Multiple Choice - BYU Marriott School

advertisement

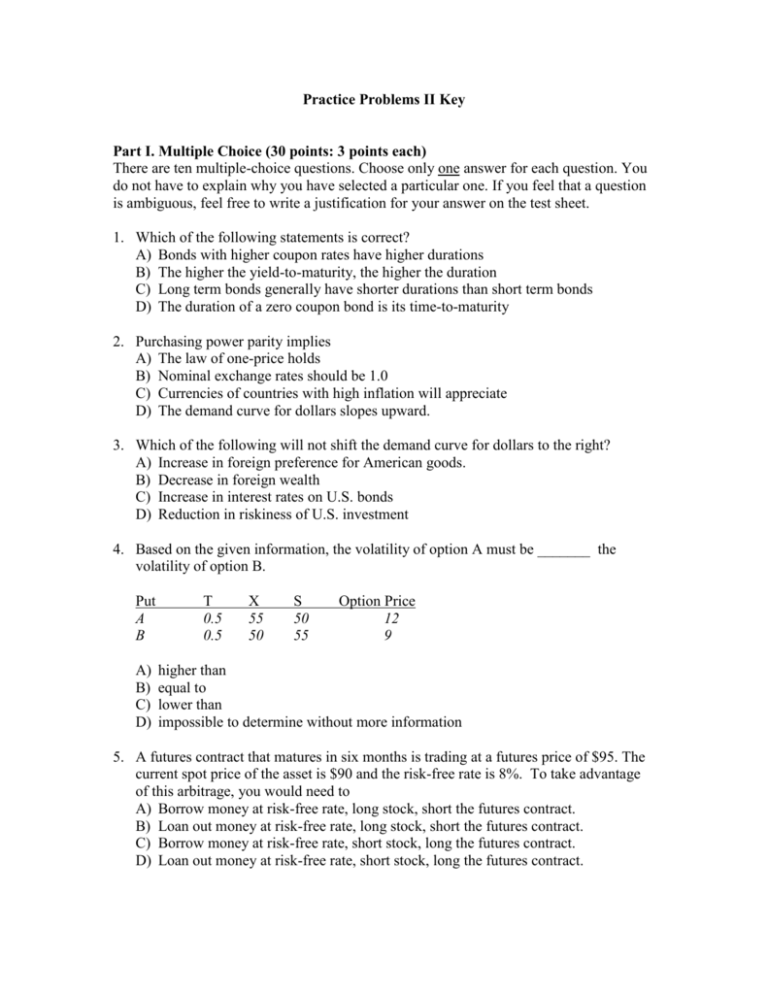

Practice Problems II Key Part I. Multiple Choice (30 points: 3 points each) There are ten multiple-choice questions. Choose only one answer for each question. You do not have to explain why you have selected a particular one. If you feel that a question is ambiguous, feel free to write a justification for your answer on the test sheet. 1. Which of the following statements is correct? A) Bonds with higher coupon rates have higher durations B) The higher the yield-to-maturity, the higher the duration C) Long term bonds generally have shorter durations than short term bonds D) The duration of a zero coupon bond is its time-to-maturity 2. Purchasing power parity implies A) The law of one-price holds B) Nominal exchange rates should be 1.0 C) Currencies of countries with high inflation will appreciate D) The demand curve for dollars slopes upward. 3. Which of the following will not shift the demand curve for dollars to the right? A) Increase in foreign preference for American goods. B) Decrease in foreign wealth C) Increase in interest rates on U.S. bonds D) Reduction in riskiness of U.S. investment 4. Based on the given information, the volatility of option A must be _______ the volatility of option B. Put A B A) B) C) D) T 0.5 0.5 X 55 50 S 50 55 Option Price 12 9 higher than equal to lower than impossible to determine without more information 5. A futures contract that matures in six months is trading at a futures price of $95. The current spot price of the asset is $90 and the risk-free rate is 8%. To take advantage of this arbitrage, you would need to A) Borrow money at risk-free rate, long stock, short the futures contract. B) Loan out money at risk-free rate, long stock, short the futures contract. C) Borrow money at risk-free rate, short stock, long the futures contract. D) Loan out money at risk-free rate, short stock, long the futures contract. 6. A defensive bank manager would want the duration of his bank to be A) Positive if he expects interest rates to increase B) Positive if he expects interest rates to decrease C) Close to zero D) Positive if he expects interest rates to decrease E) Negative if he expects interest rates to decrease 7. The purpose of a clearing corporation A) Determine who is cleared to be a broker on the CBOE trading floors B) Determine which stocks are cleared to have options written on them C) Guarantee that options expire “in the money” D) Remove default risk from the option contract 8. Which of the following is not a problem with duration analysis? A) Can only analyze parallel shifts in the yield curve B) Time horizon to determine duration is ambiguous C) Only valid for small changes in interest rates D) The risk of duration drift 9. Assume you are in the 30% tax bracket. A treasury bond promises a YTM of 6% over the next year while a municipal bond promises a YTM of 4%. You should A) Buy the treasury bond since it provides a higher after-tax yield. B) Buy the municipal bond because it promises a higher after tax yield C) Buy the treasury bond since it provides a lower after-tax yield. D) Buy the municipal bond because it promises a lower after tax yield 10. The Basel Accord A) Established a regime of fixed exchange rates across countries B) Established a set of capital requirements for banks across countries C) Allows banks to branch across state lines in the United States. D) Established a system to detect money laundering in Switzerland. Part II. Free Response 1. Explain what is meant by “regulation Q”. (4 points) 2. A client has a liability to pay 10 million yen in three months, and has asked that you help him hedge the currency risk he is facing. A) What position in futures contracts would allow the client to hedge the currency risk? (3 points) B) What position in options would allow the client to hedge the currency risk? (3 points) 3. The current price of Zions stock, which is currently not paying dividends, is $75 per share. In one year from now, the value of Zions will be either $80 or $70. The effective annual risk-free rate is 4% per year. Find the value of a European call option on one share of Zions stock with a strike of $78. using the binomial option pricing model. (5 points) 4. The nominal yield on U.S. bonds is 4%, and the dollar is expected to appreciate relative to Mexican pesos by 8% over the next year. If capital is mobile, so that interest rate parity holds, what must be the nominal yield on bonds in Mexico? (3 points) 5. Assume a basket of goods in the U.S. costs 100 dollars, and the same basket of goods in Brazil costs 24,500 “reais”. According to the theory of purchasing power parity, what should be the dollar exchange rate in terms of reais? (3 points) 6. As a management assistant assigned to the bank’s asset/liability management committee, you have been asked to calculate the duration of a loan on which the borrower pays $8000 per year for four years. Assume the yield to maturity on the loan is 5%. What is the modified duration? (5 points) 7. Analyze the following quotes on currency markets in terms of supply and demand: A) The dollar pulled back ahead of a report on the fourth-quarter U.S. trade deficit, which is expected to show a large increase to $219.5 billion from $195.8 billion in the third quarter. (2 points) B) The dollar slid broadly amid reports suggesting that expectations for interest-rate increases by the Federal Reserve are overdone. (2 points) C) The dollar pulled ahead today following the announcement of officials at Standard and Poor’s that the credit rating firm had decided to downgrade Argentina’s sovereign debt. 8. You are responsible for the risk management operations for a local bank. The balance sheet for the bank is as follows: The number under “rate” for each asset and liability is the effective monthly rate earned or paid by the bank each month. The number under “Duration” is the modified duration. A) If you classify all assets and liabilities with a duration of 5 years or less as “interest rate sensitive”, what is the bank’s gap? (3 points) B) If effective monthly interest rates increase by 45 basis points over the next month, what will be the effect on the bank’s monthly net income? (3 points) C) What is the modified duration of the bank’s assets and liabilities? (3 points) D) If interest rates increase by 45 basis points over the next month, what will be the effect on bank equity? (3 points) 9. A futures contract for Cisco stock is trading at a futures price of F0=$70 per share. The spot price of Oracle is $69.50 per share. Assume the effective annual risk-free rate is 3% and the futures contract matures in five months. How would you take advantage of the arbitrage opportunity? How much would you make? Assume each contract is for one share (5 points). 10. The current price of Best Buy stock, which is currently not paying dividends, is $75 per share. In three months from now, the value of Best Buy will be either $82.5 or $67.5. The effective annual risk-free rate is 2% per year. Find the value of a European put option on one share of best Buy stock with a strike of $80. The option expires in 3 months. (5 points) 11. The dollar exchange rate in terms of yuan is 10.00, the dollar exchange in terms of roubles is 30.00. What is the rouble exchange rate in terms of yuan? (3 points) 12. The modified duration of your bank assets is 15, while the modified duration of bank liabilities is 4. The ratio of liabilities to assets is 80%. Total assets are 1 billion. A) If interest rates increase by 75 basis points over the next year, what will be the percent change in equity? (3 points) B) A futures contract on zero-coupon bonds exists. Each contract is on 1 million face value of bonds that mature in two years. The futures contract matures in one year. What is the no arbitrage futures price? Assume the yield is 8 percent (2 points). C) If you wanted to protect your bank equity in the event that rates increase by 75 basis points, how many futures contracts would you need to short? (4 points) D) A put option on zero-coupon bonds exists. Each contract is on 1million face value of bonds that mature in two years. The put matures in one year. Assume the put premium is $1000 , and the strike price is the same as your futures price found in part (B) above. If rates increase by 75 basis points, how would the put protect your equity? 13. Assume if rates increase by 200 basis points, the equity for a bank drops by $18 million. The bank can enter a swap. The notional amount for is on 100,000. The fixed side will pay 9% fixed on the notional amount. The floating side will pay Libor + 4% on the same notional amount. Assume Libor is currently 5% and changes along with other changes in interest rates. A) What are the net cash flows to either party from one swap contract at current rates? B) If rates increase by 200bp, what are net cash flows to either side of the swap contract? C) What position does the bank want to take (paying fixed or floating)? How many contracts should it take this position on if it wants to perfectly offset the loss to equity in the case that rates increase by 200bp?