health care - Standard & Poor's

advertisement

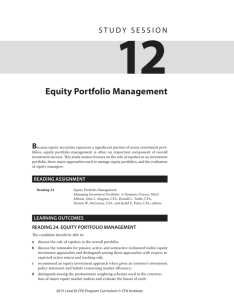

S&P PowerPicks Mid-Year 2005 Portfolio July 2005 Equity Research / North America Stephen Biggar Equity Research Robert Gold Equity Research HIGHLIGHTS S&P STARS: **** S&P EARNS / DIV RANKING: The S&P PowerPicks Mid-Year 2005 Portfolio represents the current collective “best ideas” of Standard & Poor’s U.S. equity research staff. Each of the 40 contributing industry analysts on S&P’s U.S. equity research staff considers the following stocks to be those best positioned for superior growth from each of the analyst’s coverage universe. The S&P PowerPicks Mid-Year 2005 Portfolio is diversified across all the 10 S&P economic sectors comprising the S&P 500 Index. The portfolio will be a “frozen” one, meaning that it will undergo no changes throughout the entire year. The objective of the portfolio is to exceed the total return (capital appreciation plus dividends paid) generated by the S&P 500 during the year. B S&P ISSUER CREDIT RATING: A- GICS SECTOR: 55 Water Street Information Technology New York, NY 10041 INDUSTRY: Semiconductor Equipment This report is for information purposes and should not be considered a solicitation to buy or sell any security. Neither Standard & Poor’s nor any other party guarantees its accuracy or makes warranties regarding results from its usage. Redistribution is prohibited without written permission. Copyright © 2005. All required disclosures appear on page 16 of this report. Additional information is available upon request. PEER GROUP: Equity Research / North America INVESTMENT OUTLOOK: 2005 MID-YEAR UPDATE Following a dismal first quarter, in which the S&P 500 dipped by more than 2.5%, investors may feel a bit apprehensive about the second quarter coming to a close. Since March 31, the S&P 500 has recovered some of the loss experienced in the first quarter when six of its 10 sectors were in the red. The S&P 500’s 0.9% advance in Q2 was supported by increases for six sectors, led by gains in financials, health care and utilities. S&P 500 Sectors % Chgs. As of 6/30/05 Q1 Q2 YTD Energy Utilities Health Care Consumer Staples S&P 500 17.1 4.4 (1.0) 0.2 (2.6) 1.5 8.3 3.7 (1.2) 0.9 18.8 13.2 2.7 (1.0) (1.7) Financials Industrials Information Technology Telecommunication Services Consumer Discretionary Materials (7.0) (2.0) (7.5) (8.6) (5.9) 1.3 3.6 (3.8) 1.6 2.6 (1.2) (10.0) (3.6) (5.7) (6.0) (6.2) (7.0) (8.8) S&P’s Investment Policy Committee believes that the muted first half performance for stocks was the result of a projected slowdown in corporate earnings growth, the impact of record energy prices on consumer spending and the sustainability of the Fed’s rate-tightening program. S&P equity analysts project the S&P 500 to post an 11% year-over-year increase in operating earnings in 2005, which is less than half of the gain seen for 2004. Energy prices – after having set a record of more than $60 per barrel – have recently eased, yet S&P’s Investment Policy Committee thinks elevated oil prices will remain a challenge to consumers and investors as prices for West Texas Intermediate oil are projected to average nearly $52/bbl. this year, while moderating to around $48/bbl. in 2006. Now that the Federal Reserve has raised short-term interest rates nine times, from a 1.00% Fed funds rate seen a year ago to the current 3.25%, prognosticators are divided on the Fed’s future course of action. S&P believes the Fed will continue to raise rates throughout the year – despite a possible pause at the August FOMC meeting. S&P projects a 4.0% Fed funds rate, and 4.75% yield on the 10-year Treasury note, by the end of 2005. Even though the yield curve -- the difference between the yield on short and long-term instruments -- will likely narrow to 75 basis points (approximately 35 basis points below its 35-year average), S&P does not believe it portends an impending recession. We think it is more a reflection of the global nature of financial markets reflecting the attractiveness the U.S. offers global investors in the form of economic and governmental stability. Even though the dog days of summer may prove challenging to investors this year as they usually do – since 1990, the S&P 500 and its 10 sectors have posted declines on average during June through August – S&P’s Investment Policy Committee believes the S&P 500 will close out 2005 at the 1255 level for a 3.6% full-year gain. We believe the combination of still-healthy economy growth, an attractive market valuation and the eventual end to the Fed’s rate-tightening efforts will lead to an end-of-year rally in stocks. The IPC’s recommended allocation for a traditional “balanced” investors is 45% U.S. stocks, 15% foreign equities, 25% short-to-intermediate term bonds and 15% cash. We continue to believe that equities offer a superior risk-adjusted return. S&P suggests that investors overweight their exposure to the consumer staples, health care and utilities sectors, while underweighting the consumer discretionary, financials, industrials, information technology and materials sectors. July 2005 2 Equity Research / North America S&P POWERPICKS 2005 MID-YEAR PORTFOLIO The S&P PowerPicks 2005 Mid-Year Portfolio represents the current collective “best ideas” by the Standard & Poor’s U.S. equity research staff. Each of the 40 contributing industry analysts on S&P’s U.S. equity research staff considers the following stocks to be those best positioned for superior growth from each of the analyst’s industry coverage universe. The S&P PowerPicks 2005 Mid-Year Portfolio is diversified across all the 10 S&P economic sectors comprising the S&P 500 Index. The Portfolio will be “frozen”, meaning that it will undergo no changes during its one-year lifespan. The objective of the Portfolio is to exceed the total return (capital appreciation plus dividends paid) generated by the S&P 500 Index over the coming 12-months. The median capitalization of the S&P PowerPicks 2005 Mid-Year Portfolio is approximately $7.9 billion, ranging from a high of $388 billion for Exxon Mobil Corp. to a low of $300 million for Renovis Inc.. By contrast, the median market capitalization of the S&P 500 Index at May 31, 2005 was approximately $10.3 billion, ranging from a high of $387 billion for General Electric Co. to a low of $538 million for Delta Air Lines Inc.. The S&P PowerPicks 2005 Mid-Year Portfolio is comprised of 25 stocks considered to be large capitalization issues (market cap at or above $5 billion), 16 mid-cap issues ($1 billion to $4.99 billion), and one small-cap issue (below $1 billion). The sector representations within the S&P PowerPicks 2005 Mid-Year Portfolio are broadly representative of those within the S&P 500. On an equally weighted basis, the most significant sector weightings in the Portfolio are in the Financial, Information Technology and Health Care sectors, which collectively account for roughly 48% of the Portfolio. On a market capitalization-weighted basis, the collective weightings of these sectors within the S&P 500 Index also approximates 48%. July 2005 3 Equity Research / North America THE S&P POWERPICKS MID-YEAR 2005 PORTFOLIO S&P Ticker Company Mkt. Cap ($ Mln) Earns & S&P Index STARS Divd Rank Dividend Sub Industry Yield (%) Consumer Discretionary ISCA International Speedway 3,000 A- 400 5 0.1 LQI La Quinta Corp. 1,700 C None 5 - Leisure Facilities MCD McDonald’s Corp. 37,000 A 500 5 1.9 Restaurants MDC M.D.C. Holdings 3,500 A+ 600 5 0.8 Homebuilding NWS News Corp. 'A' 56,000 NR None 5 - Hotels, Resorts & Cruise Lines Movies & Entertainment Consumer Staples CVS CVS Corp, 24,000 B 500 5 0.4 SPC Spectrum Brands Inc. 1,800 NR 600 5 - Drug Retail Household Products STZ Constellation Brands Inc. 6,200 B+ 500 5 - Distillers & Vintners WWY Wrigley, (Wm) Jr. 15,600 A+ 500 5 1.6 Packaged Foods & Meats Energy SII Smith International, Inc. VLO Valero Energy Corp. XOM ExxonMobil Corp. 6,800 B 400 5 0.7 Oil & Gas Equipment & Services 21,000 B+ 500 5 0.4 Oil & Gas Refining, Marketing & Transportation 388,000 A- 500 5 1.9 Integrated Oil & Gas Financials ALL Allstate Corp 40,000 B+ 500 5 2.0 Property & Casualty Insurance C Citigroup Inc. 247,000 A+ 500 5 3.7 Other Diversified Financial Services CBH Commerce Bancorp Inc. 4,900 A+ 400 5 1.4 Regional Banks GS Goldman Sachs Group 50,000 NR 500 5 0.9 Investment Banking & Brokerage NDE IndyMac Bancorp Inc. 2,700 B+ 400 5 3.6 Thrifts & Mortgage Finance PFG Principal Financial Group 12,100 NR 500 5 1.2 Other Diversifed Financial Services SPG Simon Property Group 16,200 B+ 500 5 4.2 Real Estate Investment Trusts Health Care AMLN Amylin Pharmaceuticals Inc. HCA HCA Inc. 1,700 C None 5 - 24,000 B 500 5 1.0 IVX IVAX Corp. 5,500 B- 400 5 - Pharmaceuticals PHS PacifiCare Health Systems 5,600 B 400 5 - Managed Health Care RNVS Renovis Inc. NR None 5 - Biotechnology STJ St. Jude Medical Inc. 14,300 B 500 5 - Health Care Equipment 300 Biotechnology Health Care Facilities Industrials ASD American Standard Inc. BNI Burlington Northern Santa Fe GWW Grainger W.W. Inc. IR Ingersoll-Rand 'A' MTW Manitowoc Co. 8,900 B- 500 5 1.4 Building Products 19,000 A- 500 5 1.4 Railroads 5,000 A- 500 5 1.7 Trading Companies & Distributors 13,000 A 500 5 1.3 Industrial Machinery 1,300 B 600 5 0.6 Construction & Farm Machinery & Heavy Trucks Information Technology CSCO Cisco Systems Inc. 123,000 B+ 500 5 - Communications Equipment CTXS Citrix Systems Inc, 3,600 B+ 500 5 - Application Software EMC EMC Corp. 35,000 B 500 5 - Computer Storage & Peripherals MFE McAfee Inc. 4,300 B- 400 5 - Systems Software MXIM Maxim Integrated Products Inc. 13,000 B+ 500 5 1.0 NVLS Novellus Systems Inc. 3,700 B- 500 5 - ATI Allegheny Technologies Inc. 2,200 B- 500 5 1.0 FMC FMC Corp. 2,200 B- 400 5 - 4,600 A 500 5 0.6 10,300 C 500 5 - Semiconductors Semiconductor Equipment Materials Steel Diversified Chemicals Telecommunications Services CTL CenturyTel Inc. Integrated Telecommunication Services Utilities AES AES Corp. Independent Power Producers *Data as of June 30, 2005 July 2005 4 Equity Research / North America S&P POWERPICKS MID-YEAR 2005 PORTFOLIO SECTOR BREAKDOWN Information Technology 15% Materials 5% Telecommunication Services 3% Utilities 3% Consumer Consumer Discretionary Consumer Staples Energy Discretionary 13% Financials Consumer Staples 10% Industrials Industrials 12% Health Care Information Technology Health Care 15% Financials 17% Energy 7% Materials Telecommunication Services Utilities July 2005 5 Equity Research / North America STANDARD & POOR’S POWERPICKS MID-YEAR 2005 PORTFOLIO CONSUMER DISCRETIONARY International Speedway (ISCA): ISCA promotes motor sports activities in the U.S., sponsoring more than 100 events annually. The company owns and/or operates 11 major motorsports facilities, including Daytona International Speedway; Talladega Superspeedway in Alabama; Michigan International Speedway; and California Speedway. La Quinta Corp. (LQI): La Quinta operates a limited-service lodging company. The company owns and franchises 590 hotels in 39 states mainly under the names La Quinta Inns and La Quinta Inn & Suites, with approximately 65,000 rooms in 35 states. Other brands the company operates under include Baymont Inn & Suites, Woodfield Suites and Budgetel. McDonald’s Corp. (MCD): McDonald's is a global foodservice retailer with more than 30,000 local restaurants in more than 100 countries, serving a value-priced menu. Approximately 70% of McDonald's restaurants worldwide are owned and operated by independent, local businessmen and women. The company also operates Boston Market and Chipotle Mexican Grill, and has a minority interest in Pret A Manger. M.D.C. Holdings (MDC): MDC, whose subsidiaries build homes under the name Richmond American Homes, is a regional homebuilder with a presence in multiple states including Arizona, California, Colorado, Florida, Maryland, Utah, and Virginia. The Company also provides mortgage financing, primarily for its homebuyers, through a wholly owned subsidiary, HomeAmerican Mortgage Corporation. News Corp. ‘A’ (NWS.A): News Corp is a diversified international media and entertainment company with operations in eight industry segments: filmed entertainment; television; cable network programming; direct broadcast satellite television; magazines and inserts; newspapers; book publishing; and other. U.S.-based assets include Fox TV, FOX Film, HarperCollins Publishers, and an equity interest in Gemstar-TV Guide. July 2005 6 Equity Research / North America CONSUMER STAPLES CVS Corp. (CVS): CVS operates approximately 5,400 retail and specialty pharmacy stores in 36 states and the District of Columbia. The majority of CVS’ sales come from its pharmacy operations, predominantly derived from third-party managed care providers under prescription drug plans. The company also runs an online pharmacy at CVS.com. Spectrum Brands, Inc. (SPC): Spectrum Brands, formerly known as Rayovac, is a supplier of batteries, lawn and garden care products, specialty pet supplies, shaving and grooming products, household insecticides, personal care products and portable lighting. The company sells its products under the Rayovac, Remington, and VARTA brands. Constellation Brands, Inc. (STZ): Constellation Brands is an international producer and marketer of beverage alcohol brands with a broad portfolio across the wine, spirits and imported beer categories. Brands in Constellation's portfolio include Corona, Negra Modelo, St. Pauli Girl, Grande Amber Brandy, Effen Vodka and Robert Mondavi Winery brands. Wrigley, (Wm) Jr. (WWY): This company manufactures and markets quality confectionery products, primarily chewing gum. WWY’s primary brands include Juicy Fruit, Doublemint, Big Red, Wrigley's Spearmint, Airwaves, Alpine, Eclipse, Extra, Freedent, P.K and Winterfresh. ENERGY Smith International, Inc. (SII): The company is a worldwide supplier of premium products and services to the oil and gas exploration and production industry, the petrochemical industry and other industrial markets. Among the products and services provided by the company include drilling and completion fluid systems, solids control equipment and waste management services. Valero Energy Corp. (VLO): VLO owns and operates 14 refineries throughout the U.S., Canada and the Caribbean with a combined throughput capacity of approximately 2.4 million barrels per day. Valero is also one of the nation's largest retail operators with approximately 4,700 retail and wholesale branded outlets under Diamond Shamrock, Shamrock, Ultramar, Valero and Beacon brands. ExxonMobil Corp. (XOM): ExxonMobil explores for, produces, transports and sells crude oil, natural gas and petroleum products in the U.S. and about 200 other countries and territories. In addition the company makes and sells petrochemicals and owns interests in electric power generation facilities. July 2005 7 Equity Research / North America FINANCIALS Allstate Corp. (ALL): ALL provides insurance products to more than 16 million households through its exclusive agents and financial specialists. The company writes property-liability insurance, primarily private passenger automobile and homeowners’ policies, as well as offering life insurance, annuity and group pension products. Citigroup, Inc. (C): This global financial services company has some 200 million customer accounts and does business in more than 100 countries, supporting consumers, corporations, governments and institutions. The company’s range of financial products and services include consumer banking and credit, corporate and investment banking, insurance, securities brokerage, and asset management. Commerce Bancorp Inc. (CBH): Commerce has approximately 330 branches throughout New Jersey, New York, Pennsylvania, Delaware, and newer markets Washington, D.C., and Virginia. In addition, the company acts as an insurance broker, offering employee benefit programs as well as traditional insurance and risk management services. Goldman Sachs Group (GS): Goldman Sachs conducts global investment banking and securities business that provides services worldwide to a diversified client base that includes corporations, financial institutions, governments and high-net-worth individuals. The majority of the company’s revenues are derived from the trading and principal investments in equities, fixed income products, currencies and commodities. IndyMac Bancorp Inc. (NDE): NDE owns and operates IndyMac Bank F.S.B., a savings and loan association. IndyMac Bank is the largest savings and loan headquartered in Los Angeles County, CA and the 10th largest nationwide, based on assets as of December 2004. Through its hybrid thrift/mortgage banking business model, IndyMac handles financing related to single-family homes. Principal Financial Group (PFG): The Principal Financial Group is a provider of retirement savings, investment and insurance products and services, with about 15 million customers The company offers its products and services to small and medium sized businesses, individuals, and institutional clients in the United States and internationally. Simon Property Group (SPG): Simon Property Group, a real estate investment trust (REIT), engages in the ownership, operation, leasing, management, acquisition, expansion, and development of real estate properties. The majority of SPG’s income producing properties are regional malls and community shopping centers. July 2005 8 Equity Research / North America HEALTH CARE Amylin Pharmaceuticals, Inc. (AMLN): Amylin Pharmaceuticals engages in the discovery, development, and commercialization of drug candidates for the treatment of diabetes, obesity, and cardiovascular disease. Its primary drug candidates include exenatide and SYMLIN, which have completed phase III clinical trials for the treatment of diabetes. HCA, Inc. (HCA): HCA, Inc. engages in the ownership, management, or operation of hospitals, freestanding surgery centers, diagnostic and imaging centers, radiation and oncology therapy centers, rehabilitation and physical therapy centers. The facilities are located in 23 U.S. states, England, and Switzerland. IVAX Corp. (IVX): IVAX Corp. is a mid-sized developer, manufacturer and marketer of a wide range of generic and proprietary prescription pharmaceuticals. In the U.S., the company produces about 73 generic prescription drugs, in 168 dosage strengths, primarily under the trade names Zenith Goldline and Goldline. PacifiCare Health Systems (PHS): PacifiCare Health Systems, with total health plan enrollment of about more than 3.3 million members, is the largest Medicare HMO in the U.S., with more than 704,000 Medicare members. The majority of its members are located in Arizona, California, Colorado and Texas. In early July, PHS agreed to be acquired by UnitedHealth Group, pending necessary approvals. Renovis, Inc. (RNVS): Renovis is developing biopharmaceuticals to treat pain or trauma caused by neurodegenerative diseases and disorders, such as sciatica and strokes. As of early 2005, the company had three products in clinical development and numerous others in its research program St. Jude Medical Inc. (STJ): The company develops, manufactures and distributes cardiovascular medical devices for the global cardiac rhythm management, cardiac surgery and cardiology and vascular access therapy areas. STJ offers a range of products, such as pacemaker systems, defibrillator systems, and mechanical and tissue heart valves. July 2005 9 Equity Research / North America INDUSTRIALS American Standard, Inc. (ASD): The company manufactures air conditioning systems, fixtures and fittings for bathrooms and kitchens, and vehicle control systems including pneumatic breaking control systems for trucks, trailers and buses. The various products the company offers are sold under the brand names such as Trane, American Standard, Ideal Standard, Porcher, and Wabco. Burlington Northern Santa Fe (BNI): Burlington Northern Santa Fe, through its subsidiaries, operates a rail system of over 32,000 miles that spans 28 states and two Canadian provinces. The company transports various products and commodities throughout North America, including industrial products, coal, agricultural, and consumer products. Grainger W.W. (GWW): Grainger supplies facilities maintenance and other related products to organizations and institutions in North America. The company’s operations include the distribution of safety and security supplies, pumps and plumbing supplies, cleaning and painting supplies, as well as offering outsourced solutions for process re-engineering, inventory and, purchase management. Ingersoll-Rand ‘A’ (IR): Ingersoll-Rand designs manufactures, sells, and services climate control products, such as transport temperature control units, refrigerated display merchandisers, beverage coolers, and walk-in storage coolers and freezers, as well as heating, ventilation, and air conditioning systems. In addition, IR offers its customers a variety of infrastructure products such as skid-steer loaders and road construction equipment. Manitowoc Co. (MTW): The company makes crawler cranes, tower cranes and boom trucks for the global construction industry; commercial refrigeration equipment for the foodservice industry; and provides ship building, repair and maintenance services in the Great Lakes region. July 2005 10 Equity Research / North America INFORMATION TECHNOLOGY Cisco Systems, Inc. (CSCO): Cisco Systems manufactures and sells networking and communications products worldwide. The company provides a line of products for transporting data, voice, and video within buildings and across campuses. Its offerings include routers, which interconnect computer networks by moving data, voice, and video from one network to another, and switching systems that are used to build local area networks. Citrix Systems, Inc. (CTXS): Citrix Solutions designs, develops, markets and supports access infrastructure software and services for enterprise applications. The company’s broad suite of offerings enable corporate information technology (IT) staffs to support enterprise resources on demand and manage and protect access to their business information across their public networks. EMC Corp. (EMC): EMC designs, manufactures, markets, and supports a range of storage-related hardware, software and service products used to store and manage information over its lifecycle. The company’s products and services are used in transaction processing, enterprise resource planning, customer relationship management, data warehousing, electronic commerce, email, and Web hosting. McAfee, Inc. (MFE): McAfee supplies computer security solutions to prevent intrusions on networks and protect computer systems from various threats and attacks worldwide. The company’s software offerings include anti-virus, anti-spyware, managed services, application firewalls, and security products to protect systems, such as desktops and servers. Maxim Integrated Products, Inc. (MXIM): Maxim Integrated Products designs, develops, manufactures, and markets a range of linear and mixed-signal integrated circuits. The company’s products include data converters, interface circuits, microprocessor supervisors, power supplies, battery chargers, fiber optic transceivers, sensors, and voltage references. Novellus Systems, Inc. (NVLS): Novellus Systems develops manufactures, sells, and services semiconductor equipment used in the fabrication of integrated circuits. Customers for these products are manufacturers of semiconductor integrated circuits, who either incorporates the chips they manufacture in their own products or sell them to other companies. July 2005 11 Equity Research / North America MATERIALS Allegheny Technologies, Inc. (ATI): Allegheny Technologies produces, converts, and distributes stainless steel, nickel-based alloys, and titanium and titanium-based alloys, in various product forms, including plate, sheet, strip, engineered strip, and precision rolled strip products. The company serves the aerospace, oil and gas, transportation, food, chemical processing and medical industries. FMC Corp. (FMC): FMC is a chemical company that serves the agricultural, industrial, and consumer markets worldwide. The company manufactures and sells proprietary insecticides and herbicides used for the protection of cotton, corn, rice, cereals, vegetables and other crops. In addition, FMC manufactures and sells products that add texture, structure, and physical stability to beverage, dairy, meat and bakery products. TELECOMMUNICATIONS SERVICES CenturyTel Inc. (CTL): CenturyTel provides traditional local exchange telephone service mainly in rural areas and small to mid-size cities in 22 states, including Louisiana, Michigan, Ohio and Wisconsin. The company also provides long distance, Internet access, and, fiber transport and other communications services. UTILITIES AES Corp. (AES): AES provides electricity through its large utilities, contract generation, competitive supply, and growth distribution businesses. The company's generating assets include interests in 120 facilities in 25 countries totaling approximately 44 gigawatts of capacity. July 2005 12 Equity Research / North America Standard & Poor’s Global Equity Research 55 Water Street, 44th Floor New York, NY 10041, USA Sharon Shawn 212-438-9505 Equity Liaison Officer Brian McGovern 212-438-4654 Institutional Sales EQUITY RESEARCH POLICY Kenneth Shea Managing Director, Global Equity Research INVESTMENT POLICY Mark Arbeter, CMT Chief Technical Analyst Sam Stovall Chief Investment Strategist David Wyss, Ph.D. Chief Economist CONSUMER STAPLES & ENERGY Richard Joy, Group Head Beverages, Packaged Foods Joseph Agnese Agribusiness, Drug Retail, Food Retail Howard Choe Household Products, Personal Care Anishka Clarke Diversified Consumer Staples Stewart Glickman Oilfield Services & Drilling Charles LaPorta, CFA Oil & Gas Exploration & Production Royal Shepard, CFA NORTH AMERICAN EQUITY RESEARCH 55 Water Street New York, NY 10041 Oil & Gas Transportation Tina Vital Global Integrated Oil & Gas Stephen Biggar Director of Research - North America CONSUMER DISCRETIONARY- Cyclical Thomas Graves, CFA, Group Head HEALTH CARE Robert Gold, Group Head Health Care Equipment Frank DiLorenzo, CFA Biotechnology Markos Kaminis Emerging Growth Cameron Lavey Healthcare Facilities & Services Jeffrey Loo, CFA Diversified Health Care Lodging & Gaming Tuna N. Amobi, CFA, CPA Media & Entertainment Efraim Levy, CFA Auto Mfrs. & Auto Parts William Mack, CFA Homebuilding & Consumer Discretionary Gary McDaniel Media James Peters Publishing, Advertising Herman Saftlas Pharmaceuticals Phillip Seligman Managed Health Care CONSUMER DISCRETIONARY- Retail Marie Driscoll, CFA, Group Head Apparel Retailers & Mfrs. Jason Asaeda FINANCIALS- Insurers & Banks Catherine Seifert, Group Head Property Casualty Insurance Mark Hebeka, CFA Diversified Financial Services Christopher Muir Regional Banks General Merchandise Stores Amy Glynn, CFA Household Durables, Consumer Electronics Dennis Milton Restaurants Michael Souers Specialty Retail Jason Seo, CFA Thrifts & Mortgage Finance Gregory Simcik, CFA Life Insurance FINANCIALS- Asset Managers & Brokers Robert Hansen, CFA, Group Head Asset Managers & Securities Brokers Raymond Mathis Real Estate Investment Trusts Robert McMillan Real Estate Investment Trusts July 2005 13 Equity Research / North America EMERGING GROWTH Mark Basham INDUSTRIALS & MATERIALS Michael Jaffe, Group Head Building Products & Diversified Commercial Services Emerging Growth Richard Tortoriello Emerging Growth James Corridore Airlines & Air Freight Anthony Fiore, CFA Industrial Machinery Robert Friedman, CPA Aerospace & Defense SUPERVISORY ANALYSTS Barry King Jeff Perlmutter Pamela Schultz John Hingher Diversified Materials Leo Larkin Diversified Metals & Mining Richard O’Reilly, CFA Chemicals Stewart Scharf Environmental Services, Water Utilities & Packaging EDITORS Charles Baumann Diane Cappadona Art Epstein Mike Fink Peter Willson Andrew West, CFA Railroads & Trucking EUROPEAN EQUITY RESEARCH INFORMATION TECHNOLOGY Scott Kessler, Group Head Internet Software & Services; Internet Retail Zaineb Bokhari Applications Software Stephanie Crane IT Services Megan Graham-Hackett Computer Hardware Colin McArdle Semiconductor Equipment Jonathan Rudy, CFA Software Richard Stice, CFA Computer Storage; Electronic Manufacturing Services Amrit Tewary Semiconductors 20 Canada Square Canary Wharf, London United Kingdom Subhajit Gupta, CFA Director of Research – Europe Telecommunications & Information Technology Derek Chambers Financials Alessandra Coppola Consumer Discretionary Jelena Karafotias, CFA Consumer Staples Sreedhar Mahamkali Consumer Staples Yannick Mathieu, CFA Consumer Discretionary Sho Matsubara Health Care TELECOM SERVICES & UTILITIES Kenneth Leon, CPA, Group Head Wireless Telecom Services Ari Bensinger Telecommunications Equipment Justin McCann Electric Utilities Todd Rosenbluth Integrated Telecom Services Yogeesh Wagle Gas Utilities Habib Nasrallah, CFA Industrials Cristina Perea Telecommunications David Seemungal Pharmaceuticals Rahul Shah Financials Dave Thomas Energy David Wilson Utilities Clive McDonnell European Strategist Charles Dautresme Assistant Strategist July 2005 14 Equity Research / North America NORDIC EQUITY RESEARCH Mäster Samuelsgatan 6 Box 1753 111 87 Stockholm, Sweden Tom Smith, CFA Head of Equities – Nordic Region Mats Anderson Financials Stefan Andersson, CEFA Commercial Services Hans Derninger Construction Lars Glemstedt Automobiles & Parts, Industrials Morten Larsen Biotechnology Stefan Nelson Media Claes Rasmuson Paper & Forest Products Daniel Schmidt Consumer Goods Analyst Joakim Ström Diversified Financials Inger Söderbom Communications Equipment Johan Wettergren Industrial Machinery ASIAN EQUITY RESEARCH 30 Cecil Street, Singapore 049712 Singapore Lorraine Tan, CFA Director of Research – Asia Energy, Materials & Utilities Sharon Wong, CFA Deputy Head – Asia Consumer Staples & Discretionary Christopher K. Lee Deputy Head – Asia Industrials, Electronics & Technology Winston Siay, CFA Financials Yeu Huan Lai, CFA Real Estate & REITs Belinda Chan, CPA Industrials Alexander Chia, ACA Malaysia Telecommunications & Industrials Lee Leng Hoe, CPA Malaysia Consumer Discretionary & Staples Donovan Huang China Energy, Materials & Utilities Chan Pheng Lee, CFA Malaysia Property & Technology Joy Lee Telecommunications & Media Vincent Ng Transportation Geraldine Seah Real Estate & REITs Alison Seng Consumer Staples David So Telecommunications, Tech & Media Bradley Way China Energy, Materials & Utilities John S. Yang Japan Technology Dean Khor Technical Analyst Shukor Yusof Supervisory Editor July 2005 15 Equity Research / North America Required Disclosures In the U.S. As of June 30, 2005, research analysts at Standard & Poor’s Equity Research Services U.S. have recommended 30.2% of issuers with buy recommendations, 57.5% with hold recommendations and 12.3% with sell recommendations. In Europe As of June 30, 2005, research analysts at Standard & Poor’s Equity Research Services Europe have recommended 34.4% of issuers with buy recommendations, 46.8% with hold recommendations and 18.8% with sell recommendations. In Asia As of June 30, 2005, research analysts at Standard & Poor’s Equity Research Services Asia have recommended 33.3% of issuers with buy recommendations, 47.2% with hold recommendations and 19.5% with sell recommendations. Globally As of June 30, 2005, research analysts at Standard & Poor’s Equity Research Services globally have recommended 31.0% of issuers with buy recommendations, 55.4% with hold recommendations and 13.6% with sell recommendations. 5-STARS (Strong Buy): Total return is expected to outperform the total return of a relevant benchmark, by a wide margin over the coming 12 months, with shares rising in price on an absolute basis. 4-STARS (Buy): Total return is expected to outperform the total return of a relevant benchmark over the coming 12 months, with shares rising in price on an absolute basis. 3-STARS (Hold): Total return is expected to closely approximate the total return of a relevant benchmark over the coming 12 months, with shares generally rising in price on an absolute basis. 2-STARS (Sell): Total return is expected to underperform the total return of a relevant benchmark over the coming 12 months, and the share price is not anticipated to show a gain. 1-STARS (Strong Sell): Total return is expected to underperform the total return of a relevant benchmark by a wide margin over the coming 12 months, with shares falling in price on an absolute basis. Relevant benchmarks: in the U.S. the relevant benchmark is the S&P 500 Index, in Europe the S&P Europe 350 Index, in Asia the S&P Asia 50 Index, and in Malaysia the KLCI or KL Emas Index. For All Regions: All of the views expressed in this research report accurately reflect the research analyst's personal views regarding any and all of the subject securities or issuers. No part of analyst compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in this research report. Additional information is available upon request. Other Disclosures This report has been prepared and issued by Standard & Poor’s and/or one of its affiliates. In the United States, research reports are prepared by Standard & Poor’s Investment Advisory Services LLC (“SPIAS”). In the United States, research reports are issued by Standard & Poor’s (“S&P”), in the United Kingdom by Standard & Poor’s LLC (“S&P LLC”), which is authorized and regulated by the Financial Services Authority; in Hong Kong by Standard & Poor’s LLC which is regulated by the Hong Kong Securities Futures Commission, in Singapore by Standard & Poor’s LLC, which is regulated by the Monetary Authority of Singapore; in Japan by Standard & Poor’s LLC, which is regulated by the Kanto Financial Bureau; in Sweden by Standard & Poor’s AB (“S&P AB”), in Malaysia by Standard & Poor’s Malaysia Sdn Bhd (“S&PM”) which is regulated by the Securities Commission and in Australia by Standard & Poor’s Information Services (Australia) Pty Ltd (“SPIS”) which is regulated by the Australian Securities & Investments Commission. The research and analytical services performed by SPIAS, S&P LLC, S&P AB, S&PM and SPIS are each conducted separately from any other analytical activity of Standard & Poor’s. One of the following sentences should also be included, where applicable: S&P and/or one of its affiliates has performed services for and received compensation from this company during the past twelve months. OR This company is not a customer of S&P or its affiliates. Disclaimers This material is based upon information that we consider to be reliable, but neither S&P nor its affiliates warrant its completeness, accuracy or adequacy and it should not be relied upon as such. With respect to reports issued by S&P LLC-Japan and in the case of inconsistencies between the English and Japanese version of a report, the English version prevails. Neither S&P LLC nor S&P guarantees the accuracy of the translation. Assumptions, opinions and estimates constitute our judgment as of the date of this material and are subject to change without notice. Neither S&P nor its affiliates are responsible for any errors or omissions or for results obtained from the use of this information. Past performance is not necessarily indicative of future results. This material is not intended as an offer or solicitation for the purchase or sale of any security or other financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Any opinions expressed herein are given in good faith, are subject to change without notice, and are only correct as of the stated date of their issue. Prices, values, or income from any securities or investments mentioned in this report may fall against the interests of the investor and the investor may get back less than the amount invested. Where an investment is described as being likely to yield income, please note that the amount of income that the investor will receive from such an investment may fluctuate. Where an investment or security is denominated in a different currency to the investor’s currency of reference, changes in rates of exchange may have an adverse effect on the value, price or income of or from that investment to the investor. The information contained in this report does not constitute advice on the tax consequences of making any particular investment decision. This material does not take into account your particular investment objectives, financial situations or needs and is not intended as a recommendation of particular securities, financial instruments or strategies to you. Before acting on any recommendation in this material, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. For residents of the U.K. –this report is only directed at and should only be relied on by persons outside of the United Kingdom or persons who are inside the United Kingdom and who have professional experience in matters relating to investments or who are high net worth persons, as defined in Article 19(5) or Article 49(2) (a) to (d) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2001, respectively. July 2005 16