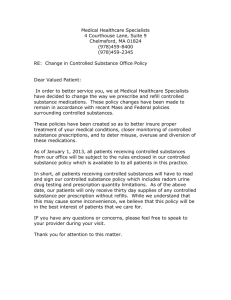

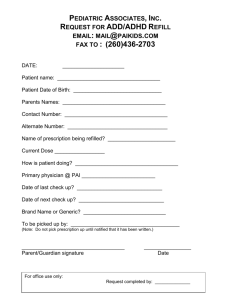

section 15 - prescription drugs

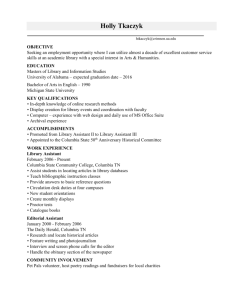

advertisement