MF distributionreport

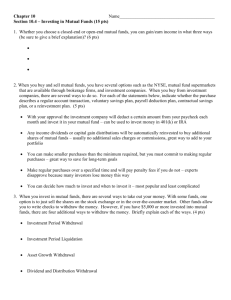

advertisement