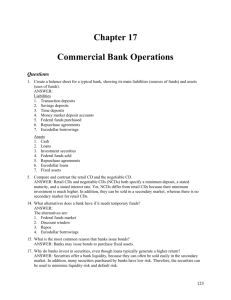

Unit i - E

advertisement

UNIT I

FINANCIAL MARKET

Syllabus

Financial Market in India – Financial Sector Reforms – Money Market –

Capital Market – Bond Market – Types of Bonds.

1 What is Indian Financial Market?

What does the India Financial market comprise of? It talks about the primary market, FDIs, alternative

investment options, banking and insurance and the pension sectors, asset management segment as well.

With all these elements in the India Financial market, it happens to be one of the oldest across the globe

and is definitely the fastest growing and best among all the financial markets of the emerging economies.

The history of Indian capital markets spans back 200 years, around the end of the 18th century. It was at

this time that India was under the rule of the East India Company. The capital market of India initially

developed around Mumbai; with around 200 to 250 securities brokers participating in active trade during

the second half of the 19th century.

2 What is the Scope of the India Financial Market?

The financial market in India at present is more advanced than many other sectors as it became organized

as early as the 19th century with the securities exchanges in Mumbai, Ahmedabad and Kolkata. In the

early 1960s, the number of securities exchanges in India became eight - including Mumbai, Ahmedabad

and Kolkata. Apart from these three exchanges, there was the Madras, Kanpur, Delhi, Bangalore and Pune

exchanges as well. Today there are 23 regional securities exchanges in India.

The Indian stock markets till date have remained stagnant due to the rigid economic controls. It was only

in 1991, after the liberalization process that the India securities market witnessed a flurry of IPOs serially.

The market saw many new companies spanning across different industry segments and business began to

flourish.

The launch of the NSE (National Stock Exchange) and the OTCEI (Over the Counter Exchange of India)

in the mid 1990s helped in regulating a smooth and transparent form of securities trading.

The regulatory body for the Indian capital markets was the SEBI (Securities and Exchange Board of

India). The capital markets in India experienced turbulence after which the SEBI came into prominence.

The market loopholes had to be bridged by taking drastic measures.

Potential of the India Financial Market India Financial Market helps in promoting the savings of the economy - helping to adopt an effective

channel to transmit various financial policies. The Indian financial sector is well-developed, competitive,

efficient and integrated to face all shocks. In the India financial market there are various types of financial

products whose prices are determined by the numerous buyers and sellers in the market. The other

determinant factor of the prices of the financial products is the market forces of demand and supply. The

various other types of Indian markets help in the functioning of the wide India financial sector.

3 What are the Features of the Financial Market in India?

India Financial Indices - BSE 30 Index, various sector indexes, stock quotes, Sensex charts, bond

prices, foreign exchange, Rupee & Dollar Chart

Indian Financial market news

Stock News - Bombay Stock Exchange, BSE Sensex 30 index, S&P CNX-Nifty, company

information, issues on market capitalization, corporate earning statements

Fixed Income - Corporate Bond Prices, Corporate Debt details, Debt trading activities, Interest

Rates, Money Market, Government Securities, Public Sector Debt, External Debt Service

Foreign Investment - Foreign Debt Database composed by BIS, IMF, OECD,& World Bank,

Investments in India & Abroad

Global Equity Indexes - Dow Jones Global indexes, Morgan Stanley Equity Indexes

Currency Indexes - FX & Gold Chart Plotter, J. P. Morgan Currency Indexes

National and Global Market Relations

Mutual Funds

Insurance

4 What is Capital market?

Introduction

There are 22 stock exchanges in India, the first being the Bombay Stock Exchange (BSE), which began

formal trading in 1875, making it one of the oldest in Asia. Over the last few years, there has been a rapid

change in the Indian securities market, especially in the secondary market. Advanced technology and

online-based transactions have modernized the stock exchanges. In terms of the number of companies

listed and total market capitalization, the Indian equity market is considered large relative to the country’s

stage of economic development. The number of listed companies increased from 5,968 in March 1990 to

about 10,000 by May 1998 and market capitalization has grown almost 11 times during the same period.

The debt market, however, is almost nonexistent in India even though there has been a large

volume of Government bonds traded. Banks and financial institutions have been holding a substantial part

of these bonds as statutory liquidity requirement. The portfolio restrictions on financial institutions’

statutory liquidity requirement are still in place. A primary auction market for Government securities has

been created and a primary dealer system was introduced in 1995. There are six authorized primary

dealers. Currently, there are 31 mutual funds, out of which 21 are in the private sector. Mutual funds were

opened to the private sector in 1992. Earlier, in 1987, banks were allowed to enter this business, breaking

the monopoly of the Unit Trust of India (UTI), which maintains a dominant position.

Before 1992, many factors obstructed the expansion of equity trading. Fresh capital issues were

controlled through the Capital Issues Control Act. Trading practices were not transparent, and there was a

large amount of insider trading. Recognizing the importance of increasing investor protection, several

measures were enacted to improve the fairness of the capital market. The Securities and Exchange Board

of India (SEBI) was established in 1988. Despite the rules it set, problems continued to exist, including

those relating to disclosure criteria, lack of broker capital adequacy, and poor regulation of merchant

bankers and underwriters. There have been significant reforms in the regulation of the securities market since

1992 in conjunction with overall economic and financial reforms. In 1992, the SEBI Act was enacted giving

SEBI statutory status as an apex regulatory body. And a series of reforms was introduced to improve

investor protection, automation of stock trading, integration of national markets, and efficiency of market

operations. India has seen a tremendous change in the secondary market for equity. Its equity market will

most likely be comparable with the world’s most advanced secondary markets within a year or two. The

key ingredients that underlie market quality in India’s equity market are:

• exchanges based on open electronic limit order book;

• nationwide integrated market with a large number of informed traders and fluency of short or

long positions; and

• no counterparty risk.

Among the processes that have already started and are soon to be fully implemented are electronic

settlement trade and exchange-traded derivatives. Before 1995, markets in India used open outcry, a

trading process in which traders shouted and handsignaled from within a pit. One major policy initiated by

SEBI from 1993 involved the shift of all exchanges to screen-based trading, motivated primarily by the

need for greater transparency. The first exchange to be based on an open electronic limit order book was

the National Stock Exchange (NSE), which started trading debt instruments in June 1994 and equity in

November 1994. In March 1995, BSE shifted from open outcry to a limit order book market. Currently, 17

of India’s stock exchanges have adopted open electronic limit order. Before 1994, India’s stock markets

were dominated by BSE. In other parts of the country, the financial industry did not have equal access to

markets and was unable to participate in forming prices, compared with market participants in Mumbai

(Bombay). As a result, the prices in markets outside Mumbai were often different from prices in Mumbai.

These pricing errors limited order flow to these markets. Explicit nationwide connectivity and

implicit movement toward one national market has changed this situation (Shah and Thomas, 1997). NSE

has established satellite communications which give all trading members of NSE equal access to the

market. Similarly, BSE and the Delhi Stock Exchange are both expanding the number of trading terminals

located all over the country. The arbitrages are eliminating pricing discrepancies between markets. Despite

these big improvements in microstructure, the Indian capital market has been in decline during the last

three years. The amount of capital issued has dropped from the level of its peak year,1994/95, and so have

equity prices. In 1994/95, Rs276 billion was raised in the primary equity market. This figure fell to Rs208

billion in 1995/96 and to Rs142 billion in 1996/97. The BSE-30 index or Sensex, the sensitive index of

equity prices, peaked at 4,361 in September 1994 and fell during the following years. A leading

cause was that financial irregularities and overvaluations of equity prices in the earlier years had eroded

public confidence in corporate shares. Also, there was a reduced inflow of foreign investment after the

Mexican and Asian financial crises. In a sense, the market is now undergoing a period of adjustment.

Thus, it is time for regulatory authorities to make greater efforts to recover investors’ confidence and to

further improve the efficiency and transparency of market operations. The Indian capital market still faces

many challenges if it is to promote more efficient allocation and mobilization of capital in the economy.

First, market infrastructure has to be improved as it hinders the efficient flow of information and effective

corporate governance. Accounting standards will have to adapt to internationally accepted accounting

practices. The court system and legal mechanism should be enhanced to better protect small shareholders’

rights and their capacity to monitor corporate activities. Second, the trading system has to be made more

transparent. Market information is a crucial public good that should be disclosed or made

available to all participants to achieve market efficiency. SEBI should also monitor more closely cases of

insider trading. Third, India may need further integration of the national capital market through

consolidation of stock exchanges. The trend all over the world is to consolidate and merge existing stock

exchanges. Not all of India’s 22 stock exchanges may be able to justify their existence. There is a pressing

need to develop a uniform settlement cycle and common clearing system that will bring an end to

unnecessary speculation based on arbitrage opportunities. Fourth, the payment system has to be improved

to better link the banking and securities industries. India’s banking system has yet to come up with good

electronic funds transfer (EFT) solutions. EFT is important for problems such as direct payments of

dividends through bank accounts, eliminating counterparty risk, and facilitating foreign institutional

investment. The capital market cannot thrive alone; it has to be integrated with the other segments of the

financial system.

The global trend is for the elimination of the traditional wall between banks and the securities

market. Securities market development has to be supported by overall macroeconomic and financial sector

environments. Further liberalization of interest rates, reduced fiscal deficits, fully market-based issuance

of Government securities, and a more competitive banking sector will help in the development of a

sounder and a more efficient capital market in India. Capital Market Reforms and Developments

Reforms in the Capital Market Over the last few years, SEBI has announced several far-reaching reforms

to promote the capitalmarket and protect investor interests. Reforms in the secondary market have focused

on three main areas: structure and functioning of stock exchanges, automation of trading and post trade

systems, and the introduction of surveillance and monitoring systems. (See Appendix 1 for a listing of

reforms since 1992). Computerized online trading of securities, and setting up of clearing houses or

settlement guarantee funds were made compulsory for stock exchanges. Stock exchanges were permitted

to expand their trading to locations outside their jurisdiction through computer terminals. Thus, major

stock exchanges in India have started locating computer terminals in far-flung areas, while smaller

regional exchanges are planning to consolidate by using centralized trading under a federated structure.

Online trading systems have been introduced in almost all stock exchanges. Trading is much more

transparent and quicker than in the past.

Until the early 1990s, the trading and settlement infrastructure of the Indian capital market was

poor. Trading on all stock exchanges was through open outcry, settlement systems were paper-based, and

market intermediaries were largely unregulated. The regulatory structure was fragmented and there was

neither comprehensive registration nor an apex body of regulation of the securities market. Stock

exchanges were run as “brokers clubs” as their management was largely composed of brokers. There

was no prohibition on insider trading, or fraudulent and unfair trade practices (see Appendix 2).

Since 1992, there has been intensified market reform, resulting in a big improvement in securities trading,

especially in the secondary market for equityMost stock exchanges have introduced online trading

and set up clearing houses/corporations. A depository has become operational for scripless trading

and the regulatory structure has been overhauled with most of the powers for regulating the capital

market vested with SEBI. The Indian capital market has experienced a process of structural transformation

with operations conducted to standards equivalent to those in the developed markets. It was opened

up for investment by foreign institutional investors (FIIs) in 1992 and Indian companies were allowed

to raise resources abroad through Global Depository Receipts (GDRs) and Foreign Currency Convertible

Bonds (FCCBs). The primary and secondary segments of the capital market expanded rapidly, with

greater institutionalization and wider participation of individual investors accompanying this growth.

However, many problems, including lack of confidence in stock investments, institutional overlaps, and

other governance issues, remain as obstacles to the improvement of Indian capital market efficiency.

Stock Market

PRIMARY MARKET

Since 1991/92, the primary market has grown fast as a result of the removal of investment restrictions

in the overall economy and a repeal of the restrictions imposed by the Capital Issues Control Act. In

1991/92, Rs62.15 billion was raised in the primary market.

5 What is Bond market ?

The need for a liquid and efficient Indian rupee debt market to fund infrastructure and other term

finance is well accepted . But very little has happened. It is difficult to imagine an efficient debt market

with an illiquid and inefficient sovereign bond market. The sovereign bond market sets the benchmark for

pricing across the credit-risk spectrum. Liquidity and efficiency in a financial market can be measured

using three parameters :

Immediacy: Ability to execute trades of a small size immediately without moving the price adversely

Depth: Impact cost suffered when doing large trades

Resilience: Speed with which prices and liquidity of the market revert to normal conditions after a large

trade has taken place.

India’s sovereign bond market satisfies the immediacy and depth conditions only for “on-the -run”

government bonds (i.e., the most recently-issued government bond of a specific maturity). Otherwise, the

domestic sovereign bond market is largely inefficient. Except for about 8-10 securities at a time for which

two way quotes are available in the market, other parts of the yield curve represent securities that are not

actively traded. Activity is concentrated in a few securities due to the market confidence in them and the

ability to liquidate positions quickly for these specific bonds at a fair value.

The absence of market making activity in other securities or the non-availability of any reasonable quote

discourages trading in such securities. Perceived inability to offload holdings at around stop loss levels, if

required, works as an effective deterrent . The depth of the secondary market as measured by the ratio of

turnover to average outstanding stocks is extremely low in India at roughly 5% compared with 20% in a

developed market like the US.

Non availability of reliable hedging instruments such as rupee derivatives restricts the possibility of

hedging positions in the derivatives market. Absence of speculators at retail level deprives the market of

the cushioning effect in cases of movements without adequate change in fundamentals.

For a start, RBI, as the banker to the government , should start extinguishing illiquid securities by buying

them back. Fresh issuance at different tenors should be done only in the liquid, ‘popular’ securities so that

there is a single security at each tenor that represents the tenor and also has critical mass. Second,

differences in coupon for securities of the same tenor tend to drive the price and yield differences across

securities. This has to be addressed. Finally, the sovereign bond issue structure has to be aligned not just

with the government's preference for duration but also with a focus on deepening the government market.

This means issuing securities at each critical tenor, not just the tenors that are compatible with the

government’s borrowing.

The need to maintain SLR requirements by banks (the largest holder of sovereign bonds) means that banks

become a captive market for government securities and this dilutes market pricing. Thus, government

bonds are not necessarily transacted at a market clearing rate. For example, auctions may be cancelled

because rates are not deemed appropriate, or the debt manager( in this case RBI) fixes a minimum reserve

price for the auction, or keeps the right to allocate less than the amount announced if price dispersions are

too high.

6 What is Indian Financial Sector Reforms?

Introduction

At the outset, I am thankful to the Institute of International Bankers for giving me this opportunity of

addressing the Annual Washington Conference 2007. The banking system in India has undergone

significant changes during last 15 years. There have been new banks, new instruments, new windows, new

opportunities and, along with all this, new challenges. While deregulation has opened up new vistas for

banks to augment revenues, it has also entailed greater competition and consequently greater risks. The

traditional face of banks as mere financial intermediaries has since altered and risk management has

emerged as the defining attribute. Financial sector reforms introduced in the early 1990s as a part of the

structural reforms have touched upon almost all aspects of banking operations. For a few decades

preceding the onset of banking and financial sector reforms in India, banks operated in an environment

that was heavily regulated and characterised by sufficient barriers to entry, which protected them

against too much competition. This regulated environment set in complacency in the manner in

which banks operated and responded to the customer needs. The administered interest rate

structure, both on the liability and the assets sides, allowed banks to earn reasonable spread

without much efforts. Despite this, however, banks’ profitability was low and NPLs level was

high, reflecting lack of efficiency. Although banks operated under regulatory constraints in the

form of statutory holding of Government securities (statutory liquidity ratio or SLR) and the cash

reserve ratio (CRR) and lacked functional autonomy and operational efficiency, the fact was that

most banks did not operate efficiently.

While the broad objectives of the financial sector reforms, thus, were to enhance

efficiency and productivity, the process of reforms were initiated in a gradual and properly

sequenced manner so as to have a reinforcing effect. The approach has been to consistently

upgrade the financial sector by adopting the international best practices through a consultative

process. Financial sector reforms were carried out in two phases. The first phase of reforms

was aimed at creating productive and profitable financial institutions operating within the 2

environment of operational flexibility and functional autonomy. The focus of the second phase of

financial sector reforms starting from the second-half of 1990s has been on strengthening of the

financial system consistent with the movement towards global integration of financial services.

7 what is Financial Sector Reforms in India?

The deregulation of interest rates constituted an integral part of financial sector reforms.

The interest rate regime has been largely deregulated with a view to achieving better price

discovery and efficient resource allocation. Banks now have flexibility to decide their deposit and

lending rate structures and manage their assets and liabilities accordingly. At present, apart

from interest rates on savings deposits and NRI deposits on the deposit side, and export credit

and small loans up to Rs. 2 lakh on the lending side, all other interest rates have been

deregulated.

Indian banking system operated for a long time with high reserve requirements both in

the form of Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR). This was mainly to

accommodate the high fiscal deficit and its monetisation. The efforts in the recent period have

been to lower both the CRR and SLR. The SLR has been gradually reduced from a peak of 38.5

per cent to 25 per cent. The CRR was reduced from its peak level of 15.0 per cent maintained

during 1989 to 1992 to 4.5 per cent of NDTL in June 2003. Although the Reserve Bank

continues to pursue its medium-term objective of reducing the CRR, in recent years, on a review

of macroeconomic and monetary conditions, the CRR has been revised upwards to 6.0 per cent

(to be effective from March 3, 2007).

It has been the endeavour of the Reserve Bank to establish an enabling regulatory

framework with prompt and effective supervision, and development of legal, technological and

institutional infrastructure. Persistent efforts, therefore, have been made towards adoption of international

benchmarks, as appropriate to Indian conditions. In 1994, a Board for Financial Supervision (BFS) was

constituted comprising select members of the Reserve Bank Board with a variety of professional expertise

to exercise 'undivided attention to supervision' and ensure an integrated approach to supervision of

commercial banks and financial institutions. The Reserve Bank had instituted a state of-the-art Off-site

Monitoring and 3 Surveillance (OSMOS) system for banks in 1995 as part of crisis management

framework for Early Warning System (EWS) and as a trigger for on-site inspections of vulnerable

institutions.

The scope and coverage of off-site surveillance has since been widened to capture various

facets of efficiency and risk management of banks. As a part of the financial sector reforms, the regulatory

norms with respect to capital adequacy, income recognition, asset classification and provisioning have

progressively moved towards convergence with the international best practices. These measures have

enhanced transparency of the balance sheet of the banks and infused accountability in their functioning.

Besides sub-standard assets, provisioning has also been introduced for the standard assets.

Measures to reduce the levels of NPAs concentrated on improved risk management practices

and greater recovery efforts facilitated by the enactment of Securitisation and Reconstruction of

Financial Assets and Enforcement of Security Interest (SARFAESI) Act, 2002. Several other

channels of NPA management have also been instituted, including Debt Recovery Tribunals,

Lok Adalats (People’s court) and corporate debt restructuring mechanism with separate

schemes for small and medium industries.

The minimum capital to risk assets ratio (CRAR), which was earlier stipulated at eight per

cent was revised to 9 per cent in 1999, which is one percentage point above the international

norm. As some banks in the public sector were not able to comply with the CRAR stipulations,

there was a need to recapitalise them to augment their capital base. Banks were allowed to rise

capital from the market. In line with the amendment to incorporate market risk in Basel I, separate capital

charge for market risk was also introduced in 2004.

Accounting standards and disclosure norms were strengthened with a view to improving

Governance and bringing them in alignment with the international norms. The disclosure

requirements broadly covered capital adequacy, asset quality, maturity distribution of select

items of assets and liabilities, profitability, country risk exposure, risk exposures in derivatives,

segment reporting, and related party disclosures. In April 2005, commercial banks were advised

to put in place business continuity measures, including a robust information risk management

system within a fixed time frame.

In view of the increasing degree of deregulation and exposure of banks to various types

of risks, the Reserve Bank initiated measures for further strengthening and fine-tuning risk

management systems in banks. The guidelines on asset-liability management and risk management

systems in banks were issued in 1999 and Guidance Notes on Credit Risk Management and Market Risk

Management in October 2002 and the Guidance Note on Operational risk management in 2005. In the

Reserve Bank, the risk-based approach to supervision has been adopted since 2003 and about 23 banks

have been brought under the fold of risk-based supervision (RBS) on a pilot basis. On the basis of the

feedback received from the pilot project, the RBS framework is being reviewed.

As part of the reform programme, due consideration has been given to diversification of

ownership of banking institutions for greater market accountability and improved efficiency. The

public sector banks expanded their capital base by accessing the capital market, which diluted

the Government ownership. To provide banks with additional options for raising capital funds

with a view to enabling smooth transition to the Basel II, the Reserve Bank in January 2006,

allowed banks to augment their capital funds by issue of additional instruments. With a view to enhancing

efficiency and productivity through competition, guidelines were laid down for establishment of new

banks in the private sector and the foreign banks have been allowed more liberal entry. Since 1993, 12

new private sector banks have been set up. As a major step towards enhancing competition in the banking

sector, foreign direct investment in the private sector banks is now allowed up to 74 per cent, subject to

conformity with the guidelines issued from time to time. The regulatory framework in India, in addition to

prescribing prudential guidelines and encouraging market discipline, is increasingly focusing on ensuring

good governance through "fit and proper" owners, directors and senior managers of the banks.

Transfer of shareholding of five per cent and above requires acknowledgement from the

Reserve Bank and such significant shareholders are required to meet rigorous ‘fit and proper'

requirements. Banks have also been asked to ensure that the nominated and elected directors

are screened by a nomination committee to satisfy ‘fit and proper' criteria. Directors are also

required to sign a covenant indicating their roles and responsibilities. The Reserve Bank has

issued detailed guidelines on ownership and governance in private sector banks emphasising

diversified ownership.

The Reserve Bank released a roadmap for foreign banks articulating a liberalised policy

consistent with the WTO commitments in March 2005. The roadmap is divided into two phases.

During the first phase, between March 2005 and March 2009, foreign banks wishing to establish

presence in India for the first time could either choose to operate through branches or set up 100

per cent wholly owned subsidiaries (WOS), following the one-mode presence criterion. For new

and existing foreign banks, it is proposed to go beyond the existing WTO commitment of 12

branches in a year. During this phase, permission for acquisition of shareholding in Indian

private sector banks by eligible foreign banks will be limited to banks identified by the Reserve

Bank for restructuring. The second phase is scheduled to commence from April 2009 after a

review of the experience gained and after due consultation with all the stakeholders in the

banking sector. In this phase, three interconnected issues would be taken up. First, rules for the

removal of limitations on the operations of the WOS and treating them at par with domestic

banks, to the extent appropriate, would be designed and implemented. Second, the WOS of

foreign banks, on completion of a minimum prescribed period of operation, may be allowed to list

and dilute their stake so that, consistent with the guidelines issued on March 5, 2004, at least 26

per cent of the paid-up capital of the subsidiary is held by resident Indians at all times. Third,

during this phase, foreign banks may be permitted to enter into merger and acquisition

transactions with any private sector bank in India, subject to the overall investment limit of 74 per

cent.

In recent years, comprehensive credit information, which provides details pertaining to credit

facilities already availed of by a borrower as well as his payment track record, has become

critical. Accordingly, a scheme for disclosure of information regarding defaulting borrowers of

banks and financial institutions was introduced. In order to facilitate sharing of information

related to credit matters, a Credit Information Bureau (India) Limited (CIBIL) was set up in 2000.

The Banking Ombudsman Scheme was notified by the Reserve Bank in 1995 to provide

for a system of redressal of grievances against banks. The scheme sought to establish a system

of expeditious and inexpensive resolution of customer complaints. The scheme was revised

twice, first in 2002 and then in 2006. At present, the scheme is being executed by Banking

Ombudsman (BO) appointed by the Reserve Bank at 15 centres covering the entire country. The

BO scheme covers all commercial banks and scheduled primary cooperative banks. The scheme was

revised recently which brought more grounds of complaints within its ambit. An independent Banking

Codes and Standards Board of India was set up on the model of the UK in order to ensure that

comprehensive code of conduct for fair treatment of customers is evolved and adhered to. With a view to

achieving greater financial inclusion, since November 2005, all banks need to make available a basic

banking ‘no frills’ account either with ‘nil’ or very low minimum balances as well as charges that would

make such accounts accessible to vast sections of population. Banks were urged to review their existing

practices to align them with the objective of ‘financial inclusion’.

The smooth functioning of the payment and settlement system is a pre-requisite for

financial stability. The Reserve Bank, therefore, has taken several measures from time to time to

develop the payment and settlement system in the country along sound lines. The Board for

Regulation and Supervision of Payment and Settlement Systems (BPSS), set up in March 2005

as a committee of the Central Board of the Reserve Bank, is the apex body for giving policy

direction in the area of payment and settlement systems. Real time gross settlement (RTGS)

was operationalised on March 26, 2004. Its usage for transfer of funds, especially for large

values and for systemically important purposes, has increased since then. With introduction of

RTGS, whereby a final settlement of individual inter-bank fund transfers is effected on a gross

real time basis during the processing day, a major source of systemic risk in the financial system

has been reduced substantially.

A risk free payments and settlements system in government securities and foreign

exchange was established by the Clearing Corporation of India Limited (CCIL), which is set up

by banks. CCIL acts as the central counter party (CCP) for all the transactions and guarantees

both the securities and funds legs of the transaction. Under the DvPIII mode of settlement that

has been adopted, both the securities leg and the fund leg are settled on a net basis. The settlement through

CCIL has thus reduced the gross dollar requirement by more than 90 per cent. A screen-based negotiated

quote-driven system for dealings in the call/notice and the term money market (NDS-CALL) has been

launched by the CCIL in September 18, 2006. The introduction of NDS-CALL helps in enhancing

transparency, improving price discovery and strengthening market microstructure.

8 what are the Impact of Financial Sector Reforms in India?

Banks have been accorded greater discretion in sourcing and utilisation of resources,

albeit in an increasingly competitive environment. The outreach of the Indian banking system

has increased in terms of expansion of branches/ATMs. In the post-reform period,

assets/liabilities of banks have grown consistently at a high rate. The financial performance of

banks also improved as reflected in their increased profitability. Net profit to assets ratio

improved from 0.49 per cent in 2000-01 to 1.13 per cent in 2003-04. Although it subsequently

declined to 0.88 per cent in 2005-06, it was still significantly higher than that in the early 1990s.

Banks have been successful in weathering the impact of upturn in interest rate cycle through

increasing diversification of their income. Though banks had to incur huge expenditures on

upgradation of information technology, the restructuring of the workforce in public sector banks

helped them cut down the staff cost and increase in business per employee.

Another welcome development has been the sharp reduction in non-performing loans

(NPLs). Both gross and net NPLs started to decline in absolute terms since 2002-03. Gross NPLs as

percentage of gross advances, which were above 15 per cent in the early 1990s, are now less than 3 per

cent. This distinct improvement in asset quality may be attributed to theimproved recovery climate

underpinned by strong macroeconomic performance as well as several institutional measures initiated by

the Reserve Bank/Government such as debt recovery tribunals, Lok Adalats, scheme of corporate debt

restructuring in 2001, the SARFAESI Act in 2002.

Since 1995-96, the banking sector, on the whole, has been consistently maintaining

CRAR well above the minimum stipulated norm. The overall CRAR for scheduled commercial

banks increased from 8.7 per cent at end-March 1996 to 12.3 per cent at end-March 2006. The

number of banks not complying with the minimum CRAR also declined from 13 at end-March

1996 to just two by end-March 2006. Improved capital position stemmed largely from the

improvement in profitability and raising of capital from the market, though in the initial stages the

Government had to provide funds to recapitalise weak public sector banks. Even though public sector

banks continue to dominate the Indian banking system, accounting for nearly three-fourths of total assets

and income, the increasing competition in the banking system has led to a falling share of public sector

banks, and increasing share of the new private sector banks, which were set up around mid-1990s. It is

clear that we are at the beginning of this new phase in the Indian banking with competitive pressure, both

domestic and external, catching up and the need for banks to continuously reassess and reposition

themselves in their business plans.

9 what are the Future Challenges for Indian Banks?

A few broad challenges facing the Indian banks are: threats of risks from globalisation;

implementation of Basel II; improvement of risk management systems; implementation of new

accounting standards; enhancement of transparency and disclosures; enhancement of customer

service; and application of technology.

Globalisation – a challenge as well as an opportunity

The waves of globalisation are sweeping across the world, and have thrown up several opportunities

accompanied by concomitant risks. Integration of domestic market with international financial markets

has been facilitated by tremendous advancement in information and communications technology. There is

a growing realisation that the ability of countries to conduct business across national borders and the

ability to cope with the possible downside risks would depend, inter alia, on the soundness of the financial

system. This has necessitated convergence of prudential norms with international best practices as well

consistent refinement of the technological and institutional framework in the financial sector through a

non-disruptive and consultative process.

Opening up of the Capital Account

The Committee on Fuller Capital Account Convertibility (Chairman: Shri S.S. Tarapore) observed that

under a full capital account convertibility regime, the banking system would be exposed to greater market

volatility, and this necessitated enhancing the risk management capabilities in the banking system in view

of liquidity risk, interest rate risk, currency risk, counter-party risk and country risk that arise from

international capital flows. The potential dangers associated with the proliferation of derivative

instruments – credit derivatives and interest rate derivatives also need to be recognised in the regulatory

and supervisory system. The issues relating to cross-border supervision of financial intermediaries in the

context of greater capital flows are just emerging and need to be addressed.

Basel II implementation

The Reserve Bank and the commercial banks have been preparing to implement Basel

II, and it has been decided to allow banks some more time in adhering to new norms. As against

the deadline of March 31, 2007 for compliance with Basel II, it was decided in October 2006 that

foreign banks operating in India and Indian banks having presence outside India would migrate

to the standardised approach for credit risk and the basic indicator approach for operational risk

under Basel II with effect from March 31, 2008, while all other scheduled commercial banks are

required to migrate to Basel II by March 31, 2009.

It is widely acknowledged that implementation of Basel II poses significant challenge to

both banks and the regulators. Basel II implementation may also be seen as a compliance

challenge. But at the same time, it offers two major opportunities to banks, viz., refinement of

risk management systems; and improvement in capital efficiency. The transition from Basel I to

Basel II essentially involves a move from capital adequacy to capital efficiency. This transition in

how capital is used and how much capital is needed will become a significant factor in return-onequity

strategy for years to come.

The reliance on the market to assess the riskiness of banks would lead to increased

focus on transparency and market disclosure, critical information describing the risk profile,

capital structure and capital adequacy. Besides making banks more accountable and responsive

to better-informed investors, these processes enable banks to strike the right balance between

risks and rewards and to improve the access to markets. Improvements in market discipline also

call for greater coordination between banks and regulators.

Improving Risk Management Systems

Basel II has brought into focus the need for a more comprehensive risk management

framework to deal with various risks, including credit and market risk and their inter-linkages.

Banks in India are also moving from the individual silo system to an enterprise-wide risk

management system. While the first milestone would be risk integration across the entity, the

next step would entail risk aggregation across the group both in the specific risk areas as also

across the risks. Banks would, therefore, be required to allocate significant resources towards

this endeavour. In India, the risk-based approach to supervision is also serving as a catalyst to

banks’ migration to the integrated risk management systems. However, taking into account the

diversity in the Indian banking system, stabilizing the RBS as an effective supervisory

mechanism is another challenge.

Corporate Governance

To a large extent, many risk management failures reflect a breakdown in corporate

governance which arise due to poor management of conflict of interest, inadequate

understanding of key banking risks, and poor Board oversight of the mechanisms for risk

management and internal audit. Corporate governance is, therefore, the foundation for effective

risk managements in banks and, thus, the foundation for a sound financial system. Therefore,

the choices which banks make when they establish their risk management and corporate

governance systems have important ramifications for financial stability. Banks may have to

cultivate a good governance culture building in appropriate checks and balances in their

operations. There are four important forms of oversight that should be included in the

organisational structure of any bank in order to ensure appropriate checks and balances: (i)

oversight by the board of directors or supervisory board; (ii) oversight by individuals not involved

in the day-to-day running of the various business areas; (iii) direct line supervision of

different business areas; and (iv) independent risk management, compliance and audit

functions. In addition, it is important that key personnel are fit and proper for their jobs.

Furthermore, the general principles of sound corporate governance should also be applied to all

banks, irrespective of their unique ownership structures.

Implementation of New Accounting Standards

Derivative activity in banks has been increasing at a brisk pace. While the risk

management framework for derivative trading, which is a relatively new area for Indian banks

(particularly in the more structured products) is an essential pre-requisite, the absence of clear

accounting guidelines in this area is a matter of significant concern. The World Bank’s ROSC on

Accounting and Auditing in India has commented on the absence of an accounting standard

which deals with recognition, measurement and disclosures pertaining to financial instruments.

The Accounting Standards Board of the Institute of Chartered Accountants of India (ICAI) is

considering issue of Accounting Standards in respect of financial instruments. These will be the

Indian parallel to International Accounting Standards 32 and 39. The proposed Accounting

Standards will be of considerable significance for financial entities and could, therefore, have

implications for the financial sector. The formal introduction of these Accounting Standards by

the ICAI is likely to take some time in view of the processes involved. In the meanwhile, the

Reserve Bank is considering the need for banks and financial entities adopting the broad

underlying principles of IAS 39. Since this is likely to give rise to some regulatory/prudential

issues, all relevant aspects are being comprehensively examined. The proposals in this regard

would, as is normal, be discussed with the market participants before introduction. Adoption and

implementation of these principles are likely to pose a great challenge to both the banks and the

Reserve Bank.

Supervision of financial conglomerates

The financial landscape is increasingly witnessing entry of some of the bigger banks into

other financial segments like merchant banking, insurance etc. Emergence of several new

players with diversified presence across major segments make it imperative for supervision to be

spread across various segments of the financial sector. In this direction, an inter-regulatory

Working Group was constituted with members from RBI, SEBI and IRDA. The framework

proposed by the Group is complementary to the existing regulatory structure wherein the

individual entities are regulated by the respective regulators and the identified financial

conglomerates are subjected to focussed regulatory oversight through a mechanism of interregulatory

exchange of information. As a first step in this direction, an inter-agency Working

Group on Financial Conglomerates (FC) comprising the above three supervisory bodies

identified 23 FCs and a pilot process for obtaining information from these conglomerates has

been initiated. The complexities involved in the supervision of financial conglomerates are a

challenge not only to the Reserve Bank of India but also to the other regulatory agencies, which

need to have a close and continued coordination on an on-going basis.

In view of increased focus on empowering supervisors to undertake consolidated

supervision of bank groups and since the Core Principles for Effective Banking Supervision

issued by the Basel Committee on Banking Supervision have underscored consolidated

supervision as an independent principle, the Reserve Bank had introduced, as an initial step,

consolidated accounting and other quantitative methods to facilitate consolidated supervision.

The components of consolidated supervision include, consolidated financial statements intended

for public disclosure, consolidated prudential reports intended for supervisory assessment of

risks and application of certain prudential regulations on group basis. In due course,

consolidated supervision as introduced above would evolve to cover banks in mixed

conglomerates, where the parent may be non-financial entities or parents may be financial

entities coming under the jurisdiction of other regulators.

Application of Advanced Technology

The role of technology in banking in creating new business models and processes, in

maintaining competitive advantage, in enhancing quality of risk management systems in banks,

and in revolutionising distribution channels, cannot be overemphasised. Recognising the

benefits of modernising their technology infrastructure, banks are taking the right initiatives.

While doing so, banks have four options to choose from: they can build a new system

themselves, or buy best of the modules, or buy a comprehensive solution, or outsource. A

further challenge which banks face in this regard is to ensure that they derive maximum

advantage from their investments in technology and avoid wasteful expenditure which might

arise on account of uncoordinated and piecemeal adoption of technology; adoption of

inappropriate/ inconsistent technology and adoption of obsolete technology. A case in point is

the implementation of core banking solution by some banks without assessing its scalability or

adaptability to meet Basel II requirements.

Financial Inclusion

While banks are focusing on the methodologies of meeting the increasing demands

placed on them, there are legitimate concerns with regard to the banking practices that tend to

exclude rather than attract vast sections of population, in particular pensioners, self-employed

and those employed in unorganised sector. While commercial considerations are no doubt

important, banks have been bestowed with several privileges, especially of seeking public

deposits on a highly leveraged basis, and consequently they should be obliged to provide

banking services to all segments of the population, on equitable basis. Further, experience has

shown that consumers’ interests are at times not accorded full protection and their grievances

are not properly attended to. Feedback received reveals recent trends of levying unreasonably

high service/user charges and enhancement of user charges without proper and prior intimation.

It is in this context that the Governor, Reserve Bank of India had mentioned in the Annual Policy

Statement 2005-06 that RBI will take initiatives to encourage greater degree of financial

inclusion in the country; setting up of a mechanism for ensuring fair treatment of consumers; and

effective redressal of customer grievances.

Conclusion

With the increasing levels of globalisation of the Indian banking industry, evolution of

universal banks and bundling of financial services, competition in the banking industry will

intensify further. The banking industry has the potential and the ability to rise to the occasion as

demonstrated by the rapid pace of automation which has already had a profound impact on

raising the standard of banking services. The financial strength of individual banks, which are

major participants in the financial system, is the first line of defence against financial risks.

Strong capital positions and balance sheets place banks in a better position to deal with and

absorb the economic shocks.

Money Market

10 What Does Money Market Mean?

A segment of the financial market in which financial instruments with high liquidity and very short

maturities are traded. The money market is used by participants as a means for borrowing and lending in

the short term, from several days to just under a year. Money market securities consist of negotiable

certificates of deposit (CDs), bankers acceptances, U.S. Treasury bills, commercial paper, municipal

notes, federal funds and repurchase agreements (repos).

Money Market: What Is It?

he money market is a subsection of the fixed income market. We generally think of the term fixed income

as being synonymous to bonds. In reality, a bond is just one type of fixed income security. The difference

between the money market and the bond market is that the money market specializes in very short-term

debt securities (debt that matures in less than one year). Money market investments are also called cash

investments because of their short maturities.

Money market securities are essentially IOUs issued by governments, financial institutions and large

corporations. These instruments are very liquid and considered extraordinarily safe. Because they are

extremely conservative, money market securities offer significantly lower returns than most other

securities.

One of the main differences between the money market and the stock market is that most money market

securities trade in very high denominations. This limits access for the individual investor. Furthermore, the

money market is a dealer market, which means that firms buy and sell securities in their own accounts, at

their own risk. Compare this to the stock market where a broker receives commission to acts as an agent,

while the investor takes the risk of holding the stock. Another characteristic of a dealer market is the lack

of a central trading floor or exchange. Deals are transacted over the phone or through electronic systems.

The easiest way for us to gain access to the money market is with a money market mutual funds, or

sometimes through a money market bank account. These accounts and funds pool together the assets of

thousands of investors in order to buy the money market securities on their behalf. However, some money

market instruments, like Treasury bills, may be purchased directly. Failing that, they can be acquired

through other large financial institutions with direct access to these markets.

There are several different instruments in the money market, offering different returns and different

risks. In the following sections, we'll take a look at the major money market instruments.

Money Market: Treasury Bills (T-Bills)

11. What Does Treasury Bill - T-Bill Mean?

A short-term debt obligation backed by the U.S. government with a maturity of less than one year. T-bills

are sold in denominations of $1,000 up to a maximum purchase of $5 million and commonly have

maturities of one month (four weeks), three months (13 weeks) or six months (26 weeks).

T-bills are issued through a competitive bidding process at a discount from par, which means that rather

than paying fixed interest payments like conventional bonds, the appreciation of the bond provides the

return to the holder.

Investopedia explains Treasury Bill - T-Bill

For example, let's say you buy a 13-week T-bill priced at $9,800. Essentially, the U.S. government (and its

nearly bulletproof credit rating) writes you an IOU for $10,000 that it agrees to pay back in three

months. You will not receive regular payments as you would with a coupon bond, for example. Instead,

the appreciation - and, therefore, the value to you - comes from the difference between the discounted

value you originally paid and the amount you receive back ($10,000). In this case, the T-bill pays a 2.04%

interest rate ($200/$9,800 = 2.04%) over a three-month period.

Money Market: Certificate Of Deposit (CD)

A certificate of deposit (CD) is a time deposit with a bank. CDs are generally issued by commercial banks

but they can be bought through brokerages. They bear a specific maturity date (from three months to five

years), a specified interest rate, and can be issued in any denomination, much like bonds. Like all time

deposits, the funds may not be withdrawn on demand like those in a checking account.

CDs offer a slightly higher yield than T-Bills because of the slightly higher default risk for a bank but,

overall, the likelihood that a large bank will go broke is pretty slim. Of course, the amount of interest you

earn depends on a number of other factors such as the current interest rate environment, how much money

you invest, the length of time and the particular bank you choose. While nearly every bank offers CDs, the

rates are rarely competitive, so it's important to shop around.

A fundamental concept to understand when buying a CD is the difference between annual percentage

yield (APY) and annual percentage rate (APR). APY is the total amount of interest you earn in one year,

taking compound interest into account. APR is simply the stated interest you earn in one year, without

taking compounding into account. (To learn more, read APR vs. APY: How The Distinction Affects You.)

The difference results from when interest is paid. The more frequently interest is calculated, the greater

the yield will be. When an investment pays interest annually, its rate and yield are the same. But when

interest is paid more frequently, the yield gets higher. For example, say you purchase a one-year, $1,000

CD that pays 5% semi-annually. After six months, you'll receive an interest payment of $25 ($1,000 x 5 %

x .5 years). Here's where the magic of compounding starts. The $25 payment starts earning interest of its

own, which over the next six months amounts to $ 0.625 ($25 x 5% x .5 years). As a result, the rate on the

CD is 5%, but its yield is 5.06. It may not sound like a lot, but compounding adds up over time.

The main advantage of CDs is their relative safety and the ability to know your return ahead of time.

You'll generally earn more than in a savings account, and you won't be at the mercy of the stock market.

Plus, in the U.S. the Federal Deposit Insurance Corporation guarantees your investment up to $100,000.

Despite the benefits, there are two main disadvantages to CDs. First of all, the returns are paltry compared

to many other investments. Furthermore, your money is tied up for the length of the CD and you won't be

able to get it out without paying a harsh penalty.

Money Market: Commercial Paper

For many corporations, borrowing short-term money from banks is often a laborious and annoying task.

The desire to avoid banks as much as possible has led to the widespread popularity of commercial paper.

(See Why do companies issue bonds instead of borrowing from the bank?)

Commercial paper is an unsecured, short-term loan issued by a corporation, typically for financing

accounts receivable and inventories. It is usually issued at a discount, reflecting current market interest

rates. Maturities on commercial paper are usually no longer than nine months, with maturities of between

one and two months being the average.

For the most part, commercial paper is a very safe investment because the financial situation of a company

can easily be predicted over a few months. Furthermore, typically only companies with high credit ratings

and credit worthiness issue commercial paper. Over the past 40 years, there have only been a handful of

cases where corporations have defaulted on their commercial paper repayment.

Commercial paper is usually issued in denominations of $100,000 or more. Therefore, smaller investors

can only invest in commercial paper indirectly through money market funds.

Money Market: Banker's Acceptance

A bankers' acceptance (BA) is a short-term credit investment created by a non-financial firm and

guaranteed by a bank to make payment. Acceptances are traded at discounts from face value in the

secondary market.

For corporations, a BA acts as a negotiable time draft for financing imports, exports or other transactions

in goods. This is especially useful when the creditworthiness of a foreign trade partner is unknown.

Acceptances sell at a discount from the face value:

Face Value of Banker's Acceptance

$1,000,000

Minus 2% Per Annum Commission for One Year

-$20,000

Amount Received by Exporter in One Year

$980,000

One advantage of a banker's acceptance is that it does not need to be held until maturity, and can be sold

off in the secondary markets where investors and institutions constantly trade BAs.

Money Market: Eurodollars

Contrary to the name, eurodollars have very little to do with the euro or European countries. Eurodollars

are U.S.-dollar denominated deposits at banks outside of the United States. This market evolved in Europe

(specifically London), hence the name, but eurodollars can be held anywhere outside the United States.

The eurodollar market is relatively free of regulation; therefore, banks can operate on narrower margins

than their counterparts in the United States. As a result, the eurodollar market has expanded largely as a

way of circumventing regulatory costs.

The average eurodollar deposit is very large (in the millions) and has a maturity of less than six months. A

variation on the eurodollar time deposit is the eurodollar certificate of deposit. A eurodollar CD is

basically the same as a domestic CD, except that it's the liability of a non-U.S. bank. Because eurodollar

CDs are typically less liquid, they tend to offer higher yields.

The eurodollar market is obviously out of reach for all but the largest institutions. The only way for

individuals to invest in this market is indirectly through a money market fund.

Money Market: Repos

Repurchase Agreement - Repo

12 What Does Repurchase Agreement - Repo Mean?

A form of short-term borrowing for dealers in government securities. The dealer sells the government

securities to investors, usually on an overnight basis, and buys them back the following day.

For the party selling the security (and agreeing to repurchase it in the future) it is a repo; for the party on

the other end of the transaction, (buying the security and agreeing to sell in the future) it is a reverse

repurchase agreement.

Investopedia explains Repurchase Agreement - Repo

Repos are classified as a money-market instrument. They are usually used to raise short-term capital.

Repos are popular because they can virtually eliminate credit problems. Unfortunately, a number of

significant losses over the years from fraudulent dealers suggest that lenders in this market have not

always checked their collateralization closely enough.

There are also variations on standard repos:

Reverse Repo - The reverse repo is the complete opposite of a repo. In this case, a dealer buys

government securities from an investor and then sells them back at a later date for a higher price

Term Repo - exactly the same as a repo except the term of the loan is greater than 30 days.

Conclusion

We hope this tutorial has given you an idea of the securities in the money market. It's not exactly a sexy

topic, but definitely worth knowing about, as there are times when even the most ambitious investor puts

cash on the sidelines.

The money market specializes in debt securities that mature in less than one year.

Money market securities are very liquid, and are considered very safe. As a result, they offer a

lower return than other securities.

The easiest way for individuals to gain access to the money market is through a money market

mutual fund.

T-bills are short-term government securities that mature in one year or less from their issue date.

T-bills are considered to be one of the safest investments - they don't provide a great return.

A certificate of deposit (CD) is a time deposit with a bank.

Annual percentage yield (APY) takes into account compound interest, annual percentage rate

(APR) does not.

CDs are safe, but the returns aren't great, and your money is tied up for the length of the CD.

Commercial paper is an unsecured, short-term loan issued by a corporation. Returns are higher

than T-bills because of the higher default risk.

Banker's acceptances (BA)are negotiable time draft for financing transactions in goods.

BAs are used frequently in international trade and are generally only available to individuals

through money market funds.

Eurodollars are U.S. dollar-denominated deposit at banks outside of the United States.

The average eurodollar deposit is very large. The only way for individuals to invest in this market

is indirectly through a money market fund.

Repurchase agreements (repos) are a form of overnight borrowing backed by government

securities.

Bond Basics: Different Types Of Bonds

Government Bonds

In general, fixed-income securities are classified according to the length of time before maturity. These are

the three main categories:

Bills - debt securities maturing in less than one year.

Notes - debt securities maturing in one to 10 years.

Bonds - debt securities maturing in more than 10 years.

Marketable securities from the U.S. government - known collectively as Treasuries - follow this guideline

and are issued as Treasury bonds, Treasury notes and Treasury bills (T-bills). Technically speaking, Tbills aren't bonds because of their short maturity. (You can read more about T-bills in our Money Market

tutorial.) All debt issued by Uncle Sam is regarded as extremely safe, as is the debt of any stable country.

The debt of many developing countries, however, does carry substantial risk. Like companies, countries

can default on payments.

Government Bonds

In general, fixed-income securities are classified according to the length of time before maturity. These are

the three main categories:

Bills - debt securities maturing in less than one year.

Notes - debt securities maturing in one to 10 years.

Bonds - debt securities maturing in more than 10 years.

Marketable securities from the U.S. government - known collectively as Treasuries - follow this guideline

and are issued as Treasury bonds, Treasury notes and Treasury bills (T-bills). Technically speaking, Tbills aren't bonds because of their short maturity. (You can read more about T-bills in our Money Market

tutorial.) All debt issued by Uncle Sam is regarded as extremely safe, as is the debt of any stable country.

The debt of many developing countries, however, does carry substantial risk. Like companies, countries

can default on payments.

13 What Does Municipal Bond Mean?

A debt security issued by a state, municipality or county to finance its capital expenditures. Municipal

bonds are exempt from federal taxes and from most state and local taxes, especially if you live in the state

in which the bond is issued.

Also known as a "muni".

Investopedia explains Municipal Bond

Municipal bonds may be used to fund expenditures such as the construction of highways, bridges or

schools. "Munis" are bought for their favorable tax implications, and are popular with people in high

income tax brackets.

UNIT II

Syllabus

Stock Exchanges – Objectives of NSE – Bombay Stock Exchange (BSE) –

OTCEI.

1 What is stock exchange?

A stock exchange is an entity which provides "trading" facilities for stock brokers and traders, to

trade stocks and other securities. Stock exchanges also provide facilities for the issue and redemption of

securities as well as other financial instruments and capital events including the payment of income and

dividends. The securities traded on a stock exchange include shares issued by companies, unit trusts,

derivatives, pooled investment products and bonds.

To be able to trade a security on a certain stock exchange, it has to be listed there. Usually there is

a central location at least for recordkeeping, but trade is less and less linked to such a physical place, as

modern markets are electronic networks, which gives them advantages of increased speed and reduced

cost of transactions. Trade on an exchange is by members only.

The initial offering of stocks and bonds to investors is by definition done in the primary market

and subsequent trading is done in the secondary market. A stock exchange is often the most important

component of a stock market. Supply and demand in stock markets is driven by various factors which, as

in all free markets, affect the price of stocks (see stock valuation).

There is usually no compulsion to issue stock via the stock exchange itself, nor must stock be

subsequently traded on the exchange. Such trading is said to be off exchange or over-the-counter. This is

the usual way that derivatives and bonds are traded. Increasingly, stock exchanges are part of a global

market for securities.

The first stock exchanges

In 12th century France the courtiers de change were concerned with managing and regulating the

debts of agricultural communities on behalf of the banks. As these men also traded in debts, they could be

called the first brokers.

Some stories suggest that the origins of the term "bourse" came from the Latin bursa meaning a

bag because, in 13th century Bruges, the sign of a purse (or perhaps three purses), was hung on the front

of the house where merchants met.

The story may well be apocryphal, however it is possible that in the late 13th century commodity

traders in Bruges gathered inside the house of the Van der Burse family (for some a Venetian family with

original name "Della Borsa" and used three leather bags as coat-of-arms), and in 1309 they

institutionalized this until now informal meeting and became the "Bruges Bourse." The idea spread

quickly around Flanders and neighboring counties and "Bourses" soon opened in Ghent and Amsterdam.

In the middle of the 13th century, Venetian bankers began to trade in government securities. In

1351, the Venetian Government outlawed spreading rumors intended to lower the price of government

funds. There were people in Pisa, Verona, Genoa and Florence who also began trading in government

securities during the 14th century. This was only possible because these were independent city states ruled

by a council of influential citizens, not by a duke.

The Dutch later started joint stock companies, which let shareholders invest in business ventures

and get a share of their profits—or losses. In 1602, the Dutch East India Company issued the first shares

on the Amsterdam Stock Exchange. It was the first company to issue stocks and bonds. In 1688, the

trading of stocks began on a stock exchange in London.

On May 17, 1792, in order to more easily trade cotton, twenty-four supply brokers signed the

Buttonwood Agreement outside 68 Wall Street in New York underneath a buttonwood tree. On March 8,

1817, properties got renamed to New York Stock & Exchange Board. In the 19th century, exchanges

(generally famous as futures exchanges) got substantiated to trade futures contracts and then choices

contracts.

There are now a large number of stock exchanges in the world.

2 WHAT IS THE ROLE OF STOCK EXCHANGES?

Stock exchanges have multiple roles in the economy. This may include the following:[1]

Raising capital for businesses

The Stock Exchange provide companies with the facility to raise capital for expansion through selling

shares to the investing public.[2]

[Mobilizing savings for investment

When people draw their savings and invest in shares, it leads to a more rational allocation of resources

because funds, which could have been consumed, or kept in idle deposits with banks, are mobilized and

redirected to promote business activity with benefits for several economic sectors such as agriculture,

commerce and industry, resulting in stronger economic growth and higher productivity levels of firms.

Facilitating company growth

Companies view acquisitions as an opportunity to expand product lines, increase distribution channels,

hedge against volatility, increase its market share, or acquire other necessary business assets. A takeover

bid or a merger agreement through the stock market is one of the simplest and most common ways for a

company to grow by acquisition or fusion.

Profit sharing

Both casual and professional stock investors, through dividends and stock price increases that may result

in capital gains, will share in the wealth of profitable businesses.

Corporate governance

By having a wide and varied scope of owners, companies generally tend to improve on their management

standards and efficiency in order to satisfy the demands of these shareholders and the more stringent rules

for public corporations imposed by public stock exchanges and the government. Consequently, it is

alleged that public companies (companies that are owned by shareholders who are members of the general

public and trade shares on public exchanges) tend to have better management records than privately held

companies (those companies where shares are not publicly traded, often owned by the company founders

and/or their families and heirs, or otherwise by a small group of investors).

Despite this claim, some well-documented cases are known where it is alleged that there has been

considerable slippage in corporate governance on the part of some public companies. The dot-com bubble

in the late 1990's, and the subprime mortgage crisis in 2007-08, are classical examples of corporate

mismanagement. Companies like Pets.com (2000), Enron Corporation (2001), One.Tel (2001), Sunbeam

(2001), Webvan (2001), Adelphia (2002), MCI WorldCom (2002), Parmalat (2003), American

International Group (2008), Bear Stearns (2008), Lehman Brothers (2008), General Motors (2009) and

Satyam Computer Services (2009) were among the most widely scrutinized by the media.

However, when poor financial, ethical or managerial records are known by the stock investors, the stock

and the company tend to lose value. In the stock exchanges, shareholders of underperforming firms are

often penalized by significant share price decline, and they tend as well to dismiss incompetent

management teams.

Creating investment opportunities for small investors

As opposed to other businesses that require huge capital outlay, investing in shares is open to both the

large and small stock investors because a person buys the number of shares they can afford. Therefore the

Stock Exchange provides the opportunity for small investors to own shares of the same companies as large

investors.

Government capital-raising for development projects

Governments at various levels may decide to borrow money in order to finance infrastructure projects

such as sewage and water treatment works or housing estates by selling another category of securities

known as bonds. These bonds can be raised through the Stock Exchange whereby members of the public

buy them, thus loaning money to the government. The issuance of such bonds can obviate the need to

directly tax the citizens in order to finance development, although by securing such bonds with the full

faith and credit of the government instead of with collateral, the result is that the government must tax the

citizens or otherwise raise additional funds to make any regular coupon payments and refund the principal

when the bonds mature.

3 What is National stock exchange?

A national stock exchange is a type of domestic market that allows buyers, sellers and brokers to trade

stocks. National Stock Exchange of India (NSE) is renowned as world third largest stock exchange. It is

the largest one in India. Ideally located in commercial capital of India, Mumbai, the National Stock

exchange was supported by several financial institutions . Approved by Government of India, NSE was

integrated in November 1992 as a tax-paying company. Many exchanges also allow other forms of

securities to be traded. Typical securities include shares in private companies, unit trusts, mutual funds,

ETFs or exchange traded funds, and bonds.

4 WHAT ARE THE OBJECTIVES OF NATIONAL STOCK EXCHANGE ?

National Stock Exchange was incorporated with several objectives in mind. NSE was set up as an

instrument to change the secondary market by creating competitive pressure. Major objectives of NSE can

be summarized as:

Commencement of nation wide trading facility to facilitate exchange of all type of securities

Establishment of an apposite telecommunication network that ensures equal admittance to

investors of the nation

Using electronic trading system that provides reasonable proficient and transparent securities

market

Proper convention of international benchmarks and standards

NATIONAL STOCK EXCHANGE

National Stock Exchange of India (NSE) is India's largest Stock Exchange & World's third largest Stock

Exchange in terms of transactions. Located in Mumbai, NSE was promoted by leading Financial

Institutions at the behest of the Government of India, and was incorporated in November 1992 as a taxpaying company. In April 1993, NSE was recognized as a Stock exchange under the Securities Contracts

(Regulation) Act-1956. NSE commenced operations in the Wholesale Debt Market (WDM) segment in

June 1994. Capital Market (Equities) segment of the NSE commenced operations in November 1994,

while operations in the Derivatives segment commenced in June 2000. NSE has played a catalytic role in

reforming Indian securities market in terms of microstructure, market practices and trading volumes. NSE

has set up its trading system as a nation-wide, fully automated screen based trading system. It has written

for itself the mandate to create World-class Stock Exchange and use it as an instrument of change for the

industry as a whole through competitive pressure. NSE is set up on a demutualised model wherein the