The Indonesia Partner's Discount Rate

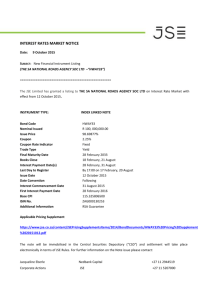

advertisement

Dick Sweeney Corning Glassworks in Indonesia: The Indonesia Partner’s Discount Rate Corning’s Indonesia partner, Mr. Batik, is likely to have a different equity discount rate from the rate Corning would use on behalf of its well-diversified shareholders. There are three possible reasons for the difference. First, Mr. Batik may use a different market index in his calculations from the Corning shareholders. This may lead him to use a different beta for an equity stake in IAI. Second, related, he may use a different risk premium on the market. Third, he may face a different risk-free rate. For Corning’s shareholders, the world market or the U.S. market is probably relevant for their decisions. Or, the shareholders may use some average of the world and U.S. markets. [Note: As time goes on, the weight on the world market likely rises for Corning shareholders. The share of international stocks in the average U.S. investor’s portfolio has risen over time.] In 1979, Mr. Batik may not be able to get enough funds out of Indonesia, at reasonable enough costs, to make the world or U.S. market relevant for him. Instead, the Indonesia stock market, as represented by the Jakarta Stock Exchange (JSE) may be a good first-cut at the stock market that is relevant for him. Possibly Mr. Batik has some fraction of his wealth outside Indonesia, but if this fraction is only say 5 percent, using the JSE is not far off. 1 [Note: As time went on from the case’s date in 1979, Indonesia’s capital markets became more open, especially for inward capital flows. Indonesians found it easier and cheaper to hold a larger fraction of their wealth outside Indonesia. Thus, as time went on, Mr. Batik and people in his position could have smaller weights in the JSE and larger weights in the world market index. Still, in many countries even today, the local partner may be diversified mostly over local financial markets.] Recall that regression analysis shows that the beta of the JSE on the world market in the pre-crisis period is approximately 0.50. Suppose that Corning believes that the project has the same beta risk as the JSE. Then, from the point of view of a U.S. investor, the project has a beta of 0.50. [Note: We have to be careful—the firms in the JSE index are levered. Suppose that the IAI project will have the same leverage as the average firm on the JSE. Then, we do not have to worry about un-levering and re-levering the JSE’s beta. If the JSE and IAI leverage ratios differ, we must go through the un-levering and re-levering process, but this is not difficult and does not detract from the main point here.] Thus, the risk premium on the project, from the point of view of a Corning shareholder, is IAI,C (E RWM - rf) where IAI,C = 0.50 is the beta on the IAI project from the viewpoint of the representative Corning shareholder and (E RWM - rf) is the risk premium on the world market. [Note that both the beta and the risk premium on the market are for USD rates of return.] One reasonable, frequently used estimate is (E R WM rf) = 5%. Thus, the risk premium on the project is IAI,C (E RWM - rf) = (0.50) (5%) = 2 ½%. Mr. Batik uses the JSE index as the market. Hence, the beta of the JSE on his market must be unity, or 1.0. Mr. Batik, then judges that IAI has a beta twice as large as the beta Corning shareholders use. 1 Of course, it is always possible to get some funds out of almost any country, but the costs can be very high. For countries with strong prohibitions that are rigorously enforced, the costs may be so high that most people do not find it worthwhile to get out more than a negligible amount. Mr. Batik uses the risk premium on the JSE as the market premium in his decisions. A major difficulty is that there is little useful information about the risk premiums that apply to financial markets in individual emerging market economies (EMEs) that are not integrated with industrial-country financial markets. [Note: there are many a priori arguments why the premium should be higher or lower than the premium in the world market, but in the absence of evidence, such arguments are not very useful.] Suppose that the risk premium on the JSE is (E RJSE - rf) = 5%, the same as the world market risk premium. Then, from Mr. Batik’s viewpoint, the risk premium on the project is IAI,Bat (E RJSE - rf) = (1.0) (5%) = 5%. The risk premium on the project that he uses is twice as large as the premium Corning shareholders use. Turn to risk-free rates in the U.S. and in Indonesia. The data in the Corning case pro formas are in real terms, so a real risk-free rate must be used in analysis. For the U.S., a real risk-free rate of 1% to 3% is reasonable. The case provides little data on the risk-free rate that an Indonesian might face. The one clue: the IAI plan calls for borrowing in Rupiahs from local banks at 18%. It is not clear if this is 18% in real or nominal terms, but there is some evidence that 18% in real terms is meant; the data on short-term debt payments in the income statement and balance sheet imply an 18% real rate. Of course, this 18% is not a risk-free real bank rate—many of the banks’ loans are defaulted on. And even taking account of the risk, it is not clear that Mr. Batik can lend to similar borrowers at similar rates compared to banks. Think about the deposit rate that Mr. Batik might get at a local bank. In particular, think about the deposit rate at a bank that is at the safe end of the spectrum in Indonesia—perhaps it is very prudent, and perhaps it has an implicit or explicit government guarantee. We cannot be sure, of course, but suppose the spread between the banks’ lending and deposit rates is 9%. Then, the lending rate is 18% in real terms and the deposit rate is 9% in real terms. [Note: In many emerging market economies (EMEs), risk-free rates are substantially higher in real terms than the USD risk-free rate; typically this results because of high and variable inflation, as for example in Brazil in various periods. In other cases, EME risk-free rates are much lower; an example is China, where banks are government controlled and, many believe, deposit rates are kept artificially low.] The real required rate of return of Corning’s shareholders might then be estimated as RRIAI,C = rf,US + IAI,C (E RWM - rf,US) = 2% + (0.50) (5%) = 2% + 2 ½ % = 4 ½ %. Mr. Batik’s real required rate of return for the IAI project is RRIAI,Bat = rf,Ind + IAI,Bat (E RJSE - rf,Ind) = 9% + (1.00) (5%) = 9% + 5 % = 14%. Mr. Batik’s required rate of return is 9 ½ % larger that Corning’s rate. Of this, 7% comes from the difference in the real risk-free rate; 2 ½ % comes from difference in risk premia for the project, and all of this 2 ½ % difference comes from the difference in the betas. Even if the real risk-free rates were the same, the difference in the betas would make Mr. Batik’s discount rate 7% versus 4½ %, or his rate would be 1.5556 times Corning’s rate. One result of Mr. Batik’s higher discount rate is that he views his investment in the project as having a lower NPV than if he had Corning’s rate. Another, more interesting implication, is that a dollar tomorrow is worth less to Mr. Batik than to Corning. He would be willing to trade a lot of far-distant dollars for a relative few close-in-time dollars. There are many deals—splitting up the IAI equity cash flows—that would give both Mr. Batik and Corning higher NPVs. The problem is whether the two sides can trust each other. In particular, if Corning is nervous and wants its money out as soon as possible, then Corning may be unwilling to make deals with Mr. Batik that give him a larger share in earlier equity cash flows in return for Corning getting a commensurately larger share in later equity cash flows. This is another way of emphasizing the importance of structuring deals so that all the participants trust each other. 2