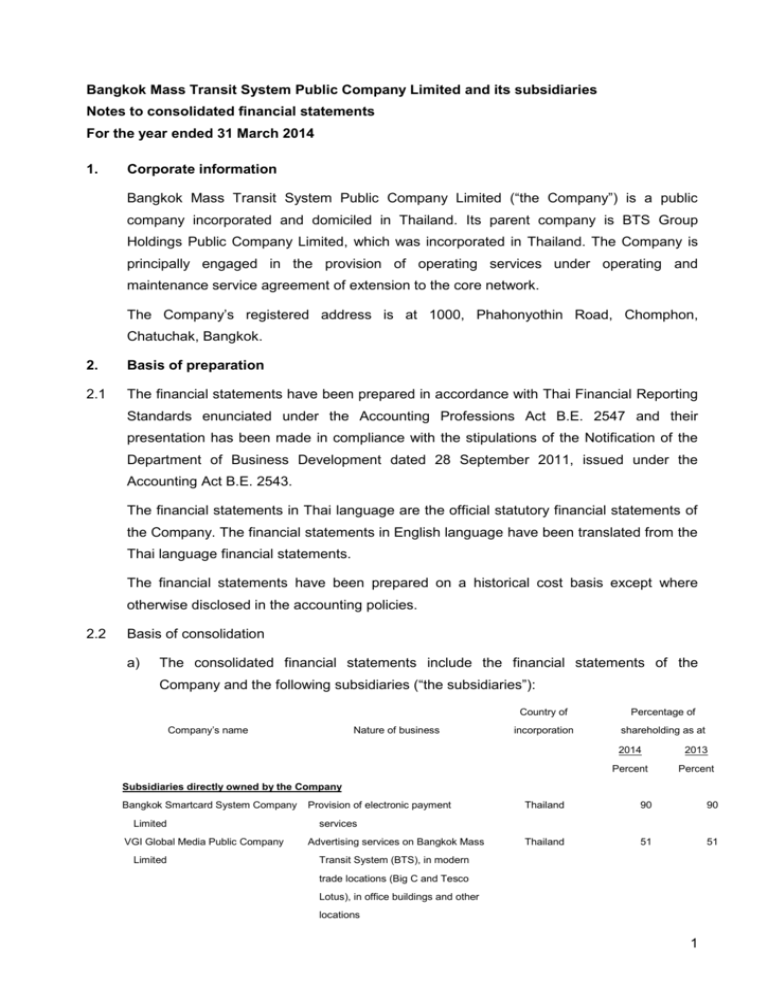

Bangkok Mass Transit System Public Company Limited and its

advertisement