high school course syllabus - Tremper High School

advertisement

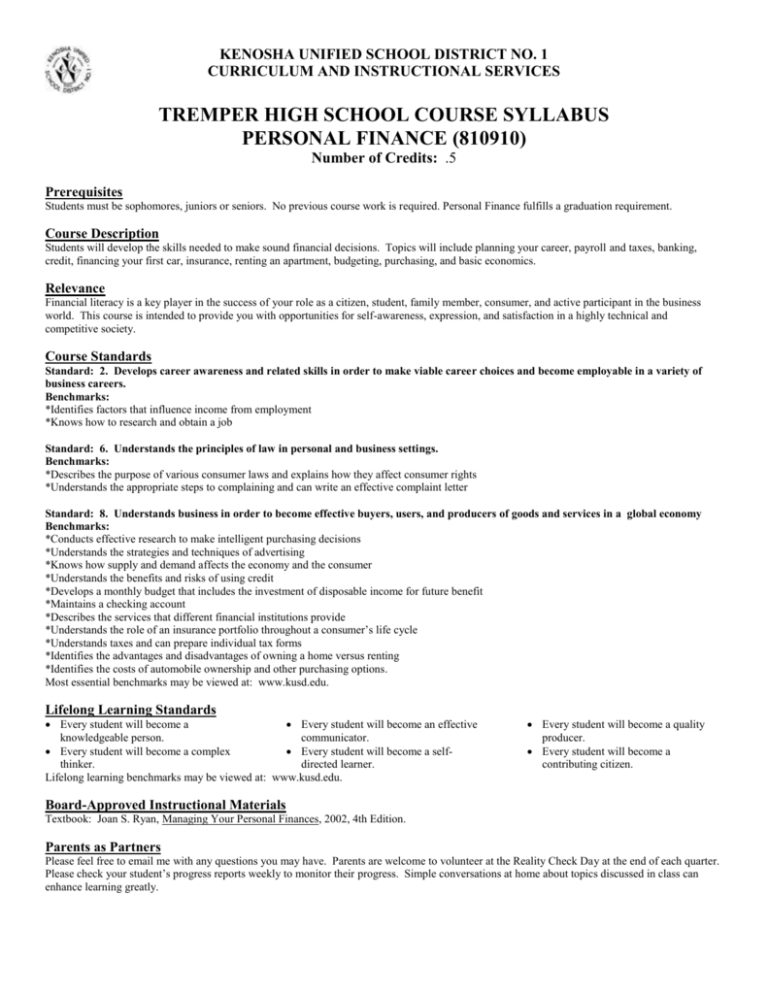

KENOSHA UNIFIED SCHOOL DISTRICT NO. 1 CURRICULUM AND INSTRUCTIONAL SERVICES TREMPER HIGH SCHOOL COURSE SYLLABUS PERSONAL FINANCE (810910) Number of Credits: .5 Prerequisites Students must be sophomores, juniors or seniors. No previous course work is required. Personal Finance fulfills a graduation requirement. Course Description Students will develop the skills needed to make sound financial decisions. Topics will include planning your career, payroll and taxes, banking, credit, financing your first car, insurance, renting an apartment, budgeting, purchasing, and basic economics. Relevance Financial literacy is a key player in the success of your role as a citizen, student, family member, consumer, and active participant in the business world. This course is intended to provide you with opportunities for self-awareness, expression, and satisfaction in a highly technical and competitive society. Course Standards Standard: 2. Develops career awareness and related skills in order to make viable career choices and become employable in a variety of business careers. Benchmarks: *Identifies factors that influence income from employment *Knows how to research and obtain a job Standard: 6. Understands the principles of law in personal and business settings. Benchmarks: *Describes the purpose of various consumer laws and explains how they affect consumer rights *Understands the appropriate steps to complaining and can write an effective complaint letter Standard: 8. Understands business in order to become effective buyers, users, and producers of goods and services in a global economy Benchmarks: *Conducts effective research to make intelligent purchasing decisions *Understands the strategies and techniques of advertising *Knows how supply and demand affects the economy and the consumer *Understands the benefits and risks of using credit *Develops a monthly budget that includes the investment of disposable income for future benefit *Maintains a checking account *Describes the services that different financial institutions provide *Understands the role of an insurance portfolio throughout a consumer’s life cycle *Understands taxes and can prepare individual tax forms *Identifies the advantages and disadvantages of owning a home versus renting *Identifies the costs of automobile ownership and other purchasing options. Most essential benchmarks may be viewed at: www.kusd.edu. Lifelong Learning Standards Every student will become a Every student will become an effective knowledgeable person. communicator. Every student will become a complex Every student will become a selfthinker. directed learner. Lifelong learning benchmarks may be viewed at: www.kusd.edu. Every student will become a quality producer. Every student will become a contributing citizen. Board-Approved Instructional Materials Textbook: Joan S. Ryan, Managing Your Personal Finances, 2002, 4th Edition. Parents as Partners Please feel free to email me with any questions you may have. Parents are welcome to volunteer at the Reality Check Day at the end of each quarter. Please check your student’s progress reports weekly to monitor their progress. Simple conversations at home about topics discussed in class can enhance learning greatly. Course Outline Unit 1: Unit 2: Career Decisions Choosing Your Career Planning Your Career Getting the Job Money Management Pay, Benefits, etc. Federal Income Taxes Budgets and Financial Records Unit 3: Unit 4: Financial Security Saving for the Future Investing for Your Future Credit Management Credit in America Credit Records and Laws Costs of Credit Problems with Credit Unit 5: Unit 6: Resource Management Personal Decision Making Renting a Residence Buying a Home Buying and Caring for a Vehicle Risk Management Property and Liability Insurance Health and Life Insurance Methods of Assessment The final exam will be cumulative in nature, emphasizing the most essential benchmarks for the course. Results of the final exam represent 20% of the final grade, but this single measure may not drop a student’s grade by more than one letter grade. The Poster Project and Reality Check Day performance will be divided into stages or components and each of those will be graded separately, providing students with specific feedback. Board-Approved Grading Scale Excerpts taken from School Board Rule 6452 B+ = 86-89% B = 83-85% B- = 80-82% A+ = 98-100% A = 93-97% A- = 90-92% C+ = 76-79% C = 73-75% C- = 70-72% D+ D DF = 66-69% = 63-65% = 60-62% = 0-59 Point Distribution Formative Summative Coursework 25% 75% 100% Coursework Final Exam Final Grade 80% 20% 100% Make-Up Work Students submitting work up to ten school days late without prior approval may receive up to two grades lower on the work than they would have received if the work had been submitted on time (i.e., B+ lowered to A D+). Student work submitted after ten school days without prior approval shall not be accepted for credit and shall be recorded with a score of zero. Upon returning to school after an absence, a student has the responsibility within the number of days equal to the length of the absence or suspension to meet with the teacher to develop a plan for making up missed work, quizzes, and examinations. A truant student has the responsibility on the first day he or she returns to the course/class to meet with the teacher to develop a plan for making up missed work, quizzes, and examinations. Lower grades may not be given for late work due to excused absences, suspension, or truancy unless the work is submitted later than agreed upon deadlines. See Rule 6452 in its entirety at: www.kusd.edu. Be Respectful! Kenosha Unified School District No. 1 Tremper High School Course Syllabus Be Responsible! 2 Be Safe! Be Your Best! Revised 3/9/2016