Module 9: Understanding key financial statements

advertisement

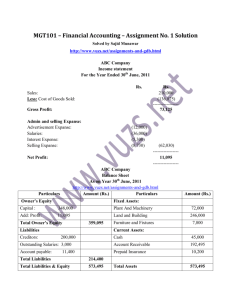

Media and Journalism Course Economic and Business Reporting THREE KEY FINANCIAL STATEMENTS Balance Sheets If you’ve never seen one before, here’s what a balance sheet looks like. As you can see, a balance sheet gives information about a company’s assets, liabilities and equity. Let’s consider each of those and understand more about what they are. Assets In your own life you probably already understand that assets are things that you own – like a computer or iPod or a book. Assets can also refer to items such as pigs and goats, or the produce from the village plantation. It’s the same for companies. Assets are things that a company owns that have a value. So for a company, this means they can either be sold or used to make products or EBR, M9Ho1 1 Media and Journalism Course Economic and Business Reporting provide services that can be sold. In company terms assets usually include physical property, such as plants, trucks, equipment and inventory. It also includes things that may not be tangible or real but which nevertheless exist and have value, such as trademarks and patents. And of course cash itself is an asset. If a company has invested in other companies or bought other assets, these investments are also considered part of the company’s assets. Assets may be split into current and non-current assets – that is, assets are generally listed based on how quickly they will be converted into cash. Current assets are things a company expects to convert to cash within one year. For example, inventory is often considered a current asset as companies usually expect to sell their inventory for cash within a year. Noncurrent assets are things a company does not expect to convert to cash within a year or that would take longer than one year to sell. Noncurrent assets include fixed assets, like warehouses, trucks, office furniture and other property that is used to run the company. Liabilities Liabilities are the term for the money that a company owes others. This can include all kinds of obligations, like money borrowed from a bank to launch a new product, rent for use of a building, money owed to suppliers for materials, payroll a company owes to its employees, environmental cleanup costs, or taxes owed to the government. Liabilities also include obligations to provide goods or services to customers in the future. Again, these are usually represented as current and non-current liabilities, depending on the due date required for payment. Liabilities are said to be either current or long-term. Current liabilities are obligations a company expects to pay off within the year. Long-term liabilities are obligations due more than one year away – examples can include deferred tax liabilities or provisions for the future. Equity This is sometimes called capital or net worth. It’s the money that would be left if a company sold all of its assets and paid off all of its liabilities. This leftover money belongs to the shareholders, or the owners, of the company. It is sometimes called Shareholder’s Equity. Sometimes companies pay out earnings, instead of keeping them – these are then called dividends. So what’s the balance sheet showing? The concept of ‘balance’ is very important in looking at company performance, as a balance sheet shows assets which are equal to the Liabilities plus any Equity. If we consider it as an equation it is simply: Assets=Liabilities plus Equity. Thus, a company's assets have to equal, or "balance," the sum of its liabilities and equity. EBR, M9Ho1 2 Media and Journalism Course Economic and Business Reporting A company’s balance sheet is set up so you can work out the basic accounting equation above - usually the assets are at the top, followed by liabilities, and equity at the bottom. Remember, a balance sheet is only a snapshot of a company’s assets, liabilities and equity at the end of the reporting period. It does not show the flows into and out of the accounts during the period. Closure This module introduced three key financial statements: Balance sheets Income statements Cash flows Balance sheets are a snapshot that contains information about a company’s assets, liabilities and equity. Income statements show the position of a company in relation to what it earned in the year. The concepts of gross and net were introduced and the earnings per share model was explained. We considered the three main components of cash flow statements – that is, operating activities, investing activities and financing activities, and understood why different activities are reported here. Importantly, we then considered the notes that are often included with such statements and how as journalists we must always look at all the evidence available. Notes and official disclosures can contain valuable information and give clues about a company’s view on its performance and future prospects. We finished by discussing the uses of each of these statements and identified where they were inter-related. EBR, M9Ho1 3