Liechtenstein

advertisement

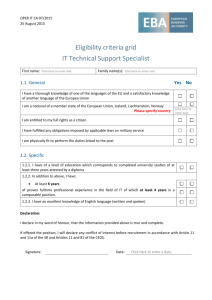

Liechtenstein General Type of Company AG Anstalt Political Stability Excellent Common or Civil Law Civil Disclosure of Beneficial Owner No Migration of Domicile Permitted Yes Corporate Taxation 12.5% with min annual tax of CHF 1,200 Language of Name Latin Alphabet Corporate Requirements Minimum Number of Shareholders / Members One One holder of Founder’s rights Minimum Number of Directors / Managers One One Corporate Directors / Managers Permitted Yes Yes Company Secretary Required No No CHF 50,000 CHF 30,000 Registered Office/Agent Yes Yes Company Secretary No No Local Directors Yes Yes Local Meetings No No Government Register of Directors / Managers Yes Yes Government Register of Shareholders /Members No No Annual Return Yes Yes Submit Accounts Yes Yes / No CHF 1,200 CHF 1,200 N/A N/A Usual Authorised Capital Local Requirements Annual Requirements Recurring Government Costs Minimum Annual Tax/Licence Fee Annual Return Filing Fee [80513] 2 GENERAL INFORMATION Introduction The Principality of Liechtenstein lies in the region of the Upper Rhine between the Swiss Canton of St. Gall and the Austrian Federal State of Vorarlberg. The topography is mainly mountainous, other than the Rhine Valley, which is the most populated area. Population The Principality of Liechtenstein has a population of approximately 35,000 people. Political Structure The Reigning Prince is Head of State and the Diet (parliament) has 25 elected members who propose the Head of Government, Deputy and 3 Councilors who form the Government and are not members of the Diet. Liechtenstein is a member of the United Nations; the Council of Europe, EFTA and the EEA, and membership of these does not influence local fiscal policy. Language The official language of The Principality of Liechtenstein is German, although a dialect is spoken widely. English is also spoken and is used in most commercial transactions and communications. Currency The official currency of The Principality of Liechtenstein is the Swiss Franc. Exchange Control Under the treaty with Switzerland, there are no foreign Exchange Controls. Type of Law Civil Law; based on Swiss and Austrian law with local adaptations. Principal Corporate Legislation Personen und Gesellschaftsrecht mit dem Gesetz über das Treuhandunternehmen 1926 (Persons and Companies Law with the Law on Registered Trusts). COMPANY INFORMATION Type of Company for International Trade and Investment Aktiengesellschaft – AG Ltd (Company Limited by Shares). Gesellschaft mit beschränkter Haftung - GmbH (Private Limited Company without Shares). Anstalt (Establishment, commercial and non-commercial without shares). Stiftung (Foundation). Treuunternehmen (Registered Trust). Treuhandschaft (Trust). There are three main types of entities in use - the Establishment or Anstalt, the family foundation and the company limited by shares. The most important entity for tax purposes is the Anstalt, which is commonly used by foreign companies as a holding company for overseas subsidiaries. The Anstalt is an entity, which has no members, participants or shareholders but a holder of the founder's rights, and is a hybrid between a company limited by shares and a foundation. It is popular because, with minor exceptions, it is free to conduct all kinds of business, including non-trading activities such as holding passive investments. Procedure to Incorporate The procedure for the establishment of Liechtenstein entities follows Civil Law practice. The procedure requires the submission to the Offentlichkeitsregister (Public Registry) of the following information: The Deed constituting the statutes signed by the subscriber or agent. The proposed name of the company. Share capital, division of capital and type of shares (where appropriate). A declaration that the minimum capital has been paid in to a Bank in either Liechtenstein or Switzerland. [80513] 2 2 3 Names, addresses and nationalities of directors and confirmation that they consent to act as directors. Confirmation that a Liechtenstein resident representative has been appointed. Restrictions on Trading A Liechtenstein body corporate or trust cannot undertake the business of banking, insurance, assurance, reinsurance, fund management, collective investment schemes or any other activity that would suggest an association with the Banking or Finance industries, unless a special licence is obtained. Powers of Company The powers of Liechtenstein bodies corporate are contained in the Company's statutes (within the framework of the PGR), but may be defined in such a way to provide general powers. Language of Legislation and Corporate Documents German, but foreign language translations can be obtained. Registered Office Required Entities must appoint a local representative. Shelf Companies Available Owing to the costs associated with incorporation and the paid up share capital requirements, shelf companies are not widely available. Time Scale to Incorporate Subject to the proposed name being approved by the Public Registry and the criteria for incorporation has been strictly adhered to, a body corporate or trust can be established in 3-5 working days. Name Restrictions A name that is identical or similar to an existing name. A major name that is known to exist elsewhere. A name that may imply government patronage. A name that in the opinion of the Registrar may be considered undesirable. Language of Name The name of a body corporate or trust entity may use any language using the Latin alphabet, but the Public Registry may require a German translation. Names Requiring Consent or a Licence The following names or their derivatives: bank, building society, savings, insurance, assurance, reinsurance, fund management, investment fund, Liechtenstein, state, country, municipality, principality, Red Cross and their foreign language equivalents. Suffixes to Denote Limited Liability Aktiengesellschaft – AG Ltd or SA Ltd. Gesellschaft mit beschränkter Haftung - GmbH. Anstalt - Establishment Disclosure of Beneficial Owner to Authorities None, but the identity of the beneficial owners must be provided to the local representatives/trust management company only. COMPLIANCE Authorised and Issued Share Capital The minimum authorised issued and paid up share capital for: An Aktiengesellschaft is CHF 50,000. An Anstalt is CHF 30,000. A Stiftung is CHF 30,000. A Trust Enterprise is CHF 30,000. [80513] 3 3 4 Classes of Shares Permitted An Aktiengesellschaft may issue registered, bearer, no par value, preference shares and shares with special voting rights. A GmbH, Anstalt, Stiftung and a Trust do not have shares. (The founder's / owner's rights are expressed in a deed or in bylaws.) Taxation In September 2010, Liechtenstein’s government adopted a new Tax Act, designed to modernize the existing Liechtenstein Tax Act of 1961 and includes as 12.5% flat rate of corporate tax (minimum tax CHF 1,200 per annum). The Act came into force on 1st January 2011. Double Taxation Agreements Liechtenstein has agreements with Austria and Luxembourg. Licence Fees See taxation. Financial Statement Requirements An Aktiengesellschaft and GmbH are required to submit audited financial statements to the Liechtenstein tax administrator for assessment. A commercial Anstalt is required to submit audited financial statements to the Liechtenstein tax administrator. A non-commercial Anstalt need not submit accounts to the Liechtenstein tax administrator, solely a statement of assets and liabilities has to be drawn up. A Stiftung need not submit accounts to the Liechtenstein tax administrator; solely a statement of assets and liabilities has to be drawn up. Directors The minimum number of directors for Aktiengesellschaft, GmbH and Anstalt is one. The directors may be natural persons or bodies corporate and can be of any nationality, but at least one director must be a natural person, a resident of Liechtenstein and qualified to act. The Liechtenstein Stiftung does not have a board of directors, but appoints a Foundation Council, who may be natural persons or bodies corporate. They may be of any nationality but at least one member of the Council must be a natural person, a resident of Liechtenstein and qualified to act. Company Secretary The concept of a company secretary is not recognised in The Principality of Liechtenstein. Shareholders The minimum number of shareholders/equity participants/ beneficiaries of any Liechtenstein entity is one, except of the GmbH, which requires two. Disclaimer Whilst every effort has been made to ensure that the details contained herein are correct and up-to-date, it does not constitute legal or other professional advice. OCRA Worldwide does not accept any responsibility, legal or otherwise, for any errors or omission. [80513] 4 4