk. Measuring and supervising the risks inherent with market-making, dealing, and position-taking activities in interest rates, foreign exchange, equity and commodities markets. Price risk represents a risk to earnings or capital arising from changes in the value of portfolios of financial instruments. e. Compliance risk. Maintaining legal compliance with various regulations as well as the organizations ALCO policies. f. Reputation risk. Developing and retaining marketplace confidence in handling customers’ financial transactions in an appropriate manner as well as protecting the safety and soundness of the consolidated institution. E. ___ Definitions 1. Was it determined that the bank’s current policy ensures that terms and acronyms are consistent with those recognized and used in the financial services industry? F. ___ Asset/Liability Management Committee 1. Was the current policy reviewed to ensure there is a asset/liability management committee (ALCO) to coordinate the asset/liability management of each subsidiaries into a unified asset/liability management function and to communicate board policies regarding limits and concerts? 2. Does current policy state the purpose of the ALCO is to report the status of the holding company’s funds management to the board of directors through monthly reports and discussions at monthly meetings? 3. Was it determined that the current policy mandates that each subsidiary bank maintain its own ALCO while the corporate ALCO ensures the operations of each subsidiary bank supports the overall goals of the organization? 4. Is it stated within current policy that each subsidiary ALCO provide the corporate ALCO with the following information on a monthly basis: a. Financial statements and capital position? b. Statements of historical and projected sources and uses of funds? c. Local business and economic conditions? d. Anticipated changes in the volume and mix of loans, investments, and sources of funds? e. Current interest rates offered on deposits? f. Current interest rates paid on investments? g. Comparison of key bank performance ratios of the past four quarters with those of peer banks? h. Maturity distributions and rate sensitivities of assets and liabilities? G. ___ Parent Company Funding 1. Was the standard policy of the bank holding company reviewed to ensure it doesn’t engage in any activities that could impair the safety or stability of subsidiary banks? 2. Does the current policy ensure the use of short-term debt that will only be used to fund assets that are readily convertible to cash without undue loss? 3. Within the current policy does the parent company maintain enough liquid assets to cover short-term liabilities? 4. Is it the standard policy of the parent company to maintain a fixed charge coverage ratio of two, that being an operating income that is twice the level of its operating expenses? H. ___ Commercial Papers 1. Was the standard policy of the bank holding company not to use commercial paper to fund long-term assets or corporate dividends or to pay current expenses reviewed? 2. Was it determined that the current policy ensures purchasers of its commercial paper understand that they are buying an uninsured debt obligation of the holding company organization and that the paper does not represent an insured deposit of any of the subsidiary banks? 3. With regards to the previous question, is it policy for employees to orally inform potential customers of the noninsured status of commercial paper? 4. Is it stated within current policy that the bank holding company may not sell commercial paper in any public area where retail deposits are accepted, including any of the subsidiary banks’ lobby areas? 5. Is the currently practiced policy that an unaffiliated bank may fully support all issuances of commercial paper with backup lines of credit to cover any unexpected runoff of commercial paper maturity? I. ____ Liquidity 1. Did you review the standard policy to ensure that the following liquidity measures are monitored by ALCO on a consolidated basis: Measure Target a. Liquidity ratio? Minimum of 20 percent b. Loan-to-deposit ratio? 70 to 80 percent c. Investments to total assets ratio? Minimum of 10 percent d. Large liability dependency ratio? Maximum of 10 percent J. ____ Rate Sensitivity 1. Was it determined that it is the standard policy for the bank holding company to manage its gap positions to provide a stable net interest margin? 2. Is ALCO responsible for evaluating economic forecasts and their corresponding effects on BHC’s balance sheet and pricing strategy in addition to establishing guidelines for the consolidated organizations rate sensitivity as part of standard policy? 3. Has the board reviewed current policy to ensure that if ALCO recommends the rate sensitivity should be modified that alternative funding strategies have been recommended by ALCO? K. ___ Profitability 1. Was the standard policy reviewed to ensure the bank holding company work diligently to maintain a sufficient and stable net interest and margin through synchronized management of the holding company’s rate sensitivity and pricing mechanisms, as well as through active management of non-interest expenses? 2. Is it the current policy, as approved by the board, to supervise the organization’s interest rate spread between its yield on deposits and investments and its cost of funds will decrease its vulnerability to interest rate fluctuations?