Questions and Answers

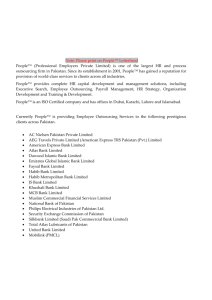

advertisement