vol01_210706 - Ontario Energy Board

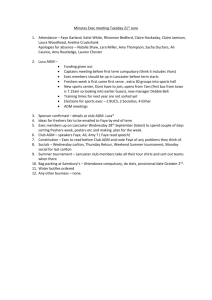

advertisement