hcsb financial corporation

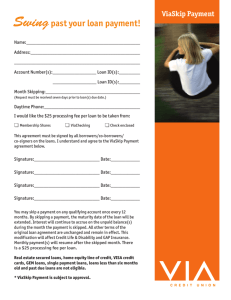

advertisement