CHAPTER 20 – Restatements

Student Solutions

Assignment 20-8 (WEB)

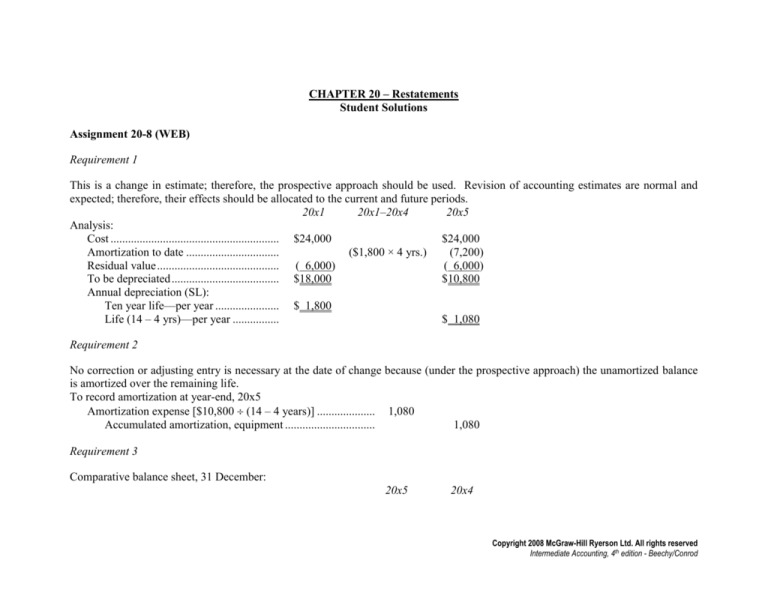

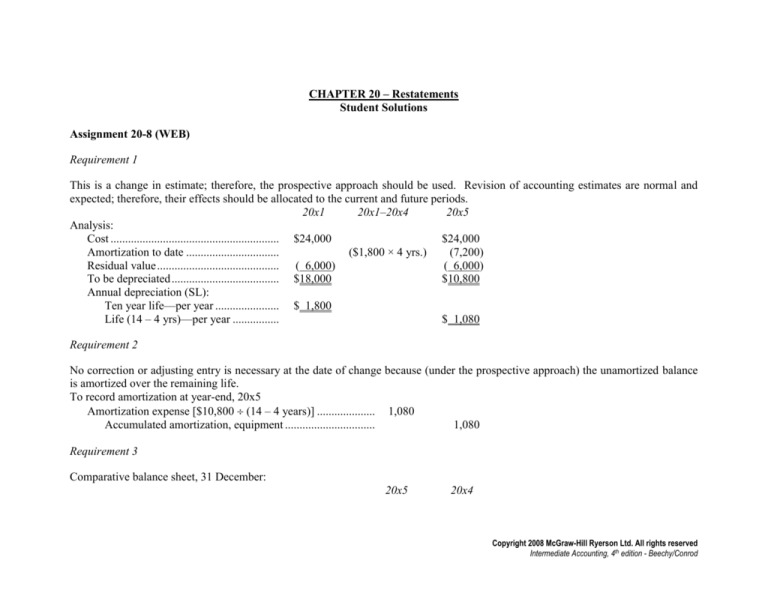

Requirement 1

This is a change in estimate; therefore, the prospective approach should be used. Revision of accounting estimates are normal and

expected; therefore, their effects should be allocated to the current and future periods.

20x1

20x1–20x4

20x5

Analysis:

Cost .......................................................... $24,000

$24,000

Amortization to date ................................

($1,800 × 4 yrs.)

(7,200)

Residual value .......................................... ( 6,000)

( 6,000)

To be depreciated ..................................... $18,000

$10,800

Annual depreciation (SL):

Ten year life—per year ...................... $ 1,800

Life (14 – 4 yrs)—per year ................

$ 1,080

Requirement 2

No correction or adjusting entry is necessary at the date of change because (under the prospective approach) the unamortized balance

is amortized over the remaining life.

To record amortization at year-end, 20x5

Amortization expense [$10,800 (14 – 4 years)] .................... 1,080

Accumulated amortization, equipment ...............................

1,080

Requirement 3

Comparative balance sheet, 31 December:

20x5

20x4

Copyright 2008 McGraw-Hill Ryerson Ltd. All rights reserved

Intermediate Accounting, 4th edition - Beechy/Conrod

Equipment .................................................................................... $24,000

Accumulated amortization .......................................................... ( 8,280)*

Net book value ....................................................................... $15,720

*$7,200 + $1,080 = $8,280

Comparative income statement for year:

Income prior to amortization and tax ........................................... $52,800

Amortization expense .................................................................. ( 1,080)

Net income before tax .................................................................. $51,720

$24,000

( 7,200)

$16,800

$49,800

( 1,800)

$48,000

No note disclosure is required because the change is very ordinary. However, if the company wishes to make disclosures:

Note X: Change in accounting estimate—Effective in 20x5, the company revised the estimated life on equipment. In 20x5, this change

in estimated useful life caused net income to be higher than under the prior basis by $720.

Assignment 20-9 (WEB)

Requirement 1

Gunnard Company

Income Statement—Successful Efforts

For the Years Ended 31 December

20x5

Revenues ................................................................................. $7,100,000

Expenses:

Resource exploration costs ............................................... 4,700,000

Amortization .....................................................................

200,000

Other ................................................................................. 2,050,000

Total ........................................................................................ 6,950,000

NI before tax ...........................................................................

150,000

Income tax expense (30%) ......................................................

45,000

20x4

$4,400,000

3,200,000

40,000

720,000

3,960,000

440,000

132,000

Copyright 2008 McGraw-Hill Ryerson Ltd. All rights reserved

Intermediate Accounting, 4th edition - Beechy/Conrod

Net income .............................................................................

$105,000

$308,000

Requirement 2

Resource exploration costs to be capitalized ............................

Additional amortization expense, 20x4 ($240,000 – $40,000) .

Net effect on 20x4 income, pre-tax...........................................

Additional resource exploration costs, asset, 20x4

($3,200,000 – $200,000) .....................................................

$(3,200,000)

200,000

$(3,000,000)

$ 3,000,000

Journal entry:

Resource exploration costs (see above) .................................... 3,000,000

Future income tax liability ($3,000,000 × .3) .....................

Retained earnings, ($3,000,000 × .7) ..................................

Cumulative effect of accounting change

Amortization expense, 20x5 .....................................................

Resource exploration costs .................................................

900,000

2,100,000

850,000

850,000

This assumes that the $4,700,000 resource development costs incurred in 20x5, that would have been expensed under SE, have been

correctly capitalized. If not, the following entry is needed:

Resource exploration costs (asset) ..........................................

Resource exploration expense...........................................

4,700,000

4,700,000

Copyright 2008 McGraw-Hill Ryerson Ltd. All rights reserved

Intermediate Accounting, 4th edition - Beechy/Conrod

Requirement 3

Gunnard Company

Income Statement—Full Costing

For the Years Ended 31 December

20x5

20x4

Revenues ................................................................................ $7,100,000

$4,400,000

Expenses:

Exploration cost amortization ..........................................

850,000

240,000

Other ................................................................................ 2,050,000

720,000

Total ....................................................................................... 2,900,000

960,000

NI before tax .......................................................................... 4,200,000

3,440,000

Income tax expense (30%) ..................................................... 1,260,000

1,032,000

Net income ............................................................................. $2,940,000

$2,408,000

In 20x5, the Company changed from SE to FC for accounting for resource exploration costs. The change increased 20x4 net income

by $2,100,000 and 20x5 income by $2,835,000*. The 20x4 comparative statements are restated to reflect the change.

* Reduced resource exploration costs ............................................................ $(4,700,000)

Increased amortization expense ($850,000 – $200,000) ............................

650,000

Net effect on income ................................................................................... (4,050,000)

After-tax effect (1 – .3) ............................................................................... $(2,835,000)

Requirement 4

Gunnard Company

Retained Earnings Statement

For the Years Ended 31 December

20x5

20x4

Opening retained earnings, as previously reported ................ $ 308,000

$

-Cumulative effect of accounting policy change, net of

income tax of $900,000.................................................... 2,100,000

-Opening retained earnings, as restated................................... 2,408,000

--

Copyright 2008 McGraw-Hill Ryerson Ltd. All rights reserved

Intermediate Accounting, 4th edition - Beechy/Conrod

Net income ............................................................................. 2,940,000

Closing retained earnings ...................................................... $5,348,000

2,408,000

$2,408,000

Requirement 5

Under successful efforts, expenditures for exploration costs would be an outflow under the operations section. Under FC, such costs

would be an investing outflow. Using the indirect method to present the operations section, the amortization would be a non-cash

expense add-back.

The change in policy is not disclosed on the CFS.

Assignment 20-27 (WEB)

Requirement 1

This is a change in accounting principle to conform with industry practices, from completed-contract to percentage-of-completion. It

should be applied retrospectively with restatement.

Requirement 2

Construction in progress inventory ($195 – $180) ............................ 15,000

Future income tax liability (1) ....................................................

Retained earnings: cumulative effect of change in accounting

principles (1).............................................................................

(1) CC Income, 20x3-20x6: ($60,000 + $120,000) .........................

PC Income, 20x3-20x6: ($40,000 + $65,000 + $50,000 +

$40,000) ....................................................................................

Increase in net income ................................................................

Tax effect (40%) .........................................................................

Impact on retained earnings .......................................................

6,000

9,000

$180,000

195,000

15,000

6,000

$ 9,000

Copyright 2008 McGraw-Hill Ryerson Ltd. All rights reserved

Intermediate Accounting, 4th edition - Beechy/Conrod

Requirement 3

KLB Corporation

Retained Earnings Statement

For the Year Ended 31 December 20x7

20x7

20x6

Opening retained earnings, 1 January .......................................... $440,000

$320,000

Cumulative effect of a change in accounting principle (2) ..........

9,000

57,000

Opening retained earnings, as restated......................................... 449,000

377,000

Net income (1) ............................................................................. 160,000

92,000

Dividends ..................................................................................... (20,000)

(20,000)

Closing retained earnings, 31 December ..................................... $589,000

$449,000

(1) CC income, 20x6 .................................................. $120,000

PC income, 20x6 ...................................................

40,000

Decrease in income ...............................................

80,000

Tax effect (40%) ...................................................

32,000

Change in 20x6 income ........................................

48,000

20x6 income, as reported ...................................... 140,000

Revised 20x6 income ............................................ $ 92,000

Copyright 2008 McGraw-Hill Ryerson Ltd. All rights reserved

Intermediate Accounting, 4th edition - Beechy/Conrod

(2) Cumulative effect (increase) .................................

20x6 effect (see #1) (decrease) .............................

$ 9,000

48,000

$57,000

Proof: CC income 20x3-20x5...................................................................... $ 60,000

PC income, 20x3-20x5 ($40,000 + $65,000 + $50,000) .................. 155,000

Increase in income ............................................................................

95,000

After tax (1 – 40%) ........................................................................... $ 57,000

Requirement 4

KLB Corporation

Retained Earnings Statement

For the Year Ended 31 December 20x7

20x7

20x6

Opening retained earnings, 1 January, as previously

reported ...................................................................................... $440,000

$320,000

Cumulative effect of a change in accounting principles ..............

9,000

—

Opening retained earnings, as restated......................................... 449,000

320,000

Net income ................................................................................... 160,000

140,000

Dividends ..................................................................................... (20,000)

(20,000)

Closing retained earnings, 31 December ..................................... $589,000

$440,000

Requirement 5

If it were impossible to restate any opening balances, the change would be made in 20X8. Information could then be gathered to

restate closing 20X7 (opening 20X8) balances and the change could be accounted for retrospectively with no restatement in 20X8.

Assignment 20-31 (WEB)

Case A:

Copyright 2008 McGraw-Hill Ryerson Ltd. All rights reserved

Intermediate Accounting, 4th edition - Beechy/Conrod

1.

Change in accounting “estimate”—prospective basis. Amortization policies are “principles” and some will automatically respond

that this is a change in policy. However, amortization methods must be reviewed regularly and changes applied prospectively if

based on a different pattern of expected benefit. Thus, the classification is a change in estimate.

2.

a)

Amortization expense ............................................................ 5,500

Accumulated amortization ...............................................

$60,000 – $5,000 = $55,000 ÷ 10 = $5,500

5,500

b) No entry is required for a prospective change.

c)

3.

Amortization expense ............................................................. 7,600

Accumulated amortization ...............................................

Net book value = $60,000 – ($5,500 × 4) = $38,000

$38,000 × 20% = $7,600

7,600

20x4 balances reflect straight-line amortization and are not changed.

Case B:

1.

Change in accounting policy to conform to revised accounting standards—retrospective approach with no restatement. No

restatement is possible because prior opening balances cannot be restated. Report the effect of the accounting change as an

adjustment to the beginning balance of retained earnings.

2.

Entry to record the effect of the change:

1 January 20x5:

Inventory ($17,000 – $12,000) ...................................................... 5,000

Retained earnings, accounting change ...................................

3.

a)

5,000

The effect of the change is reported on the 20x5 comparative statement of retained earnings as an adjustment to the beginning

balance of 20x5 retained earnings.

Copyright 2008 McGraw-Hill Ryerson Ltd. All rights reserved

Intermediate Accounting, 4th edition - Beechy/Conrod

b) On the 20x5 comparative statements, the 20x4 income statement amounts are unchanged, and are reported on the LIFO basis, as

data is not available to retrospectively restate balances.

Case C:

1.

This is a change in estimate; the prospective approach is used. Revision of accounting estimates are normal and expected;

therefore, their effects should be apportioned to the current and future periods.

2.

a)

31 December 20x4, adjusting entry (based on the prior estimates):

Amortization expense, patent.................................................

850

Patent................................................................................

$17,000 20 yrs = $850

b)

No entry is made to record the cumulative effect of the change in estimate.

c)

31 December 20x5, adjusting entry (based on the new estimates and the unamortized balance):

Amortization expense, patent................................................. 1,700

Patent................................................................................

3.

850

Computation:

Patent cost .........................................................

Amortization to date ($17,000 x 4/17 yrs.) .......

Residual value ...................................................

Unamortized balance ........................................

$17,000

(3,400)

(0)

$13,600

Amortization each year:

[$13,600 (12 – 4) = $13,600 ÷ 8 yrs.] ............

$ 1,700

1,700

The 20x4 financial statement amounts as originally reported in 20x4 are reported in the 20x5 comparative financial statements.

Copyright 2008 McGraw-Hill Ryerson Ltd. All rights reserved

Intermediate Accounting, 4th edition - Beechy/Conrod