Bus fin syllabus

advertisement

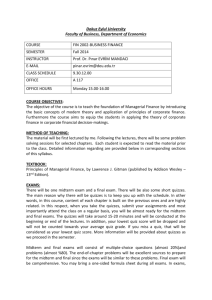

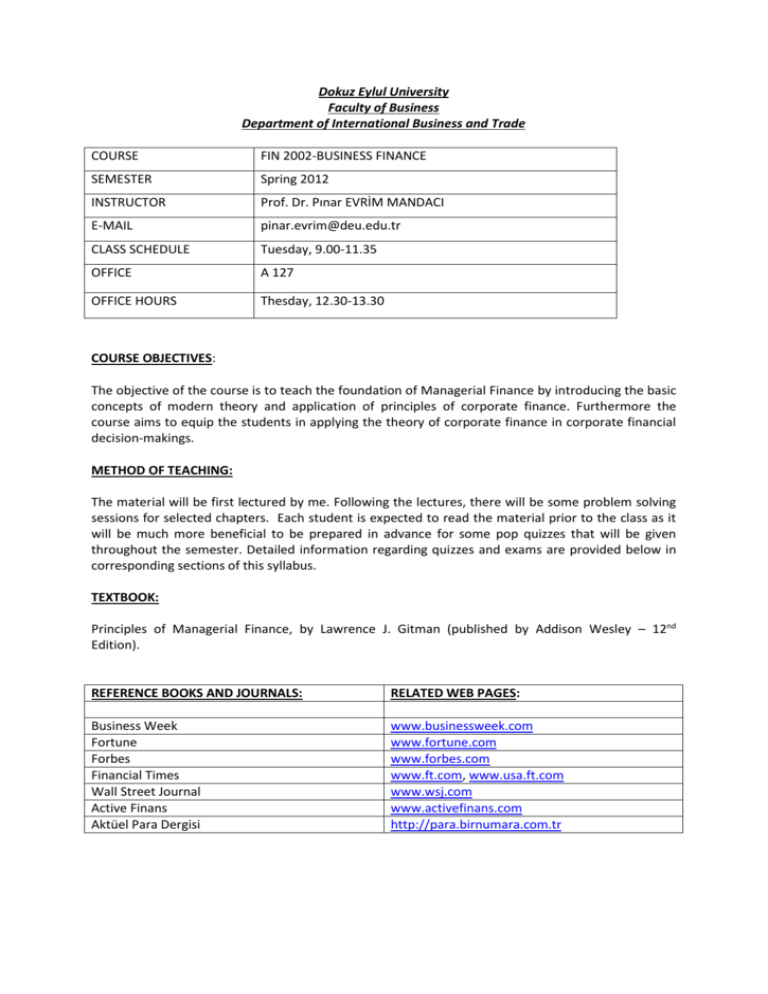

Dokuz Eylul University Faculty of Business Department of International Business and Trade COURSE FIN 2002-BUSINESS FINANCE SEMESTER Spring 2012 INSTRUCTOR Prof. Dr. Pınar EVRİM MANDACI E-MAIL pinar.evrim@deu.edu.tr CLASS SCHEDULE Tuesday, 9.00-11.35 OFFICE A 127 OFFICE HOURS Thesday, 12.30-13.30 COURSE OBJECTIVES: The objective of the course is to teach the foundation of Managerial Finance by introducing the basic concepts of modern theory and application of principles of corporate finance. Furthermore the course aims to equip the students in applying the theory of corporate finance in corporate financial decision-makings. METHOD OF TEACHING: The material will be first lectured by me. Following the lectures, there will be some problem solving sessions for selected chapters. Each student is expected to read the material prior to the class as it will be much more beneficial to be prepared in advance for some pop quizzes that will be given throughout the semester. Detailed information regarding quizzes and exams are provided below in corresponding sections of this syllabus. TEXTBOOK: Principles of Managerial Finance, by Lawrence J. Gitman (published by Addison Wesley – 12nd Edition). REFERENCE BOOKS AND JOURNALS: RELATED WEB PAGES: Business Week Fortune Forbes Financial Times Wall Street Journal Active Finans Aktüel Para Dergisi www.businessweek.com www.fortune.com www.forbes.com www.ft.com, www.usa.ft.com www.wsj.com www.activefinans.com http://para.birnumara.com.tr EXAMS: There will be one midterm exam and a final throughout the course. There will be also some short quizzes. The main reason why there will be quizzes is to keep you up with the schedule. In other words, in this course, content of each chapter is built on the previous ones and are highly related. In this respect, when you take the quizzes, submit your assignments and most importantly attend the class on a regular basis, you will be almost ready for the midterm and final exams. The quizzes will take around 15-20 minutes and will be conducted at the beginning or end of the lectures. In addition, your lowest quiz score will be dropped and will not be counted towards your average quiz grade. If you miss a quiz, that will be considered as your lowest quiz score. More information will be provided about quizzes as we proceed in the semester. Midterm and final exams will consist of multiple-choice questions and problems. The end-of-chapter problems and quizzes will be excellent sources to prepare for the midterm and final as the exams will be similar to these problems and quiz questions. Final exam will be comprehensive. There will be a class period for final exam review to discuss the possible contents of the final exam as well as to solve some problems. You may bring a one-sided formula sheet during all exams. In exams, you can use a calculator. Actually, I strongly recommend you to buy a sophisticated calculator for this course as you will definitely need it throughout the semester. COURSE GRADING Course grades will be based on a weighted composite of performance evaluations in several areas: Mid-term Exam Quizzes Final Exam 30% 20% 50% COURSE OUTLINE: Feb. 14,2012 1 CHAPTER Feb. 21,2012 Feb. 28,2012 Mar. 6,2012 Mar. 6,2012 Mar. 13,2012 2 2 3 3 4 4 TOPIC Introduction: The Role and Environment of Managerial Finance Financial Statements and Analysis Financial Statements and Analysis (contd) Cash Flow and Financial Planning Cash Flow and Financial Planning Time Value of Money Time Value of Money (contd) Mar. 20,2012 Mar. 27,2012 5 5 Risk and Return Risk and Return (contd) 6 6 7 7 Mid-term Exams Interest Rates and Bond Valuation Interest Rates and Bond Valuation (contd) Stock Valuation Stock Valuation (contd) Apr.2-13 Apr. 17,2012 Apr. 24,2012 May. 8,2012 May. 15,2012 May.22,2012 PROBLEMS Self Test 2-2, Problems 2-2, 2-6, 2-17, 2-21 Problems 3-5, 3-6, 3-9,3-16 (QUIZ-1) Problems 4-4,4-5, 4-13,4-18, 4-19,4-23,4-35,4-42- 4-48 Self-test 5-2 Problems 5-5, 5-12,513,,5-18 (QUIZ 2) Self Test 6-1, Problems 6-12, 6-15,6-16,6-24 Self Test 7-1,7-2, Problems 7-9,711,7-17,7-19 (QUIZ 3) 9 Capital Budgeting Techniques 9 Capital Budgeting Techniques (contd) Problems 9-3, 9-7, 9-18 11 The Cost of Capital Problems 11-8, 11-15, 11-17 (QUIZ 4) The above syllabus is tentative and can be changed by the instructor at any time. The student is supposed to be aware of the facts written on the syllabus and should keep a track of changes in the course conduct throughout the semester.