The social regulation of debt in rural South

advertisement

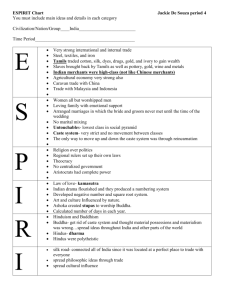

Debt in rural South-India: fragmentation, social regulation and discrimination Isabelle Guérin, University Paris I Sorbonne – Institute of Research for Development Bert D’Espallier, Hogeschool-Universiteit Brussel Marc Roesch, CIRAD G. Venkatasubramanian, French Institute of Pondicherry Abstract By combining multivariate statistics and qualitative analysis, this micro-level study highlights the fragmentation of debt for rural households in South-India. We find that debt is socially regulated in the sense that both access, price and use of debt are shaped by social interactions, and that caste, class and localization are key indicators. According to their caste, social class and localisation, people borrow varied amounts, from distinct money providers, for varied purposes and they pay a different price. Therefore, instead of being a purely economic transaction, debt is first and foremost a social relationship which sets debtors and creditors into local systems of hierarchies. Debt is also an illustration and catalyst of broader socioeconomic and political trends, namely the lack of social protection, persistent underemployment and increasing consumerism. Turning to policy, our study analyzes the ambiguities and illusions of “financial inclusion”-policies that aim at eradicating informal debt. Key words: debt, informal debt, India, political economy, economic anthropology JEL-classification codes: O17, O53, Z13 1 1. INTRODUCTION For centuries and still today discussions about debt raise debates and controversies. Economists are looking for debt contracts that allow for a better allocation of resources and risk management. Political economists examine debt as a relationship of power and exploitation and as a source of inequalities. Sociologists and anthropologists look at debt as a social relationship and are interested both in the diversity and the ambivalence of debt. They analyze how debt may stifle or protect, create and reinforce hierarchies but also maintain, update and build solidarities and identities. Politicians and decision-makers, on their hand, question the fairness and effectiveness of debt and seek mainly to regulate and control it. The issue of formality – whether debt transactions are recorded and debt providers registered as legal financial entities – is at the heart of the debate. While for many economists informal debt is doomed to disappear with the "modernization" of the economy, political economists argue that exploitation through debt is not only compatible with capitalism but even feeds it. Others, mainly among anthropologist and sociologists, highlight the fascinating capability of informal debt to evolve and adapt to the diversity of human societies. As for politicians and decision makers, informal debt is most often condemned as something amoral and unfair. These debates took on a particularly sharp edge in India, starting with the “colonial obsession with debt” (Hill 1982, pg. 216) to the current policies of "financial inclusion". Despite multiple policies that have succeeded for over a century, Indian households, especially rural, still largely depend on informal debt. The first rural financial cooperatives date from the early twentieth century with British cooperation. From Independence till the nineties Indian authorities have been conducting a very active rural credit policy, aiming both at developing agriculture and the Green revolution and eradicating poverty. Though in quantitative terms the results are impressive, the quality of such measures is highly contested. India still has one of the largest rural banking networks in the world: according to the Reserve Bank of India in 1998 they were more than 64,000 rural branches in 1998, which means between around 20,000 rural citizens per branch. Many of regional rural banks, however, have proven to be inefficient and unfair in loan delivery as well as financially unsustainable. As for anti-poverty subsidized credit programs, the most important one was the Integrated Rural Development Programme (IRDP) installed in the eighties and nineties. It has been considered as the “world’s largest program” (Tsai, 2004) but also as a complete disaster, with extremely low repayment rates, poor targeting and corruption at every stage (Copestake, 1987; Dreze, 1990; Shah et al., 2007). 2 Since the 1990s, liberalization and privatization policies have introduced severe credit rationing, with rural areas and poor segments of the population the most severely affected (Ramachandran and Swaminathan, 2005; Shah, 2007; Shetty 2004)1. With a focus on sustainability and discipline, microfinance raises new promises: incentives and collateral better adapted to the poor (mainly the joint-liability system and the focus on women) are expected to ensure repayment performance, while strategic partnerships (mainly between banks and NGOs) are considered to be an efficient means of lowering transaction costs and ensuring financial sustainability (Ghate, 2007; Seibel and Khadka, 2002). In 2009 it was estimated that around 86.2 million people have had access to microfinance services in India (Sa-Dhan, 2009). Here too however it seems that quantitative objectives have been achieved at the expense of quality. Though the vast diversity of the microfinance industry prevents any generalization, a number of studies raise serious doubts about the effectiveness and fairness of microfinance. For subsidized microfinance, it has been found that it was acting mainly as a substitute for other public expenses (Rao, 2008) while reproducing caste, class and gender inequalities (Garikipati, 2008; Rao, 2008; Pattenden, 2010). As for commercial microfinance, the crises faced by Andhra Pradesh in 2006 and again in 2009, where dozens of over-indebted clients have been driven to the brink of suicide, have highlighted mission drift in the industry, a shift away from the poor and towards increased profitability and commercialization. According to census data, the share of informal debt in rural households’ outstanding debt had significantly dropped from the seventies untill the nineties (from 61% in 1971 to 36% in 1991) and then has increased again (Shah et al., 2007), albeit with wide variations between states and social groups. It is also likely that such large-scale survey underestimates the importance and diversity of informal debt (Jones & Howard, 1994). Various micro-level studies conducted in different parts of rural India give estimates of 70 to 90%2. In our own study, informal debt represents almost 80% of outstanding debt and our field-work emphasizes the importance and persistence of informal debt in our target area. 1 According to data from the Indian central bank, the number of credit contracts has declined with more than20% in the period 1992-2001 from 65.8 million to 52.3 contracts. Most of this decline can be attributed to rural areas with a decline from 33.9 million in 1992 to 22.5 million in 2001. While rural credit constituted 18% of the total credit dispersed at the end of the 1980’s, this was only 10% in 2003, and small rural business were most heavily affected (Reserve Bank of India, 2006). 2 See, for example, Collins et al. (2009), Bouman (1989), Chandavarkar (1994), De Haan (1994), Drèze et al., (1997), Gooptu (2001), Hardiman (1996), Harriss-White and Collei (2004), Harriss-White (1981), Jones (1994), Mosse (2005), Pouchepadass (1980), Sriram and Parhi (2006). 3 How can we explain the persistence of informal debt and what are the consequences in terms of households’ well-being and inequalities? This article aims to deepen understandings of rural household borrowing practices by drawing on a case study from rural Southern India. It combines multivariate statistics and qualitative analysis to study the structure of rural financial markets, both formal and informal: which households access to which lenders, under which conditions and for what purposes? Based upon the empirical findings, this paper sets out three main arguments. First, informal debt is not a synonym for unorganised or unstructured debt. Following the analysis of HarrissWhite on Indian informal economy and labour (Harriss-White 2003; 2010), we argue that rural debt, both formal and informal, is fragmented, in the sense that borrowers face different prices and borrowing conditions, and socially regulated, in the sense that social institutions such as caste, class, gender and space shape the demand for, the access to and the use of debt transactions. Second, social regulation translates into persistent inequalities. The most marginalized have access to debt sources which are the most expensive, financially and socially, and use it mainly for purposes which do not generate direct income. Dominant groups, by contrast, enjoy access to the cheapest sources and use debt more often for income generating activities. Third, social regulation does not mean that debt follows a pre-determined path and is fixed over time. All of the social interactions and processes that shape the debt contract evolve in a very irregular way depending on local circumstances and specific periods in history. In our case this is illustrated by distinctive debt patterns between eco-type systems. For instance, wet villages are typical for an agrarian economy in which debt is a marker of interdependence between farmers and labourers. Dry villages by contrast combine increasing dependence on outside and labour with a loosening of caste and class interdependence and a broadening of horizons and aspirations (Epstein, 1973). This translates into distinct debt patterns: on average households borrow more and at a cheaper price, they have a larger range of options and use their loans more often for rituals and social events. Debt is thus shaped by broader socioeconomic and political changes. Our findings have major implications. Theoretically, we argue that the social meaning of debt, defined as the process by which debt sets debtors and creditors into local systems of hierarchies, is as important as its financial criteria. This finding is in line with recent insights from political economy and economical anthropology. Turning to policy, our findings shed light on the challenges faced by financial inclusion policies. In the given socioeconomic context, informal debt relationships are efficient and adapt to local circumstances, and 4 therefore eradication is problematic. Furthermore, the main problem of poor rural households is not the unequal access to credit. It is mainly the low and irregular income and growing consumer needs that drives poor households into indebtness. The fact that a very large part of the debt is allocated to consumption, instead of income generating activities, further enhances the debt-cycle. Being blind to these phenomena, financial inclusion policies, only devoted to increasing access to funds, may well encourage over-indebtedness rather than poverty. The over-indebtness problem and failure of financial inclusion policies can already be observed in other parts of India. The paper is organized as follows. Section 2 presents a theoretical framework in which this research can be framed. Section 3 gives details about the context and methodology. The following sections draw on quantitative analysis – descriptive and multivariate statistics – to describe and analyses debt amounts sources (section 4), debt purposes (section 5) and debt price (section 6). Section 7 uses qualitative analysis to discuss and interpret the results. Section 8 concludes and summarizes the main implications of this research. 2. THEORETICAL FRAMEWORK Various schools of thought with specific rationales, definitions and objectives have sought to unravel the determinants of financial service usage (Johnson, 2005). Neo-classical economic theory focuses on economic efficiency, collateral, transaction and information costs, to explain debt practices. In this view, households are believed to opt for informal credit due to a lack of access to formal sources i.e. credit rationing3, or because it enables lower transaction and information costs, since informal credit procedures are usually quicker and simpler 4. Through interlinked transactions, informal credit is also considered an efficient way to access other resources and cope with risk. On the supply side, neo-classical economics argues that the interest rate charged charged by lenders are determined by the default risk and enforcement mechanisms. This theoretical pradigm suffers from two major problems. The first one is the very narrow view of financial transactions as being induced by individual utility-maximizing behavior, thereby nurturing the hypothesis of “financial dualism”. Informal finance exists only because of incomplete and imperfect markets and is expected to disappear with the development of a 3 4 See for instance Hoff & Stiglitz (1990) as well as Conning (1999). See for instance Guirkinger (2008). 5 formal credit supply (Tsai, 2004). The second problem is that in this view, bargaining power shaped by social interactions is totally absent (Gill, 2007; Harriss, 2006). It is precisely power and the broader social environment that is the focus of political economists. While neo-institutional economics investigates the details of the debt transaction in a given framework, political economy examines the historical, social and institutional conditions that have shaped this specific framework, giving central importance to power inequalities. Numerous studies, particularly in South-India, have documented in detail the role of debt in the reproduction of social hierarchies and exploitation, and how debt has evolved over time and adapted to the requirements of contemporary capitalism. New forms of debt linkage and related labour relations have emerged over the last decades (Breman, 1974, 1996; Breman et al., 2009; Lerche, 1995; Byres et al., 1999), while traditional forms of agrarian linkage described for example by Hardiman (1996) and Bhaduri (1977) are fading away. Political economists also shed light on the role of social institutions in the emergence and continuous renewal of financial arrangements (Bouman, 1977, 1995; Bouman and Hospes, 1994; Servet, 1995, 2006). The main finding of this stream of literature is a differentiation and fragmentation of debt along various lines such as gender (Johnson, 2004), localization (Johnson, 2011), agro-ecological conditions (Bouman and Hospes, 1994; Lont and Hospes, 2004) or political systems (Tsai, 2004). Regarding rural South-India particularly, it is observed that debt fragmentation takes place along caste, class and gender (Harriss-White, 1996; Harriss-White and Colatei, 2004). This translates into inequalities of access and use of debt and these inequalities have itensified with the financial liberalization of the last two decades (Ramachandran and Swaminathan, 2005). Economic anthropology analyzes debt as social relationships and looks at the social meaning of debt. Fine-grained ethnographies show that individuals often accumulate debt and credit and repay loans in accordance with their own informal hierarchies and calculation frameworks5. Such phenomena transcend material or self-centred motivations and reflect questions of status, honour, power, and individual as well as group identity. Far from being only economic transfers, monetary debts also entail obligations and entrustments (Shipton 2007). An important lesson from political economics and economic anthropology is to approach formal and informal finance along a continuum rather than to view them as distinctive 5 See for instance Akin & Robbins (1999), Bloch and Parry (1989), Guérin (2006), Guérin et al. (2011a, 2011b), Malamoud (1988), Morvant-Roux (2006), Servet (2006), Shipton (2007), Zelizer (1994), Villarreal (2004). 6 spheres. The dualistic view of formal versus informal finance violates the empirical diversity of financial landscapes, which are “chameleon-like and kaleidoscopic in nature, catering to every taste, purse and preference” (Bouman, 1994, p. 6). Debt is not segmented into “formal” or “informal” practices but fragmented, in the sense that formal and informal debt is interrelated, with contagion, imitation or competition between one another. The “formal” sector is usually associated with transparency, reliability, contracts and longer-term projects. In contrast the “informal” sector is often thought of as short-term, insecure, unreliable and enmeshed with social relationships (Collins et al., 2009). Practices prove much more complicated. For instance, formal debt relationships may use informal mechanisms and conversely informal debt relationships may use formal combine mechanisms (Guérin et al. 2011a). By drawing both on political economy and economical anthropology, this paper examines the diversity and the fragmentation of debt in a rural South-Indian context. Specifically, we analyze to what extent caste, class and localization determine the access and use of various debt sources as well as purpose and loan cost. Far from the atomised, anonymous and shortterm transactions described by neo-institutional economists, our findings reveal that debt is first and foremost a relationship between individuals, debtors and creditors, endowed with unequal resources. Both are looking for economic gains or minimizing losses, but they also have an identity and a status that they permanently try to preserve or to enhance. 3. METHOD AND DATA We combine quantitative and qualitative data collected in 2005 and 2006 from four villages in the southern Arcot region of Tamil Nadu6. These villages are situated on the border of the Cuddalore and Villipuram districts, and were selected because they cover a relatively small area of both dry, rainfed areas as well as wet, irrigated areas that are so typical not only of Tamil Nadu, but also of much of southern and central India (Djurfeldt et al., 2008; HarrissWhite and Janakarajan, 2004). In dry villages, agricultural opportunities are limited to one or possibly two types of crops, mainly paddy and ground nut. For about the past two decades, mainly male farmers and landless labourers from dry villages have been migrating to supplement their farm incomes. Some commute to nearby small towns, mainly working as manual or semi-skilled labourers in the construction or transport sectors. Others depart for a 6 The four villages range in size between 300 and 800 households. 7 couple of months to Kerala to work in coconut plantations or local industries. A few households have opted for international migration. In irrigated villages, agriculture still remains a central occupation, both for landowners and landless labourers. Irrigated villages grow two or three crops and many producers are specialized in cash crops (sugarcane, paddy, cotton, ragi, flowers, mango trees, banana trees) and their cultivable lands are larger. Migration, mainly in the form of commuting to Chennai and Pondicherry, does exist, but it is much less widespread than in dry villages. As elsewhere in Tamil Nadu and India, caste remains a fundamental feature of social, economic, ritualistic and political life. Local classifications of social hierarchy correspond roughly to administrative categories: at the bottom of the hierarchy one finds Dalits (“exintouchables”, here mainly Paraiyars and a few Kattunayakkans), classified as Scheduled Castes; next come the ‘lowest-middle’ castes (here mainly Goundars, Vanniars and few Barbers), classified as Most Backward Castes, followed by ‘middle castes’ (here mainly Mudaliars, Chettiars, Yadhavars, Agamudayars, Asaris and Padithars), classified as Backward Castes. Most of households at the top of the hierarchy (here Reddiars, Naidus and few Jains classified as Forward Castes) have deserted the village and have settled in tows while investing in urban-based activities7. They still own houses and land, but these are leased to Dalits and lowest-middle castes, As a first stage, qualitative tools (semi-structured interviews with men and women and key informants, group discussions, observation) were used to capture the diversity of borrowing practices and the way people talk about debt. This facilitated the design of an effective questionnaire for gathering reliable, relevant data using appropriate terms. For instance, asking “who do you obtain money from” proved far more efficient than asking “to whom are you indebted” (kadangaran or kadangar). It also proved more useful to adopt the local expression “well-known persons” over “moneylender”, which has negative connotations. As a second stage a quantitative questionnaire was implemented on 344 households, randomly selected in four villages, with a stratified sample based on caste and localisation (dry/irrigated). The survey focused on household socio-economic characteristics and borrowing practices8. In the third stage of the study, qualitative analysis was used again for interpreting the quantitative results. We carried out approximately twenty case studies with households, chosen to reflect the diversity and breadth of the sample population. We met with 7 They represent between 2% and 4% of the population in the villages studied here. In order to limit the duration of interviews, the survey was limited to amounts exceeding 500 INR and thus under-estimates the importance of relatives and friends. 8 8 agricultural labourers, small producers, urban wage workers and petty entrepreneurs, including both landless householders and small landowners. There was a mixture of educated and uneducated interviewees. We met households with varying levels of debt that had been derived from a wide variety of sources. Semi-structured interviews were used, where interviewees were firstly asked to list the major events of their life, such as life cycle events, livelihood changes they had experienced, or migration they had undertaken. They were then asked to describe how they had financed each event or noticeable change, and to discuss the diversity of their debt relationships, both financially (cost, repayment modalities, duration, etc.) and from a subjective perspective. Group discussions were useful to gain an understanding of social norms and confront individual experiences on specific aspects. This final stage also involved interviews with lenders, who were asked about their practices in terms of loan terms, cost, duration, collateral requirements and sanctions for non-repayment, as well as how they evaluate customer creditworthiness and manage risk. Around 15 lenders with different profiles were interviewed. The table below lists socioeconomic characteristics of the 344 households in the sample according to caste. < Insert Table 1 around here > 4. WHO IS BORROWING FROM WHOM? a. Univariate statistics Table 2 summarizes the minimum, maximum and average number of total borrowings from different sources, as well as the percentage of households using a particular source. As can be seen, at the time of the survey, 91.27% of households were in debt, and the average outstanding amount of debt is 27,847 INR which is around one a half to twice the amount of annual household income. Turning towards borrowing from different sources, we find that 54.94 % of households borrow from pawnbrokers for an average amount of 4,987 INR. On average this represents 25.35% of total borrowings. “Well-known people” are the next most frequent source. “Wellknown people” (Terijavanga) is the tamil term the most commonly used to refer to private moneylenders. As we shall see later it covers a wide variety of lenders and debt relationships. 9 45.93% of households borrow from well-known persons for an average amount of 11,474 INR. In terms of total volume, borrowing from well-known persons accounts for roughly one third (30.91%) of total borrowing volume driven by the large average amounts and large number of families that are using this source. Borrowing from self-help groups ranks third in terms of the number of loans (41.28%) as well as in terms of volume borrowed (3,756 INR) followed by ambulant lenders, family and friends, banks, and shopkeepers. Note that loans from banks and family account for a larger proportion of total volume than ambulant lending because the average borrowing amount is higher, whereas ambulant lending exceeds both categories in terms of the number of loans. If we count bank and SHG loans as formal debt and the other sources as informal debt, around 80% of household outstanding debt is informal. < Insert table 2 around here > Though most households are indebted and patch together various sources, descriptive statistics indicate that amounts and sources used differ significantly between classes, castes and localisation. We analyze the differences in borrowings in terms of localization, caste and class in table 3 and table 4. Differences have been analyzed using mean comparison t-tetsts and Wilcoxon signed-rank tests. We discuss the main results separately for class, caste and localization. (i) Class Labour relationships (employer, peasants and employee) and land size are the typical classification criteria for social class in rural India. With the increasing diversification of rural economies the monetary value of assets can also be used as an indicator. All three criteria have been used here and return consisent results. As can be seen from table 3, land-owners borrow significantly more than non-landowners (35,549 INR versus 20,909). Similar results are obtained when using housing and the monetary value of total assets as criteria for class (see table 4). When turning to the different borrowing sources, following results jump out. Land-owners carry more often bank-debt and for larger amounts. Land-owners also more often turn to friends and family thjan non land-owners. They don’t turn to ambulant lenders and pawnbrokers as much as no land-owners. 10 (ii) Caste Caste is clearly an important factor for borrowing behavior as can be seen from table 3 and 4. More Dalits have borrowings than the rest (92% versus 90%), but for smaller amounts (the average outstanding is 21,937 INR against 37,336 INR). As for borrowing sources, higher castes borrow more often from well-known persons (56.6% against 39.62%), banks (33.33% against 13.67%), family and friends (26.51% against 11.79%) and shops (12.12% against 3.3%). Dalits borrow more often from ambulant lenders (34.90% against 24.24%). With regards to SHG, though percentage in use does not differ, upper castes borrow higher amounts. (iii) Localization Localization seems to be another important factor that drives borrowing practices. In dry areas, significantly more households are indebted (93% versus 89%) and average borrowing amounts are significantly higher than in irrigated areas (32,970 INR versus 22,602 INR). Furthermore, households in dry areas borrow more often from well-known persons (63.21% against 28.23% in irrigated areas) and for larger amounts. Conversely, households in irrigated areas borrow more often from SHG (51.76% against 31.03% in dry areas and for higher amounts). < Insert table 3 around here > < Insert table 4 around here > b. multivariate statistics In table 5 we regress total borrowing on cast, class and localization while controlling for other factors that might affect borrowing using OLS. These multivariate regressions investigate and quantify the impact of caste, class and localization on borrowing behavior while holding constant household characteristics that affect borrowing. In columns 1 to 3 the factors are taken up separately as regressors, while in column 4 all factors are taken up simultaneoulsy. The results confirm that all three factors have a significant relation with total borrowing. As can be seen, Middle/upper and lowest-middle castes have on average 12,429 and 30,645 INR more borrowing than Dalits (the omitted category). These differences are highly significant. Localization also matters and households from irrigated areas carry on average 14,022 INR borrowings than dry areas (the omitted category). Class is also an important factor, ass can be 11 seen from the coefficient on monetary value of total assets, which is positive and highly significant. The control variables, added to control for differences in other household characteristics are in line with expectations. Employment matters for total borrowings, and farmers have on average 35,000 INR more borrowing than casual workers (the omitted category). Borrowings are also affected by size of the household. One extra household member increases total borrowings with 2,751 INR. We also controlled for migration, religion, age and education, but these variables seem to play a smaller role in explaining borrowing behavior. < Insert table 5 around here > Table 6 repeats the regressions from the previous table, but for each borrowing source separately. Again, the results are in line with the univariate statistics presented earlier. Borrowing from well-known persons is significantly associated with dry areas and higher castes, while farmers borrow less from well-known persons. SHG-borrowing is associated with irrigated areas. There is also some evidence (10%) that SHG-borrowing is higher for lower castes. Ambulant lending is associated with Dalits, lower education and casual workers. Bank-lending is associated with higher castes, farmers and household size. With regards to the category family and friends, the only significant factor is education: the more schooling, the less households borrow from family and friends. < Insert table 6 around here > 5. WHO IS BORROWING FOR WHAT? In Table 7 we list the different purposes for which the loans are used according to importance and we analyze whether these purposes are different for caste, class and localization. Column 1 lists the different purposes for the entire sample, while the columns 2 to 7 present the purposes for different groups. For the entire sample, economic investment is the most frequent purpose (29.50%) as can be seen from column 1. This includes mainly agriculture investment but also housing, land and cattle. Next come household needs (20.18%), followed by ceremonies (17.08%), health 12 (12.87%), education (10.36%) and loan repayments (6.15%). This ranking in debt purposes however displays important differences according to caste, class and localization. Borrowing for economic investment is a more frequent purpose in irrigated areas (37 % against 23% in dry areas), for higher castes (35.35% against 24.69% for Dalits), and for the richest households (43.01% against 16.52% for the poorest). Borrowing for household expenditures is more frequent in irrigated areas (26.83% against 16.70%) and to some extend for Dalits (23.65% against 17.68%) and landless households (22.27% against 19.74%). Borrowing for education is more frequent in dry areas (13.75% against 5.69%), for Dalits (13.07% against 7.07%) and for the poorer households (13.39% against 7.21%). With regards to ceremonies, wealth is the main differentiating factor: poor households affect 22.54% of their loans for ceremonies against 11.40% for the richest. < Insert table 7 around here > 6. WHO PAYS HOW MUCH? In this section we investigate whether interests rates charged on the various loans differ with the socio-economic factors of the households. As such, we assess whether there is pricediscrimination going on based upon class, caste and localization of the household. Table 8 summarizes the mean, median, minimum and maximum monthly interest rates for the different lending sources. On average, banks are the cheapest source (1.01% monthly interest), followed by SHG (1.72%), pawnbrokers (2.83%), family and friends (3.11%) and well-known people (3.73%). Within each category, price differs according to the borrower’s profile, as can be seen from table 9. Descriptive statistics indicate that bank loans are more expensive for landless households (1.28% against 0.94% for landowners). Loans from well-known people are more expensive for Dalits (4.09% against 3.35%), in irrigated areas (4.25% against 3.55%) and for landless households (4% against 3.47%). SHG loans are more expensive in dry areas (2.13% against 1.47% in wetlands). The interest rates charged by family and friends does not differ between castes, class or localization. < Insert table 8 around here > < Insert table 9 around here > 13 In table 9 we analyze observed differences in interest-rates multivariately by regressing the monthly interest charged on caste, class and localization while controlling for other factors that might determine interest rates. We control for the loan-amount, duration of the loan and the purpose of the loan. The analysis largely confirms the descriptive statistics. As can be seen, the interest rate charged by well-known persons is significantly higher for lower castes, lower classes and in irrigated areas. SHG loans are more expensive in dry areas. < Insert table 10 around here > 7. VERIFICATION FROM QUALITATIVE ANALYSIS The statistical analyses reveal two important things. First, the financial landscape is highly diverse, but also highly fragmented along various lines. Bivariate and multivariate analyses clearly demonstrate significant differences along caste, class and localization both in terms of debt amount, sources, purposes ad price. Second, caste, class and localisation do not operate in the same way. Debt fragmentation along class reflects unequal endowments, both material and immaterial. Rich households and farmers borrow bigger amounts, more often for economic investments and the latter are almost the only one accessing bank loans. This reflects the priority given to agriculture by rural banks, one could argue. Looking at debt purposes, however, we see that a significant part of bank loans are used for many other purposes, including for farmers. Being a farmer allows them both to use agriculture as an excuse to claim for a loan and to activate the networks and connections that are needed to be eligible. Debt fragmentation along caste is a matter of discrimination and self-exclusion. As for debt fragmentation along localisation, we suggest distinctive patterns of livelihood, socialisation and lifestyle affect the access and use of borrowing. In what follows we use insights from our qualitative analyses to elaborate on fragmentation of debt along caste, class and localization. a. Caste Caste is a source of discrimination in accessing credit and a source of inequality in using credit. Dalits borrow lower amounts, more often for social purposes and from the most expensive and dishonoring sources. 14 (i) Banking discrimination With regards to borrowing sources, it is the access to bank loans which is the most influenced by caste: multivariate analysis clearly indicates that access to banks increases with caste hierarchy. Financially speaking, banks loans offer the best conditions. There are low interest rates (1.06% on average), significant amounts lent (16,701 INR on average) and rather long durations (783 days on average). Various cases and group discussions revealed that both discrimination exerted by bankers and self-exclusion contribute to the low access to bank loans for the low castes. Most bank loans are secured on land or gold. As far as land is concerned, land quality is as important as the size. Notwithstanding irrigation – wetlands are more valued than dry lands – what also matters is where the land is situated within the village. Land and housing in colonies (the part of the village where Dalits live) have almost no market value (see the case study below of Praba). Land title is also an issue. Many Dalit landowners have bought or inherited their land from their employers9. Others got it through government programs. Most often however it is a right of use and not ownership per se as land titles were never given. With regards to gold, for Dalits, bank managers very often ask for the ownership certificate, while for others the good faith is enough. Accessing bank loans also requires a specific know-how. Bribes and “gifts” are the norm rather than the exception. These should be given at the right moment to the right person. To be familiar with these informal rules speeds up procedures and avoids missteps. Knowing “someone” within the branch or the bank network, or sometimes simply belonging to the right community, can avoid paying bribes. The two cases below illustrate how caste discrimination operates in practice in accessing bank loans. Shakeela has been waiting 45 days for an individual bank loan of 30,000 INR, though her husband is a permanent employee at the railway station. She describes us the slowness, the complexity but also the unfairness of the procedure. “If you want 10 paisa from the bank, your leg will reduce from 10 inches”, she says, referring to the multiple rounds trip she had to do. When we met her she already had come 12 times and she was still waiting for the check. Each time the papers were not good, each time she had to bring a new certificate (certificate of residence, certificate from a local elite stating that she would reimburse, etc.). She knows that she has to give money to the clerk and the cashier but she does not know how much and how. It 9 This was often at the time of land reform which imposed a cap on large landowners. 15 is a man from the Vanniar community (low caste hindu) who told her about this loan scheme: he got it within 10 days, without any certificate. « Why do you think he got it in days, without giving any certificate, while I have to wait for 45 days? This is because I’m poor and because I’m from the colony” (Shakeela, Dalit, housewife, spouse of a permanent employee). According to the Revenue Department, Praba’s land (50 cents) is valued 100,000 INR. After multiple negotiations with the bank, and though mortgage banks loans are expected to reflect the estimates of the Revenue Department, she got only 10,000 INR. A man from the same village, but from middle caste, and whose land is adjacent to Praba’s one, got 150,000 INR mortgaged on 2 acres of land. In his case the value of the land was valued five times more (Praba, Dalit, NGO field worker). Many Dalits do not even try to obtain a bank loan. Asked about this, they shrug their shoulders, as if it was even pointless to try. The comments gathered during a group discussion with women shed lights on the diversity of factors of discrimination. “We are dark, they don’t look at us.” “Upper castes get big money as they have every thing big with them.” “When they see us, it is like a joke, they feel we depend upon them for the money; they give priority to those who have big money in their account; five of these Naidus [upper caste] have more money than the whole colony, they don’t care about us.” “They shout at us ‘you should repay properly, huh, otherwise you won’t get anything else’; they never use these words with upper castes.” “Vanniar [low caste] are very strong here. If the bank manager says something bad to a Vanniar, the whole community [of vanniar] will come and shout.” “It is also because we are women; there are only men in the bank; upper castes send men, not women”. Their comments illustrate the importance of material factors but also social networks, and finally gender in accessing bank loans. For lowest castes, it is most often women who are in charge of managing household budget and administrative affairs. It is therefore more often women who come at the bank to ask for loans, while bank managers are mainly male. This is obviously an additional factor of discrimination. Self-exclusion is also an issue: some low castes individuals don’t even try and refuse to bow to the discriminatory practices of the bankers. The following case illustrates the issue of selfexclusion. 16 Shiva Kumar explains that he never tries to get any bank loan. “When you are Dalit and you ask for a loan secured on loan, they ask for the property certificate. For caste Hindus they never ask any thing. I don’t want to be at their feet. I borrow elsewhere.” (Shiva Kumar, Dalit, NGO field worker). ii) Well-known people Well-known persons (Terinjavanga) represent a major loan source of cash for large expenses. We find that Dalits use them less and pay more. Access to well-known persons is above all a matter of interpersonal skills and trust. The use of the term terinjavanga presupposes the idea of mutual acquaintanceship (‘I know him/her, he/she knows me’). There is then a broad spectrum of more or less contractual relations, embedded to various degrees in social and political relationships going far beyond a formal debt relationship. There are firstly professional lenders belonging to merchant castes specialized in moneylending (here, these are Mudaliar, Chettiar, and Marwari). Their motives are purely commercial and they make no secret that theirs is a business. The terms of the transaction depend on the type of collateral: in the cases we saw, the cost is 4 - 5% monthly in the absence of collateral; from 2 - 3% with collateral (jewels, cultivatable land, tractors, bullock carts, etc.). Over the last few decades in the area under study, some Vanniars have also come to specialize in pawnbroking (in the region Vanniars traditionally specialize in agriculture). Though these debt relationships are contractual, in the sense that the transaction is solely monetary, caste is instrumental in shaping the terms of the contract. This is because debt is a strong marker of social caste hierarchy. Some middle/upper caste lenders refuse to lend to castes who are too low in the hierarchy in comparison to them, stating that it would be degrading to go and claim their due. Vanniars by contrast (lowest-middle caste) are often specialized on smaller transactions, poorer clients and Dalits. We also observe that debt transactions are undertaken differently depending on the borrower’s caste. For those willing to lend to Dalits, transactions often take place in the borrowers’ village (by hiring a Dalit person as an intermediary and to collect repayments). “Dalits are untrustworthy and irresponsible”, is a common view of lenders, “money burns their fingers”. For this reason it is deemed safer to visit them on their doorsteps. In contrast, transactions with caste Hindus usually take place in town, mainly as a matter of discretion. These two arguments – risk and the need for intermediaries – are used to justify different prices. All these being equal, our data indicate that the Dalit pay more caste Hindus. 17 For Dalits, a well-known person can also be a local patron. The debt is then just one component of a much broader relationship. Debt is used either as labour bondage (amongst big landowners and mainly in irrigated areas) and/or for social and political purposes (Guérin et al. 2011a). Its financial conditions are quite favourable, with low costs (0 - 3 per cent), flexible repayments and only rare full repayment of the principal. Borrowers regularly pay back interest and from time to time part of the capital, which allows them to reborrow. But money is just one aspect of the cost. Borrowers are still obliged to work for the lender and to offer multiple services. For men, these sometimes include irrigation, or numerous everyday services such as running errands to the shops, and caring for children or elders. Women have to make themselves available for domestic work when there are ceremonies, visitors, or when the masters’ wife is ill. Borrowers, men or women, are also strongly encouraged to show allegiance. They invite their lenders as guests of honor at their family ceremonies, thereby enhancing their reputation as “benefactors”. They participate in their political rally or those of their friends or allies. Very few caste Hindus are involved in this type of interlinked transactions. Taking into account all costs, financial and nonfinancial, then the cost of debt for the Dalits is even higher. iii) Ambulant or mobile lenders We also found that low caste borrow more often from ambulant lenders. Borrowing from mobile lenders is seen as the most degrading practice, reserved to Dalits (and to women). Mobile lenders come to households’ doorsteps, precluding any form of discretion. They do not request any collateral but use coercive enforcement methods. The lenders themselves state that lowest castes and women are more prepared to tolerate abusive language from them. Monthly interest rates range between 4 and 10%, sometimes more, which is rather high compared to the other options. What is interesting however is that caste Hindus, especially among middle and upper castes, often deny using ambulant lenders, while they are much more prevalent for Dalits. However here too the way transactions are done differs. In colonies, mobile lenders do their business openly: they go door to door, negotiations, often bitter and tense, take place in the street, shouting and insults are made public. In the Ur by contrast (the place where caste Hindus castes live), the transactions are conducted more discretely, sometimes on the workplace or at the tea shop and not at home. 18 iv) SHG SHG are supposed to facilitate financial inclusion. Interestingly however, multivariate analysis indicates that the poorest do not enjoy a better access and for Dalits the effect is not clear (significant at 10%). From dalit borrowers’ perspective, SHG loans are described with mixed feelings. Some people appreciate this new safety net that allows them to limit their dependency, particularly upon their relatives. Others complain of being forced to comply with new forms of intermediaries to be eligible for a bank loan. The following case illustrates. “Because we are dark are obliged to use federation, SHG and all that; we need brokers (tharakar), Naidus and Vanniars don’t need this. They [microfinance NGOs] say they give respect but it is only formal.” (Shiva Kumar, Dalit, NGO field worker) Cost is the main advantage of SHG loans (1.71% on average). However the opportunity costs are often rather high, in particular due to time taken for participation in group meetings and delays in loans attributions. Some also complain of the social control exerted by the NGO and by the group. In the villages studied here, microfinance NGOs ask their members to avoid multiple borrowing, whether from other MFIs, NGOs or even moneylenders. This may limit the risks over-indebtedness problems such as those observed in Andhra Pradesh, although preventing borrowers to approach moneylenders is illusory. And many borrowers complain of the social control exerted by NGOs: “They give the money and they put paint on us like cows to say “we are with [name of the microfinance NGO]”. With this paint we cannot go elsewhere; sometimes they even threaten moneylenders. What can we do without moneylenders?” “This SHG is like handcuff” v) Daily survival and education versus economical investments We also find that Dalits borrow more often for daily survival (23.65% against 17.68% for caste Hindus), health (11.41% against 14.65%) and education (13.07% against 7.07%), and much less for economical investments (24.69% against 35.35%). This reflects the fact that Dalits are more often landless and therefore less able to invest in agriculture. This also reflects the difficulties that Dalits face in creating small businesses (Harriss-White 2010b; Prakash 2010). b. Localization: dry versus irrigated areas. 19 Important and significant differences were found between wet and drylands, both in terms of debt amounts, sources, price and purposes. Households from dry areas borrow much higher amounts. They borrow less from SHG and more from “well-known people” and at cheaper price. Compared to their total borrowing, they borrow less for daily survival and economic investments and much more for ceremonies, health and education. We argue that these differences in borrowing practices illustrate broader patterns which have to do as much with distinctive livelihood portfolios as with socialisation networks and social aspirations. As various works on both past and present rural South India have pointed out, agro-ecological conditions plays a fundamental role in shaping local economies. The eco-type distinction pertains not only to production processes, technical constraints and crop type, it also shapes identities, social hierarchies, the intensity of ties of dependence and both spatial and social mobility circuits10. The irrigated hamlets of our sample are still typical of an oppressive and exploitative agrarian economy. Upper castes monopolize land and use Dalits as labor. Employment relationships are based on hierarchy, patronage and debt. When labourers need large amounts of cash, the employer is most often the only option. Restricted social networks explain the lower importance of “well-known people” as lenders. Next to economic investment, household expenditures represent an important debt purpose. Income irregularity due to agriculture seasonality combined with limited consumer needs contribute to this. SHG loans are more common, probably because "productive" uses, real of fictive, are easier in wetlands. In the area studied most microfinance organizations require their clients to avoid ‘lavish’ and ‘unsustainable’ expenses, such as ceremonies. Local markets are very limited and barriers to entry are multiple; SHG loans are therefore very rarely used to set up small businesses. When they serve economic purposes, breeding a cow is the most common option and it is easier in irrigated areas due to the presence of grazing and labor. As for bank loans, practice differ from discourses – only a small fraction of SHG loans are used for economic purposes – and this is also easier in irrigated villages where it is easier to borrow the neighbor’s cow as a proof of “productive” investment. The dry hamlets, by contrast, are typical of “extroverted” villages (Epstein, 1973; Epstein et al., 1998). Most upper castes have sold their land or lease it, mainly to lowest-middle castes who are now the main landowners. Dalits work in their fields but also and increasingly outside the village in the non farm sector, especially men. Men come and go to the neighbouring cities. Some leave a few days, others a few weeks. Some settle for a few 10 For a historical analysis, see Ludden (2005). For contemporary analysis, see for instance Bouton (1985), Chambers & Harriss (1977), Djurfeld et al. (2008), Epstein (1973), Epstein et al. (2002), Venkatesh et al. (1986). 20 months, but circulation between villages and towns is a constant. Travels vary according to financial needs, job opportunities, but also, and very often, indebtedness. Circulation and exposure to urban life act both as an incentive and as an opportunity on borrowing practices. Migration acts as an incentive, as the status of migrant creates new expectations. Even if migration conditions are usually rather poor, with casual jobs at the bottom of the hierarchy, badly paid, without any security, circular migrants and their families want to consume “modern” items. When migrants tell their first migration experience, they often insist on their first purchases, as if this was a proof of their success. Devaraj, for instance, who is now 30 years old, started to work in Chennai twelve years back and tells how his first job enable him to bring back a TV, a tape recorder, dresses, plastic vessels. Except few cases, and mainly among middle and upper castes, debt is rarely used for economic investment: diversification takes place through wage labour and investments are more social and symbolic than economic. As migration allows for a loosening of dependence ties with the village, Dalit migrants feel allowed competing socially with caste Hindus: this desire for social mobility translates into more prestigious social and religious rituals. Though this phenomenon is widespread all over Tamil Nadu (Kapadia, 2002) no doubt that in our case study it is more important in dry areas. Before we had marriages in our home or temple. Now the youth demand to do in marriage hall. They say that I need respect (gowravam) from my friends […] My brother may expect to do in marriage hall as his friends from Chennai may come for marriage […] So we borrow regularly and we have to settle it from earnings. It is routine (Veerapan, Dalit, mason in Chennai). Migration also acts as an opportunity, as migrants might now have a larger range of borrowing options. As clearly explained below, the status of migrant is a source of creditworthiness: lenders know that their borrowers can migrate to ensure the repayment. One advantage is as I work in Chennai, I can take credit from neighbour. All the lenders say that “he is going to Chennai, he will return back money and interest”. I can use “Chennai” to be trustable. I also have confidence (nambikkai) while take credit. If any one in a family work in Chennai, then it is easy to borrow. We can borrow money locally when we go to Chennai. (Suresh, lowest-middle caste, mason) For me, life is better when I go to work to Chennai. I give back all the credit that I’ve borrowed. When I go to Chennai, my wife borrows INR 2000-3000 from the neighbours. I settled them when I back. During my last stay in Chennai for 10 days, my wife borrowed INR 2000 locally. The lenders have confidence that her husband is working in Chennai and she will give back the money. If I stay in the village, no one give credit to me. If I go outside to work, it is easy to borrow money for interest. All will trust (Arasan, Dalit, mason) 21 Kaliyan is a recruiter for brick kiln moulding. He provides advances to the workers: one couple of workers will get 40,000 INR in dry villages against 25,000 INR in irrigated villages. His argument is very clear: workers in dry villages are considered as “permanent workers”, “I know they will repay”, while in dry areas working outside the village is a last resort option (Kaliyan, lowest-middle caste, labour contractor) This is confirmed by interviews with lenders. In this area some of them target primarily dry villages: households are more in demand, they say, and they have a better creditworthiness thanks to ‘migration money’. Competition, locally and outside, explains why debt prices are also cheaper in dry villages, especially for well-known persons. Circular migration broadens social networks and thus access to debt. Borrowing from “wellknown persons” is much more frequent in dry lands. Over time credit migrants have built solid financial networks, for themselves but also for their neighbours and the members of their own community, for whom they act as guarantors. Ravi, dalit, has started migrating around 20 years back, first as a sugar cane harvester, then as a brick kiln moulder. Gradually he developed good relationships with recruiters and accountants from different brick kilns, for whom moneylending is a regular business. Now his main job consists in acting as an intermediary between these lenders and the Dalits of his own village (Ravi, Dalit, brick kiln moulder). Last, and not least, the anonymity of urban life increases the propensity to go into debt. Though most households are chronically indebted, debt is still something people are hardly proud of. “I don’t want to see the face of my creditor every day” is an expression that was often heard during the discussions. I don’t like the lender standing in front of my home. No one around me knew about my indebtedness. If I want money I ask for the labour recruiter (Thanikachalam, Dalit, mason). Multiples interactions between urban labour and debt are observed. Gradually, urban workers do not have the choice: they are kept in a permanent circle of debt, and circular migration is the only way to get out of it, at least temporarily. All go to work in Chennai to earn. There is no special attraction. We are indebted outside. We have to get rid of this debt. So we go to Chennai (Arasan, Dalit, mason) If I stayed in the village, I cannot do anything. I will be over indebted with all villagers. How to repay the loan? (Ganesan, Dalit, mason) 22 8. Conclusion This micro-level study highlights the persistence of informal debt for rural households in South-India. This study also shed lights on debt fragmentation, both formal and informal. According to their caste, social class and localisation, people borrow varied amounts, from distinct money providers and for varied purposes and they pay different price. Far from being a pure market price where prices reflect the relative demand and supply or different types of financing, debt is socially regulated in the sense that both access and use are shaped by social institutions. The social regulation of debt should not be understood only as a way to cope with insufficient formal enforcement mechanisms. Debt is socially regulated also because of its social meaning. Rural households of course borrow because they need cash to meet certain specific needs. They naturally look for cheap costs and repayment modalities adapted to their cash flows. Those who lack physical collaterals struggle to access specific sources. However, debts are not just monetary flows for topping up irregular and low incomes, and for coping with unpredictable expenses. They are not just financial transactions defined in terms of amount loaned, repayment period or interest rates, but are first and foremost relationships between a debtor and a creditor. Debts are shaped by social relationships and social hierarchies, especially those related to caste, class, gender and kin. The social meaning of debt depends upon pre-existing relationships between debtors and creditors, and debt in turn strengthens, preserves and sometime challenges pre-existing positions within local hierarchies. Debt is also both an illustration and a catalyst of broader and structural socioeconomic and political trends. At the micro-level, distinct debt patterns are constitutive of distinct village economies and social structure. In dry villages debt is higher, more diversified and more often used for social and symbolic investments: this reflects an increasing dependence upon circular migration and urban wage labour, which in turn translates into rising social aspirations, consumerism and enlargement of social networks that allow a better access to finance. Turning to policy, our findings show both the importance of informal debt and the importance of credit for consumption. The evolutionist scenario, which argues that formal finance (including microfinance) could gradually replace informal finance (Collins et al. 2009; World Bank 2007), is unconvincing. As long as poor rural Indian households lack access to social protection and employment security – and unfortunately this is unlikely to take place soon – local financial arrangements such as those described here present many comparative advantages. 23 References Breman, Jan, (1974) Patronage and exploitation: Changing agrarian relations in South Gujarat, India, Berkeley: University of California Press. Breman Jan (2007) Labour bondage in West India. From past to present, Oxford, Oxford University Press, 2007. Breman, Jan, Guérin Isabelle & Aseem Prakash (eds) (2009) India's unfree workorce. Old and new practices of labour bondage, New-Delhi, Oxford University Press. Bouman, F.A.J. (1989) Small, Short and Unsecured - Informal Rural Finance in India, Delhi/Oxford/New York: Oxford University Press, 1989. Cederlof, Gunnel, (1997) Bonds lost; .subordination, conflict and mobilisation in rural South India c.. 1900-1970, New-Delhi: Manohar. Bloch M., Parry J. (1989) (eds) Money and the Morality of Exchange, Cambridge: Cambridge University Press. Bouman F. (1989) Small, short and unsecured. Informal rural finance in India, New-Delhi: Oxford University Press. Bouman, F. and Hospes, O. (1994). Financial Landscape Reconstructed: The Fine Art of Mapping Development, Boulder, CO: Westview Press. Bouman, F. (1994). Informal Rural Finance: An Aladdin’s Lamp of Information in Bouman & Hospes, op. cit., pp. 7-1/7-9. Chandavarkar R. (1994), The Origins of Industrial Capitalism: Business Strategies and the Working Classes in Bombay, 1900-1940. Cambridge: Cambridge University Press. Collins, D. Morduch, J., Rutherford, S., Ruthven, O. (2009). Portfolios of the Poor: How the World's Poor Live on $2 a Day, Princeton: Princeton University Press. Conning J. (1999). Outreach, Sustainability and leverage in monitored and peer-monitored lending, Journal of Development Economics 60 (1) : 51-77. Commons J. R. (1989) Institutional Economics, Its place in Political Economy, New Brunswick, London: Transaction Publishers [1st édition 1934], 2 volumes. Copestake, J. (2010) Microfinance and development finance in India: research implications, CEB Working Paper N° 10/028, Brussels: Centre Emile Bernheim/Solvay Business School. Drèze J. Lanjouw P. Sharma N. (1997) Credit in Rural India: A Case Study, Discussion Paper DEDPS/6, London: The Suntory Centre/Suntory and Toyota International Centres for Economics and Related Disciplines/ London School of Economics and Political Science/Hyderabad Institute of Public Enterprises Fisher T., Sriram M.S., (2002) Beyond microcredit. Putting development back into micro-finance, New-Delhi: Vistaar Publications Fernando J. (2006) (ed), Microfinance Perils and Prospects, New York: Routledge. Fouillet, C., (2009). La construction spatiale de la microfinance en Inde, Thèse de doctorat en sciences économiques et de gestion, Bruxelles : Université libre de Bruxelles. Garikipati, S. (2008). The impact of lending to women on household vulnerability and women’s empowerment: evidence from India, World Development 36(12), pp. 2620-2642 24 Ghate, P. (2007) Indian microfinance. The challenges of rapid growth, New-Delhi: Sage. Gooptu N. (2001) The Politics of the Urban Poor in Early Twentieth Century India, Cambridge: Cambridge University Press. Guérin, I. Morvant S. Servet J.-M. Understanding the diversity and complexity of demand for microfinance services: lessons from informal finance, in Armendariz B. & Labie M. (eds) Handbook of Microfinance, Washington: World Scientific Publishing, forthcoming. Guérin I. (2006) Women and Money: multiple, complex and evolving practices, Development and Change, 37(3), May: 549-570. Guirkinger C. (2008) Understanding the Coexistence of Formal and Informal Credit Markets in Piura, Peru, World Development, 36 (8): 1436-1452. Hardiman David (1996) Feeding the Baniya. Peasants and usurers in Western India, New- Delhi: Oxford University Press. Harriss Barbara (1981) Transitional trade and rural development, Delhi: Vikas Publishing House. Harriss-White B. (1994) The Question of Traders as Credit Agents in India, in Bouman & Hospes (eds). Op. cit. pp. 19/1-19/9. Harriss-White B. and Colatei D. (2004), Rural credit and the collateral question, in Harriss-White & Janakarajan (eds) Rural India facing the 21st century. Essays on long term change and recent development policy, London: Anthem South Asian Studies, pp. 252-283. Hill, P. (1982) Dry Grain Farming Families: Hausaland (Nigeria) and Karnataka (India) Compared. Cambridge University Press. Hoff K. and Stiglitz J. (1990) Imperfect Information and Rural Credit Markets. Puzzles and Policy Perspectives, World Bank Economic Review, 4 (3), pp. 235-250. Jones J. Howard M. (1994) A Changing Financial Landscape in India: Macro-Level and Micro-Level Perspectives, in Bouman FJA, Hospes O. (eds). Financial Landscape Reconstructed: The Fine Art of Mapping Development, Boulder, CO: Westview Press, Chap 1, 1-18. Johnson S. (2007) Institutionalized suspicion: the management and governance challenge in userowned microfinance groups in Dichter & Harper (eds) What’s wrong with microfinance, Warwickshire : Practical Action Publishing, pp. 61-72. Johnson S. (2005) Fragmentation and embeddedness: an alternative approach to the analysis of rural financial markets, Oxford Development Studies 33 (3&4): 357-376. Johnson S. (2004) Gender norms and financial markets: evidence from Keyna, World Development, 32 (8): 1355-1374. Jones, J.H.M. (1994), A Changing Financial Landscape in India: Macro-level and Micro-level perspectives, in Bouman F.J.A. and O. Hospes (eds.) Financial Landscapes Reconstructed, Boulder, San Francisco, Oxford: Westview Press, pp. 305 – 324. 25 Kalpana K. (2008) The Vulnerability of ‘Self-Help’: Women and. Microfinance in South India’, Working. Paper 303 Institute of Development Studies, April. Karnani, A. (2009) Romanticising the poor harms the poor, Journal of International Development, 21(1): 76-86. Kapadia, K. (1996). Siva and her sisters. Gender, Caste and Class in Rural India, Delhi: Oxford University Press. Lont, H. Hospes, O. (eds) (2004). Livelihood and Microfinance. Anthropological and Sociological Perspectives on Savings and Debt, Delft: Eburon Academic Publishers. Nabard (2008) Report of the committee on financial inclusion, New-Delhi: Nabard. http://www.nabard.org/pdf/report_financial/Full%20Report.pdf. Last access 15th of July 2010. Malamoud, C. (éd.), (1980). La dette, Paris : Ecole des Hautes Etudes en Sciences sociales (coll. Purusartha, vol. 4). Morvant-Roux, S. (2006). Processus d’appropriation des dispositifs de microfinance : un exemple en milieu rural mexicain, Thèse de doctorat en sciences économiques, Université Lumière Lyon 2. Mosse David (2005) Cultivating development. An ethnography of aid policy and practice, London: Pluto Book. Polanyi K. (1968) Primitive, Archaich and Modern Economies [ed. by G. Dalton] Boston: Beacon Press. Pouchepadass J. (1980) "L'endettement paysan dans le Bihar colonial", in: C. Malamoud (éd.), La dette, Paris : Ecole des Hautes Etudes en Sciences sociales (coll. Purusartha, vol. 4), pp. 165-205. Ramachandran V. K. & Madhura Swaminathan (2005), Financial liberalization, rural credit and landless labour households: Evidence from a Tamil Nadu village, 1977, 1985 and 1999, in Ramachandran V. K. & Madhura Swaminathan (eds) Financial liberalization and rural credit in India, New-Delhi: Tulika Books, pp. 157-177. Rutherford, S. (2001). The Poor and their Money, Oxford: Oxford University Press. Sa-Dhan (2009) The Bharat Microfinance Report – Quick Data 2009,New-Delhi: Sa-Dhan. Shah M., Rangu Rao R., P S Vijay Shankar V. (2007) Rural Credit in 20th Century India, Economic and Political Weekly, 14-04-2007, 42 (15). Servet J.-M. (2006). Banquiers aux pieds nus : La microfinance, Paris: Odile Jacob. Servet J.-M. (1984) Nomismata. Etat et origines de la monnaie, Lyon: Presses Universitaires de Lyon. Shipton P. (2007). The nature of entrustment. Intimacy, exchange and the sacred in Africa, NewHaven & London: Yale University Press. Srinivasan N. (2009). Microfinance in India. State of the report 2008, New-Delhi: Sage. Sriram M S, Parhi S. (2006) Financial Status of Rural Poor, Economic and Political Weekly, 41 (51) December 23 - December 29. 26 World Bank (2007) Finance for All? Policies and Pitfalls in Expanding Access. A World Bank Policy Research Report, Washington: The World Bank. Zelizer V. (1994) The social meaning of money, New-York: Basic Books. 27 Table 1. Household characteristics All Dalits Lowest-middle castes Middle-upper castes n = 344 n =212 n = 104 n = 28 4.71 4.66 4.66 5.17 37 36 37 38 % landowners 47.39% 33.49% 69.23% 71.43% % concrete housing 29.07% 25.94% 26.92% 60.71% 498 276 593 1,827 38.66% 45.28% 31.73% 14.29% Household size (# members) Age of household head value of monetary assets (x 1000 INR) occupation education % casual worker agriculture only % casual worker 7.85% 8.02% 7.69% 7.14% % employee, self-employed, pension 14.83% 18.87% 7.69% 10.71% Farmer 13.08% 3.30% 24.04% 46.43% Farmer-worker 23.26% 21.23% 27.88% 21.43% unknown 2.33% 3.30% 0.96% 0.00% % primary 54.94% 58.96% 43.27% 67.86% % secundary 9.01% 9.91% 7.69% 7.14% % technical 1.16% 1.41% 0.96% 0.00% % none 34.88% 29.77% 48.08% 25.00% 28 Table 2. Summary statistics We report summary statistics on the access to different borrowing sources for the 344 households in the sample. perc. > 0 is the percentage of households that are using a particular source. mean, min. and max. are respectively the average, minimum and maximum dollar amount of the loan that is borrowed from a particular source. % of total borrowing gives for each source the average dollar amount as a percentage of total borrowing. source all pawnbrokers wellknown persons SHG ambulant lenders bank family and friends shop perc. > 0 91.27% 54.94% 45.93% 41.28% 30.81% 21.22% 17.44% 6.68% mean 27,846 4,987 11,474 3,756 558 3,882 2,646 541 min. 0 0 0 0 0 0 0 0 max. 250,000 70,000 200,000 110,000 12,000 110,000 79,500 25,000 % of total borrowing 100% 25.35% 30.91% 17.46% 8.16% 9.35% 7.28% 1.47% 29 Table 3. Does access to sources differ by localization, caste or social class: Univariate cross-tabs Borrowing behavior in groups that differ in their localization (dry versus irrigated), caste (low caste versus the rest which is lowest middle and mid & upper) and ownership (no land-owners versus landowners). We look at mean values for total borrowings and borrowings from different sources scaled by total borrowing (differences tested by mean comparison t-test). We also look at percentage of families using a certain source (differences tested by Wilcoxon signed-rank test). All localization dry n = 174 32,970 93.10% irrigated n = 170 22,602 89.41% sig. rest n= 132 37,336 90.15% sig. 2.81*** 2.76*** caste low n = 212 21,937 91.98% land n = 163 35,549 91.41% sig. 4.12*** 2.91*** class no land n = 181 20,909 91.16% total borrowing mean perc. > 0 n= 344 27,847 91.27% pawnbrokers mean perc. > 0 0.23 54.94% 0.23 59.77% 0.23 53.12% 0.95 0.33 0.25 56.60% 0.19 52.27% -1.58 -1.35 0.26 58.56% 0.20 50.92% -1.78* -1.89* wellknown persons mean perc. > 0 0.28 45.93% 0.42 63.21% 0.14 28.23% 7.23*** 6.84*** 0.26 39.62% 0.32 56.06% 1.55 2.32** 0.29 43.09% 0.27 49.07% -0.45 0.37 SHG mean perc. > 0 0.16 41.28% 0.04 31.03% 0.28 51.76% -8.27*** -5.77*** 0.20 39.62% 0.09 43.93% -3.39*** -0.70 0.18 37.02% 0.14 46.01% -1.01 2.06** ambulant lenders mean perc. > 0 0.07 30.81% 0.07 35.73% 0.08 25.88% -0.30 1.50 0.08 34.90% 0.06 24.24% -0.83 -1.98** 0.08 38.67% 0.06 22.08% -1.33 -3.26*** bank mean perc. > 0 0.09 21.22% 0.08 21.26% 0.08 21.17 -0.04 -0.08 0.06 13.67% 0.13 33.33% 3.03*** 4.15*** 0.03 8.28% 0.15 35.58% 5.13*** 6.16*** family and friends mean perc. > 0 0.06 17.44% 0.07 19.77% 0.06 14.70% 0.76 1.27 0.06 11.79% 0.08 26.51% 1.24 3.20*** 0.05 12.71% 0.08 22.69% 1.42 2.37** shop mean perc. > 0 0.01 6.68% 0.01 8.04% 0.01 5.29% 0.16 0.99 0.01 3.30% 0.02 12.12% 0.56 3.12*** 0.01 2.76% 0.01 11.04% 0.17 2.99*** 4.02*** 3.56*** 30 Table 4. Other classification criteria for caste and class Borrowing behavior in groups that differ in their administrative caste (scheduled caste versus most backward caste versus backward caste) and class (concrete housing versus mud or semi-concrete housing; high versus low value for monetary value of total assets). We look at mean values for total borrowings and borrowings from different sources scaled by total borrowing (differences tested by mean comparison t-test). caste class administrative castes housing SC MBC BC n = 133 n = 105 104 total borrowing 19,489 34,139 31,686 pawnbroking borrowing 0.24 0.21 wellknown persons 0.16 SHG sig. monetary value total assets concrete mud/semi-concrete n = 100 n = 244 3.63*** 38,785 23,363 0.25 -0.38 0.21 0.37 0.35 5.01*** 0.29 0.07 0.08 ambulant lenders 0.09 0.08 bank 0.06 family and friends shop sig. high low sig. n = 172 n = 172 -3.84*** 33,669 22,023 -3.17*** 0.24 0.98 0.22 0.24 0.56 0.22 0.31 1.87** 0.25 0.30 1.13 -7.17*** 0.21 0.14 -2.05** 0.14 0.16 0.53 0.04 -1.62* 0.06 0.08 1.06 0.05 0.09 1.69** 0.10 0.10 1.61* 0.11 0.07 -1.53** 0.13 0.03 -4.24*** 0.05 0.08 0.08 1.54* 0.07 0.06 -0.54 0.08 0.05 -1.41* 0.01 0.00 0.03 1.28 0.03 0.01 -0.57 0.01 0.01 0.01 31 Table 5. Are total borrowings dependent upon caste, class and localization: a regression analysis OLS-regressions where total borrowings are regressed against caste (column 1), class (column 2), localization (column 3) and a number of controls. In column 4 the variables concerning caste, class and localization are added simultaneously. Confidence levels calculated using robust standard errors. *,** and *** denote significance at 10%, 5% and 1% level, respectively. dep. var.: total borrowing caste local caste classification dumLOW-MID dumMID&UP (1) Ln(monetary value total assets) controls education dumprimary 3,132 dumsecondary 12,318 # household members age of head dumCHRISTIAN migration stats (4) 3,252* 19,657*** -14,022*** class size age religion (3) 12,429*** 30,645*** localization dumIRR employment dumemployee dumfarmer (2) -12,657*** 8,291*** 7,360*** 5,010 2,491 2,918 13,505* 9,138* 12,197** 6,437 3,181** 3,360 2,388* 5,349 4,659 13,414*** 17,325*** 2,751** -211 1,745 2,645** -156 -4.141 2,464** -122 6,865 2,129* -185 2,211 dummigrant 1,486 993 1,060 127 n F-stat 343 5.11*** 343 4.88*** 342 4.97*** 342 4.97*** 0.15 0.12 0.19 0.20 R² 32 Table 6. Relation between caste, class and localization and the different borrowing source: regression analysis Different sources regressed against caste, class and localization and a number of controls. In the OLS-regressions the dependent variables are the amounts borrowed from a certain source scaled by total borrowings. In the LOGIT-regressions, the dependent is a 1/0 indicating whether the household uses that source or not. Confidence levels calculated using robust standard errors. *,** and *** denote significance at 10%, 5% and 1% level, respectively. dep.var.: pawn / total (1) (2) OLS LOGIT wellknown / total (3) (4) OLS LOGIT SHG / total (5) (6) OLS LOGIT ambulant / total (7) (8) OLS LOGIT caste dumLOW-MID dumMID&UP -0.07* -0.08* -0.25 0.29 0.09* 0.05 0.63* 0.73** -0.09* -0.03 -0.13 -0.96* -0.02 -0.05* -0.54* -1.69** class ln(monetary value TA) 0.01 0.18 -0.02 0.38** -0.01 0.20 -0.03* -0.38** localization dumIRR -0.06* -0.43* -0.20*** -1.08*** 0.21*** 0.74*** -0.01 -0.71* dumprimary dumsecondary employment dumemployee dumfarmer size # household members age age of head religion dumCHRISTIAN migration dummigrant 0.00 0.08* -0.09* -0.10* -0.01 0.00 -0.06 -0.04 0.20 0.75 -0.73 -0.74* 0.12 0.01 -0.13 -0.14 0.02 0.11 -0.01 -0.20*** 0.02 -0.02 0.09 -0.04 0.09 0.42 0.11 -0.51** 0.14** 0.01 0.98** -0.41 -0.04 -0.08 0.02 -0.03 0.02 0.01 -0.07 0.01 -0.42 -0.30 -0.01 -0.07 0.17** 0.02 -0.28 0.12 -0.02 -0.11*** 0.02 0.01 0.00 0.00 -0.05 0.00 -0.07 -0.11* -0.87** -0.56** 0.13* 0.02 -0.54 -0.07 stats n 342 342 342 342 342 342 342 342 F-stat R² 1.22 0.05 18.68* 0.05 5.72*** 0.16 55.25*** 0.14 6.64*** 0.20 35.57*** 0.10 4.13*** 0.04 38.75*** 0.10 education 33 dep.var.: bank/total (1) (2) OLS LOGIT F&F / total (3) OLS (4) LOGIT shop / total (5) OLS (6) LOGIT caste dumLOW-MID dumMID&UP 0.04 0.11** 0.41* 1.75*** -0.02 0.04 0.47 1.74*** 0.01 0.05 1.92 3.20 class ln(monetary value TA) 0.03 0.69** -0.05 0.56 -0.01 -0.17 localization dumIRR 0.03 0.20 -0.03* -0.36 0.01 -0.37 dumprimary dumsecondary employment dumemployee dumfarmer size # household members -0.03 -0.09** 0.06 0.08* 0.01 0.08 -0.05 0.18 0.75*** 0.24** -0.02 -0.08** -0.01 0.07 0.01 -0.29 -1.27*** 0.53 0.24 -0.17 0.01 -0.01* 0.00 0.02 0.01 0.72 0.63 0.34 -0.68 0.10 age religion migration age of head dumCHRISTIAN dummigrant -0.01 0.00 0.04 -0.01 0.18 0.19 -0.01 -0.01 0.03 0.01 0.82 0.46 0.01 0.01 -0.01 -0.06** 0.81 -0.74 stats n F-stat R² 342 5.33*** 0.14 342 71.51*** 0.26 342 3.65*** 0.18 342 43.11*** 0.15 342 1.65* 0.08 342 38.43*** 0.36 education 34 Table 7. Do borrowing purposes differ by localization, caste or social class: Univariate cross-tabs Relative importance of loan-purposes across groups that differ in their localization (dry versus irrigated), caste (low caste versus the rest which is lowest middle and mid & upper) and ownership (no land-owners versus landowners). Differences between groups assessed by Pearson χ² and LR-statistics. All localization dry irrigated caste low rest class no land land investments/housing/land/cow 29.50% 23.77% 37.40% 24.69% 35.35% 16.35% 41.67% household expenditures 20.96% 16.70% 26.83% 23.65% 17.68% 22.27% 19.74% ceremonies 17.08% 18.07% 15.72% 17.34% 16.67% 22.75% 11.84% health 12.87% 17.68% 6.23% 11.41% 14.65% 16.82% 9.21% education 10.36% 13.75% 5.69% 13.07% 7.07% 12.56% 8.33% repayments 6.15% 6.68% 5.42% 6.58% 5.30% 6.40% 5.92% other 3.08% 3.34% 2.71% 2.90 3.28 2.84% 3.29% number of households 344 174 170 212 132 181 163 number of loans 878 509 369 482 396 422 456 LR-stat 63.34*** 22.67*** 79.82*** Pearson Chi²-stat 60.66*** 22.42*** 77.42*** 35 Table 8. Other criteria for caste and class Relative importance of loan-purposes across groups that differ in their administrative caste (scheduled caste versus most backward caste versus backward caste) and class (concrete housing versus mud or semi-concrete housing; high versus low value for monetary value of total assets). Differences between groups assessed by Pearson χ² and LR-statistics. All caste class Administrative castes Housing Monetary value total assets SC MBC BC concrete mud/semi-concrete high low investments/housing/land/cow 29.50% 29.92% 29.37% 29.27% 42.00% 23.01% 43.01% 16.52% household expenditures 20.96% 30.68% 16.43% 17.07% 20.33% 21.18% 20.01% 21.88% ceremonies 17.08% 17.42% 18.53% 15.55% 14.33% 18.51% 11.40% 22.54% health 12.87% 6.82% 17.83% 13.41% 8.67% 15.05% 9.30% 16.29% education 10.36% 7.20% 8.04% 14.94% 6.67% 12.28% 7.21% 13.39% repayments 6.15% 5.30% 5.94% 7.01% 5.33% 6.57% 6.05% 6.25% other 3.08% 2.65% 3.85% 2.74% 2.67% 3.29% 3.02% 3.13% number of households 344 133 105 104 100 244 172 172 number of loans 878 264 286 328 300 578 448 430 LR-stat 42.64*** 39.04*** 87.26*** Pearson Chi²-stat 43.18*** 39.25% 85.03*** 36 Table 9. Summary statistics for interest rates charged per lending source Mean, median, minimum and maximum for the percentage rate charged by different lending sources. interest rates mean median min. max. n iwellknown person 3.73 3.00 0.00 10.00 227 ipawnbroker 2.83 3.00 0.00 4.00 207 ifamily and friends 3.11 3.00 0.00 5.00 45 ibank 1.01 1 0 2 78 iSHG 1.72 2 1 4 156 Table 10. Summary statistics for interest rates charged per lending source Mean interest rate charged in different groups that differ in their localization (dry versus irrigated), caste (low caste versus the rest which is lowest middle and mid & upper) and ownership (no land-owners versus landowners). Differences analyzed by mean comparison t-test. All iwellknown person ipawnbroker ifamily and friends ibank iSHG 3.73 2.83 3.11 1.01 1.72 localization dry irrigated 3.55 4.25 2.88 2.75 3.28 2.90 1.08 0.92 2.13 1.47 sig. -3.88*** 1.88 0.91 1.63 8.28*** caste low 4.09 2.88 2.80 1.07 1.66 rest 3.35 2.74 3.20 0.97 1.81 sig. -4.72*** -2.07** 0.80 -0.92 1.61 class no land 4.00 2.89 2.55 1.28 1.71 land 3.47 2.75 3.25 0.94 1.74 sig. -3.28*** -2.12** 1.35 -2.90*** 0.32 37 38