Insert Title of Paper Here…

Fiduciary Duties in the New Millennium - Quo

Vadis

John L. Powell QC (UK)

4 New Square, Lincoln's Inn, London WC2A 3RJ

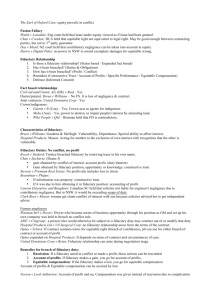

The fiduciary concept in the UK is still in relative adolescence. A general test for a fiduciary relationship is elusive. The professional and client context is a fertile ground for fiduciary duties.

Aspects of the core duty of loyalty have been clarified, but there remain moot points. In the financial sector the incidents of a fiduciary relationship must take account of a vast regulatory regime.

Dishonestly assisting a breach of a fiduciary duty is a species of accessory liability but the mens rea threshold is high. Breach of fiduciary duty remains a Spartan among causes of action. It is too ascetic to attract great popularity. Conflicts of interest are better managed than suppressed.

The Finn legacy

Few legal treatises can claim to equal the influence upon the development of the common law in the

Commonwealth or elsewhere over the last three decades than Paul Finn's " Fiduciary Obligations " published in

1977. It is, and will remain, a classic of the common law. Subsequent and continued writing by him on the same and related subjects have ensured a huge and enduring Finn legacy.

Caveat emptor, care and trust

The title to this session, " Fiduciary Duties in the New Millennium - Quo Vadis " conjures an Olympian vista. Lord

Atkin 1 called a new legal world of care into existence to redress the old world of caveat emptor . Is the former now to be eclipsed by a world of trust based on an expansion of fiduciary duties?

A survey of Commonwealth and US caselaw on the subject demonstrates markedly different perspectives of the domain of the fiduciary concept. Canadian cases illustrate the widest domain.

2

The fiduciary concept in the UK

In the UK the fiduciary concept has been a comparatively late developer. It is still in relative adolescence.

Wayward tendencies of that age have attracted recent judicial scrutiny and restraint, primarily by Lord Millett. An acquisitive tendency reflected in the assertion of a "fiduciary duty of care" has evoked firm censure.

3 The place of a fiduciary in the pantheon of legal concepts is now better demarcated in terms of his core attribute: " A fiduciary is someone who has undertaken to act for or on behalf of another in a particular matter in circumstances which give rise to a relationship of trust and confidence. The distinguishing obligation of a fiduciary is the obligation of loyalty.

" 4

1

Donoghue v. Stevenson [1932] A.C. 562 at 580.

2

See the following decisions of the Supreme Court of Canada: in a collaborative context, LAC Minerals Ltd. v.

International Corona Resources Ltd.

(1989) 61 D.L.R. (4 th ) 14; in an investment and professional context, Hodgkinson v.

Simms (1994) 117 DLR (4 th

) 161 (accountants); in a medical context, Norberg v. Wynrib (1992) 92 D.L.R. (4 th

) 449,

McInerey v. MacDonald (1992) 93 DLR (4 th

) 415; Smith v. Arndt (1997) 148 DLR (4 th

Breen v. Williams (1996) 186 CLR 71 (Aus. HC).

) 48. As to a medical context, cf.

3

Bristol and West Building Society v. Mothew [1998] Ch. 1 at 16-18.

4

Ibid . at 18, per Millett L.J.

© 2003 John L. Powell QC Page 1

Fiduciary Duties in the New Millennium - Quo

Vadis

Although expressed as an obligation or duty of loyalty, loyalty essentially imposes an inhibition or disability. It requires, in the pursuit of the interests of the beneficiary, the exclusion of the interests of other persons, in particular the fiduciary himself. The inhibitory quality of loyalty finds manifestation in the proscriptive as opposed to prescriptive formulation of critical fiduciary duties, the "no profit" rule and the "no conflict" rule.

Loyalty has feudal connotation. It implies a bond extending beyond everyday relationships, contractual or otherwise, and one linked to relative status. The potency of the bond is reflected in the equitable remedies available against transgressors (traitors?), which are wider (more condign?) than those available for transgression of less potent bonds.

Aspects and consequences of fiduciary relationships have been explored in varied contexts. The nature of the court's interference will depend upon the particular relationship. Case law manifests a range of flexible responses reflective of the origin and continued location of the fiduciary concept within the wider firmament of equity (itself of feudal origin). Nevertheless, recognition of a fiduciary relationship is often difficult, despite the assurance of comfortable paradigm. The rapacious trustee or solicitor of Victorian novel parody provides kindergarten introduction. Other relationships, especially in a wide range of commercial contexts, present less recognisable demons, if demons at all. The elephant test trumpets a siren call.

A general test

A general test for a fiduciary relationship is elusive. Characteristics of a fiduciary relationship derived from paradigms 5 include trust, confidence, dependence, vulnerability, ascendancy, influence and discretion. The

Supreme Court of Canada has espoused another, "power-dependency".

6 The Atlantic divide probably introduces too much discordance to make that congenial to English ears.

7 Lack of mutuality has been invoked by the Privy

Council to deny an undertaking or imposition of loyalty.

8 However, these characteristics are not determinant.

Professor Finn (as he then was) has expressed the important question as whether " ...the actual circumstances of a relationship are such that one party is entitled to expect that the other will act in his interests in and for the purposes of the relationship " and characteristics of the like described are " important only to the extent that they evidence a relationship suggesting that entitlement ." 9

While recognising that the best that a general test can provide is not a determining mechanism but rather a broad framework within which to weigh up competing specific considerations, I venture to suggest that UK judges would be more comfortable with a narrower, albeit less elegant, formulation: whether the circumstances of a relationship are such that (1) one party is reasonably entitled to expect the other to act in his interests in some or all aspects of the relationship to the exclusion of the other's own interests or those of another party and

(2) the imposition of inhibitions on the other's conduct is reasonably necessary to secure that entitlement. The first part of the formulation is designed to emphasise the specificity of a fiduciary relationship and its inhibitory quality. The second part is designed to import three other considerations in seeking to identify the fiduciary domain: the moral factor, proportionality and other causes of action.

5 e.g. trustee and beneficiary; agent and principal; partners; solicitor and client; director and company.

6

7

Hodgkinson v. Simms (1994) 117 DLR (4 th ) 161.

Wagner not Purcell. The notion of " undue influence " is comfortingly more limited, and more controllable as a separate doctrine: see Royal Bank of Scotland Plc v. Etridge (No 2) [2001] 3 WLR 1021 (HL).

Arklow Investments Ltd. v. Maclean [2000] 1 W.L.R. 594 (PC) at 600.

8

9

" The Fiduciary Principle " in " Equity, Fiduciaries and Trusts " (Youdan ed.) (1989) Carswell, Toronto, at 46.

© 2003 John L. Powell QC Page 2

Fiduciary Duties in the New Millennium - Quo

Vadis

The relevance of a moral scale or spectrum was stressed by Lord Steyn in a case concerned with damages for deceit. He addressed " the question of policy whether there is justification for differentiating between the extent of liability for civil wrongs depending on where in the sliding scale from strict liability to intentional wrongdoing the particular civil wrong fits in ." He answered the question affirmatively, concluding that " the exclusion of heads of loss in the law of negligence, which reflects considerations of legal policy, does not necessarily avail the intentional wrongdoer " for reasons of both morality and deterrence.

10 By parity of reasoning, it is useful to place wrongs of a putatively fiduciary nature within a moral spectrum in order to test whether and to what extent the relevant relationship was fiduciary in nature and also to assess the appropriate equitable response.

The moral factor is a readily recognisable leitmotif for differentiating between the extremes of a spectrum of wrongs. But for more fine tuned distinctions along the sliding scale proportionality, which is still an aspect of the moral factor, is a better and more recognisable leitmotif . The designation of a relationship as a fiduciary with consequent exposure of the wrongdoer to a wider range of remedies and also preclusion of a defence of contributory negligence 11 may seem disproportionate to the perceived degree of wrongdoing. This may be a potent consideration when a fiduciary relationship is asserted in commercial contexts.

The availability of other causes of action and remedies appropriate to them is another consideration. Obvious examples include breach of contract, the tort of negligence and statutory causes of action. The latter and related remedies may provide a sufficient response to the perceived degree of wrongdoing. The availability of contractual and tortious causes of action against a negligent solicitor no doubt influences the rejection of a

"fiduciary duty of care."

Professional and client relationships

The relationship between a professional and his client is a fertile ground for fiduciary duties 12 . Nevertheless, the contract of engagement regulates whether and to what extent the professional is in a fiduciary position relative to the client. Mason J.'s classic statement of this principle 13 has been often cited by UK courts.

14 In practice professionals frequently seek to contract with clients on terms which constrain fiduciary inhibitions. A fiduciary duty will not be imposed which is inconsistent with the contractual terms agreed. Moreover, the client's informed consent to a professional acting for two principals with conflicting interests, whether express or implied, negates fiduciary duties which otherwise would preclude him from so acting.

15

The fiduciary duty of loyalty is typically engaged in resolving conflict disputes, whether a personal conflict between professional and client or existing client conflict which may arise when a professional acts for two or more clients. The subject was addressed by Millett L.J. in Bristol and West BS v. Mothew, 16 a domestic conveyancing case involving a solicitor acting for a lender and borrower, where the judge deduced a series of tenets in respect of existing client conflict. First, the "double employment rule" (or "no conflict" rule) deduced

10

Smith New Court Securities Ltd. v Scrimgeour Vickers (Asset Management) Ltd.

[1997] A.C. 254 at 279.

11

12

See below.

As to the position in the UK, see further Jackson and Powell on Professional Negligence (5 th ed., 2002) esp. paras. 2-

125 to 2-140) and treatment of fiduciary duties in chapters specific to particular professionals.

Hospital Products v. United States Surgical Corporation (1984) 156 C.L.R. 41 at 97 (High Court of Australia).

13

14

15

16 e.g. Kelly v. Cooper [1993] A.C. 205 (P.C) at 215 (estate agents).

see Kelly v. Cooper ibid.

and Clark Boyce v. Mouat [1994] 1 A.C. 428 (P.C.) (solicitors).

[1998] Ch 1 (CA), as Millet L.J.

© 2003 John L. Powell QC Page 3

Fiduciary Duties in the New Millennium - Quo

Vadis from the duty of loyalty, precludes a fiduciary from acting for two principals with potentially conflicting interests without the informed consent of both. Secondly, the "duty of good faith" requires a fiduciary properly acting for two principals with potentially conflicting interests to act in good faith in the interests of each. This precludes the fiduciary not only from intentionally acting to further the interests of one principal to the prejudice of those of the other but also from intentionally allowing his duties to one principal to be influenced by his relationship with the other. Thirdly, the "no inhibition" principle, related to the duty of good faith, involves a fiduciary not being inhibited by his duties to one client from carrying out his duties to the other. Fourthly, the "actual conflict rule" requires a fiduciary not to place himself in a position where he cannot fulfil his duties to one client without failing the other.

A glittering judicial debate as to the existence of a fiduciary relationship in a professional and commercial context is displayed by the High Court of Australia in Pilmer v. Duke Group Ltd.

17 A reading of Kirby J.'s dissenting judgment confirms the inspirational, indeed pyrotechnic, quality of the Aurora Australis. The plaintiff company

("Kia Ora") acquired another company ("Western") for a mix of cash and newly issued shares. The defendants included a firm of accountants which had reported to Kia-Ora on the value of Western, as required under an

Australian stock exchange rule. Kia Ora contended that in so doing the firm owed it not only contractual and tortious duties of care but also a fiduciary duty. This contention was directed towards a wider measure of recovery based on equitable compensation and avoidance of a defence of contributory negligence. The existence of a fiduciary relationship between Kia Ora and the firm was rejected by the trial judge, accepted on appeal by the Full Court of South Australia but rejected again by the High Court of Australia by a 4 to 1 majority.

The overall judicial score was 5 to 4 against a fiduciary duty. The actual decision on the issue is of less interest, however, than the judicial discourse on the factors for and against a fiduciary relationship.

The particular fiduciary duty alleged was a duty to act solely in the best interests of Kia Ora. Factors invoked in asserting a fiduciary relationship included the following. The relationship between Kia Ora and the firm was one of client and professional adviser. It involved not only a valuation but also an independent opinion as to the fairness of the Kia Ora's price, which under the stock exchange rule was prerequisite to its takeover of Western.

Both Kia Ora and its shareholders relied upon the professional expertise and judgment of the firm which was in a position of great responsibility and trust. Given that the non-independent directors would have been personally advantaged by the takeover proceeding, there was a necessary expectation that the firm would act solely in the interests of Kia Ora as a whole. This gave rise to a duty to avoid acting in the firm's own interests and those of third parties such as the non-independent directors, which would conflict with those of Kia Ora. In the circumstances the firm, or rather certain partners of the firm, lacked independence and the firm's duty to act solely in Kia Ora's interests substantially conflicted with the personal and commercial loyalty of certain partners to certain Kia Ora directors. By not declining to provide a report, the firm breached its fiduciary duty to Kia Ora.

The majority in the High Court of Australia recited with approval the trial judge's conclusions that the report fell short of amounting to advice to enter the takeover transaction. There was no agency relationship nor one of ascendancy or influence or dependence or trust "in the relevant sense". The firm's breach of an admitted (on the pleadings) contractual duty of independence did not generate a fiduciary relationship. More significantly, there was neither an actual conflict nor a "real or substantial possibility of conflict" in accepting and performing the engagement with Kia Ora to provide the report. There was no prior or concurrent other engagement or undertaking by the firm, as necessary to present such a conflict. Past dealings with directors or the hope or expectation of future dealings were insufficient to found a conflict. The majority stressed the importance of identifying the conflicting duty or interests.. Were a claim on like facts litigated in the UK, there can be little doubt that our courts would conclude that there was no fiduciary relationship.

The reasoning of the majority in Pilmer as to the circumstances which give rise to conflict, is broadly consistent with that of the House of Lords in Prince Jefri Bolkiah v. KPMG.

18 The main significance of the decision lies in

17

(2001) 180 ALR 249; [2001] 2 BCLC 773.

18

[1999] 2 A.C. 222 (HL).

© 2003 John L. Powell QC Page 4

Fiduciary Duties in the New Millennium - Quo

Vadis the elucidation by Lord Millett 19 of the contrast between the "no conflict" rule in relation to existing clients and the duty of confidentiality owed to both existing and former clients. Prince Jefri was the former chairman of the

Brunei investment agency. KPMG were auditors to the agency. KPMG had also provided forensic accounting and litigation support services to Prince Jefri in a personal capacity in major litigation to recover assets from third parties. Information as to his affairs acquired by KPMG in the course of that litigation was both confidential and subject to legal privilege. Later after the litigation and KPMG's related engagement had ended, the agency sought to retain KPMG to act for it in investigating assets of the agency allegedly misapplied by Prince Jefri. He sought an injunction to restrain KPMG from acting for the agency. The "no conflict rule" did not inhibit KPMG from acting for agency given that the firm no longer acted for Prince Jefri. The surviving duty of confidentiality did. KPMG unsuccessfully resisted the injunction on the basis that there was no risk of disclosure or misuse of confidential information. The firm claimed to have erected an adequate information barrier (Chinese wall) to prevent information acquired by its forensic team when acting for Prince Jefri from flowing to its investigatory team acting for the agency. The issue turned on the degree of the risk of disclosure. It was held that it sufficed that it was a real risk, beyond fanciful or theoretical but not necessarily substantial. KPMG had failed to discharge the evidential burden upon it to show that there was no such real risk on the facts.

In several later cases the particular information barriers were held to be sufficient. In each the first instance judges concerned seem to have taken a more lenient view of the integrity of the required information barriers, 20 suggestive of judicial disagreement with the strictness and practicality of the disclosure risk test favoured in

Prince Jefri.

The duty of confidentiality is a subject for another day. Although frequently called a fiduciary duty, it is of uncertain or mixed lineage and is not peculiar to a fiduciary.

21 For present purposes, the interest of Prince Jefri lies in Lord Millet's analysis of the core fiduciary duty of loyalty in professional contexts. The House of Lords reaffirmed that the termination of a professional engagement also terminated the professional's duty of loyalty and more specific fiduciary duties deduced from it. Thus there is no absolute bar under English law on solicitor to act in litigation against former client. The basis of the jurisdiction for a court to intervene on behalf of a former client is the protection of confidential information. In contrast, the basis of jurisdiction for court to intervene on behalf of an existing client is the avoidance of conflict of interest: "a fiduciary cannot act at the same time both for and against the same client, and his firm is in no better position. A man cannot without the consent of both clients act for one client while his partner is acting for another in the opposite interest. His disqualification has nothing to do with the confidentiality of client information. It is based on the inescapable conflict of interest which is inherent in the situation.

" Consent to a professional acting for two (or more) existing clients may be express or inferred. It is to be inferred in the case of auditors, as also in the case of estate agents, 22 although they must keep confidential the information obtained from their respective clients.

19

Who gave the leading speech.

20

Young v. Robson Rhodes [1999] 3 All ER 524 (Laddie J.); Halewood International v. Addleshaw Booth & Co [2000]

P.N.L.R. 788 (Neuberger J.); Re a Firm of Solicitors [2000] 1 Lloyd's Rep. 31 (Timothy Walker J.); Koch Shipping Inc v

Richards Butler (CA) Times Law Reports 21 August 2002; cf. Re A Firm of Solicitors [1999] PNLR 950.

21

22

The basis of this duty may be rationalised as an express or implied term of a professional's contract of engagement, or as a fiduciary duty or even as a free standing duty. See generally as to the position in the UK, Toulson and Phipps,

Confidentiality (Sweet and Maxwell 1996). For recent appellate cases, see Arklow Investments v. Maclean [2000] 1

W.L.R. 594 (PC); A-G v. Blake [2001] 1 AC 768 (HL). Note also in New Zealand, Arklow Investments v. Maclean [1998]

3 N.Z.L.R. 680 (CA); in Canada, Cadbury Schweppes Inc. v. FBI Foods (1999) 167 DLR (4 th

) (SCC).

Kelly v. Cooper [1993] A.C. 205 (P.C.)

© 2003 John L. Powell QC Page 5

Fiduciary Duties in the New Millennium - Quo

Vadis

Some moot issues

First, the double employment rule was expressed in Mothew and in Prince Jefri in terms of a general prohibition upon a professional or any of his partners acting simultaneously for two clients with actual or potentially conflicting interests without the informed consent of both. English law remains unclear as to whether the prohibition applies only where the two clients are represented in the same or related matter and, in cases of potential conflict, as to the necessary degree of likelihood of a conflict . Despite suggestions to the contrary, 23 I doubt that the ambit of the double employment rule extends beyond the same or related matters. The issue needs to be tested in the context of a spectrum of possibilities.

24

Nevertheless, even if the double employment rule pertains only to representation of two clients with conflicting interests in the same or related matters, it still constitutes a significant impediment. The more the matters in which a professional firm (especially one with many partners) may represent a client at any one time, the greater the prospects that those matters may relate to a matter in which the same firm represents another client and the greater the scope for conflict. This consideration is important when representing different companies (perhaps in different jurisdictions) within a large group. Moreover, if an actual conflict arises, the actual conflict rule will be engaged. This may require the firm to choose between which of its clients to represent or even require it to decline to continue to act for either. This may be to the prejudice of the clients concerned and the firm may be liable to compensate one or both clients for any consequent loss.

Secondly, may there be a fiduciary duty (e.g. as a function of the duty of loyalty) to disclose information to a client on one matter, which was obtained him from another client on a separate matter?

25 Such a duty is sometimes advanced as a reason why a solicitor cannot act for two clients with conflicting interests. Resolution of the problem arising from the conflict between (a) the disclosure duty to one client and (b) the confidentiality duty to another, is likely to be the subject of pragmatic case by case development. UK courts are likely to take a pragmatic view as to the application of fiduciary duties to large partnerships. A client cannot be presumed to be entitled to the knowledge which every partner has which may be relevant to his case. A partial solution to the problem is one based on express or implied consent. A client by consenting to a professional firm acting for another client with an adverse interest is to be taken as consenting to the firm not disclosing to him confidential information acquired from the latter.

26 The duty of a solicitor to disclose relevant information to a client is probably qualified to the extent that there is no duty to disclose information obtained in confidence from another existing client or former client, the disclosure of which would involve a breach of duty to the latter.

27

Thirdly, may the scope of a fiduciary duty be increased by contract (e.g. not to act for another client in an unrelated matter) and retain its fiduciary character? The point is significant in the context of retainers sought to be imposed on lawyers by US companies. The question may be relevant to the remedies available for breach.

An affirmative answer may be rationalised on the basis of loyalty. So a client may require a higher standard of

23

See Hollander and Salzedo , Conflicts of Interests and Chinese Walls (2000) at 3-22.

24

In cases preceding Mothew and Bolkiah , the double employment rule was treated as extending only to representation of two clients in the same transaction. North and South Trust v. Berkeley [1971] 1 W.L.R. 471 (Donaldson J.); Clark v.

Mouat [1994] 1 A.C. 428 (PC).

25

See e.g. Bowstead & Reynolds on Agency (17 th

ed) paras. 6-048 and 6-048 et seq.

and Hollander & Salzedo, Conflicts of Interests and Chinese Walls (Sweet and Maxwell, 2000) chap. 5.

Lord Millett reasoned to like effect with respect to accountants in Prince Jefri .

26

27

See reasoning to this effect in cases where solicitors have acted for borrowers and lenders, e.g. Bristol & West Building

Society v. Baden Barnes Groves & Co.

[2000] Lloyd's Rep. P.N. 788. Note also Bowstead & Reynolds , op. cit. at 6-048, namely that the information which the second client 'buys' is limited to that held by the solicitor independently of that acquired through his client or clients .

© 2003 John L. Powell QC Page 6

Fiduciary Duties in the New Millennium - Quo

Vadis loyalty than normal when instructing a professional firm. However, the contract can only succeed in achieving the purpose so long as there is no inconsistent public policy based on restraint of trade or a competition regulatory regime.

Fourthly, English law concerning fiduciary duties remains in a state of development in relation to their application to a professional relationship consisting of (1) a client which is a company which is part of a large group and/or

(2) a professional firm comprising tens or hundreds of partners or more. Again, development is likely to be pragmatic on a case-by-case basis. The key point of departure is that, although companies may belong to the same group, each is a different legal entity. Thus when one company in a group retains a firm of solicitors or accountants, the fiduciary duties which arise will generally be owed by the firm to that company and not to others within the same group. Once the retainer ends, the duty of confidentiality to that company as a former client survives but not other fiduciary duties, including the duty of loyalty. So in the case of a large group of companies and a frequently instructed firm of solicitors or accountants, at any one time companies in the group will fall into the following categories in relation to that firm. Some will be current clients and thus may be owed a range of fiduciary duties. Others will be former clients and thus only owed duties of confidentiality. A third category will never have instructed the firm and will never have been owed fiduciary or confidentiality duties.

The "group" may be most unhappy about the firm acting for a client outside the group and may wish to take action to restrain it from doing so. In that case it would be essential for the "group" to identify which company or companies within the group would provide the best platform for the attack on the solicitors or accountants based on the potency and relevance of the duties owed to the perceived conflict.

The financial sector

The financial sector in the U.K. including banking, financial services and insurance has been the subject of a series of regulatory statutes, culminating in the Financial Services and Markets Act 2000 ("FSMA 2000") and a vast regulatory regime including rules and guidance overseen by a single regulator, the Financial Services

Authority.

28 The imposition and raising of standards are fundamental objectives of regulatory regimes. The achievement of those objectives, especially In relation to the retail investment sector, requires a metamorphosis of culture from that of a salesman to that of a professional adviser. It is likely to remain incomplete so long as remuneration is contingent on an investment being made, however open (or less opaque) the commission disclosure requirements. Major scandals relating to misselling of home income plans, pensions, endowment policies, split capital investment trusts and high income bonds illustrate how far the change in culture has to go.

Indeed the Janus faces of representatives of product providers in the investment sector, one of salesman and the other of adviser, portends continuing misunderstanding, misconduct and litigation.

The law relating to fiduciary duties in its application to the financial sector and to their interrelationship with regulatory requirements is still in a relatively nascent state of development.

29 The sector provides principal illustrations of the fact that the normal incidents of a fiduciary relationship may be modified not only by any underlying contractual relationship between the parties but also by regulatory statutes and rules. An important feature of regulatory statutes is provision for "whistle blowing": hence, provision to the effect that an auditor is not to be regarded as contravening any duty of confidence when making disclosure to a regulator.

30 Regulatory rules seek to prevent, limit or manage (primarily by disclosure requirements) conflicts of interest in a variety of

28

See further Jackson on Powell on Professional Negligence ( op. cit.

), chap. 13; Lomnicka and Powell, Encyclopedia of

Financial Services Law (Sweet and Maxwell)

29

Its state motivated the involvement of the Law Commission. Following an earlier Consultation Paper (No 124,1992), it published its final report " Fiduciary Duties and Regulatory Rules " (LC Paper No 236). in December 1995

.

30

FSMA 2000, ss. 342, 343.

© 2003 John L. Powell QC Page 7

Fiduciary Duties in the New Millennium - Quo

Vadis circumstances.

31 They vary in their application depending on the nature of service provided and the investment experience and expertise of the client. An execution-only service is far less regulated than a discretionary management service. As obviously apparent in relation to the latter service, the existence of regulatory requirements does not necessarily preclude the concurrent application of fiduciary duties. However, the ascertainment of the existence and scope of any fiduciary duty will need to take account of such regulatory requirements which may also have contractual effect. Contravention of such requirements may give rise to criminal and civil liabilities under the FSMA 2000.

The interrelationship of regulatory requirements and fiduciary duties as well as contractual duties is illustrated in a case which engaged the rules and practices of the London Metal Exchange.

32 The judge dismissed a challenge by LME brokers to an arbitral award made against them in favour of their former clients. He endorsed the arbitrators' conclusions that certain rules of the brokers' regulator 33 were incorporated in contracts made between the brokers and their clients and also that the brokers owed fiduciary duties to their clients. He held that the relationship between the parties was such that the brokers were acting as principal and not as agent for an undisclosed principal, but that in all other respects the substance of the relationship was much more closely akin to that of agency than of buyer and seller. Agency was by its nature a form of fiduciary relationship. This impacted on allocation of orders (brokers were required to process the orders of different clients in due turn).

Moreover, "front-running" (the placing by a broker of a prior order in advance of placing a client's order anticipated to move the market) and misuse of confidential information involved a breach of fiduciary duties.

34

The practitioner needs to beware that the sheer detail of the regulatory regime does not obfuscate the identification of fiduciary duties. Fiduciary duties and regulatory duties are not necessarily coincident, albeit the latter may strongly influence the application and scope of the former. Moreover, a private litigant may access an equitable remedy by establishing a breach of a fiduciary duty, which is wider than the compensation recoverable under the statutory cause of action for breach of regulatory rules 35 or the damages recoverable on the basis of a concurrent contractual or tortious cause of action.

Companies

Enron and its aftermath have enlivened corporate governance debates in the UK as well as in the USA.

36 Bull markets encourage transgressions. Bear markets reveal them. The role of directors, especially non-executive directors, has become under increasing scrutiny in the UK, 37 as has the role of professional advisers, especially

31

See the Financial Services Authority's Handbook of rules and guidance: www.fsa.gov.uk , especially the Conduct of

Business module in the Business Standards block.

32

Brandeis (Brokers) Ltd. v. Herbert Black [2001] 2 Lloyd's Rep. 359 (Toulson J. - now chairman of the Law Commission).

33

34

The Securities and Futures Authority - now superseded by the Financial Services Authority.

35

36

See also Ata v. American Express Bank Ltd. (CA unreported, June 17, 1998), it was held that the defendant bank owed a "fiduciary obligation" based on "classic principles" to the plaintiff investor when it performed discretionary management functions for him, but not when performing other functions including execution-only functions.

FSMA 2000, s. 150.

See e.g. in the USA the Sarbanes-Oxley Act 2002. Draft rules proposed to be made by the SEC thereunder applicable to lawyers in the USA and overseas, impact on their fiduciary duties to clients.

37

See the Higgs Review of the role and effectiveness of non-executive directors (January 2003). This is available on the

Department of Trade and Industry's website: : www.dti.gov.uk/cld/non_exec_review .

© 2003 John L. Powell QC Page 8

Fiduciary Duties in the New Millennium - Quo

Vadis analysts.

38 That a company is owed fiduciary duties by its directors is an important factor in constraining transgressions, not least diversion of corporate opportunities from the company either to the errant directors or to persons and entities related to them.

Misleading financial promotion is an enduring human frailty exploited over the centuries by inducing desires as eclectic as tulips, the South Sea and guano. The common law would be the poorer without the large volume of misleading prospectus cases decided in the half century of so before The First World War - the legal flotsam of victims of the heady entrepreneurial optimism of late Empire. However, investors who have been misled to invest in a company, including by a Ponzi fraud of the apparent like of Enron, will generally not be able to avail themselves of a claim against the directors for breach of fiduciary duty because the directors do not owe fiduciary duties to the company's shareholders or potential investors. In such circumstances investors may be able to sue directors in respect of fraudulent misrepresentations in promotional material on the basis of the tort of deceit or statutory causes of action.

39 A major disadvantage of not being owed fiduciary duties by directors is that consequently it is not open to the shareholders (as distinct from the company itself) to sue "deep pocket" accessories (e.g. accountants, banks, lawyers and valuers) on the basis of dishonestly assisting the directors in a breach of a relevant fiduciary duty.

40 This may be a factor in explaining the paucity of class actions by investors against accessories in the UK.

Independence issues have attracted increasing attention, especially in relation to non-executive directors and auditors. Independence is frequently invoked in asserting a putative fiduciary duty.

41 Nevertheless the quality of independence is distinct from the quality of loyalty. Indeed it circumscribes loyalty - or rather what would be a misplaced sense of loyalty. Thus a failure to qualify an audit report may be the product of a misplaced sense of loyalty supplanting independence. While we await a UK decision on the issue, I suggest that independence is better perceived as a quality rather than a duty or, if a duty, at best an ethical duty. It is hard to perceive independence as a substantive duty owed to a client, for which liability may be incurred. Lack of independence may, nevertheless, be an aspect or explanation of breach of some other substantive duty to the client, e.g. the duty of care or a fiduciary duty.

Accessory liability

Breach of fiduciary duty is an important component of a species of accessory or participatory liability, dishonestly assisting a breach of fiduciary duty. However, the dishonesty criterion entails a very high mens rea threshold for establishing such liability, as recently made clear by the House of Lords in a claim against a solicitor.

42 It held that dishonesty requires more than knowledge of the facts which make the conduct wrongful: it requires

" consciousness that one is transgressing ordinary standards of honest behaviour ".

43 The decision on the point

38

See the FSA's Consultation Paper 171: " Conflicts of Interest: Investment Research and Issues of Securities :" (February

2003). This is available on the FSA's website: www.fsa.gov.uk

.

39 e.g. FSMA 2000, s. 90. Further the directors' misconduct may entitle the regulator (the Financial Services Authority) to seek injunctions, remedial and restitution orders against them under ss. 380 and 382 of the same statute.

40

See below. Shareholders may be able to establish a claim against such accessories on the basis of conspiracy to injure by unlawful means. Also regulators may seek remedies against directors under statutory participatory liability provisions: see below.

41

42

As in. Pilmer v. Duke Group Ltd. (in liq.) (2001) 180 ALR 249; [2001] 2 BCLC 773. (unsuccessfully).

43

See generally Royal Brunei Airlines v. Tan [1995] 2 A.C. 378 (PC) (; BCCI (Overseas) Ltd. v. Akindele [2000] 4 All ER

221 (CA) and Twinsectra v. Yardley [2002] AC 164 (HL); in relation to directors, see Brown v. Bennett [1999] 1 BCLC

630 (CA).

Twinsectra v. Yardley [2002] AC 164 at 170 (per Lord Hoffman).

© 2003 John L. Powell QC Page 9

Fiduciary Duties in the New Millennium - Quo

Vadis was by a majority. There was a strong dissent by Lord Millett in favour of an objective dishonesty test: " I think that we should return to the traditional description of this head of equitable liability as arising from knowing assistance.' " 44 The FSMA 2000, 45 contains statutory participatory liability provisions unique to regulators (as opposed to private litigants), as did the predecessor regulatory statute.

46 Liability is imposed for breach of relevant requirements not only on primary contravenors but also on persons " knowingly concerned in the contravention ." 47 The mens rea threshold of this criterion has yet to be judicially explored in detail.

48

Other developments

Recent case law has clarified some recondite aspects of claims for breach of fiduciary duties. Assertion of an entitlement to equitable compensation for a breach of a fiduciary duty is not an Open Sesame to bounteous recovery. The claimant must still establish a causal connection between the relevant breach and loss.

49 The defence of contributory negligence is based on statute in the UK, as elsewhere. There are conceptual let alone construction objections to allowing it as a defence to a claim for breach of fiduciary duty. The House of Lords recently affirmed 50 that the defence was not available to a claim for deceit. The reasoning is consistent with the defence being unavailable also to a claim for breach of fiduciary duty, as has been held in a first instance decision.

51 The UK position thus corresponds with that in Australia.

52 Uncertainty as to the limitation period applicable to a claim for equitable compensation for breach of fiduciary duty has been recently removed.

53 .

No new world of trust

The question was posed at the beginning of this paper whether there is heralded a new world of trust based on an expansion of fiduciary duties. The answer, so far as UK law is concerned, is a firm No. This is not to say that

44

Ibid. at 202.

In Singapore an objective test was adopted in Banque Nationale de Paris v. Hew Keong Chan Gary [2001]

SLR 300 (Lai Kew Chai J.).

ss. 380, 382.

45

46

47

Financial Services Act 1986, ss. 6, 61.

Solicitors were held liable on this basis in Securities and Investments Board v. Pantell SA (No 2) [1993] Ch. 256 (CA).

See also Securities and Investments Board v. Scandex Capital Management A/S [1998] 1 All ER 514 (CA).

48

It would include wilful blindness. See E.Z. Lomnicka (2000) 21 Co. Lawyer 120 "' Knowingly concerned?' Participatory liability to regulators ".

49

See Swindle v. Harrison [1997] 4 All ER 705 (CA), esp. at 733: " There is no equitable by-pass of the need to establish causation ". The same was earlier established in a breach of trust case: Target Holdings Ltd. v. Redferns [1996] 1 A.C.

421 (HL).

50

Standard Chartered Bank v. Pakistan National Shipping Corpn.

[2002] 3 WLR 1547.

51

52

Nationwide Building Society v. Balmer Radmore [1999] Lloyd's Rep PN 241 (Blackburne J.)

See Astley v. Austrust Ltd.

(1999) 197 CLR 1; Pilmer v. Duke Group Ltd. (in liq.) (2001) 180 ALR 249; [2001] 2 BCLC

773. Cf. New Zealand, see: Day v. Mead [1987] 2 NZLR 443 (NZCA) and Taylor v. Schofield Peterson [1999] 3 NZLR

435 (NZ High Court).

53

See Cia de Seguros Imperio v. Heath (REBX) Ltd.

[2001] 1 WLR 112 (CA): the time limits applicable to tort and simple contract claims were to be applied by analogy.

© 2003 John L. Powell QC Page 10

Fiduciary Duties in the New Millennium - Quo

Vadis there will be no expansion beyond paradigms. Collaborative relationships of various kinds 54 provide enticing territory. As in the case of the duty of care in tort, expansion is likely to be incremental. Breach of fiduciary duty is a Spartan among causes of action. It is too ascetic to attract popularity. It has its place, but UK courts can be expected to confine it to a limited domain and to resist cuckoo tendencies to usurp the nests of other causes of action. Conflicts of interest will continue to attract the assertion of breach of fiduciary duty. Yet conflicts are endemic and proliferate with imagination. Management rather than suppression is so often the better solution and the objective of the creative lawyer. The prophylactic for conflicts must not be so strong as to become the poison for enterprise.

February 14, 2003 j.powell@4newsquare.com

Copyright John L. Powell QC 2003. These materials are subject to copyright. No part may be reproduced, adapted or communicated without the written consent of the copyright owner except as permitted under applicable copyright law.

54 e.g. joint venture arrangements of various kinds, syndicates in banking, insurance and other contexts.

© 2003 John L. Powell QC Page 11