Chapter: Leverage - First

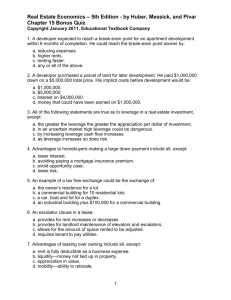

DFL= EBIT

EBIT-I

DOL= Sales-VC

EBIT

DCL= DOL x DFL

Chapter: Leverage

1. Definition of Leverage

2. Degree of Leverage

3. Situation of Leverage

4. Types of Leverage

5. Difference between Operating Leverage and Financial Leverage.

6. Risk involved in Leverage

7. Earning Per Share (EPS)

8. How EBIT affects on EPS?

Definition of Leverage:

There are three types of Decisions, Such as Investment Decisions, Financing Decisions and

Dividend Decisions. i.)Leverage is an investment techniques in which a small amount of own money is used to make an investment of much/larger value. Leverage gives us significant financial power.

Leverage is defended as the employment of assets or sources of funds for which the firm has to pay a fixed cost or fixed return and investing the available fund in order to get the larger value against investment.

Leverage is to invest the amount of debt resources for getting large return is called leverage.

The amount of debt used to finance firms assets. A firm with significantly more debt than equity is considered to be highly leveraged.

If the debt financing is higher, then Leverage will be higher.

If the debt financing is lower, then Leverage will be lower

Degree of Leverage: “A measure at a given level of sales of how a percentage changes in sales volume will affect profits. The degree of operating Leverage is computed by dividing contribution margin by net operating income.”

For Example: a)If you borrow 90% of the cost of a house, you are using the leverage to buy a much more expensive property than you could have afforded by paying cash. b). If you sell the property for more than you borrowed, the profit is entirely yours. The reverse is also true. If you sell at a loss, the amount you borrowed is still due and the entire loss is yours.

Leverage may be favorable and unfavorable.

Situation of Leverage: There are Two (2) situations

Favorable Leverage: If the earnings less the variable costs exceed the fixed costs or earning before interest and taxes (EBIT) exceeds the fixed return requirement, the leverage is called favorable.

Unfavorable Leverage: If the earnings less the variable costs not exceed the fixed costs or earning before interest and taxes (EBIT) not exceeds the fixed return requirement , the leverage is called unfavorable.

Favorable Unfavorable

(Earning –VC)> FC (OL) (Earning –VC)< FC

Earning or EBIT> Fixed interest Change (FL) Earning or EBIT< Fixed Interest charges

Types of Leverage : There are basically three types of Leverage:

1.

Operating Leverage OL (Equity)

2.

Financial Leverage FL (Debt/Loan)

3.

Combined Leverage CL ( Operating and financial)

Operating Leverage OL (Equity): Leverage associated with the assets acquisitive investment activities is referred to as operating leverage. It may be also define as the ability to use the fixed operating cost to magnify the effect of change in sales on its operating profits (EBIT).

A business that has a higher proportion of fixed costs and a lower proportion of variable costs is said to have used more operating leverage. Those businesses with lower fixed costs and higher variable costs are said to employ less operating leverage.

Degree (Change) of Leverage: DOL, DFL, DCL

Degree of operating Leverage: (DOL) : By using fixed operating cost, a small change in sales revenue that magnified into a larger change in operating income/EBIT.

Operating leverage involves using a large proportion of fixed costs to variable costs in the operations of the firm. The higher the degree of operating leverage the more volatile the EBIT figure will be relative to a given change in sales, all other things remaining the same. It may be determined by the relationship between sales revenue & EBIT.

Percentage change in EBIT

DOL= ------------------------------------(Small changes in Sales , Large change in EPS)

Percentage change in Sales

Sales---Variable Cost

DOL=-------------------------------------------------where, EBIT=Sales-VC-FC

EBIT

IF DOL=2, then a 1% increase in sales will result in a 2 % increase in operating income.

Financial Leverage FL : Financial leverage is the 2 nd

types of leverage which is related to the financing decision of a firm. It results from the presence of fixed firm charges.

Degree of Financial Leverage: (DFL): Using debt financing, a small change in EBIT that magnified in to larger change in earning per share.

Percentage change in EPS

DFL = --------------------------------- (Small changes in Sales, Large change in EPS)

Percentage in EBIT

EBIT

DFL= -------------------------

EBIT-I

If DFL = 3, then a 1% increase in operations income will result in a 3% increase in earning per share.

Combined Leverage: CL: A leverage ratio that summarizes the combined effect the degree of operating leverage (DOL), and the degree of financial leverage has on earnings per share(EPS), given a particular change in sales. This ratio can be used to help determine the most optimal level of financial and operating leverage to use in any firm.

Degree of Combined Leverage: (DCL): It is the combined effect of DOL and DFL. By using operating leverage and financial leverage, a small changes in sales that magnified into larger changes in Earning Per Share (EPS).

% Changes in EPS

DCL=--------------------------------- = DOL X DFL

% Changes in Sales

Sales-Variable Cost EBIT

DCL= ---------------------- x ------------

EBIT EBIT-I

Sales-Variable Cost

DCL= ----------------------------------

EBIT-I

Sales

DOL

EBIT

DFL

EPS Shareholders

Difference between Operating Leverage and Financial Leverage:

Difference between Operating Leverage and Financial Leverage.

The differences between Operating Leverage and Financial Leverage are as follows:

Mode / Features of Difference

1.Definition/Arises

2.Determination

3.Risk

4. Formula Used

5. Affects

6. Use/Fulcrum

Operating Leverage

Operating Leverage arises from the cost structure

It is determined by the relationship between Sales and

EBIT

Degree of Operating leverage creates Business Risk.

DOL=Sales-VC/EBIT

Financial Leverage

Financial Leverage arises from the capital Structure.

It is determined by the relationship between EBIT and

EPS.

Degree of financial leverage creates financial Risk.

DFL=EBIT/EBIT-I

It affects the sales and EBIT IT affects the EBIT and EPS.

In operating leverage the In financial leverage the fulcrum fulcrum is the fixed cost. is the fixed interest charges that must be paid to service the long term debt.

Risk involves in Leverage :

Two concepts that enhance our understanding of risk....

1.

Operating Leverage-----affects a firm’s business risk.

2.

Financial Leverage------affects a firm’s financial risk

Business Risk: The variability or uncertainty of a firm’s operating income (EBIT).

Business Risk: 1. Sales volume variability

2. Competition

3. Growth

4. Product Diversification

5. Operating Leverage

6. Growth Prospects

7. Size

Financial Risk: The variability or uncertainty of a firm’s earnings per share(EPS) and the increased probability of insolvency that arises when a firm uses financial leverage

Earning Per Share (EPS): What Does Earnings Per Share (EPS) mean?

EPS is net income minus dividend on preferred stock divided by the number of shares outstanding.

The portion of a company’s profit allocated to each outstanding share of common stock.

EPS serves as an indicator of a company’s profitability.

Calculations As: Net Income-Dividend on preferred stock

No of shares outstanding

For Example: Assume that a company has a net income of Tk 25 Millions. If the company pays out

1 million in preferred dividends and no of shares outstanding is Tk 10 millions.

EPS= 25-1 = 24/10 = 2.4

10

Example of Levered Firm/Company:

Sales (1,00,000 units) variable Costs

Fixed Costs

Tk 14,00,000

8,00,000

2,50,000

Interest Paid

Tax Rate

Common Shares Outstanding

1,25,000

@ 34 %

Tk 1,00,000

Degree of Operating Leverage from Sales Level

DOL= Sales-VC/EBIT 14, 00,000=8,00,000/3,50,000 = 6,00,000/3.50,000 = 1.714

So, 1% increases of Sales means 1.714 % or 10% inc. in sales means 17.14% EBIT will increase....

Problems

Problem No: 1

From the following selected operating data, determine the degree of operating leverage. Which company has the greater amount of business risk and why? Give you answer.

Sales

Details

Fixed Costs

Variable expenses as a percentage of sales are 50% of Firm X and 25% for Firm Y

Problem No: 2

ABC Company Ltd has an average selling price of Tk 10 per unit. Its variable costs are Tk 7 and fixed costs are amount to Tk 1, 70,000. It finances all its assets by equity funds. It pays 50% tax on its income. PQR Company Ltd is identical except respect of pattern of financing. The late finances its assets 50% by equity and 50% debt. The interest on which amount to Tk 20,000 for PQR Co.

Determine the degree of operating Leverage, Financial Leverage and Combined Leverage at Tk 7,

00,000 sales for both of the firms and interpret the result.

Problem No: 3 Crown Industries, a well established firm in plastics, is considering the purchase one of the two manufacturing companies. The financial manager of the company has developed the following information about the two companies. Both companies have total assets of Tk 15, 00,000.

Operating Income Statement

Particulars

Sales Revenue

Less: Cost of Goods sold

Less: Selling Expenses

Less: Administrative Exp.

Less: Depreciation

Variable Cost:

Company X in Tk

25,00,000

7,50,000

EBIT

Cost of Goods Sold

Company Y in Tk

30,00,000

15,00,000

Company A

30,00,000

22,50,000

2,40,000

90,000

1,20,000

3,00,000

9,00,000

Company B

30,00,000

22,50,000

2,40,000

1,50,000

90,000

2,70,000

18,00,000

Selling Expenditures

Total Variable Cost

1,50,000

10,50,000 a). Calculate the degree of operating leverage.

1,50,000

19,50,000 b) . If Crown industries wishes to buy a company which has a lower degree of business risk, which company would you be purchases by it?

Problem No: 4 The operating and cost data of XYZ Company Ltd are:

Sl Particular Amount in Tk

1 Sales

2 Variable Cost

3 Fixed Cost

20,00,000

14,00,000

4,00,000 (including 15% interest on 10,00,000)

a) Calculate its Operating, Financial and Combined Leverage b) Determine the additional sales to double its EBIT.

Problem No: 5: A firm has sales of Tk 20, 00,000 …, variable cost of Tk 14,00,000 , fixed cost of

Tk 4,00,000 and a debt of Tk 10,00,000 @ 10%. a) Calculate its operating, fixed changes and combined leverage b) It the firm decides to double it EBIT, how much of a rise in sales would be needed on a percentage basis?

Problem No: 6 From the following financial data of Companies X and Y, Prepare their income statements

Variable cost as % of Sales

Interest paid

Particulars

Degree of operating leverage

Degree of Financial Leverage

Company P

50

20,000

3-1 (Highest)

2-1

@ 55%

Company Q

60

6,000

Income Tax Rate

5-1 (Highest)

3-1

@ 55%

Roushan Ara Sultana

Assistant Professor &

Co-coordinator of EMBA Program, FBA, USTC

M Phil (Research Fellow), CU

MBA (Actg), PGDPM (BIM), BBA (Hons), CU

Email: mbaexeustc@gmail.com

Phone: 01554-335733