Grounds Maintenance Worker I

advertisement

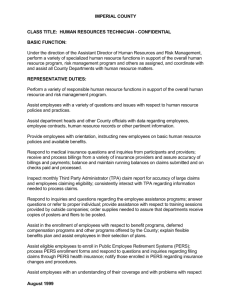

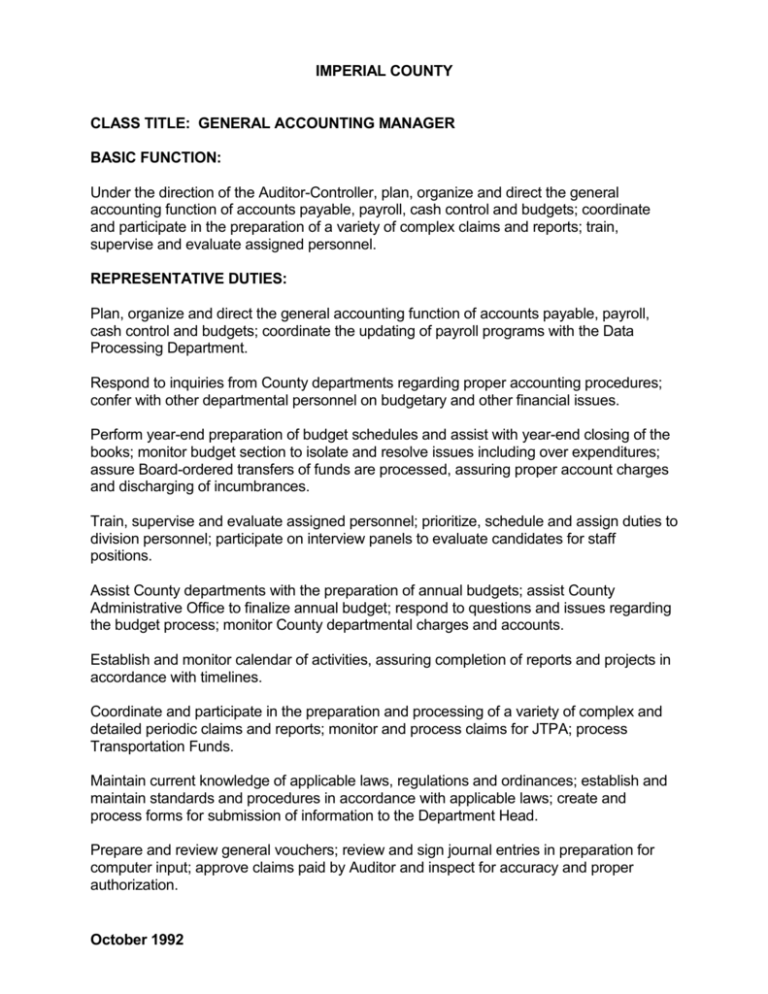

IMPERIAL COUNTY CLASS TITLE: GENERAL ACCOUNTING MANAGER BASIC FUNCTION: Under the direction of the Auditor-Controller, plan, organize and direct the general accounting function of accounts payable, payroll, cash control and budgets; coordinate and participate in the preparation of a variety of complex claims and reports; train, supervise and evaluate assigned personnel. REPRESENTATIVE DUTIES: Plan, organize and direct the general accounting function of accounts payable, payroll, cash control and budgets; coordinate the updating of payroll programs with the Data Processing Department. Respond to inquiries from County departments regarding proper accounting procedures; confer with other departmental personnel on budgetary and other financial issues. Perform year-end preparation of budget schedules and assist with year-end closing of the books; monitor budget section to isolate and resolve issues including over expenditures; assure Board-ordered transfers of funds are processed, assuring proper account charges and discharging of incumbrances. Train, supervise and evaluate assigned personnel; prioritize, schedule and assign duties to division personnel; participate on interview panels to evaluate candidates for staff positions. Assist County departments with the preparation of annual budgets; assist County Administrative Office to finalize annual budget; respond to questions and issues regarding the budget process; monitor County departmental charges and accounts. Establish and monitor calendar of activities, assuring completion of reports and projects in accordance with timelines. Coordinate and participate in the preparation and processing of a variety of complex and detailed periodic claims and reports; monitor and process claims for JTPA; process Transportation Funds. Maintain current knowledge of applicable laws, regulations and ordinances; establish and maintain standards and procedures in accordance with applicable laws; create and process forms for submission of information to the Department Head. Prepare and review general vouchers; review and sign journal entries in preparation for computer input; approve claims paid by Auditor and inspect for accuracy and proper authorization. October 1992 General Accounting Manager - Continued Page 2 Receive and respond to complaints, questions and issues referred to the AuditorController’s Office; research, resolve and report final determination and actions to the Department Head. Attend conferences, seminars and workshops to remain current on new laws, regulations and legislation; read and interpret laws pertaining to the department; recommend and implement new practices and procedures to improve efficiency. Coordinate the accounts payable section, assuring each claim is audited, corrected or rejected; assure proper departmental funds are charged. Assure daily cash amount balances with the Treasurer’s Office; coordinate the processing of adjustments as needed. Perform related duties as assigned. KNOWLEDGE AND ABILITIES: KNOWLEDGE OF: Complex governmental accounting principles, practices and procedures. Principles of public finance and business law applicable to County fiscal operations. Laws, rules and regulations related to assigned activities. Policies and objectives of assigned program and activities. Generally Accepted Accounting Principles applicable to County accounting. Contract provisions and benefit requirements affecting County payroll. Preparation and analysis of complex financial statements and reports. Principles and practices of supervision and training. Budget preparation and control. Modern office practices, procedures and equipment. Oral and written communication skills. County organization, operations, policies and objectives. Interpersonal skills using tact, patience and courtesy. Operation of a computer terminal and data entry techniques. ABILITY TO: Plan, organize, direct complex general accounting operations. Perform a wide variety of complex accounting duties related to the preparation, maintenance and review of financial records, accounts and reports for the County. Prepare and analyze comprehensive accounting reports. Develop and analyze comprehensive budgets. Prepare, verify, process and control an assigned major payroll. Read, interpret, apply and explain rules, regulations, policies and procedures. Maintain current knowledge of program rules, regulations, requirements and restrictions. Analyze situations accurately and adopt an effective course of action. Establish and maintain cooperative and effective working relationships with others. Maintain records and prepare reports. Operate a computer terminal to enter data, maintain records and generate reports. Plan and organize work. October 1992 General Accounting Manager - Continued Page 3 Prioritize and schedule work. Train, supervise and evaluate personnel. EDUCATION AND EXPERIENCE: Any combination equivalent to: bachelor’s degree in accounting, finance or business administration and three years of professional accounting experience. LICENSES AND OTHER REQUIREMENTS: Valid California driver's license. WORKING CONDITIONS: Office environment; subject to time deadlines and driving a vehicle to conduct work. Physical abilities required include bending, reaching to retrieve and maintain files, carrying, moderate lifting, dexterity of hands and fingers to operate standard office equipment and computers, hearing and speaking to exchange information, sitting for extended periods of time, and climbing stairs. October 1992