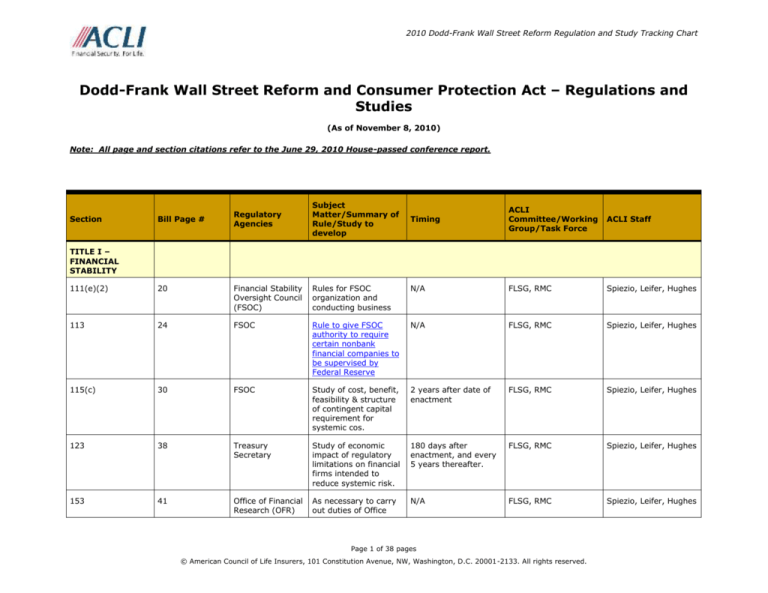

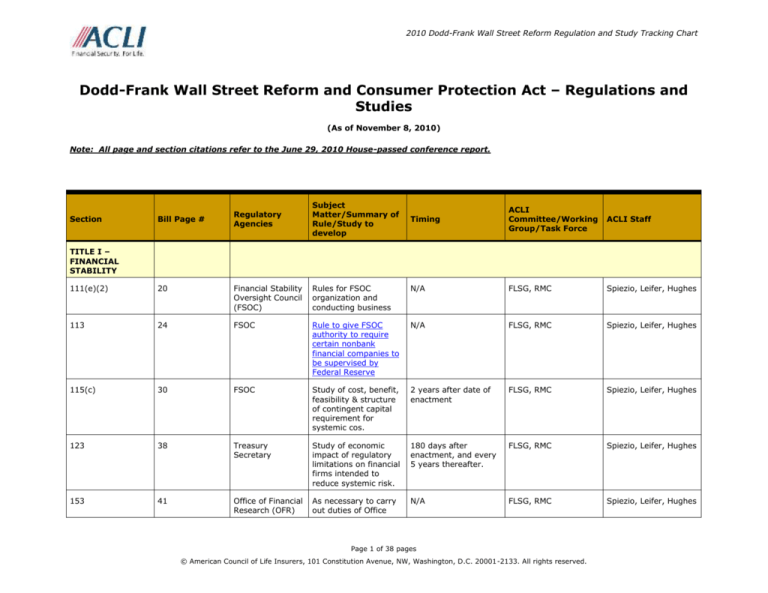

2010 Dodd-Frank Wall Street Reform Regulation and Study Tracking Chart

Dodd-Frank Wall Street Reform and Consumer Protection Act – Regulations and

Studies

(As of November 8, 2010)

Note: All page and section citations refer to the June 29, 2010 House-passed conference report.

Section

Bill Page #

Regulatory

Agencies

Subject

Matter/Summary of

Rule/Study to

develop

Timing

ACLI

Committee/Working

Group/Task Force

ACLI Staff

TITLE I –

FINANCIAL

STABILITY

111(e)(2)

20

Financial Stability

Oversight Council

(FSOC)

Rules for FSOC

organization and

conducting business

N/A

FLSG, RMC

Spiezio, Leifer, Hughes

113

24

FSOC

Rule to give FSOC

authority to require

certain nonbank

financial companies to

be supervised by

Federal Reserve

N/A

FLSG, RMC

Spiezio, Leifer, Hughes

115(c)

30

FSOC

Study of cost, benefit,

feasibility & structure

of contingent capital

requirement for

systemic cos.

2 years after date of

enactment

FLSG, RMC

Spiezio, Leifer, Hughes

123

38

Treasury

Secretary

Study of economic

impact of regulatory

limitations on financial

firms intended to

reduce systemic risk.

180 days after

enactment, and every

5 years thereafter.

FLSG, RMC

Spiezio, Leifer, Hughes

153

41

Office of Financial

Research (OFR)

As necessary to carry

out duties of Office

N/A

FLSG, RMC

Spiezio, Leifer, Hughes

Page 1 of 38 pages

© American Council of Life Insurers, 101 Constitution Avenue, NW, Washington, D.C. 20001-2133. All rights reserved.

ACLI Issue Status Chart

2010 Dodd-Frank Wall Street Reform Regulation and Study Tracking Chart

Subject

Matter/Summary of

Rule/Study to

develop

Timing

ACLI

Committee/Working

Group/Task Force

ACLI Staff

Regarding type and

scope of data to be

collected by OFR

N/A

FLSG, RMC

Spiezio, Leifer, Hughes

Treasury

Secretary

Rules for assessment

base and rates of

financial cos. to fund

OFR

2 years after

enactment

FLSG, RMC

Spiezio, Leifer, Hughes

52

Federal Reserve

Board (FRB)

Rules requiring

systemic cos to

maintain contingent

capital

Subsequent to report

required under sec.

115(c)

FLSG, RMC

Spiezio, Leifer, Hughes

165(e)(1)&(5)

54 and 55

FRB

Rules on concentration

limits, credit exposure

& attribution rule

N/A

FLSG, RMC

Spiezio, Leifer, Hughes

165(f)

55

FRB

Rules on enhanced

public disclosures by

systemic cos.

N/A

FLSG, RMC

Spiezio, Leifer, Hughes

165(g)

55

FRB

Rules governing short

term debt limits for

systemic cos

N/A

FLSG,RMC

Spiezio, Leifer, Hughes

165(h)(2)

56

FRB

Rules requiring and

governing risk

committees in financial

cos.

N/A (but see 165(h)(4) FLSG, RMC

on page 133 re: 15

months from ‘transfer

date’)

Spiezio, Leifer,

Hughes

165(i)(2)(C)

57

Primary federal

financial

regulators in

coordination with

FRB & FIO

Establish rules for

required stress tests

for systemic cos.

N/A

FLSG, RMC

Spiezio, Leifer, Hughes

165(j)(3)

58

FRB

Rules establishing

compliance with

leverage limits

N/A

FLSG, RMC

Spiezio, Leifer, Hughes

Section

Bill Page #

Regulatory

Agencies

154(b)(1)(C)

43

OFR

155(d)

45

165(c)(1)

Page 2 of 38 pages

© American Council of Life Insurers, 101 Constitution Avenue, NW, Washington, D.C. 20001-2133. All rights reserved.

ACLI Issue Status Chart

2010 Dodd-Frank Wall Street Reform Regulation and Study Tracking Chart

Subject

Matter/Summary of

Rule/Study to

develop

Timing

ACLI

Committee/Working

Group/Task Force

ACLI Staff

Rules requiring early

remediation of

financially distressed

systemic co.

N/A

FLSG, RMC

Spiezio, Leifer, Hughes

FRB

Rules establishing

criteria for determining

need to establish

intermediate HC by

systemic cos.

N/A

FLSG, RMC

Spiezio, Leifer, Hughes

61

FRB with FSOC

Rules for exempting

cos. From oversight

under secs. 113 & 115

N/A

FLSG, RMC

Spiezio, Leifer, Hughes

171(b)(7)

65

Federal banking

agencies subject

to FSOC

recommendations

Risk and activity based

capital requirements

for systemic co and

insured depository

institution HCs.

N/A

FLSG, RMC, BTHC

Subgroup

Spiezio, Leifer, Hughes

174

67

Comptroller

General in

consultation with

the FRB, Treasury

& FDIC

Studies on use of

N/A re hybrid capital;

hybrid capital & foreign 18 mos re foreign HCs

bank intermediate HC

capital requirements

FLSG, RMC

Spiezio, Leifer, Hughes

202(d)(5)

75

FDIC

Rules governing

termination of

receivership

N/A

RMC, Solvency Cmte,

FLSG

Spiezio, Leifer,

Mehlman

202(e)

75

Comptroller

General & Admn.

Office of U.S.

Courts

Study of financial co.

liquidation under

Bankruptcy Code

1 year after and

enactment, every year

for the next 3 years,

then once every 5

years

RMC, Solvency Cmte,

FLSG

Spiezio, Leifer,

Mehlman

Regulatory

Agencies

Section

Bill Page #

166(a)

59

FRB with FSOC &

Federal Deposit

Insurance

Corporation

(FDIC)

167(c )

61

170

TITLE II –

ORDERLY

LIQUIDATION

AUTHORITY

Page 3 of 38 pages

© American Council of Life Insurers, 101 Constitution Avenue, NW, Washington, D.C. 20001-2133. All rights reserved.

ACLI Issue Status Chart

2010 Dodd-Frank Wall Street Reform Regulation and Study Tracking Chart

Regulatory

Agencies

Subject

Matter/Summary of

Rule/Study to

develop

Section

Bill Page #

202(f)

76

Comptroller

General

Study of international

coordination of

financial co.

insolvencies

202(g)

76

Comptroller

General

209

86

210(a)(7)(D)

Timing

1 year after enactment

ACLI

Committee/Working

Group/Task Force

ACLI Staff

RMC, International

Cmte, FLSG

Spiezio, Leifer, Smith

Study of banking

1 year after enactment

agency implementation

of prompt corrective

action

RMC, FLSG

Spiezio, Leifer

FDIC in

consultation w/

FSOC

Such rules necessary

to implement T.II

N/A

RMC, FLSG

Spiezio, Leifer

96

FDIC

Rules establishing

interest rate &

payments to claimants

of insolvent covered

financial co.

N/A

RMC, Solvency Cmte,

FLSG

Spiezio, Leifer,

Mehlman

210(c)(8)(H)

117

Primary federal

regulatory

agencies

Rules requiring

financial cos maintain

records re: qualified

financial contracts

2 years after

enactment

RMC, Life Insurance

Investments

Committee (“LIIC”),

FLSG

Spiezio, Leifer,

Wilkerson

210(n)(7)

135

FDIC and

Treasury in

consultation with

FSOC

Rules governing FDIC’s N/A

maximum obligation

limitation

RMC, Solvency Cmte,

FLSG

Spiezio, Leifer,

Mehlman

210(o)(6)

140

FDIC in

consultation w/

Treasury

Rules to carryout

assessment authority

N/A

RMC, Federal Company Spiezio, Leifer, Welsh

Tax Cmte, FLSG

215

146

FSOC

Study on secured

creditor haircuts

1 year after enactment

RMC, LIIC, FLSG

Spiezio, Leifer,

Wilkerson

216

147

FRB in

consultation w/

Office of US

Courts

Study of resolution of

financial cos. Under

chapters 7 & 11 of

Bankruptcy code

1 year after enactment

RMC, FLSG

Spiezio, Leifer

Page 4 of 38 pages

© American Council of Life Insurers, 101 Constitution Avenue, NW, Washington, D.C. 20001-2133. All rights reserved.

ACLI Issue Status Chart

2010 Dodd-Frank Wall Street Reform Regulation and Study Tracking Chart

Section

Bill Page #

217

148

Regulatory

Agencies

Subject

Matter/Summary of

Rule/Study to

develop

FRB in

consultation w/

Office of US

Courts

International

coordination of

systemic co.

insolvencies

1 year after enactment

RMC, International

Cmte, FLSG

FRB or OCC

Any regulation

proposed by the OTS

in advance of the

Transfer Date, but

which has not been

published as a final

regulation, shall be

deemed a proposed

regulation of either the

FRB or the OCC, as

appropriate.

1 year after date of

enactment

B/THC Subgroup, RMC, Neill, Spiezio

FLSG

Timing

ACLI

Committee/Working

Group/Task Force

ACLI Staff

Spiezio, Leifer, Smith

TITLE III –

TRANSFER OF

POWERS TO THE

COMPTROLLER OF

THE CURRENCY,

FDIC, AND BOARD

OF GOVERNORS

316(d)(1)

Page 5 of 38 pages

© American Council of Life Insurers, 101 Constitution Avenue, NW, Washington, D.C. 20001-2133. All rights reserved.

ACLI Issue Status Chart

Section

2010 Dodd-Frank Wall Street Reform Regulation and Study Tracking Chart

Bill Page #

Regulatory

Agencies

Subject

Matter/Summary of

Rule/Study to

develop

Timing

ACLI

Committee/Working

Group/Task Force

ACLI Staff

316(d)(2)

FRB or OCC

Any interim or final

1 year after date of

OTS regulation that

enactment

has not yet become

effective as of the

Transfer Date, shall

become effective as a

regulation of either the

FRB or the OCC, unless

modified in accordance

with applicable law by

the OCC or FRB, as

appropriate, by any

court or by operation

of law.

B/THC Subgroup, RMC, Neill, Spiezio

FLSG

331(b)(2)

FDIC

FDIC must amend

1 year after date of

regulations under the

enactment

FDIA to define the

term “assessment

base”, an amount that

the FDIC determines is

necessary to establish

assessments

consistent with the

definition of a custodial

bank or a banker’s

bank as those terms

are defined under

FDIA.

B/THC Subgroup, RMC, Neill, Spiezio

FLSG

Page 6 of 38 pages

© American Council of Life Insurers, 101 Constitution Avenue, NW, Washington, D.C. 20001-2133. All rights reserved.

ACLI Issue Status Chart

Section

2010 Dodd-Frank Wall Street Reform Regulation and Study Tracking Chart

Bill Page #

Regulatory

Agencies

Subject

Matter/Summary of

Rule/Study to

develop

Timing

ACLI

Committee/Working

Group/Task Force

ACLI Staff

TITLE IV –

REGULATION OF

ADVISORS TO

HEDGE FUNDS &

OTHERS

404

200-203

406

203

412

206

SEC

The SEC shall issue

rules requiring each

investment advisor to

a private fund to file

reports containing

such information as

the SEC deems

necessary for the

protection of investors

or the assessment of

systemic risk.

N/A

Life Insurance

Investments

Committee (“LIIC”)

Wilkerson, Melnyk

SEC, CFTC, FSOC

Disclosure Rules on

Private Funds – will

jointly promulgate

rules to establish the

form of the reports

required to be filed

with the SEC under

subsection 204(b) by

investment advisers

that are registered

both under this title

and the Commodity

Exchange Act.

Not later than 12

months after

enactment

LIIC

Wilkerson, Melnyk

Comptroller

General of the US

(GAO)

Custody rule costs –

compliance costs

associated with

Exchange Commission

rules 204-2 and rule

206(4)-2

3 years

LIIC

Wilkerson, Melnyk

Page 7 of 38 pages

© American Council of Life Insurers, 101 Constitution Avenue, NW, Washington, D.C. 20001-2133. All rights reserved.

ACLI Issue Status Chart

2010 Dodd-Frank Wall Street Reform Regulation and Study Tracking Chart

Section

Bill Page #

415

207

Regulatory

Agencies

Subject

Matter/Summary of

Rule/Study to

develop

Comptroller

General of the US

(GAO)

Appropriate criteria for

determining financial

thresholds to qualify

for accredited investor

status

Timing

ACLI

Committee/Working

Group/Task Force

ACLI Staff

3 years

LIIC

Wilkerson, Melnyk

416

208

Comptroller

General of the US

(GAO)

Feasibility of self1 year

regulatory organization

for private funds

LIIC

Wilkerson, Melnyk

417(a)(1)

208

SEC

Current scholarship on, 2 years

and state of, short

selling

LIIC

Wilkerson, Melnyk

417(a)(2)

208

SEC

Feasibility of public

reporting of short

selling

1 year

LIIC

Wilkerson, Melnyk

TITLE V INSURANCE

313(f)(2)

212

Federal Insurance

Office (FIO)

Publish notice in

Federal Register of

potential pre-emption

of state law

Prior to pre-emption

determination

RMC, International

Cmte, FLSG,SLSG

Spiezio, Hughes, Cobb,

Smith

313(h)

213

Treasury

Rules, orders and

policies to implement

sec. 313 (T.V, subt. A)

N/A

RMC, FLSG

Spiezio, Hughes

313(n)(1)

214

FIO

Report to Congress on

FIO pre-emptions

Every year on 9/30

starting on 9/30/11

RMC, International

Cmtte, FLSG, SLSG

Spiezio, Hughes, Cobb,

Smith

313(n)(2)

214

FIO

Report to Congress on

insurance industry

Every year on 9/30

starting on 9/30/11

RMC, FLSG

Spiezio, Hughes

Page 8 of 38 pages

© American Council of Life Insurers, 101 Constitution Avenue, NW, Washington, D.C. 20001-2133. All rights reserved.

ACLI Issue Status Chart

2010 Dodd-Frank Wall Street Reform Regulation and Study Tracking Chart

Subject

Matter/Summary of

Rule/Study to

develop

ACLI

Committee/Working

Group/Task Force

Section

Bill Page #

Regulatory

Agencies

313(o)

214

FIO

Report to Congress on

global reinsurance

market & effect of

Nonadmitted and

Reinsurance Act of

2010

Re: global reinsurance

market by 9/30/12; re

effect of Act by 1/1/13

and again on 1/1/15

Reinsurance Cmte,

International Cmte

Cobb, Smith

313(p)

215

FIO

Study & report on

insurance regulation

modernization

18 months after

enactment

RMC, FLSG

Spiezio, Hughes

603(b)(1)-(3)

GAO (Controller

General)

Study on whether it is

18 mos. after date of

necessary to eliminate enactment

BHCA exemptions for

holding companies of

credit card banks,

industrial banks, trust

companies and savings

associations.

Bank/Thrift Holding

Company Subgroup

(B/THC Subgroup),

RMC, FLSG

Spiezio, Neill

616(a)

FRB

Regulations to make

capital requirements

for BHCs

countercyclical.

Bank/Thrift Holding

Company Subgroup

(B/THC Subgroup),

RMC, FLSG

Spiezio, Neill

Timing

ACLI Staff

TITLE VI –

IMPROVEMENTS

TO REGULATION

OF BANK AND

SAVINGS

ASSOCIATION

HOLDING

COMPANIES AND

DEPOSITORY

INSTITUTIONS

1 year after date of

enactment

Page 9 of 38 pages

© American Council of Life Insurers, 101 Constitution Avenue, NW, Washington, D.C. 20001-2133. All rights reserved.

ACLI Issue Status Chart

Section

2010 Dodd-Frank Wall Street Reform Regulation and Study Tracking Chart

Bill Page #

Regulatory

Agencies

Subject

Matter/Summary of

Rule/Study to

develop

Timing

ACLI

Committee/Working

Group/Task Force

ACLI Staff

616(b)

Federal banking

agencies

Regulations to make

capital requirements

for savings and loan

holding companies

countercyclical

1 year after date of

enactment

Bank/Thrift Holding

Company Subgroup

(B/THC Subgroup),

RMC, FLSG

Neill, Spiezio

616(c)

Federal banking

agencies

Regulations to require

1 year after date of

bank holding

enactment

companies and savings

and loan holding

companies to serve as

a source of strength

for depository

institution subsidiaries

Bank/Thrift Holding

Company Subgroup

(B/THC Subgroup),

RMC, FLSG

Neill, Spiezio

250

FSOC

study on

implementation of

Volcker Rule

6 mos. After date of

enactment

Bank/Thrift Holding

Company Subgroup

(B/THC Subgroup),

RMC, FLSG

Spiezio, Neill

13(b)(2)

251

Bank/Thrift Holding

Company Subgroup

(B/THC Subgroup),

RMC, FLSG

Spiezio, Neill

256

Rules to carryout

Volcker Rule

provisions, w/

consideration of

findings of FSOC

9 mos. After

completion of FSOC

study (above)

13(d)(2)(B)

13(e)

257

FRB for B/THCs;

federal banking

agencies(jointly)

for insured

depository

institutions; CFTC

& SEC for

institutions they

respectively

regulate; to be

coordinated by

the FSOC

13(c)(6)

253

FRB

Rules to implement

divestiture

requirements and

extended transition for

illiquid funds

6 mos after date of

enactment

Bank/Thrift Holding

Company Subgroup

(B/THC Subgroup),

RMC, FLSG

Spiezio, Neill

(T. VI, Sec. 619)

13(b)(1)

Page 10 of 38 pages

© American Council of Life Insurers, 101 Constitution Avenue, NW, Washington, D.C. 20001-2133. All rights reserved.

ACLI Issue Status Chart

2010 Dodd-Frank Wall Street Reform Regulation and Study Tracking Chart

Subject

Matter/Summary of

Rule/Study to

develop

Bill Page #

Regulatory

Agencies

719

285

CFTC

Study of the effects (if

any) of the position

limits imposed

pursuant to the other

provisions of this title

on excessive

speculation and on the

movement of

transactions from

exchanges in the

United States to

trading venues outside

the United States.

719

286

CFTC & SEC

Study of the feasibility Within 8 months after

of requiring the

the date of the

derivatives industry to enactment

adopt standardized

computer-readable

algorithmic

descriptions which may

be used to describe

complex and

standardized financial

derivatives

Section

Timing

ACLI

Committee/Working

Group/Task Force

ACLI Staff

TITLE VII – WALL

STREET

TRANSPARENCY &

ACCOUNTABILITY

Within 12 months after ACLI Life Insurance

the imposition of

Investments

position limits

Committee (“LIIC”)

pursuant to the other

provisions of Title VII

LIIC

Wilkerson, Melnyk

Wilkerson, Melnyk

Rules related to ACLI’s legislative priorities in the derivatives title that have a direct impact on life insurers are denoted with an “*”; other rules primarily

impact participants other than life insurers but present secondary priorities for life insurers because they may increase the costs of doing business with

derivatives counterparties.

Page 11 of 38 pages

© American Council of Life Insurers, 101 Constitution Avenue, NW, Washington, D.C. 20001-2133. All rights reserved.

ACLI Issue Status Chart

2010 Dodd-Frank Wall Street Reform Regulation and Study Tracking Chart

Section

Bill Page #

Regulatory

Agencies

719

286

CFTC & SEC

719

287*

CFTC & SEC

Subject

Matter/Summary of

Rule/Study to

develop

ACLI

Committee/Working

Group/Task Force

ACLI Staff

Study relating to (i)

Not later than 18

swap regulation in the months after the date

United States, Asia,

of enactment

and clearing house and

clearing agency

regulation in the

United States, Asia,

and Europe and that

identifies areas of

regulation that are

similar in the United

States, Asia and

Europe and other

areas of regulation

that could be

harmonized

LIIC

Wilkerson, Melnyk

Study to determine

whether stable value

contracts fall within

the definition of a

swap. If CFTC & the

SEC determine that

stable value contracts

fall within the

definition of a swap,

they jointly shall

determine if an

exemption for stable

value contracts from

the definition of swap

is appropriate and in

the public interest

LIIC

Wilkerson, Melnyk

Timing

Not later than 15

months after the date

of the enactment

Page 12 of 38 pages

© American Council of Life Insurers, 101 Constitution Avenue, NW, Washington, D.C. 20001-2133. All rights reserved.

ACLI Issue Status Chart

2010 Dodd-Frank Wall Street Reform Regulation and Study Tracking Chart

Subject

Matter/Summary of

Rule/Study to

develop

Timing

ACLI

Committee/Working

Group/Task Force

ACLI Staff

No time limit.

LIIC

Wilkerson, Melnyk

CFTC

May include within, or

No time limit.

exclude from, the term

'floor broker' any

person in or

surrounding any pit,

ring, post, or other

place provided by a

contract market for the

meeting of persons

similarly engaged who

trades for any other

person

LIIC

Wilkerson, Melnyk

CFTC

May include within, or

No time limit.

exclude from, the term

'floor trader' any

person in or

surrounding any pit,

ring, post, or other

place provided by a

contract market for the

meeting of persons

similarly engaged who

trades solely for such

person's own account

LIIC

Wilkerson, Melnyk

Section

Bill Page #

Regulatory

Agencies

721(a)(6)

290

CFTC

May include within, or

exclude from, the term

'commodity pool

operator' any person

engaged in a business

that is of the nature of

a commodity pool,

investment trust,

syndicate, or similar

form of enterprise

721(a)(10)

291

721(a)(11)

291

Page 13 of 38 pages

© American Council of Life Insurers, 101 Constitution Avenue, NW, Washington, D.C. 20001-2133. All rights reserved.

ACLI Issue Status Chart

2010 Dodd-Frank Wall Street Reform Regulation and Study Tracking Chart

Section

Bill Page #

Regulatory

Agencies

721(a)(13)

291

CFTC

721(a)(15)

293

CFTC

Subject

Matter/Summary of

Rule/Study to

develop

Timing

ACLI

Committee/Working

Group/Task Force

ACLI Staff

May include within, or

exclude from, the term

'futures commission

merchant' any person

who engages in

soliciting or accepting

orders for, or acting as

a counterparty in, any

agreement, contract,

or transaction subject

to this Act, and who

accepts any money,

securities, or property

(or extends credit in

lieu thereof) to

margin, guarantee, or

secure any trades or

contracts that result or

may result therefrom

No time limit.

LIIC

Wilkerson, Melnyk

May include within, or

exclude from, the term

'introducing broker'

any person who

engages in soliciting or

accepting orders for

any agreement,

contract, or

transaction subject to

this Act, and who does

not accept any money,

securities, or property

( or extend credit in

lieu thereof) to

margin, guarantee, or

secure any trades or

contracts that result or

may result therefrom

No time limit.

LIIC

Wilkerson, Melnyk

Page 14 of 38 pages

© American Council of Life Insurers, 101 Constitution Avenue, NW, Washington, D.C. 20001-2133. All rights reserved.

ACLI Issue Status Chart

2010 Dodd-Frank Wall Street Reform Regulation and Study Tracking Chart

Section

Bill Page #

Regulatory

Agencies

721(a)(16)

294 *

CFTC

721(b)

301 *

CFTC

Subject

Matter/Summary of

Rule/Study to

develop

ACLI

Committee/Working

Group/Task Force

ACLI Staff

Define by rule or

Within one year after

regulation the term

enactment.

'substantial position' at

the threshold that the

CFTC determines to be

prudent for the

effective monitoring,

management, and

oversight of entities

that are systemically

important or can

significantly impact the

financial system of the

United States

LIIC

Wilkerson, Melnyk

May adopt a rule to

define (1) the term

"commercial risk"; and

(2) any other term

included in an

amendment to the

Commodity Exchange

Act (7 U.S.C. 1 et

seq.) made by this

subtitle.

LIIC

Wilkerson, Melnyk

Timing

Within one year after

enactment.

Page 15 of 38 pages

© American Council of Life Insurers, 101 Constitution Avenue, NW, Washington, D.C. 20001-2133. All rights reserved.

ACLI Issue Status Chart

2010 Dodd-Frank Wall Street Reform Regulation and Study Tracking Chart

Subject

Matter/Summary of

Rule/Study to

develop

Section

Bill Page #

Regulatory

Agencies

721(c)

301 *

CFTC

To include transactions

and entities that have

been structured to

evade this subtitle (or

an amendment made

by this subtitle), the

Commodity Futures

Trading Commission

shall adopt a rule to

further define the

terms "swap", "swap

dealer", "major swap

participant", and

"eligible contract

participant"

723(a)(3)

308

CFTC

Shall adopt rules for a

derivatives clearing

organization's

submission for review,

pursuant to this

paragraph, of a swap,

or a group, category,

type, or class of

swaps, that it seeks to

accept for clearing

ACLI

Committee/Working

Group/Task Force

ACLI Staff

Within one year after

enactment.

LIIC

Wilkerson, Melnyk

Within one year after

enactment.

LIIC

Wilkerson, Melnyk

Timing

Page 16 of 38 pages

© American Council of Life Insurers, 101 Constitution Avenue, NW, Washington, D.C. 20001-2133. All rights reserved.

ACLI Issue Status Chart

2010 Dodd-Frank Wall Street Reform Regulation and Study Tracking Chart

Section

Bill Page #

Regulatory

Agencies

723(a)

309

CFTC

725(c)

323

Derivatives

Clearing

Organizations

Subject

Matter/Summary of

Rule/Study to

develop

ACLI

Committee/Working

Group/Task Force

ACLI Staff

Shall prescribe rules

Within one year after

under this subsection

enactment.

(and issue

interpretations of rules

prescribed under this

subsection) as

determined by the

CFTC to be necessary

to prevent evasions of

the mandatory clearing

requirements under

Act

LIIC

Wilkerson, Melnyk

Each derivatives

clearing organization

shall"(i) establish and

enforce rules to

minimize conflicts of

interest in the decision

-making process of the

derivatives clearing

organization; and "(ii)

establish a process for

resolving conflicts of

interest

LIIC

Wilkerson, Melnyk

Timing

No time limit.

Page 17 of 38 pages

© American Council of Life Insurers, 101 Constitution Avenue, NW, Washington, D.C. 20001-2133. All rights reserved.

ACLI Issue Status Chart

2010 Dodd-Frank Wall Street Reform Regulation and Study Tracking Chart

Section

Bill Page #

Regulatory

Agencies

725(d)

323

CFTC

Subject

Matter/Summary of

Rule/Study to

develop

Timing

Shall adopt rules

No time limit.

mitigating conflicts of

interest in connection

with the conduct of

business by a swap

dealer or a major swap

participant with a

derivatives clearing

organization, board of

trade, or a swap

execution facility that

clears or trades swaps

in which the swap

dealer or major swap

participant has a

material debt or

material equity

investment

ACLI

Committee/Working

Group/Task Force

ACLI Staff

LIIC

Wilkerson, Melnyk

Page 18 of 38 pages

© American Council of Life Insurers, 101 Constitution Avenue, NW, Washington, D.C. 20001-2133. All rights reserved.

ACLI Issue Status Chart

2010 Dodd-Frank Wall Street Reform Regulation and Study Tracking Chart

Section

Bill Page #

Regulatory

Agencies

726(a)

326

CFTC

Subject

Matter/Summary of

Rule/Study to

develop

To mitigate conflicts of

interest, the CFTC

shall adopt rules which

may include numerical

limits on the control

of, or the voting rights

with respect to, any

derivatives clearing

organization that

clears swaps, or swap

execution facility or

board of trade

designated as a

contract market that

posts swaps or makes

swaps available for

trading, by a bank

holding company (as

defined in section 2 of

the Bank Holding

Company Act of 1956

with total consolidated

assets of

$50,000,000,000 or

more, a nonbank

financial company (as

defined in section 102)

supervised by the

Board, an affiliate of

such a bank holding

company or nonbank

financial company, a

swap dealer, major

swap participant, or

associated person of a

swap dealer or major

swap participant

Timing

Within 180 days after

enactment

ACLI

Committee/Working

Group/Task Force

ACLI Staff

LIIC

Wilkerson, Melnyk

Page 19 of 38 pages

© American Council of Life Insurers, 101 Constitution Avenue, NW, Washington, D.C. 20001-2133. All rights reserved.

ACLI Issue Status Chart

2010 Dodd-Frank Wall Street Reform Regulation and Study Tracking Chart

Subject

Matter/Summary of

Rule/Study to

develop

Timing

ACLI

Committee/Working

Group/Task Force

ACLI Staff

Authorized and

required to provide by

rule for the public

availability of swap

transaction and pricing

data

No time limit.

LIIC

Wilkerson, Melnyk

CFTC

Establish and enforce

rules to minimize

conflicts of interest in

the decision-making

process of the swap

data repository, and

establish a process for

resolving conflicts of

interest

No time limit.

LIIC

Wilkerson, Melnyk

CFTC

Interim final rule

providing for the

reporting of each swap

entered into before the

date of enactment

within 90 days of the

date of enactment

LIIC

Wilkerson, Melnyk

Section

Bill Page #

Regulatory

Agencies

727

327 *

CFTC

728

332

729

332 *

Page 20 of 38 pages

© American Council of Life Insurers, 101 Constitution Avenue, NW, Washington, D.C. 20001-2133. All rights reserved.

ACLI Issue Status Chart

2010 Dodd-Frank Wall Street Reform Regulation and Study Tracking Chart

Subject

Matter/Summary of

Rule/Study to

develop

Timing

ACLI

Committee/Working

Group/Task Force

ACLI Staff

In consultation with

the CFTC and the SEC,

shall jointly adopt

rules for swap dealers

and major swap

participants, with

respect to their

activities as a swap

dealer or major swap

participant, for which

there is a prudential

regulator imposing:

capital requirements;

and both initial and

variation margin

requirements on all

swaps that are not

cleared by a registered

derivatives clearing

organization.

No time limit.

LIIC

Wilkerson, Melnyk

CFTC

Shall adopt rules

governing reporting

and recordkeeping for

swap dealers and

major swap

participants

No time limit.

LIIC

Wilkerson, Melnyk

CFTC

Shall prescribe rules

governing business

conduct standards for

swap dealers and

major swap

participants

No time limit.

LIIC

Wilkerson, Melnyk

Regulatory

Agencies

Section

Bill Page #

731

336*

Prudential

Regulators in

Consultation with

the SEC

731

338 *

731

341*

Page 21 of 38 pages

© American Council of Life Insurers, 101 Constitution Avenue, NW, Washington, D.C. 20001-2133. All rights reserved.

ACLI Issue Status Chart

2010 Dodd-Frank Wall Street Reform Regulation and Study Tracking Chart

Subject

Matter/Summary of

Rule/Study to

develop

Timing

ACLI

Committee/Working

Group/Task Force

ACLI Staff

Shall adopt rules

governing

documentation

standards for swap

dealers and major

swap participants

No time limit.

LIIC

Wilkerson, Melnyk

CFTC & SEC

May promulgate rules

defining the universe

of swaps that can be

executed on a swap

execution facility

No time limit.

LIIC

Wilkerson, Melnyk

349

CFTC

Shall prescribe rules

governing the

regulation of

alternative swap

execution facilities

No time limit.

LIIC

Wilkerson, Melnyk

356

CFTC

By rule, regulation, or

order, may exempt,

conditionally or

unconditionally, any

person or class of

persons, any swap or

class of swaps, any

contract of sale of a

commodity for future

delivery or class of

such contracts, any

option or class of

options, or any

transaction or class of

transactions from any

requirement it may

establish with respect

to position limits

No time limit.

LIIC

Wilkerson, Melnyk

Section

Bill Page #

Regulatory

Agencies

731

341 *

CFTC

733

344 *

733

737

Page 22 of 38 pages

© American Council of Life Insurers, 101 Constitution Avenue, NW, Washington, D.C. 20001-2133. All rights reserved.

ACLI Issue Status Chart

2010 Dodd-Frank Wall Street Reform Regulation and Study Tracking Chart

Subject

Matter/Summary of

Rule/Study to

develop

Timing

ACLI

Committee/Working

Group/Task Force

ACLI Staff

Rules to implement

new statutory

framework for

certification and

approval of new

products – applicable

to designated contract

markets (DCM)

derivatives clearing

organizations (DCO),

swap execution

facilities (SEF), and

swap data repositories

(SDR).

No time limit.

LIIC

Wilkerson, Melnyk

CFTC

Grants CFTC authority

to amend the

Commodity Exchange

Act (CEA) to prohibit

certain trading

practices deemed

disruptive of fair and

equitable trading

No time limit.

LIIC

Wilkerson, Melnyk

SEC

Regarding the term

No time limit.

“security-based swap”

define, by rule or

regulation, the term

'substantial position' at

the threshold that the

CFTC determines to be

prudent for the

effective monitoring,

management, and

oversight of entities

that are systemically

important or can

significantly impact the

financial system of the

United States

LIIC

Wilkerson, Melnyk

Section

Bill Page #

Regulatory

Agencies

745

367

CFTC

747

371

761(a)

388 *

Page 23 of 38 pages

© American Council of Life Insurers, 101 Constitution Avenue, NW, Washington, D.C. 20001-2133. All rights reserved.

ACLI Issue Status Chart

2010 Dodd-Frank Wall Street Reform Regulation and Study Tracking Chart

Subject

Matter/Summary of

Rule/Study to

develop

ACLI

Committee/Working

Group/Task Force

ACLI Staff

Not later than 1 year

after the date of the

enactment

LIIC

Wilkerson, Melnyk

No time limit.

LIIC

Wilkerson, Melnyk

SEC

Shall adopt rules

No time limit.

governing persons that

are registered as

clearing agencies for

security-based swaps

LIIC

Wilkerson, Melnyk

SEC

Shall prescribe rules

governing the

regulation of securitybased swap execution

facilities under this

section

LIIC

Wilkerson, Melnyk

Section

Bill Page #

Regulatory

Agencies

763

396 *

SEC

Shall adopt rules for a

clearing agency's

submission for review,

pursuant to this

subsection, of a

security-based swap,

or a group, category,

type, or class of

security-based swaps,

that it seeks to accept

for clearing

763

401

SEC

To be registered and

to maintain

registration as a

clearing agency that

clears security-based

swap transactions, a

clearing agency shall

comply with such

standards as the CFTC

may establish by rule

763

401

763

407

Timing

No time limit.

Page 24 of 38 pages

© American Council of Life Insurers, 101 Constitution Avenue, NW, Washington, D.C. 20001-2133. All rights reserved.

ACLI Issue Status Chart

2010 Dodd-Frank Wall Street Reform Regulation and Study Tracking Chart

Subject

Matter/Summary of

Rule/Study to

develop

ACLI

Committee/Working

Group/Task Force

ACLI Staff

Shall, by rules and

No time limit.

regulations, define and

prescribe means

reasonably designed to

prevent, such

transactions, acts,

practices, and courses

of business as are

fraudulent, deceptive,

or manipulative, and

such quotations as are

fictitious concerning

security-based swaps

LIIC

Wilkerson, Melnyk

CFTC

By rule or regulation,

as necessary or

appropriate in the

public interest or for

the protection of

investors, establish

limits (including

related hedge

exemption provisions)

on the size of positions

in any security-based

swap, including

aggregate positions

No time limit.

LIIC

Wilkerson, Melnyk

CFTC

Authorized to provide

by rule for the public

availability of securitybased swap

transaction, volume,

and pricing data

No time limit.

LIIC

Wilkerson, Melnyk

Section

Bill Page #

Regulatory

Agencies

763

410

SEC

763

410

763

412

Timing

Page 25 of 38 pages

© American Council of Life Insurers, 101 Constitution Avenue, NW, Washington, D.C. 20001-2133. All rights reserved.

ACLI Issue Status Chart

2010 Dodd-Frank Wall Street Reform Regulation and Study Tracking Chart

Subject

Matter/Summary of

Rule/Study to

develop

Timing

ACLI

Committee/Working

Group/Task Force

ACLI Staff

Establish and enforce

rules to minimize

conflicts of interest in

the decision-making

process of the

security-based swap

data repository

No time limit.

LIIC

Wilkerson, Melnyk

SEC

May prescribe rules

applicable to securitybased swap dealers

and major securitybased swap

participants, including

rules that limit the

activities of non-bank

security-based swap

dealers and major

security-based swap

participants

No time limit.

LIIC

Wilkerson, Melnyk

SEC

Shall issue rules under

this section to provide

for the registration of

security-based swap

dealers and major

security-based swap

participants

Within one year after

enactment

LIIC

Wilkerson, Melnyk

Regulatory

Agencies

Section

Bill Page #

763

417

Security-based

swap repository

764

418

764

418

Page 26 of 38 pages

© American Council of Life Insurers, 101 Constitution Avenue, NW, Washington, D.C. 20001-2133. All rights reserved.

ACLI Issue Status Chart

2010 Dodd-Frank Wall Street Reform Regulation and Study Tracking Chart

Subject

Matter/Summary of

Rule/Study to

develop

Timing

ACLI

Committee/Working

Group/Task Force

ACLI Staff

No time limit.

LIIC

Wilkerson, Melnyk

Shall adopt rules which Within 180 days of

may include numerical enactment

limits on the control

of, or the voting rights

with respect to, any

clearing agency that

clears security-based

swaps, or on the

control of any securitybased swap execution

facility or national

securities exchange

that posts or makes

available for trading

security-based swaps,

by a bank holding

company

LIIC

Wilkerson, Melnyk

Shall promulgate an

interim final rule

providing for the

reporting of each

security-based swap

entered into before the

date of enactment

LIIC

Wilkerson, Melnyk

Section

Bill Page #

Regulatory

Agencies

764

425

SEC

Shall adopt rules

governing

documentation

standards for securitybased swap dealers

and major securitybased swap

participants

765

429

SEC

766

431

SEC

Within 90 days of the

date of enactment

Page 27 of 38 pages

© American Council of Life Insurers, 101 Constitution Avenue, NW, Washington, D.C. 20001-2133. All rights reserved.

ACLI Issue Status Chart

2010 Dodd-Frank Wall Street Reform Regulation and Study Tracking Chart

Regulatory

Agencies

Subject

Matter/Summary of

Rule/Study to

develop

454

Board of

Governors

(Federal

Reserve),

Supervisory

Agencies

Authorized to prescribe NA

rules and issue orders

as may be necessary

to administer and

carry out their

respective authorities

Life Insurance

Investments

Committee (“LIIC”)

Wilkerson, Melnyk

913

458

SEC

Study and rulemaking

regarding obligation of

brokers, dealers and

investment advisers

6 months/Date of

Enactment

Standard of Care

Working Group

Leifer

914

464

SEC

Study on enhancing

investment advisers

examinations

180 days/ Date of

Enactment

Standard of Care

Working Group

Leifer

917

470

SEC

Study regarding

financial literacy

among investors

2 years/ Date of

Enactment

Standard of Care

Working Group

Leifer

918

470

Comptroller

General of the

U.S.

Study regarding

mutual fund

advertising

18 months/Date of

Enactment

Standard of Care

Working Group

Leifer

Section

Bill Page #

Timing

ACLI

Committee/Working

Group/Task Force

ACLI Staff

TITLE VIII –

PAYMENT,

CLEARING, &

SETTLEMENT

SUPERVISION

810

TITLE IX –

INVESTOR

PROTECTIONS &

IMPROVEMENTS

TO THE

REGULATON OF

SECURITIES

Page 28 of 38 pages

© American Council of Life Insurers, 101 Constitution Avenue, NW, Washington, D.C. 20001-2133. All rights reserved.

ACLI Issue Status Chart

2010 Dodd-Frank Wall Street Reform Regulation and Study Tracking Chart

Subject

Matter/Summary of

Rule/Study to

develop

ACLI

Committee/Working

Group/Task Force

Section

Bill Page #

Regulatory

Agencies

919

471

SEC

Clarification of

authority to require

investor disclosure

prior to purchase of

investment products

No deadline

Standard of Care

Working Group

Leifer

919B

472

SEC

Study on improved

access to information

on broker-deals &

investment advisers

6 months/Date of

Enactment

Standard of Care

Working Group

Leifer

919C

472

Comptroller

General of the

U.S.

Study on financial

planners and the use

of financial

designations

180 days/ Date of

Enactment

Standard of Care

Working Group

Leifer

921

474

SEC

Authority to restrict

mandatory pre-dispute

arbitration

No deadline

Standard of Care

Working Group

Leifer

939A

521

Each Federal

Agency with

regulations

requiring review

of

creditworthiness

of a security or

money market

instrument, or

referencing credit

rating agencies

Replace all regulatory

references to credit

rating agencies with

standards of credit

worthiness that each

respective agency

determines are

appropriate.

Within one year after

enactment

LIIC

Wilkerson, Melnyk

939B

522

SEC

Requires SEC to

amend Reg FD to

remove disclosure

exemption for NRSRO

for purpose of

determining credit

ratings.

No deadline

Securities and

Regulation

Committee/LIIC

Wilkerson, Melnyk

Timing

Page 29 of 38 pages

© American Council of Life Insurers, 101 Constitution Avenue, NW, Washington, D.C. 20001-2133. All rights reserved.

ACLI Staff

ACLI Issue Status Chart

2010 Dodd-Frank Wall Street Reform Regulation and Study Tracking Chart

Subject

Matter/Summary of

Rule/Study to

develop

ACLI

Committee/Working

Group/Task Force

Section

Bill Page #

Regulatory

Agencies

975(a)

550

SEC

Develop process for

registration of

municipal securities

advisors

Effective 10/1/10 to

12/31/10

Distribution

Committee, Securities

and Regulation

Committee

989A

576

Office of Financial

Literacy (Bureau

of Consumer

Financial

Protection)

Grants to states

relating to senior

designations &

suitability

No deadline

Distribution Committee Leifer, Ireland

584

SEC

Further promoting the

adoption of NAIC

Model Regulations that

enhance protection of

seniors & other

consumers

Benefits commence

June 16, 2013

Distribution Committee Leifer, Ireland

1013(b)(3)(C)

604

Bureau

Complaints regarding

consumer financial

products

Annual Report not

later than 3/31

Distribution Committee Leifer

1013(d)(4)

606

Bureau

Report on financial

literacy activities

24 months/Date of

Enactment; then

annually

Distribution Committee Leifer

989(J)

Timing

ACLI Staff

Liefer, Wilkerson

$8,000,000 authorized

2011-2015

TITLE X – BUREAU

OF CONSUMER

FINANCIAL

PROTECTION

While there is not a statutory mandate in the Dodd-Frank law to create such a rule, the SEC currently does not have a process

to register municipal investment advisors and needs to create a rule to comply with Section 975.

Page 30 of 38 pages

© American Council of Life Insurers, 101 Constitution Avenue, NW, Washington, D.C. 20001-2133. All rights reserved.

ACLI Issue Status Chart

2010 Dodd-Frank Wall Street Reform Regulation and Study Tracking Chart

Regulatory

Agencies

Subject

Matter/Summary of

Rule/Study to

develop

Timing

ACLI

Committee/Working

Group/Task Force

Section

Bill Page #

1013(d)(7)(A)

606

Comptroller

General of the

U.S.

Feasibility of

certification

program/financial

literacy

1 year/Date of

Enactment

Distribution Committee Leifer

1013(g)

608

Bureau (Office of

Financial

Protection of

Older Americans)

Best practices for

seniors, certifications

for advisors, LTC &

other services

18

months/Establishment

of Office

Distribution Committee Leifer

1016(b)

609

Bureau

Report on consumer

problems obtaining

financial products,

analysis of consumer

complaints, significant

Bureau rules and

orders, among number

of other things

Semi- annual reports

Distribution Committee Leifer

1022(b)

616

Bureau

General rulemaking

authority to implement

Federal consumer

financial laws,

including FCRA

No deadline

Distribution

Committee/Privacy

Committee

1022(c)(1)-(4)

617

Bureau

Monitoring for risks to

consumers in offering

or provision of

consumer financial

products or services

Not fewer than 1

report of significant

findings each calendar

year

Distribution Committee Leifer

1022(c)(6)

618

Bureau

Rulemaking regarding

confidential treatment

of information

obtained implementing

Federal consumer

financial law

No deadline

Privacy Committee

Page 31 of 38 pages

© American Council of Life Insurers, 101 Constitution Avenue, NW, Washington, D.C. 20001-2133. All rights reserved.

ACLI Staff

Leifer/Meyer

Meyer

ACLI Issue Status Chart

2010 Dodd-Frank Wall Street Reform Regulation and Study Tracking Chart

Subject

Matter/Summary of

Rule/Study to

develop

Timing

ACLI

Committee/Working

Group/Task Force

Rulemaking authority

regarding registration

requirements

applicable to covered

person, other than

insured depository

institution or insured

credit union

No deadline

Distribution Committee Leifer

Bureau & FTC

Definition of “covered

person” as nondepository entity

offering loan

origination & other

services

1 year after transfer

date

Reverse Mortgage

Working Group

639

Bureau

Study of arbitration

agreements used by

covered persons;

rulemaking

No deadline

Distribution Committee Leifer

1031(b)

641

Bureau

General rulemaking

regarding disclosure,

unfair, deceptive

practices & other

subjects (covered

persons)

No deadline

Reverse Mortgage

Working Group

Leifer

1032(f)

643

Bureau

Rulemaking -integrated disclosure

for mortgage loans

1 year of transfer date

Reverse Mortgage

Working Group

Leifer

1074(a)

703

Treasury

Future of

Fannie/Freddie &

reform of housing

finance

January 31, 2011

Reverse Mortgage

Working Group

Leifer

1076

711

Bureau

Study & regulation of

reverse mortgages

1 year from transfer

date

Reverse Mortgage

Working Group

Leifer

Section

Bill Page #

Regulatory

Agencies

1022(c)(7)

619

Bureau

1024(a)(2)

622

1028(a)

Page 32 of 38 pages

© American Council of Life Insurers, 101 Constitution Avenue, NW, Washington, D.C. 20001-2133. All rights reserved.

ACLI Staff

Leifer

ACLI Issue Status Chart

2010 Dodd-Frank Wall Street Reform Regulation and Study Tracking Chart

Subject

Matter/Summary of

Rule/Study to

develop

ACLI

Committee/Working

Group/Task Force

ACLI Staff

Study on differences

1 year/Date of

between consumer and Enactment

credit scores

Privacy Committee

Meyer

Bureau

Rulemaking authority

to implement number

of specific FCRA and

FACT Act provisions,

including section

relating to affiliate

sharing

No deadline

Privacy Committee

Meyer

727

Bureau

General rulemaking

authority to implement

FCRA (other than

sections relating to

Red Flags Guidelines

and disposal of

records)

No deadline

Privacy Committee

Meyer

732

CFTC

To amend the CFTC’s

GLBA privacy of

consumer financial

information rules to

broaden their scope to

apply to “swap

dealers” and “major

swap participants” and

to make other

conforming

amendments to the

rules required under

Titles VII and X.

No time limit

Privacy Committee,

LIIC

Meyer

Section

Bill Page #

Regulatory

Agencies

1078

713

Bureau

1088

724

1088(e)

1093

Timing

Page 33 of 38 pages

© American Council of Life Insurers, 101 Constitution Avenue, NW, Washington, D.C. 20001-2133. All rights reserved.

ACLI Issue Status Chart

2010 Dodd-Frank Wall Street Reform Regulation and Study Tracking Chart

Subject

Matter/Summary of

Rule/Study to

develop

ACLI

Committee/Working

Group/Task Force

ACLI Staff

“…as soon as

practicable after date

of enactment.”

FLSG, RMC

Spiezio, Kline

Not later than 30

months after

enactment.

FLSG

Spiezio, Kline

FLSG, Insurance

Holding Company

Supervision WG

Spiezio, Kline, Neill

Bill Page #

Regulatory

Agencies

1101(a)(6)(B)(1)

2011

Federal Reserve

Develop rules to

ensure emergency

lending programs

provide market

liquidity and not aid a

failing institution.

1103(b)(8)

2027

Federal Reserve

(Inspector

General)

Study on impact of

Fed’s FOIA exemption

and the ability of the

public to access

information on Fed’s

economic emergency

programs.

1105(a)

2031

Federal Reserve

in coordination

with FDIC

Develop rules to create N/A

a program to

guarantee obligations

of solvent insured

depository institutions

and holding companies

during times of stress.

Section

Timing

TITLE XI –

FEDERAL

RESERVE SYSTEM

PROVISIONS

Page 34 of 38 pages

© American Council of Life Insurers, 101 Constitution Avenue, NW, Washington, D.C. 20001-2133. All rights reserved.

ACLI Issue Status Chart

Section

2010 Dodd-Frank Wall Street Reform Regulation and Study Tracking Chart

Bill Page #

Regulatory

Agencies

Subject

Matter/Summary of

Rule/Study to

develop

Timing

ACLI

Committee/Working

Group/Task Force

ACLI Staff

N/A

FLSG

Kline, Lovendusky

TITLE XII –

IMPROVING

ACCESS TO

MAINSTREAM

FINANCIAL

INSTITUTIONS

1209(a)

2056

Treasury

Department

Develop rules to

establish grant

programs to enable

low and moderate

income individuals to

establish one or more

accounts in a federally

insured depository

institution.

TITLE XIII – PAY

IT BACK ACT

No rulemaking

provisions in this Title.

Kline, Neill

TITLE XIV –

MORTGAGE

REFORM & ANTIPREDATORY

LENDING ACT

1403

2082

Federal Reserve

(Board of

Governors)

Prescribe rules to

prohibit mortgage

originators from

steering consumers to

unsuitable loans.

Must be in final form

FLSG

18 months after

designated transfer

date. Rules take effect

12 months after

issuance

Page 35 of 38 pages

© American Council of Life Insurers, 101 Constitution Avenue, NW, Washington, D.C. 20001-2133. All rights reserved.

Kline, Leifer

ACLI Issue Status Chart

2010 Dodd-Frank Wall Street Reform Regulation and Study Tracking Chart

Subject

Matter/Summary of

Rule/Study to

develop

Timing

ACLI

Committee/Working

Group/Task Force

ACLI Staff

Develop rules to

prohibit or condition

terms or practices in

residential mortgage

loans that the Board

deems predatory or

unfair.

“”

FLSG

Kline, Leifer

Federal Reserve

(Board of

Governors)

Prescribe regulations

that revise, add to, or

subtract from criteria

that define “qualified

mortgage.”

“”

FLSG

Kline, Leifer

2125

GAO

Study to determine

effects of this Title on

availability and

affordability of credit.

1 year after enactment

FLSG

Kline, Leifer

1446

2169

HUD Secretary

Study on root causes

of foreclosure.

1 year after enactment

FLSG

Kline, Leifer

1471

2205

Fed Board, with

OCC, FDIC,

NCUA, FHFA, and

BCFP

Develop rules to

establish property

appraisal requirements

90 days after

enactment.

FLSG

Kline, Leifer

1124

2223

Fed Board, with

OCC, FDIC,

NCUA, FHFA, and

BCFP

Develop rules to

establish minimum

requirements States

will use when

registering appraisal

management

companies.

N/A

FLSG

Kline, Leifer

1125(b)

2239

Fed Board, with

OCC, FDIC,

NCUA, FHFA, and

BCFP

Promulgate rules to

create quality control

standards for use of

automated valuation

models for mortgage

lending purposes.

N/A

FLSG

Kline, Leifer

Regulatory

Agencies

Section

Bill Page #

1405(a)

2086

Federal Reserve

(Board of

Governors)

1412

2104

1421(a)

Page 36 of 38 pages

© American Council of Life Insurers, 101 Constitution Avenue, NW, Washington, D.C. 20001-2133. All rights reserved.

ACLI Issue Status Chart

2010 Dodd-Frank Wall Street Reform Regulation and Study Tracking Chart

Subject

Matter/Summary of

Rule/Study to

develop

ACLI

Committee/Working

Group/Task Force

ACLI Staff

12 months after

enactment

FLSG

Kline, Leifer

N/A

FLSG

Kline , Leifer

SEC

Promulgate rules that

N/A

require all persons that

file reports with the

SEC to disclosure

annually if conflict

minerals are necessary

for products produced

by such persons.

FLSG

Kline, Lovendusky

FDIC

Study to evaluate the

definition of “core

deposits” and effects

on calculating

insurance premiums

payable to the DIF.

FLSG

Kline, Lovendusky

Section

Bill Page #

Regulatory

Agencies

1476

2246

GAO

Study on the

effectiveness of

various appraisal

methods and valuation

models.

1492(a)

2261

GAO

Study on effectiveness

of government efforts

to combat mortgage

foreclosure rescue

scams and loan fraud

1502(b)(1)(A)

2280

1506(a)

2305

Timing

TITLE XV –

MISCELLANEOUS

PROVISIONS

1 year after enactment

Page 37 of 38 pages

© American Council of Life Insurers, 101 Constitution Avenue, NW, Washington, D.C. 20001-2133. All rights reserved.

ACLI Issue Status Chart

Section

2010 Dodd-Frank Wall Street Reform Regulation and Study Tracking Chart

Bill Page #

Regulatory

Agencies

861

IRS

Subject

Matter/Summary of

Rule/Study to

develop

Timing

ACLI

Committee/Working

Group/Task Force

ACLI Staff

TITLE XVI –

SECTION 1256

CONTRACTS

1601

Treasury

The term “Section

1256 Contract” does

not include interest

rate swaps or similar

agreements

Taxable years

beginning after date of

enactment

Company Taxation –

Federal Committee

Page 38 of 38 pages

© American Council of Life Insurers, 101 Constitution Avenue, NW, Washington, D.C. 20001-2133. All rights reserved.

Welsh