Testing of the ALM Process - Financial Managers Society

advertisement

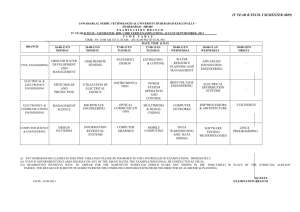

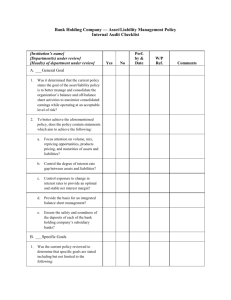

Testing of the ALM Process: What Should it Really Entail? Tuesday, June 18, 2013 2:00 PM – 3:15 PM Presented by: Bert Purdy, CPA, CTFA Senior Manager BKD, LLP 211 N. Broadway, Suite 600 St. Louis, MO 63102 P: 314.231.5544 E: rpurdy@bkd.com www.linkedin.com/in/bertpurdy www.fmsinc.org | 800-ASK-4FMS “Perhaps when a man has special knowledge & special powers like my own, it rather encourages him to seek a complex explanation when a simpler one is at hand.” – Sherlock Holmes slide 2 www.fmsinc.org | 800-ASK-4FMS Questions to be Answered 1. What testing of the ALM process is required? 2. What are the differences between model validation & ALM testing? 3. How can you perform model backtesting? 4. What are examiner expectations? slide 3 www.fmsinc.org | 800-ASK-4FMS Regulatory Guidance • Joint Agency Policy Statement on Interest Rate Risk (1996) • Comptroller’s Handbook on Interest Rate Risk (1997) • Advisory on Interest Rate Risk Management (2010) • Interest Rate Risk Management: Frequently Asked Questions (2012) slide 4 www.fmsinc.org | 800-ASK-4FMS Regulatory Guidance • FDIC’s Risk Management Manual of Examination Policies, Section 7.1 – Sensitivity to Market Risk • Comptroller’s Handbook, Community Bank Supervision, Sensitivity to Market Risk (pages 77-85) • FRB’s Commercial Bank Examination Manual, Section 4090.1 slide 5 www.fmsinc.org | 800-ASK-4FMS Related Guidance • FIL-84-2008 – Liquidity Risk Management • Interagency Policy Statement on Funding & Liquidity Risk Management • OCC 2011-12 – Supervisory Guidance on Model Risk Management • FRB’s Commercial Bank Examination Manual, Section 4027 (Model Risk Management) slide 6 www.fmsinc.org | 800-ASK-4FMS Required Testing • Internal controls, policies, procedures (Process testing) • Model validation • Back-testing slide 7 www.fmsinc.org | 800-ASK-4FMS Process Testing • Purpose: “to ensure that the interest rate risk measurement & management processes are sound.” - FDIC Exam Manual slide 8 www.fmsinc.org | 800-ASK-4FMS Process Testing • Complexity • Structure slide 9 www.fmsinc.org | 800-ASK-4FMS Process Testing • Independent: Person testing “should not have any involvement in either developing the measurement system or performing any of the routine internal functions such as reconciling data inputs, developing assumptions, or performing variance analysis.” - FDIC Exam Manual slide 10 www.fmsinc.org | 800-ASK-4FMS Process Testing • Independence can be achieved via internal audit staff, an outsourcing arrangement or a combination of the two slide 11 www.fmsinc.org | 800-ASK-4FMS Process Testing Four phases of process testing • Input process • Assumptions • System output • Management & oversight (ALCO) slide 12 www.fmsinc.org | 800-ASK-4FMS Process Testing • Input Process – Knowledge & skills – Reconciliation – Numbers in right places – Contractual terms – Review slide 13 www.fmsinc.org | 800-ASK-4FMS Process Testing • Assumptions – How are they developed? – Review & approval at set-up – Periodic review – Supporting documentation slide 14 www.fmsinc.org | 800-ASK-4FMS Process Testing • System Output – Accuracy – Interest rate scenarios – Ramps & shocks – Timeliness & frequency of reporting – Compliance with policy slide 15 www.fmsinc.org | 800-ASK-4FMS Process Testing • Management & Oversight – Policy – ALCO membership – Frequency – Policy exceptions – Assumptions – Vendor due diligence slide 16 www.fmsinc.org | 800-ASK-4FMS Model Validation • Institutions that use vendor-supplied models are not required to test the mechanics & mathematics of the measurement model. However, the vendor should provide documentation showing a credible independent third party has performed such a function. - Advisory on Interest Rate Risk Management slide 17 www.fmsinc.org | 800-ASK-4FMS Model Validation • Third party validation reports – Frequency – Review – Implement changes slide 18 www.fmsinc.org | 800-ASK-4FMS Model Validation • Use of a separate model provider – Use same processes for input – Use same assumptions – Compare results slide 19 www.fmsinc.org | 800-ASK-4FMS Back-testing • Purpose • Frequency • Complexity slide 20 www.fmsinc.org | 800-ASK-4FMS Back-testing • Independence • Performance • Results slide 21 www.fmsinc.org | 800-ASK-4FMS Examinations • Independent Review – “The person responsible for conducting the annual independent review is not independent of the control of the model as this person is responsible for monthly data inputs, reconciliations & assumption changes” slide 22 www.fmsinc.org | 800-ASK-4FMS Examinations • Independent Review – “A contravention of the Joint Agency Policy Statement on Interest Rate Risk is identified as an independent review of the bank’s input & assumptions has not been conducted” slide 23 www.fmsinc.org | 800-ASK-4FMS Examinations • “Management’s analysis of the bank’s exposure to interest rate risk does not include interest rate shocks of at least 300 to 400 basis points according to FDIC’s Financial Institution Letter entitled Financial Institution Management of Interest Rate Risk dated January 20, 2012” slide 24 www.fmsinc.org | 800-ASK-4FMS Examinations • “Only two formal Asset/Liability Committee (ALCO) meetings have been held since the last examination, although bank policy calls for quarterly meetings. Management meets informally outside of ALCO meetings to discuss IRR & maintains notes of those meetings; however, the notes are not presented to the Board for review. Further, while management stated IRR matters are discussed at the Board meetings in the absence of ALCO meetings, Board minutes lack sufficient detail of those discussions.” slide 25 www.fmsinc.org | 800-ASK-4FMS Examinations • “Guidelines in the Asset Liability Management Policy remain liberal, as was noted at the prior examination. Management should narrow the risk parameters which continue to allow for NII changes of 10, 15 & 201 percent for 100, 200 & 300 basis point rate shocks, respectively.” slide 26 www.fmsinc.org | 800-ASK-4FMS Examinations • “Though the bank’s sensitivity to market risk is satisfactory, many parameters established in the policy are liberal & allow for an inordinate amount of risk. The policy should be amended to incorporate parameters that minimize risk & establish limits for the level of risk the bank is willing to accept.” slide 27 www.fmsinc.org | 800-ASK-4FMS Questions? slide 28 www.fmsinc.org | 800-ASK-4FMS