CV_Naresh (1)

advertisement

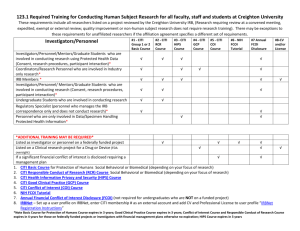

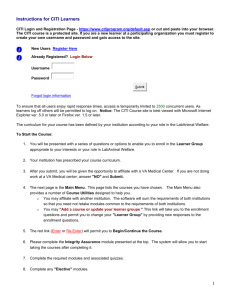

Naresh Kumar Chevala -----------------------------------------------------------------------------------------------------------8433 Southside Blvd #1911 Jacksonville, FL 32256 Cell: 443-722-1915 – naresh.chevala@gmail.com Career Objective: A Forward thinking and an experienced IT Professional with 13+ years of experience having worked in different platforms and technologies. Have good exposure to Data Warehousing Technology and worked extensively in ETL Tools. Flexible in working as part of team as well as can work individually on projects. Presently looking forward to working in challenging projects in ETL platform. Technical Skills: Operating Systems Languages Windows 7/NT, UNIX COBOL, Unix Shell Scripting , Visual Basic 6, C, C++ Ab Initio GDE V3.1.3, Ab Initio Data Profiler V3.1.3, Erwin 7, Power Designer, Crystal Reports Special Software/ Tools Database/ Database Oracle 10g, Pl/Sql, Sql Developer, Teradata Tools Application Area: Line of Business – Banking & Finance, Healthcare Line of Technology – Data Modeling, Data Profiling, Application Development Employment Summary Employer Tata Consultancy Services Limited Covansys India Ltd. Lasersoft Infosystems Ltd. From Jan 2008 Nov 2005 Nov 2001 To Till Date Dec 2007 Oct 2005 Experience Summary: Project Name Duration Client Line of business of the client About the project Role Activities OS Languages/Databases Special Tools Location CitiKYC – US July 2014 – Till Date CITI Bank Banking and Finance CitiKYC (Citi Know Your Customer) is an enterprise-wide application to implement KYC (Know Your Customer) across Citi and impacts all lines of business, compliance and operations globally. Know-Your-Customer is a process to perform the due diligence while accepting or renewing business relationship with Citi. This process ensures the compliance with KYC regulations, customer identification program procedures (CIP-P) and other regulatory requirements intended to protect Citi from being used for money laundering or terrorist financing. The key objective of CitiKYC-US is to evolve from business specific implementation of KYC requirements and policies to a standardized, global view of customer through a common KYC based record on the standards set for each type of the customer. This enables Citi to apply KYC standards to any customer, an individual or corporate, regardless of its geographic location or business affiliation. Data Modeler & Data Profiler On-site Coordinator Analyzing the Business requirements; Preparation of Effort estimation for the activity based on the requirement document; Ensure all relevant documents (checklist provided by the client if any, documents from previous phases, design documents, data mapping sheets and traceability documents) are available before start of the development work; Preparing Data Mapping Sheets and updating Data Models; Performing Data Profiling Activities using the DP Tools; Preparation of Data Profiling Result Documents; Maintaining Data Profiling Results review logs; Quality Management and Defect Prevention activities; Onsite-offshore co-ordination; Windows 7 Oracle 10g, Teradata Ab Initio Data Profiler, Ab Initio GDE, Oracle Sql Developer Jacksonville, FL, USA Project Name Duration Client Line of business of the client About the project CitiKYC –Costa Rica/ CitiKYC-Spain Nov 2013 – June 2014 CITI Bank Banking and Finance CitiKYC (Citi Know Your Customer) is an enterprise-wide application to implement KYC (Know Your Customer) across Citi and impacts all lines of business, compliance and operations globally. Know-Your-Customer is a process to perform the due diligence while accepting or renewing business relationship with Citi. This process ensures the compliance with KYC regulations, customer identification program procedures (CIPP) and other regulatory requirements intended to protect Citi from being used for money laundering or terrorist financing. The key objective of CitiKYC Costa Rica and CitiKYC Spain is to evolve from business specific implementation of KYC requirements and policies to a standardized, global view of customer through a common KYC based record on the standards set for each type of the customer. This enables Citi to apply KYC standards to any customer, an individual or corporate, regardless of its geographic location or business affiliation. Role Activities OS Languages/Databases Special Tools Data Modeler & Data Profiling Team Leader On-site Coordinator Analyzing the Business requirements; Preparation of Effort estimation for the activity based on the requirement document; Ensure all relevant documents (checklist provided by the client if any, documents from previous phases, design documents, data mapping sheets and traceability documents) are available before start of the development work; Preparing Data Mapping Sheets and updating Data Models; Performing Data Profiling Activities using the DP Tools; Preparation of Data Profiling Result Documents; Maintaining Data Profiling Results review logs; Quality Management and Defect Prevention activities; Onsite-offshore co-ordination; Windows XP Oracle 10g Ab Initio Data Profiler, Ab Initio GDE, Oracle Sql Developer Location Baltimore, MD, USA & Jacksonville, FL, USA Project Name Duration Client Line of business of the client About the project CMR – Customer Management Repository Dec 2008 – Nov 2013 CITI Bank Banking and Finance CMR (Customer Management Repository) is a MDM System. It maintains customer relationship information by matching key customer demographics such as Name, Address, SSN and DOB. CMR creates a CCID (customer identifier) for a customer account/role relationship. The ultimate goal of CMR is to contain all LOB’s Customer data and be a single golden source for customer relationship in Citi. Project Leader Analyzing the Business requirements; Preparation of Effort estimation for the activity based on the requirement document; Creation of High Level and Low Level design document; Ensure all relevant documents (checklist provided by the client if any, documents from previous phases, design documents, data mapping sheets and traceability documents) are available before start of the development work; Conducting Reviews of Software artifacts; Collecting review metrics for the project; Maintaining review logs and defect tracking documents; Quality Management and Defect Prevention activities; Windows NT, Unix Oracle 10g, Pl/Sql Erwin 7, Toad, Ab Initio Data Profiler TCS, Chennai, India & Baltimore, MD, USA Role Activities OS Languages/Databases Special Tools Location Project Name Duration Client Project Maverick – Loan Origination System April 2008 – Nov 2008 CitiFinancial Auto Citi Financial is a global Banking company. They deal in a variety of Banking products like Cards, Real Estate Lending, Mortgage, Auto Loans, Student Loans and Capital Wealth Management for a wide consumer base. Maverick system takes care of entire loan origination process. The origination process encompasses a series of steps starting from the application entry, through document approval to the final disbursement of loan. Position Responsibilities Hardware Languages/Databases Special Tools Location Project Name Duration Client Project Position Responsibilities Data Modeling Team Leader Preparation of Effort estimation for the activity based on the requirement document; Creation of High Level design document; Development of Data Models based on the design document; Preparation of Data Mapping sheets; Conducting Reviews of Software artifacts; Maintaining review logs and defect tracking documents; Quality Management and Defect Prevention activities; Scripts promotion to Database; Windows NT Oracle 10g Erwin 4, Toad TCS, Chennai, India Hospital Management System Jan 2008 – Mar 2008 Neyveli Lignite Corporation, Neyveli, Tamil Nadu, India NLC General Hospital is a 350-bedded multidisciplinary hospital managed by Neyveli Lignite Corporation. It caters to the employees of NLC and their dependents. It provides services free of cost or at nominal rates for the employees and their dependents. Hospital Management System provides a online solution for all the hospital activities, like Out-Patient Registration, In-Patient Management, Pharmacy & Stores Management, etc. Team Leader Analyzing the Business requirements Preparation of Effort estimation for the activity based on the requirement document Creation of High Level and Low Level design document. Ensure all relevant documents (checklist provided by the client if any, documents from previous phases, design documents, data mapping sheets and traceability documents) are available before start of the development work. Creating Unit test plan and test cases. Conducting Reviews of Software artifacts Collecting review metrics for the project Use IPMS for all project management related quality activities and adherence to Best Practices. Unit testing and Integration testing Maintaining review logs and defect tracking documents Quality Management and Defect Prevention activities Hardware Languages/Databases Special Tools Location UNIX, Windows NT Oracle 10g, Developer 2000 ASA, ASSENT, Revine, BIDSTM , DataClean TCS, Chennai, India Project Name Duration Client Project Research Subscribe Nov 2005 - Dec 2007 Merrill Lynch, New York, U.S.A Research (RSCH) Subscribe System, is an intranet based J2EE application built on N-tier architecture. It is an infrastructure support software for a global financial major for the publication and distribution of research materials. The whole development was in a phased manner and composed of three integrated modules. Team Member Development of code based on the design document. Creating Unit test plan and test cases. Conducting Reviews of Software artifacts Unit testing Providing support for User Acceptance testing. 24x7 Production support for RS Application Answering user queries and following up with upstream source systems if required for user query resolution. Collection of metrics for production job abends and performing root cause analysis. Maintaining review logs and defect tracking documents Quality Management and Defect Prevention activities Onsite-offshore co-ordination. Sun Solaris, Windows NT, Unix Oracle 10g, Pl/sql, J2EE Position Responsibilities Hardware Languages/Databases Special Tools Location Project Name Duration Client Project Position Responsibilities Power Designer Covansys India Ltd., Chennai, India Probanker Feb 2003 - Oct 2005 BankMuscat, Muscat, Oman This System was developed for Bank Muscat, Muscat. It is part of Core Banking System. It contains modules like: Credit Card System, POS Merchant Transaction Processing System, Debit Card Transaction Processing (Base1 and Base2 Process). Team Member Development of code based on the design document. Hardware Languages/Databases Special Tools Location Project Name Duration Client Project Position Responsibilities Hardware Languages/Databases Special Tools Location Project Name Duration Client Project Position Responsibilities Creating Unit test plan and test cases. Unit testing Providing support for User Acceptance testing Answering user queries and following up with upstream source systems if required for user query resolution. Quality Management and Defect Prevention activities Maintaining review logs and defect tracking documents Onsite-offshore co-ordination. Sun Solaris, Windows NT Oracle 9i, Pl/sql, Visual Basic 6 Crystal Reports Lasersoft Infosystems Ltd., Chennai, India Banking Automation System Sep 2002 - Jan 2003 BankMuscat, Bahrain This System was developed for Bank Muscat, Bahrain. It automates banking operations and generates Miscellaneous Reports. Team Member Development of code based on the design document. Creating Unit test plan and test cases. Unit testing Providing support for User Acceptance testing. Answering user queries and following up with upstream source systems if required for user query resolution. Quality Management and Defect Prevention activities Maintaining review logs and defect tracking documents Onsite-offshore co-ordination. Sun Solaris, Windows NT Oracle 9i, Pl/sql, Visual Basic 6 Crystal Reports Lasersoft Infosystems Ltd., Chennai, India Cash Management Services May 2002 - Aug 2002 ICICI Bank Cash Management System facilitates a bank to offer a fast credit collection of funds and disbursement service products, to its corporate customers; thereby increasing the banks service income. It is forked into 2 modules the Branch & the Hub. The Hub is the point where all the entries which are made in the Branches are processed. Team Member Development of code based on the design document. Creating Unit test plan and test cases. Unit testing Providing support for User Acceptance testing. Answering user queries and following up with upstream source systems if required for user query resolution. Novell Netware Cobol WOW Lasersoft Infosystems Ltd., Chennai, India Hardware Languages/Databases Location Education: Course Specialization Bachelor of Computer Science Science Master of Computer Computer Applications Application University / Institution Year University of Madras 1995-1998 University of Madras 1998-2001 Personal Details: : : : : : : 27th April, 1977 Male Indian Married 1 Jacksonville, FL, US : H1B 11/14/2015 Date of birth Sex Nationality Marital Status No. of Children Location Visa Details : Visa Type I94 Expiry Date : Passport Details : : Passport Number Passport Issued at Chennai H2128569 On 19 Dec, 2008. Valid upto 18 Dec, 2018