Page 2

advertisement

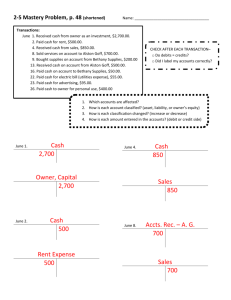

Accounting 10 Module 2 Lesson 6 Accounting 10 1 Lesson 6 Accounting 10 2 Lesson 6 Lesson Six - Identifying the Bookkeeping Base of Accounting Read pages 108 to 123 in the textbook. Topics: • • • • • • • • • Introduction Originating Transaction Data Journalizing Transaction Data Remember These Important Points Do You Understand? Conclusion Self Test Answers for Self Test Assignment 6 After studying Lesson 6, the student should be able to • name an appropriate source document or documents for common business transactions stated in narrative form. • analyze and record correctly a set of source documents in a two-column General Journal. • record a set of narrative transactions in a two-column General Journal. • make proper error corrections in a two-column General Journal. • state the advantages of using a General Journal. Accounting 10 3 Lesson 6 Introduction In actual practice, an accounting system is organized to record and build up data so financial statements can be prepared more easily at the end of any accounting period. In the language of accounting, such an accounting system would include a series of steps or routines which form the accounting cycle. Accounting cycle - the complete sequence of accounting activities repeated in every accounting period. In this lesson, you will be introduced to the first two steps of the accounting cycle. The first step explains how transaction information originates on business papers called source documents. The second step examines recording information contained in source documents into an accounting record known as the general journal. Originating Transaction Data Up to this point, all business transactions have been given to you in a brief narrative (story-like) form. However, the majority of daily transactions do not arise in that form. In actual practice, transaction data arise from the creation of business forms known as source documents. Source documents are business papers that give evidence of business transactions on a certain date. The objectivity principle states that all accounting transactions must be supported by source documents. Four common source documents are the opening balance sheet, invoice, cheque record, and remittance slip. Carefully study the source documents found on pages l08 to 113 in the textbook. Accounting 10 4 Lesson 6 Journalizing Transaction Data Several disadvantages exist for recording the debits and credits for each business transaction directly into a T-account ledger. • The debit side of the entry will appear in one or more accounts, while the credit entry will appear in one or more different accounts. Thus, you would have to search the entire ledger just to analyze one complete business transaction. • The accounts do not show a record of all the business transactions for a particular date. Thus, you would have to search through many accounts to discover how many business transactions occurred on a given day. • If an error were made in the debit or the credit entry, this error would be more difficult to locate quickly because the double entry has been separated into two or more accounts. To overcome these disadvantages, many accounting systems use an accounting record called a journal before the debits and credits are entered in the ledger accounts. The journal shows, for each day, the debits and credits analyzed for each source document. These are later transferred to individual ledger accounts. The journal is a daily record of business transactions in debit and credit form; a book of original entry. The general journal is a two-column journal which analyzes transactions and records the debits and credits in the journal. 20__ Journalizing is the process of analyzing transactions into debits and credits, and recording the results in a journal, it does not require any new knowledge. Accounting 10 5 Lesson 6 One or more source documents provide the accounting data for most business transactions. Journalizing takes the information from source documents and is the second step in the accounting cycle. Journalizing Study the illustrations and explanations on pages 117 and 118 in the textbook. Transactions must be analyzed before being entered into the journal. For review purposes, the steps in analyzing are to: • determine which accounts were affected. • determine whether the accounts were increasing or decreasing. • translate the increase or decrease into terms of debit and credit and make the appropriate entry in the journal. • make sure that the debit part of an entry always come before the credit part. When journalizing, follow these steps: • Record the year, month and day of the transaction in the date column. The month and year are repeated only at the top of a new page or when the month and/or year changes. • Write the title of the account to be debited in the Account Title and Explanation column. Then enter the debit amount in the debit column--the left-hand money column. • On the line below the debit entry, indent about l/2 inch and write the account to be credited. On the same line, enter the amount in the credit column--the right-hand money column. • On the line below the credit entry, write a brief explanation of the transaction. • Skip a line and enter the next transaction. • Ensure that total debits equal total credits for each transaction. Accounting 10 6 Lesson 6 The posting reference column is not to be used in journalizing. However, it will be used as part of the procedure in posting data to the ledger. Accuracy in journalizing cannot be over emphasized. The general journal is a book of original entry and any mistakes made in entering transactions will cause the rest of your records to be inaccurate. Illustrating Journal Entries To illustrate how a set of journal entries is recorded in a two-column General Journal, the transactions studied earlier for Central Travel will be repeated again with two additions. First, individual sales and individual expenses are listed as they would normally occur during the month. Second, appropriate source documents are identified for every transaction. Transactions for Stacom Travel repeated: Sept. 30 Rob Ireland commenced StacomTravel with the following: Cash, $28 000; Accts. Rec/Lee Baines, $1 000; Office Equipment, $11 000; Furniture, $10 000; Bank Loan Payable, $10 000; Accts. Pay./A & B Furniture Co., $6 000; Accts. Pay./Office Equipment Co., $4 000; Rob Ireland, Capital, $30 000. Oct. 1 Received a cheque for $1 000 from Lee Baines in payment of his debt owing to the business. Prepared Remittance Slip No. 1. Deposited the receipt in the firm's bank account. 2 Bought additional furniture (1 desk, 2 chairs) for $1 000 from the Herbert Office Co., Ltd. Issued Cheque No. 1 in full payment. 3 Received an invoice from Nelson Equipment Co. for the purchase of additional office equipment costing $1 400; terms 60 days' credit. 3 4 Accounting 10 Total cash sales as per Invoices 001, 002 and 003 totalled $411. Deposited the total in the firm's bank account. Mailed a covering letter to Nelson Equipment Co. returning one piece of office equipment costing $400. The equipment arrived in damaged condition. 7 Lesson 6 Oct. 5 Issued Cheque No. 2 to Office Equipment Co. for $4 000 in full settlement of the account payable. 8 Prepared a memo showing an additional investment of $3 000 by Rob Ireland. A copy of the deposit slip, initialled by the bank clerk, showed the $3 000 deposited in the firm's bank account. 8 Total cash sales as per Invoices 004, 005, 006 and 007 amounted to $600. Deposited all receipts in the firm's bank account. 12 Issued Invoice 009 to J.McCain for travel services rendered. Terms given were net 30 days. Total bill, $400. 16 Issued Cheque No. 4 for $40 in payment of monthly telephone bill. 30 Issued Cheque No. 6 for $2 000 to Rob Ireland for his personal use. 30 Issued Cheques No. 7 and 8 totalling $2 750 in payment of monthly salary for two clerks. General Journal DATE 20__ Sept. 30 ACCCOUNT TITLE AND EXPLANATION Cash Page 1 POST REF. DEBIT CREDIT 28 000.00 Accts. Rec./Lee Baines 1 000.00 Office Equipment 11 000.00 Furniture 10 000.00 Bank Loan Payable 10 000.00 Accts. Pay./A & B Furniture Co. 6 000.00 Accts. Pay./Office Equipment Co. 4 000.00 Rob Ireland Capital 30 000.00 To record the opening balance sheet amounts into accounts. Accounting 10 8 Lesson 6 Page 2 DATE 20__ Oct. 1 ACCOUNT TITLE AND EXPLANATION Cash POST REF. DEBIT CREDIT 1 000.00 Accts. Rec./Lee Baines 1 000.00 Received in full payment of account. Remittance slip No. 1. 2 Furniture 1 000.00 Cash 1 000.00 Cheque No. 1 to Herbert Office Co., Ltd. One desk and two chairs. 3 Office Equipment 1 400.00 Accts. Pay./Nelson Equip. Co., Ltd. 1 400.00 Purchased additional office equipment on 60 days' credit. 3 Cash 411.00 Sales 411.00 Total cash sales as per Invoices 001, 002, and 003. 4 Accts. Pay./Nelson Equipment Co. 400.00 Office Equipment 400.00 Returned filing cabinet, Model 70Y, damaged in shipment. Accounting 10 9 Lesson 6 Page 3 DATE 20__ Oct. 5 ACCCOUNT TITLE AND EXPLANATION Accts. Pay./Office Equipment Co. POST REF. DEBIT CREDIT 4 000.00 Cash 4 000.00 Cheque No. 2 in full settlement of account. 8 Cash 3 000.00 Rob Ireland, Capital 3 000.00 To record additional investment. 8 Cash 600.00 Sales 600.00 Total cash sales as per Invoices 004, 005, 006 and 007. 12 Accts. Rec./J. McCain 400.00 Sales 400.00 Invoice 009 on 30 days' credit. 16 Telephone Expense 40.00 Cash 40.00 Cheque No. 4 for telephone bill. 30 Rob Ireland, Drawing 2 000.00 Cash 2 000.00 Cheque No. 6 for personal use. 30 Salaries Expense 2 750.00 Cash 2 750.00 Cheques 7 and 8 for monthly salaries. Accounting 10 10 Lesson 6 Note the following: • The first entry is known as the opening entry because it identifies the accounts that open a set of accounting records for a beginning balance sheet of the new business. • An entry which includes more than one debit and more than one credit, such as the opening entry in the illustration, is called a compound entry. In every compound journal entry, the debits are listed before the credits, and the total of all the debits must be equal to the total of all the credits. This total is not shown in a two-column journal but should be checked mentally before the next journal entry is done. • Observe that only complete journal entries are shown on a journal page. A transaction is not recorded unless there are enough lines to journalize all of it. Advantages of the General Journal • The journal records the day to day transactions according to the date on which they occurred. • Since the journal provides a record of all transactions in order of date, you can compare the volume of transactions from day to day. • Because the equality of debits and credits can be checked at a glance, errors can be discovered before the transactions are transferred to the ledger. • The journal shows the debit and credit parts of the transaction in one place, and it also explains the transaction. • The journal is a factual proof of financial events in case such proof should be required in a court of law, or if any source document should be lost or destroyed. Accounting 10 11 Lesson 6 Remember These Important Points: • The accounting cycle is made up of a series of steps which are repeated in every accounting period. • The first step in every accounting cycle is to originate transaction data. • Transaction data are contained on business papers known as source documents. • The second step in the accounting cycle is to journalize transaction data. • Journalizing means breaking each business transaction into debits and credits before they are recorded in the journal. • The debit part of an entry is always recorded before the credit part. • A journal is a "book of original entry" because the debits and credits resulting from the analysis of each transaction appear first in the journal. • The opening entry in the General Journal will always be the entry to record the opening balance sheet of the new business. • A compound journal entry contains three or more accounts. Total debits must always be equal to total credits in each journal entry. Do You Understand? Accounting cycle - the complete sequence of accounting activities repeated in every accounting period. Source documents - business forms (papers) that give evidence of business transactions on a certain date. Purchase invoice - a copy of an invoice, received by the buyer, to give evidence of the purchase made. Accounting 10 12 Lesson 6 Sales invoice - a source document that gives evidence of a sale. Remittance slip - a source document proving the receipt of a customer's cheque. Journal - a daily record of business transactions in debit and credit form; a book of original entry. General Journal - a two-column journal. Journalizing - the process of analyzing transactions into debits and credits, and recording the results in a journal. Opening entry - the first entry which identifies the accounts that open a set of accounting records for a beginning balance sheet of the new business. Compound entry - an entry that involves more than two accounts. Conclusion Journalize transactions accurately. You should be able to journalize opening entries and day-to-day transactions in a general journal. Self Test 1. P 4-1, page 113 of the text 2. MC 4-3, page 115 of the text 3. P 4-4, page 123 of the text 4. MC 4-6, page 127 of the text Accounting 10 13 Lesson 6 P 4-1a • _________________________________________________________________ P 4-1b • _________________________________________________________________ P 4-1c • _________________________________________________________________ P 4-1d• _________________________________________________________________ P 4-1e • _________________________________________________________________ P 4-1f • _________________________________________________________________ P 4-1g • _________________________________________________________________ P 4-1h • P 4-1i • _________________________________________________________________ P 4-1j • _________________________________________________________________ _________________________________________________________________ ____________________________________________________________________________________ P 4-1k • Key Figure to Check: an appropriate revenue account is required for the credit entry. P 4-1l Accounting 10 14 Lesson 6 P4-1m Key Figure to Check: an appropriate expense account is required for the debit entry. Accounting 10 15 Lesson 6 P 4-4 General Journal Date 20__ Page Post Ref. Account Title Debit Credit Key Figure to Check: on November 2, debit the asset account Office Supplies for the purchase of additional office supplies. Accounting 10 16 Lesson 6 P4-4 (continued) General Journal Date 20__ Accounting 10 Page Post Ref. Account Title 17 Debit Credit Lesson 6 P 4-4 (continued) General Journal Date 20__ Accounting 10 Page Post Ref. Account Title 18 Debit Credit Lesson 6 Answers for Self Test P 4-1a J. Emery Real estate. P 4-1b Pat Rogers. P 4-1c J. Emery Real Estate would have prepared the invoice. P 4-1d The information shown by the "Terms." In this illustration, the seller gives the buyer 30 days from the invoice date to pay the bill. P 4-1e J. Emery Real Estate "sold" real estate services by selling a building belonging to Pat Rogers. P 4-1f All source documents should have numbers in sequence. The number is used to identify the source document so that it can be accounted for. P 4-1g J. Emery Real Estate charged 5% on $120 000 (the price at which the building was sold for Pat Rogers). P 4-1h Pat Rogers must pay the amount owing within 30 days of the invoice date. Thirty days from October 31 would be November 30., P 4-1i Interest at the rate of 2% per month will be charged if Pat Rogers fails to pay the amount owing within the 30 days stated on the invoice. P 4-1j J. Emery Real Estate earned $6 000 commission for selling a building for Pat Rogers; terms, net 30 days from October 31. Accounting 10 19 Lesson 6 P 4-1k Accts. Rec./Pat Rogers Commissions Earned 20__ Oct. 31 6 000 20__ Oct. 31 6 000 P 4-1l Received a bill, dated October 31, for $6 000 commission charged by J. Emery Real Estate for selling the building located at 40 Main Street West; terms, net 30 days. P 4-1m Commissions Expense Accts. Pay./J. Emery Real Estate 20__ Oct. 31 6 000 20__ Oct. 31 6 000 MC 4-3a, b The source documents involved in this type of event may vary from business to business. In general, however, the following types of documents could expect to be involved: • Purchase Order. A document sent to the company that will supply (provide) the good or service to our business. • Purchase Invoice. A bill sent to our business from the supplier stating the cost of the good or service that our business has ordered. • Cheque Copy and Stub. A cheque will be issued to pay the invoice after the item(s) has been received and checked or the service performed. • Sales Invoice. If a business sold a good or provided a service, then a sales invoice will be issued. This bill of sale will describe the good or service that the business has sold or provided and the terms of the sale. Accounting 10 20 Lesson 6 • Receipt or Remittance Slip. This source document is prepared by the business when the customer pays his or her bill. • Deposit Slip. A bank form indicating how much the business has deposited into the bank. • Bank Statement. A bank form listing all the transactions--deposits, withdrawals--that the business has made and the charges made by the bank over the past month. As a business increases its volume of transactions, additional and more complicated source documents may be required in order to provide the necessary objective evidence that such transactions have occurred. MC 4-3c The GAAP is the objectivity principle. Accounting theory requires physical or objective evidence that a transaction has occurred. A source document such as a recognized piece of paper usually provides this kind of physical evidence. P 4-4 Note: Student entries on Page 1 and Page 2 may differ from the following solution. Double entries must appear on the same page. General Journal DATE 20__ Nov. 1 ACCCOUNT TITLE AND EXPLANATION Page 1 POST REF. DEBIT Cash 2 500.00 Office Supplies 1 450.00 Accts. Pay./G. Health Suppliers CREDIT 800.00 J. Edgar, Capital 3 150.00 Opening entry of J. Edgar Consulting Services. 2 Office Supplies 150.00 Cash 150.00 Bought additional office supplies; issued cheque 001. Accounting 10 21 Lesson 6 Page 2 DATE 20__ ACCOUNT TITLE AND EXPLANATION Nov. 4 Accts. Rec./A. Lee POST REF. DEBIT CREDIT 450.00 Consulting Fees Earned 450.00 Performed consulting services. Issued sales invoice 01 and extended 30 days' credit. 6 Cash 950.00 Consulting Fees Earned 950.00 Services for Tankers Ltd. Sales Invoice 02 for cash. 7 Telephone Expense 67.00 Cash 67.00 Issued cheque 002 to Bell Telephone. 10 Rent Expense 700.00 Cash 700.00 Issued Cheque 003 for monthly rent. 12 Accts. Pay./G. Health Suppliers 200.00 Cash 200.00 Issued Cheque 004 in partial payment of account. 15 Cash 500.00 Consulting Fees Earned 500.00 Performed consulting services. Sales invoice 03 for cash. Accounting 10 22 Lesson 6 Page 3 DATE 20__ ACCOUNT TITLE AND EXPLANATION Nov. 16 Office Equipment POST REF. DEBIT CREDIT 3 000.00 Accts Pay./D. Moyer Computers Ltd. 3 000.00 Bought a Macintosh SE® computer for the office. 17 Cash 5 000.00 Bank Loan Payable 5 000.00 Borrowed from the bank and deposited the amount into the business's bank account. 20 Accts. Rec./Lambton Industries Inc. 1 200.00 Consulting Fees Earned 1 200.00 Performed consulting services. Issued sales invoice 04 and extended 30 days' credit. 23 Advertising Expense 350.00 Cash 350.00 Purchased advertising. Issued cheque 005. 25 Utilities Expense 440.00 Cash 440.00 Paid monthly utilities. Issued cheque 006. 30 Cash 3 200.00 Consulting Fees Earned 3 200.00 Performed services and issued sales invoice 05 for cash. 30 J. Edgar, Drawing 250.00 Cash 250.00 J. Edgar withdrew cash for personal use. Issued cheque 007. Accounting 10 23 Lesson 6 MC 4-6a The explanation serves the following functions: • The explanation provides a location to identify what activity has occurred within the transaction; for example, a partial payment or a payment in full. • The explanation allows the recorder to identify source document information for the purpose of cross-referencing information at some future date; i.e., an invoice number or a cheque number. • The explanation provides a location to identify detailed information concerning one or more of the accounts used in the transaction; for example, the interest rate on a mortgage payable and the mortgage payable's due date. MC 4-6b 20__ May 3 Journal entry to support (1): Cash .......... .......... .......... .......... .......... Accts. Rec. XYZ Co. ..... .......... .......... Payment in full of invoice B1345. 1 000 1 000 Journal entry to support (2): 20__ May 3 Accts. Pay./MMM Ltd. ..... .......... .......... 2 500 Cash ....... .......... .......... .......... .......... 2 500 Invoice TM-124 was paid in full with cheque 259. Journal entry to support (3): 20__ May 3 Accounting 10 Land .......... .......... .......... .......... .......... 10 000 Building ...... .......... .......... .......... .......... 90 000 Cash ....... .......... .......... .......... .......... 5 000 Mortgage Payable ....... .......... .......... 95 000 Bought a piece of land and a building. Paid $5 000 down with a cheque 4566; balance raised with a 20-year, 10% mortgage due in 20__. 24 Lesson 6