Transcending Politics: A Third Stage in Management

advertisement

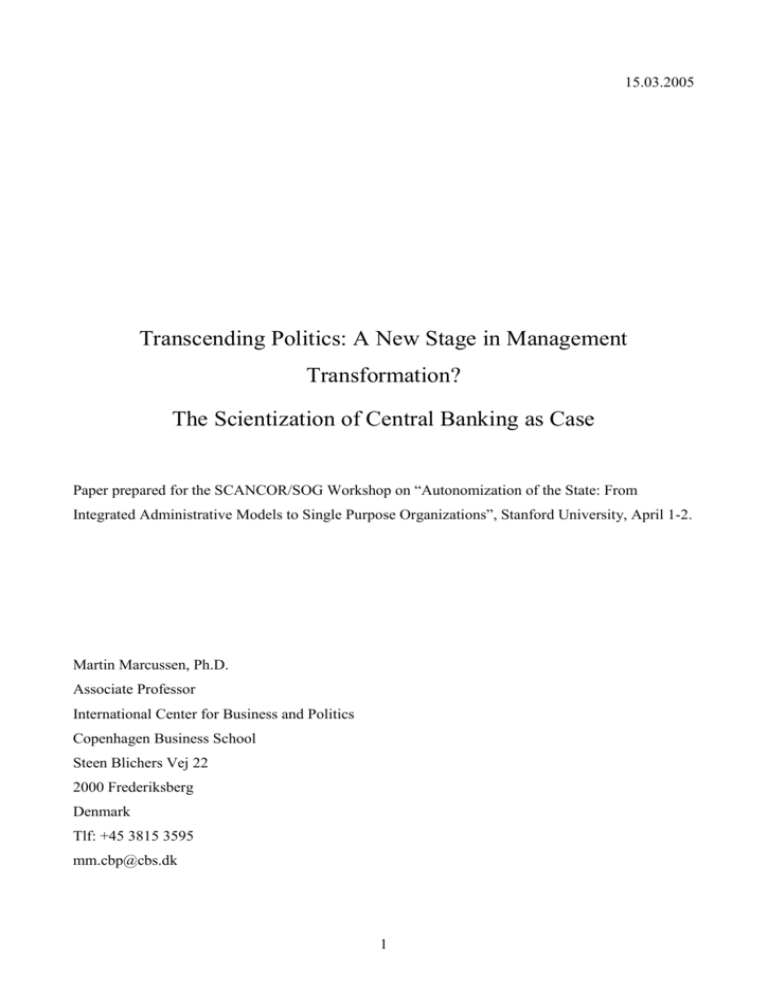

15.03.2005 Transcending Politics: A New Stage in Management Transformation? The Scientization of Central Banking as Case Paper prepared for the SCANCOR/SOG Workshop on “Autonomization of the State: From Integrated Administrative Models to Single Purpose Organizations”, Stanford University, April 1-2. Martin Marcussen, Ph.D. Associate Professor International Center for Business and Politics Copenhagen Business School Steen Blichers Vej 22 2000 Frederiksberg Denmark Tlf: +45 3815 3595 mm.cbp@cbs.dk 1 Martin Marcussen, March 2005 Transcending Politics: A New Stage in Management Transformation? The Scientization of Central Banking as Case ABSTRACT Central banking is going through a period of transformation. To an increasing intent the very function of conducting monetary and financial policy is now being considered as a scientific discipline that transcends the field of politics. The paper holds that this scientization of central banking constitutes a step beyond the more general movement towards autonomization that has characterized public administrative reforms in the 1990s. A SECOND GENERATION OF MODERNIZATION? The ‘modernization’ processes that took hold in public administrations during the last two decades had an enormous impact on central banking. Particularly during the 1990s central banking almost everywhere changed its formal status from being an integral and integrated part of the public administrative apparatus to being legally autonomous from political interference. This process of autonomization has had as a consequence that central banking has consolidated its power and status in the national and transnational macro-economic organizational fields. However, during the last few years there are signs that the conception of central banking has developed even further so that it will be possible to talk about a second generation of modernization. There are various strategies that can be applied to increase the autonomy of public bureaucracies (Flinders and Buller, 2005). In this paper, ‘Autonomization’ refers to an administrative reform process where trunks of the administrative apparatus receive a legal status that prevents politicians from intervening in the ways in which the bureaucratic agency in question conducts its business (Christensen and Lægreid, 2005). These new autonomous agencies are still part of the political 2 Martin Marcussen, March 2005 system and they are supposed to deliver public goods and services, but through a process of depolitization they are set free to exploit their unique capabilities and competences. ‘Scientization’ is a reform process that goes beyond autonomization (Drori and Meyer, forthcoming). It signifies a shift in authoritative status. Scientized bureaucratic agencies do not only base their legitimacy on delegated, rational-legal or moral authority. Scientization implies that public agencies are being endowed with scientific authority. Through scientization, central banking is to an increasing extent being framed in apolitical terms. Thus, scientization of central bankers implies that central banking is in many ways transcending formal politics. Below, a number of indicators are listed that support the claim that central banking has not only been depolitized, through a process of autonomization; it has been apoliticized through scientization and, consequently, it may be about to leave the official political game altogether. The paper sets out to do three things. First, it argues that central bank management has developed through three stages since 1875, and that it may well be that it is on its way into a fourth stage in the new millennium. Hence, the paper will shortly spell out the key characteristics of the formal status and conception of central banking over the last 150 years (Figure 1). In a second step, the paper directs its attention towards the processes of autonomization that took hold in central banking during the 1990s. Figure 2 below illustrates that legal central bank autonomy has now been implemented in the large majority of countries that has central banks. The factors explaining these reform efforts are discussed in this second section of the paper, and it will be illustrated that there are considerable differences as to the ways in which central bank autonomy has been implemented in different countries and that legal central bank autonomy does not necessarily imply that central banks are de facto autonomous (Christensen and Lægreid, 2005: 6). Finally, the paper lists and discusses the most recent tendencies in central bank management which may be early indicators of yet another reform trend in central banking: scientization. Early indicators of this second generation of modernization are that new actor profiles excel in central banking circles, that a set of new nodal points characterizes central bank discourse, that a new central bank terminology is being used in central bank communication, that new means of communication are being applied by central bankers, and that an increasing amount of financial resources is being allocated by individual central banks to research undertaken by central bankers. The paper concludes by discussing the possible consequences of central bank scientization on political coordination, control and accountability. 3 Martin Marcussen, March 2005 Nature of Monetary Policy-making Mecanics/Science PostWashington Consensus, 2000s: Liberalism: Classical Gold Standard, 18751913 Liberal rationalism Formal status of central banking Integrated Autonomous Apolitization Politization Depolitization Bretton Woods, 1944-1971: The Washington Consesus, 1990s: Embedded Liberalism Neo-Liberalism Politics Figure 1: The Formal Status and Conception of Central Banking, 1875-2005* *The horizontal axis constitutes a continuum of different formal statuses of public agencies. On one extreme, the public agency in question is completely integrated into the central administrative apparatus and as such it may be asked by its political principals to pursue diverse and sometimes conflicting purposes. On the other extreme the public agency has received formal autonomy from its political principals in its pursuance of single purposes. The vertical axis depicts another continuum with regard to society-wide conceptions of the nature of monetary policymaking. On one end of the continuum monetary policy-making is basically conceived of as a technical endeavour that can be compared to driving a car. Depending on the car it takes more or less specialized skills to drive it. An ordinary car can be driven by almost everybody with a minimum level of specialized skills. A formel-1 racer, however, can only be optimally driven by a very little number of particularly talented people. On the other end of the continuum monetary politics is considered to be one available political instrument among others. The direction and content of the actual monetary policy depends on the political priorities of the government in power. Some governments may prefer to actively intervene into monetary policy decision-making, others not. Some governments may prefer to apply monetary policy-making with a view to maximize welfare and employment, others have other priorities. Some may exploit monetary policy in order to achieve objectives in the short run; others consider long-run objectives. 4 Martin Marcussen, March 2005 200 180 160 140 120 100 80 60 40 20 2000 1990 1980 1970 1960 1950 1940 1930 1920 1910 1900 1890 1880 1870 0 Years Total number of sovereign states Cumulative number of central banks Cumulative number of independent central banks Source: Sovereign states: Freedom House (2000), McNeely (1995: 42). Central banks: The Morgan Stanley Central Bank Directory 2004, www.centralbanknet.com. Legal central bank independence: Cukierman et al. (1992), Jácome H. (2001), Malizewski (2000), Maxfield (1997), McNamara (2002), www.centralbanknet.com; national central bank legislation. Figure 2: Central bank autonomy on the rise during the 1990s 5 Martin Marcussen, March 2005 SECTION 1: 150 YEARS OF MANAGEMENT DEVELOPMENT IN CENTRAL BANKING There is no agreement about when central banking as a distinct area of governance activity was founded. The oldest central banks (Sweden and Great Britain) date back to the 17th century, but the functions that we today typically associate with central banking were only undertaken by these institutions much later. It has been argued, however, that the Classical Gold Standard (1875-1914) constituted the golden era of central banking. To a varied extent, central banks, where they existed, functioned as the bank for the government providing finance whenever the government needed so, typically in relation to war adventures, and issued notes. In addition, central bankers later started to function as a bank for the private bankers. They also undertook to protect the value of the currency in relation to gold or other precious metals, and they functioned as the lender of last resort with a view to stabilize the private financial markets and prevent bank panics. This period was a peak time for central banking, first of all because they were defined as central bankers in their own right but also because they lived a life in relative isolation. Politicians in general pursued a laissez faire policy, leaving the job of finding an economic equilibrium to market forces. Societal groups, particularly trade unions and left-wing party-groups were weak or nonexistent. External equilibrium, i.e. the stable value of the currency measured in gold, was typically prioritized higher than internal equilibrium, i.e. growth and employment. Although central bankers were not often formally autonomous agencies (see Figure 1), they typically lived a life of their own since (Conservative) politicians had no interest or will to intervene in monetary matters. The central bankers primarily derived their legitimacy from delegated authority. Political programs and plans did often not contain the issue of monetary policy-making at all. Monetary policy was not on the political agenda – it could safely be left to the discretion of trusted, competent bureaucrats. The metier of central banking was considered to be mainly a technical, mechanical endeavour although not ‘science’ strictu sensu. Within central bank circles, there was an expressed preference for ‘practical economics’ rather than ‘theoretical economics.’ Central bankers themselves did not necessarily know about monetary affairs upon taking office. Many had previous careers in the army, politics or private businesses. The financial meltdown of the 1930s and the consequent world-wide recession had tremendous impacts on the political configuration of national parliaments and on the formation and activities of civil society interest groups. The political game had undergone complete transformation and so had 6 Martin Marcussen, March 2005 the previous permissive context for central banking. After World War II a large number of central banks were nationalized and, therefore, directly subsumed under the control of the government in power. Central banking had become politicized (see figure 1). Welfare creation, growth and employment became top priority in the post WWII era. In general, internal equilibrium got first priority, sometimes at the expense of external equilibrium. The embedded liberal consensus that characterized the Bretton Woods framework illustrates very well the order of priorities in that era. Central banking in all its aspects now constituted an instrument along a long series of other macroeconomic instruments. It was not only a possibility to apply monetary and financial policy actively to intervene into the economic machinery, it was considered to be the duty of any responsible politicians to integrate monetary policy in overall economic planning. It became possible, and acceptable, to conduct monetary policy along ideological lines. Both ends of the party-political right-left scale could apply monetary and financial policies as they desired with a view to maximize the chances that their political project could become reality. Central bankers now primarily derived their legitimacy on rational-legal authority. Those people who were appointed to the top position of national central banks were considered as being loyal top civil servants with direct reference to the political principals.1 More and more typically, central bank governors were educated economists that had obtained the practical and scientific skills of running the societal machinery. They were civil servants with a special kind of competence, often within the area of societal planning and economic coordination. After the two oil crises of the 1970s, uncontrollable inflation, persistent stagnation, rising unemployment, threatening budgetary deficits, external debt, and stifling interest rates rocked the established knowledge about macro-economic cause-effect relationships. During the 1980s and 1990s a number of paradigmatic changes materialized on many levels. Central bankers kept interest rates at very high levels for longer periods of time. They send an unmistakable signal to political leaders that time had come to change strategy. Social democratic leaders hesitantly listened to these signals, but soon a number of Liberal and Conservative governments regained power. The neoliberal voices that had been subdued during the era of Keynesian dominance were suddenly not only 1 The account of the loyal, technocratic central banker has been exemplified with reference to Benjamin Strong in the interwar years and Paul Volcker, both the Federal Reserve, in the end 1970s and beginning 1980s: “Benjamin Strong’s stewardship had been hailed as the first significant triumph of technocratic government, in which disinterested managerial experts took control of policy from the raw and unruly forces of politics. Government would become professionalized, rational and efficient like business, insulated from the random folly of popular opinion. Paul Volcker, the austere technician, oblivious to his own personal gain, enjoyed the same deference. He was admired for his wisdom and competence and, like Ben Strong, for his willingness to defy and dominate elected politicians. ´Benjamin Strong’s era was described, in Milton Friedman’s monetary history, as the “high tide” of the Federal Reserve System. For a number of years, the central bank succeeded in stabilizing money. Volcker’s era, for the same reasons, was a second time of triumph for the FED” (Greider, 1987: 675). 7 Martin Marcussen, March 2005 listened to but vigorously promoted by the entire political class. The momentum was there for matching a solution in search for a problem. The problem was defined as being inflation, and the solution was framed in neo-liberal terms: monetary targeting and balanced state budgets. Internationally, attention was directed towards the two central banks that historically had performed well in terms of inflation fighting: the Federal Reserve and the German Bundesbank - the most politically independent central banks in the world. The mere existence of these banks was taken as an empirical proof that there was a viable organizational alternative to the hitherto dominating central bank paradigm. The world’s attention was also directed toward the Washington institutions, in which a macro-economic policy consensus developed. In their realization of the objectives of international financial stability and development, the IMF and the World Bank conditioned their loans and gifts on structural reform and changed policy praxis along the lines that had now become fashionable in the rich first world countries. Thus, a world-wide modernization trend had its impact on the role, size and objectives of public administration everywhere. In central bank circles this process of modernization exempted central banking from the full supervision by political authorities – central banking received formal, institutional autonomy and was thereby depoliticized (see figure 1). Autonomization became a world wide trend. During the 1990s de facto independence was formalized in new central bank laws in a very large number of countries (Figure 2). In general, politicians agreed that their central bank should first of all fight destabilizing inflation. In most cases, politicians accorded the central bankers with a large degree of autonomy with regard to the realization of that goal (instrument independence). 8 Martin Marcussen, March 2005 Table 1: Key characteristics of 150 years of central banking Gold Standard Bretton Woods Liberalism Embedded liberalism Washington Consensus Post-Washington Consensus Neo-liberalism Liberal rationalism What is central banking about? Central banking is functioning as an anonymous machine Central banking is an important tool in policy-making applied and exploited by elected politicians Central banking is an important tool in policy-making reserved for independent money managers Central banking is a science What is a typical central bankers’ profile? Central bankers are a diverse crowd of people Central bankers are typically liberal economists Central bankers are typically liberal economists Central bankers consider themselves, and are considered as, scientists What are the major Financial stability nodal points in central (gold standard, stable bank rhetoric currencies) Growth, welfare, employment Inflation Scientific breakthroughs With whom and how does a central banker communicate? With peers With political principals With market actors With scientific peer groups Central bankers’ relation to politicians No desire among politicians to influence or to know about central banking in a pragmatic, nontechnical manner De facto independence like an ideal typical, loyal civil servant Politicians think that they ought to take part in central banking and to exploit it fully for political purposes. Dependence by signalling stability and credibility via a common language: econometrics Politicians think that they should refrain from intervene in central banking, thereby signalling credibility No external parties intend to intervene or even consider thinking about, problematizing central banking De jure and de facto independence De jure and de facto independence Central bankers’ relation to science CBers are practical CBers apply science people. They use their intuition. CBers apply science CBers produce science How do central bankers achieve legitimacy? 2 Primarily “delegated authority” Primarily “Rationallegal authority” Primarily “Moral authority” (we have been entrusted power from some legitimate and powerful people) (we know the rules and procedures and deal systematically according to these rules) (we guarantee that short-sighted politicians are kept away from our business) Primarily “scientifc authority”? (We know more about the technical details than anyone else) 2 Clearly, authority rarely comes only from delegation, moral claims, science or rational-legal principles. These different bases go together. The argument here is rather that, in different periods of time, some bases are more prevalent in generating authority than others (Barnett and Finnemore, 2004: 21-24). 9 Martin Marcussen, March 2005 Apart from the fact, that central bankers did not succeed in assuring international financial stability during the 1980s and 1990s, they were increasingly considered as being reliable fire-fighters that served as counterweights for short-termist, irresponsible politicians. With global financial and capital markets almost completely liberalized, politicians increasingly perceived it to be in their own interest to let central bankers do what they wanted to do. Central bankers world wide constituted a large, homogenous community of like-minded, male, Anglo-American schooled economists, with previous experience from one of the Washington institutions (Marcussen, forthcoming). They organized themselves in a number of different international forums, and exploited every opportunity to come together. Central bankers indeed became a self-sustained group of actors that increasingly paid loyalty to the universal values of the group. A step towards scientization – maybe a second generation of modernization? – may have already been taken. SECTION 2: SCIENTIZATION Can the world-wide group of central bankers be studied as a clan, - a kind of kin network (Ouchi, 1980)? In a hierarchical conception of state governance, the central bank is an integrated element of the overall state-apparatus. Such a perspective may very well capture the situation in the post world war period until the end of the 1970s. The marketization of state governance that many refer to as a process of modernization implies that central bankers can be seen as autonomous actors on the national as well as on the global financial markets. Here the reference point is the 1980s and 1990s. The new development that I refer to concerns a tendency for central bankers to simply transcend politics by forming an increasingly exclusive network of scientific experts within the monetary and financial field. A kin network that is tied together by an organic solidarity. Such solidarity may characterize a profession where there exists a strong sense of community, partly based on a feeling of personal comfort, partly based on a shared set of normative values, on a belief in a precise set of causal relations, on a shared notion of validity, and on a strong belief in a common political project. Such a clan may be conceptualized as an epistemic community which is a network of professionals with recognized expertise and competence in a particular domain (Haas, 1992). My argument here is that there exists a number of developments that indicate that the business of central baking is going through a process of scientization, and that this scientization may lead to the formation of a world wide clan of central bankers. The kind of scientization that is dealt with here should not be confused with the post WWII trend of using science with a view to rationalizing and optimizing public administration and introducing 10 Martin Marcussen, March 2005 planning (Lebaron, 2000: 157-181). After the war, economists entered the central administrative apparatus in many countries, thereby supplementing the majority of civil servants educated in law. These economists treated society as a machine that could be tamed, and tuned, and they used scientific laws in their planning and adjusting. At university this new generation of civil servants trained in economics had most likely been confronted with mathematics. Mathematical sophistication helped to sort the insiders from the outsiders: “The valorization of the quantitative competence was a part of a meritocratic strategy. It offered an opportunity to promote a young “math whiz” better endowed with scholarly competence than social competence … by minimizing the importance of linguistic and cultural competence, mathematical economics represents an attractive route for the integration of foreign students in the United States … Mathematics offered not only a common language but also weapons and a space of competition” (Dezaylay and Garth, 2002: 75). The difference between the kind of scientization that I talk about and the tendency for public civil servants in the post WWII period to apply science in their day-to-day business is exactly that whereas public administration in the 1950s started to apply macro-economic theory, the kind of civil servants that I talk about – central bankers – have nowadays started to develop theory themselves. Indeed, part of the scientization thesis that I try to substantiate implies that central bankers consider themselves, and are increasingly being considered as being scientists in their own right. For the same reason, scientization should not be confused with Taylor’s scientific management. Scientific management does not mean that managers develop theories and concept themselves. It simply implies that they start to systematically apply theories and theoretical concepts in the planning of production. Scientific managers are not ‘scientists’, but there are indeed indicators that now-a-days central bankers are. Economic professors as central bank governors One indicator of scientization in central banking concerns the tendency for newly elected central bank governors to have been highly estimated university professors in economics. Mervyn A. King at the Bank of England, Axel A. Weber at the Bundesbank, Guy Quaden heading the Banque Nationale de Belgique, Bodil Nyboe Andersen who is central bank governor at Danmarks Nationalbank, Leszek Balcerowicz at the National Bank of Poland, and many more have all had distinguished careers as economics professors. At the time of writing it is still unknown who will replace Alan Greenspan. None of his predecessors were professors of economics, but three of the most likely contenders to follow Greenspan when he leaves his job on 1 January 2006 are university 11 Martin Marcussen, March 2005 professors. This is the case for Martin S. Feldstein (Harvard Economist), R. Glenn Hubbard (Dean, Columbia Business School) and Lawrence H. Summer (Harvard President and the youngest tenured professor in Economics at Harvard). Only Robert E. Rubin (Chairman of Citygroup Inc. executive committee and treasury secretary under Clinton) is not professionally associated with scientific activities (The Washington Post, 21 September 2004: After Alan Greenspan, Who? By Neil Henderson). In fact, that central bank governors have a degree in economics is a relatively recent phenomena. If we look among the three leading central banks, the Federal Reserve did not get a governor that was formally educated in economics until 1970: Arthur Burns. In Germany, there is a long tradition of educating economists for the public administration, but still, the Bundesbank had to wait until 1977 before one of the bank’s governors, Otmar Emminger, had a formal degree in economics. In Great Britain it took even longer! Not until 1993, when Sir Edward George took over as Governor, was the economist profession represented at the very top of the bank. 12 Martin Marcussen, March 2005 Table 2: Governors of the American, German and British central banks – and their education Federal Reserve William McChesney Martin Jr. (1951-1970) BA in English Arthur Burns (1970-1978) economist – the first in the job! G. William Miller (1978 – 1979) Marine engineer and law degree Paul Volcker (1979-1987) degree in political economy and government Alan Greenspan (1987-) economist Bundesbank Karl Blessing (1957-1970) bankier Karl Klasen (1970-1977) legal education Otmar Emminger (1977-1979) economist – the first in the job! Karl Otto Pöhl (1980 – 1991) economist Helmut Schlesinger (1991 – 1993) economist Hans Tietmeyer (1993 – 1999) economist Ernst Welteke (1999-2004) economist Axel Weber (2004-) economist Bank of England Sir Leslie O'Brien (1966-1973) educated in Bank of England from clerk upwards Gordon Richardson (1973-1983) legal education – practiced as a lawyer Robin Leigh-Pemberton (1983-1993) barrister, landowner and banker Sir Edward George (1993-2003) economist – the first in the job! Mervyn King (2003-) economist Economists have now completely taken over central banking, also in the highest managerial ranks. The fact that central bank governors to an increasing extent not only are well-trained economists, but also are highly estimated university professors, is one indicator that science in all its aspects – science production, science planning, science distribution, science management – has become part and parcel of the business of central banking. Cutting-edge research in central banks Another indicator of scientization is that central banks increasingly see themselves as producers of high-level economic research. The European Central Bank, for instance, has, by one of the members 13 Martin Marcussen, March 2005 of the Danish central bank’s board of governors (Jens Thomsen), been described as “a power house of research” to which employees of other European central banks are seconded with a view to becoming up-dated on the latest theoretical developments. In 2003, 90 so-called national experts were seconded to the ECB with exactly that purpose in mind, about half of these from central banks in Central and Eastern Europe. The ECB also attracts a number of economics researchers that can use the facilities of the ECB to enrich their own research. Thus, in 2003, 24 professional researchers stayed for longer or shorter periods of time in the ECB research environment. In another capacity, the ECB attracts a high number of students of economics who spend time at the bank as trainees and graduated students whom the ECB selects for specific research projects because they have been considered as ‘highly talented’ (ECB Annual report for 2003, 2004: 178). Presently, the Directorate General Research at the ECB counts 58 persons, of which some 43 are full-time-equivalent professionals (FTE). In comparison, the Department of Economics at London School of Economics and Political Science counts 61 academic staff members in Spring 2005, of which 9 are on leave. Not all of the remaining staff members are full-time equivalents. This means that the very number of full-time researchers at the ECB actually equals a quite large economics department at one of the major European universities, except from the fact that university people very rarely are full-time researchers in practice! The Directorate General Research was created in mid-1998, and at that time it counted about 15 persons (previously employed with the European Monetary Institute). It grew quickly in the next 4 years, and the number of FTE researchers has remained more or less constant in terms of overall staff since 2003. It goes without saying that all the recruited personal at the Directorate General Research already possess, or are about the get, a Ph.D.-degree in economics (correspondence with Ignazio Angeloni, Deputy Director General for General Research, 23.11.2004). That research was going to be a central pillar of the ECB was evident from the very beginning. Being a new actor on the international capital markets, the ECB had no track record of successes that could help them build up a good reputation. One way of boosting its authority and of getting a good reputation in the population at large, on the capital markets, and in political circles was to become a key player in the world of economics research. Research-based communication was meant to help establishing and strengthen the credibility of the ECB in Europe and elsewhere. Thus, from the very beginning, the ECB aspired to attract the most talented economists around and encouraged them to engage proactively in the general academic debates. Although the ECB has a specific directorate for research, it should not be neglected that research is also being conducted in the Directorate General Economics. This department is much larger in size 14 Martin Marcussen, March 2005 (134 FTE professionals) and is responsible mainly for economic briefing within the ECB, but it also produces research papers. It is estimated that about a third of these people hold a Ph.D.-degree. The most recent external evaluation of the economic research activities of the European Central Bank is not in doubt: “Our overall assessment of ECB research is quite positive. In the short time since its creation, the ECB has managed to build up significant research capabilities, not only in DG Research but also in other business areas. This shows in the hiring of PhD economists, the production of a large number of working papers, the publication of research in leading journals, and the participation of ECB staff in many academic conferences and workshops” (Goodfriend et al., 2004. 45). The only regret expressed in the evaluation report is that the potential for research is not exploited to its full. In other words, we haven’t seen it all yet! Although the European Central Bank is a leading star among national central banks with regard to research quantity and quality, the research taking place in the national central banks cannot be neglected. It is not only the new-coming ECB that is using science to inflate its authority, enhance its credibility and external reputation, national central banks in Europe all engage seriously in independent scientific production (Eijfinger et al., 2002). Particular small central banks such as the Finnish and the Dutch central bank have achieved an excellent scientific reputation during the 1990s. The larger central banks, however, have seemingly not been able to fully exploit their scientific potentials. For the national central banks the conclusions seem to be the same as for the ECB: there is a lot more to be expected from central banks in terms of research quality and quantity in the future. New means of research dissemination in central banking Another sign of scientization concerns the ways in which central bankers communicate their research. On almost all central bank web-sites it is possible to find a list of scientific working papers written by central bank staff, either alone or together with collaborators inside or outside the bank. These papers are sometimes published in journals, books, reports etc., thereby reaching a larger, interested public. Central bank personnel are, on a general note, also actively participating in and sometimes also organizing scientific seminars, workshops and conferences where research is presented to peers. In terms of dissemination it is fair to argue that central bankers in general have become active players in the academic debate in many research areas. 15 Martin Marcussen, March 2005 The latest interesting initiative is the launch in 2004 of a scientific journal edited and run by central bankers: The International Journal of Central Banking (IJCB).3 Concretely, the journal is a joint project of the Bank for International Settlements (BIS), the European Central Bank, and each of the Group of Ten central banks (Bank of Canada, Bank of England, Bank of France, Bank of Italy, Bank of Japan, Deutsche Bundesbank, Federal Reserve Board, National Bank of Belgium, Netherlands Bank, Sveriges Riksbank, and Swiss National Bank). The objective is ambitious: to widely disseminate “the best policy-relevant and applied research on central banking and to promote communication among researchers both inside and outside of central banks” (press release, 26 July 2004, www.bis.org). Nothing less than the best! Overall, there are tendencies that point in a certain direction: that science increasingly is playing a role for central bankers. The top managers of central banks increasingly have a proven research record, the employees of central banks increasingly have PhD.-degrees and a key role of central banks is to independently produce research. There is also a tendency that central bankers as a group are considered as having recognized expertise in their particular fields of research. It is not only within central bank circles that research gives authority, the world outside central banks also tends to consider central banks as if they have recognized expertise in their specific research areas. One indication, that central bank research is actually highly estimated today is that a central banker, Edward Prescott, in October 2004, for the first time ever, was granted the Nobel prize in economics. In the seventies Finn Kydland and Prescott developed public interest theory substantiating the claim that political credibility could be achieved, uncertainty reduced, efficiency and effectiveness maximized, and legitimacy enhanced by permanently and consistently trusting important regulatory functions to autonomous public agencies and then exempting them from political supervision (Christensen and Lægreid, 2005). This had been praxis in a number of countries for years (Christensen and Yesilkagit, 2005), but at the time, it can hardly be said to constitute a broader reform trend. Presently, with a majority of central banks endowed with statutory independence, Kydland and Prescott’s ideas have become part of mainstream, consensual knowledge. The fact that prevalent members of the central bank community have been formally recognized by scientific 3 Federal Reserve Board Governor Ben S. Bernanke serves as the initial managing editor of the International Journal of Central Banks, and will work with designees from the sponsoring institutions to develop the journal. Vítor Gaspar, Director General, DG Research, serves as the European Central Bank’s representative to the journal’s governing committee. European Central Bank economist Dr. Frank Smets and Bank of Japan Policy Board Member Dr. Kazuo Ueda serve as IJCB co-editors. 16 Martin Marcussen, March 2005 peers may boost self-confidence in the central bank community and further accelerate the move towards scientization. SECTION 3: THE EFFECTS OF SCIENTIZATION: THE CREATION OF A TRANSNATIONAL SYSTEM OF KNOWLEDGE GOVERNANCE? Modernization reforms challenge our existing understandings of accountability, legitimacy and power relations between civil servants and politicians (Christensen and Lægreid, 2005: 18). This may also be the case for the scientization processes that I have identified in this article. In this section, I will argue that the process of scientization may have consequences for how we conceptualize governance, for how knowledge is being produced and for what kind of knowledge is being produced, and it my have consequences for political accountability. The impact of scientization on governance From territorial governor communities to non-territorial knowledge communities. Scientization may imply that governance – the regulation of social behaviour – is being transnationalized. Central bankers have always been involved in international cooperation. During the Classical Gold Standard, international cooperation between central bankers was characterized by ad hoc and informal contacts. It was also characterized by a certain kind of asymmetry since some key central banks, i.e. The Bank of England, constituted the structural centre of the international cob-web of contacts. Most information and contact ran to, from and via the bank with the world reserve currency. Since the end of the Second World War, international cooperation has become formalized in a large number of international organizations and globalized, since more and more countries are now involved in increasingly complex ways. Until the present, the many fora in which central bankers meet have been defined by their national members and the territory they represent. It has been possible to speak about communities of national central bank governors. International central bank fora have had a distinct territorial dimension – larger or smaller, depending on the number and type of members. Thus, international organizations such as these are fundamentally based on a territorial principle of organization and governance (Egeberg, 2004). The territorial dimension has been ever present, but this may be changing now! If it is true that scientization takes hold of central banking and that central bankers merge with a transnational knowledge community, territorial borders cede to play a role and non-territorial principles of 17 Martin Marcussen, March 2005 organization and governance start to become more descriptive of the field. Conflict structures and patterns of governance within a knowledge community do not respect territorial borders. Cleavage structures are rather defined according to the rules of the scientific game: intra-paradigmatic quarrels about theory, methods, data etc. Knowledge communities are being constructed, partly replacing, partly supplementing/overlapping governor communities. Governor communities embrace central bank governors who represent clearly demarcated territories. Knowledge communities embrace all scientists within a field – central bank personnel or not. The knowledge community may be broader or narrower in scope than governor communities. Knowledge communities do not respect national borders. Knowledge communities are more dynamic and porous than governor communities. Membership of a knowledge community cannot be inherited the same way as membership of a governor community. For instance, the German governor will always be part of G10, but the German governor will only be member of the knowledge community if he can contribute to the generation of scientific knowledge. From political governance to knowledge governance. Political governance can, for the sake of the argument, be simplistically defined as regulation with a view to a solving a concrete problem. Central banking has so far had this practical dimension attached to it. Most tellingly, two historic persons in the history of central banking who have been keys in defining a veritable central bank culture, the British Montagu Norman and the American Benjamin Strong, have been described in the following way: “Norman and Strong had in common many things that predisposed them to congenial and effective cooperation. Both were bankers with long and responsible experiences in the greatest financial centers of their respective countries. Both shared a banker’s conservatism, distrust of “politicians” and impatience with “theory” that seemed inapplicable to “practice”” (Chandler, 1958: 260). The practical aspects of problem solving, rather than theorizing for the sake of theory, have traditionally been central for the business of central banking. Theoreticians have not been in high esteem in central bank circles, and it has been argued that the art of central banking was driven by intuition and life experience. Keynes, for instance, was viewed among central bankers as being a distant theoretician, and Strong and Norman feared that people of his like would overshadow the “practical bankers” (Jacobsson, 1979: 45). This may not be the case any more! Compared to political governance, knowledge governance can be defined as being the production and diffusion of knowledge. Central for knowledge governance is, that it is seen as an objective in itself to produce knowledge just for the sake of it. More knowledge is better than less knowledge! Central 18 Martin Marcussen, March 2005 bankers seem to have achieved a level of intellectual development where the general impression is that they know how the economic organism is functioning, and that it therefore needs to theorize all that accumulated practical knowledge. In central bank circles, as well as among other economic and political elites, a large consensus about how to understand macro-economic cause-effect relationships in general seems to have developed. Central bankers are now exploiting that consensus as a stepping stone for formalizing and modelling that consensual knowledge. This is what knowledge governance is all about. The impact of scientization on knowledge production From scientific pluralism to strategic overlay of particular research disciplines and approaches. Related to the development of knowledge governance is the question about what knowledge is and which aspects of knowledge should be expanded through intensified and targeted research. Since central bankers in many cases provide for their own income and to a large degree have free hands when it comes to spending that money, and since central bankers tend to spend considerable amounts of money in few areas of research activity, it is natural to expect a noticeable expansion of research activity in some areas of research rather than others. Through the massive injection of central bank money into research activities in delimited field of research many more actors are and will suddenly be playing on the field of generating knowledge within a particular subset of macroeconomic research. In other words, the scientization of central banking may cause a disturbing bias in research focus, since very few other funders of research, private or public, will be able to match the cashflow emanating from central bank circles. It is difficult to predict whether this potential research bias will have enduring consequences for the development of economic science in particular and the social sciences in general, but it is to be expected that the scientific disciplines of most relevance to central bankers will tend to fill relatively more in the overall field of macroeconomic research. In the same vein, just as specific scientific disciplines can become overemphasized by an extraordinary transfusion of funding so can specific scientific approaches. The new impetus to macro-economic research may have an impact on the scientific discourse in general and consequently also on which approaches are considered to be marginal/peripheral and which are considered to be central/important. Since the new actors in the knowledge game are relatively wellfinanced and since it may reasonably be feared that they have a quite narrow agenda, they will be able to dominate the kind of discussions that will be conducted in certain disciplines. Within the field of research on monetary policy, we may witness that some voices in the ongoing academic 19 Martin Marcussen, March 2005 debate will be strengthened and others will get relatively less attention. If central bank stabilityoriented ideas about sound money, finances and institutions tend to have achieved a status of hegemony, this status can only be expected to be further consolidated by additional funding in its favour. Within central bank circles, this power to actually influence the entire research climate and the conditions of scientific work is fully recognized and even counted on. The most recent evaluation report of ECB research, for instance, argue that the benefits of a central bank from engaging actively in academic research is, among other things, that the central bank “can stimulate and encourage external research on issues of interest to the central bank through publications, conferences, and consulting relationships” (Goodfriend et al, 2004: 5). The “powerhouse of research”, the European Central Bank itself, has ostensibly already grasped the overall idea behind the concept of research management since it “ uses its research capacity to encourage, coordinate, and lead research efforts of the national central banks of the Eurosystem” (Goodfriend et all, 2004: 22). And this is not in vein! It is being concluded that “[g]iven its place at the centre of a continental system of central banks, it is not surprising that the ECB has already had a major effect on academic discourse throughout Europe” (Goodfriend, 2004: 24). The impact of scientization on power-relationships and political accountability From depolitization to apolitization of the civil servant-politician relationship. Apolitization through scientization simply means that the entire language of public administration is changing. The turn towards the use of a scientific language radically alters the relationship between the scienticized civil servant and the elected politician. The major characteristic of a scientific statement, unlike political and administrative statements, “is that they are privileged in the sense that, if derived in accordance with scientific procedures, they are considered to give greater assurance of truth. It is more useful if conclusions on, say, what works and what does not work in government are scientific because scientific propositions are understood to be more reliable” (Farmer, 1995: 71). In other words, scientized civil servants becomes out of reach for political argumentation because only the language of science is a valid means of communication. From external to internal accountability. From the previous considerations it follows that the locus of accountability in central banking may be about to change. Whereas before central bankers were accountable to the financial markets (during the 1990s) and politicians (during Bretton Woods), central bankers are now accountable only to their scientific colleagues within the knowledge 20 Martin Marcussen, March 2005 community. In knowledge communities, central bankers can only enhance their legitimacy and authority by living up to a number of scientific standards and continuous peer review processes. Whereas before central bankers were obliged to communicate broadly with politicians, citizens and the financial markets, they now only need to communicate with their peers. In doing so, they apply an arcane scientific terminology that exclude a large number of people – even within the ranks of economists. So when it has become fashionable in central bank circles to engage in a debate about “How do Central Banks Talk’? (Blinder et al., 2001, Amato et al. 2002) or whether it is a good or a bad thing that central bankers talk (The Economist, July 24, 2004, Economic Focus, p. 65: “It’s not always good to talk”), this debate should not be interpreted as a general attempt to open the business of central banking to the broader public or to elected politicians. The issues that are currently being discussed internally in central bank circles is how one type of scientific economist employed in the central bank, should send signals to another kind of scientific economist on the financial markets. Transparency is indeed a buzzword in central bank circles these days (The Economist, August 9, 2003, p. 56: “As clear as mud”), but the term should not be confused with the similar term applied to the rest of the public administration. In central bank circles “transparency” simply means that certain kinds of information is been released at financial press conferences after central bank board meetings. Under the headline “Boring Bankers – Should we listen?”, Bank of England Monetary Policy Committee member, Richard Lambert, concludes that central bankers talk because they can and want to dialogue with the financial markets (April 22, 2004). They do not talk because they want to inform the broader public about the status, functions and decisions of the central bank, they do not talk to gain the trust of “the people”, but to communicate with peers on the financial markets. Clear talk! Just as we can only detect scattered indicators of scientization in central banking, the consequences of scientization discussed above may, of course, be nothing but plausibility probes that allows us to formulate testable hypotheses (Eckstein, 1975: 108). In the next session I will conclude by discussing other ways in which we could understand the process of bureaucratic scientization and whether the case of central banking can be generalized to other parts of the public bureaucracy. SECTION 4: MAIN ARGUMENT AND UNRESOLVED QUESTIONS The main argument of the present article has been that public administration may be going through a second generation of modernization. The first generation of modernization implies a wide-ranging 21 Martin Marcussen, March 2005 autonomization of public agencies. In the area of central banking, autonomization has as a consequence that politicians, while believing that monetary policy is an important element in macro-economic policy-making, are of the firm belief that they should not intervene in that particular area. Through autonomization, monetary policy has been depoliticized and a consensus has developed that it would be illegitimate for politicians and others to intervene into the domain of central banking. Both indirect (i.e. simply talking about the conduct of monetary affairs in public) and direct intervention (i.e. criticizing the monetary policies conducted by central bankers) in monetary policy is considered to be highly inappropriate, sending the wrong signals to market actors. Today, national politicians are very much aware of the special position of monetary policy and the central bank. If they do something wrong in that area, they would immediately be considered by the actors on the financial markets to be irresponsible and short-termish. The price of loosing one’s credibility can be so high that the awareness of monetary policy-making is indeed very much present. The second generation of modernization implies that public agencies are undergoing a process of scientization. To an increasing intend civil servants consider themselves as knowledge producers rather than knowledge consumers. To an increasing extent civil servants participate in the scientific game in the transational scientific community. In the area of central banking, this means that monetary policy is becoming apolitized. Apolitization means that monetary policy, by politicians and others, is being considered as a scientific discipline only which transcends politics. The entire area of monetary policy-making doesn’t play a role in the day-to-day business of playing the political game and it does not have a place in the hearts and minds of ordinary politicians. Whereas before, national politicians, while keeping it for themselves, almost always had an opinion about interest rates and the level of inflation, the new tendency today may be that national politicians do not even consider these aspects of macro-economic policy what so ever. These aspects do not form part of their preoccupation and vocabulary. They have no awareness in that area of real life phenomena. A whole trunk of potentially explosive issues has been withdrawn form the political agenda. It is possible, though, that it is too strong to interpret the movement from autonomization to scientization as being a question of profound/deep transformation (Egeberg, 2004). A first unsettled question, therefore, is whether scientization is a new stage in modernization or an additional form of autonomization? Arguments can be made both ways and in between. A critique may be that scientization is one strategy among others that can be applied in an attempt to autonomize public administration (Flinders and Buller, 2005). Alternatively, it can be argued that scientization is the, so far, highest order of autonomy that can be reached by public agencies. This implies that the 22 Martin Marcussen, March 2005 strategies applied to foster autonomization in the public administration continue to diversify and extensify. It may be that the strategy labeled “rule-making” (the public agency does exactly and only what the rules tell it to do) is a first prudent step towards autonomization and therefore exemplifying 1st order autonomy. “Preference shaping” (the public agency does what it has to do, given the external circumstances. There is no alternative), may according to a similar logic be considered a strategy that is somewhat more far reaching, and, therefore, exemplifies 2nd order autonomy. 3rd order autonomy then concerns the granting of “institutional autonomy” to public agencies (the public agency is exempted from full political supervision) and 4th order autonomy in the form of “scientization” is the, so far, most drastical step towards autonomization (knowledge creation: the public agency writes the rules of the game). A second question concerns empirical generalization. Given that the scattered data reported in this article is valid, do the identified tendencies represent a broader phenomenon in public administration? The answer at this stage of research would be a: Not yet! There are no clear tendencies that whole trunks of public administrations are defining themselves beyond politics. It is too early to label the public administration as 'the untouchables'. It is still common practice, in the media and broader public alike, to fundamentally question the raison d'être of multiple aspects of the public administration writ large. In that regard, central banking is an exeption since public questioning of central bank practices is almost absent. But it might be a question of time before we see such tendencies unfold. The public administration is funding knowledge like private research foundations, it is communicating and commercializing knowledge like private think tanks and consultancies. So the step towards also creating knowledge like universities may not be so large. In contrast, the creation of knowledge by epistemic communities at the international level is not a new phenomenon (Haas, 1992). The concept of epistemic communities has been used widely in various issue areas. Also, it is not a new phenomenon that international bureaucracies, or parts of them, are becoming scientized (Haas, 1990). At present, however, there are no obvious signs that scientization is a general phenomenon in national public administration. 23 Martin Marcussen, March 2005 REFERENCES Amato, Jeffrey D., Stephen Morris and Hyon Song Shin (2002), ‘Communication and Monetary Policy’, www.nuff.ox.ac.uk/users/Shin/policy.htm Barnett, Michael and Martha Finnemore (2004), Rules for the World – International Organizations in Global Politics, Ithaca: Cornell University Press. Blinder, Alan, Charles Goodhart, Philipp Hildebrandt, David Lipton and Charles Wyplosz (2001), “How Do Central Banks Talk?”, Geneva Reports on the World Economy, no. 3, Geneva: International Center for Monetary and Banking Studies. Chandler, Lester V. (1958), Benjamin Strong, Central Banker, Washington, D.C. : Brookings Institution. Christensen, Jørgen Grønnegaard and Kutsal Yesilkagit (2005), ‘Delegation and Specialization in Regulatory Administration: A Comparative Analysis of Denmark, Sweden and The Netherlands’, paper prepared for the SCANCOIR/SOG Workshop on “Autonomization of the State: From Integrated Administrative Models to Single Purpose Organizations”, Stanford University, April 1-2. Christensen, Tom and Per Lægreid (2005), ‘Agencification and Regulatory Reforms’, paper prepared for the SCANCOIR/SOG Workshop on “Autonomization of the State: From Integrated Administrative Models to Single Purpose Organizations”, Stanford University, April 1-2. Dezaylay, Yves and Bryant G. Garth (2002: 86-) have an interesting thesis that the source of scientification can actually be located in the Washington institutions. The IMF was directed by the research department and the World Bank got its legitimacy through its scientific authority. Drori, Gili S. and John W. Meyer (forthcoming), ‘Scientization: Making a World Safe for Organizing’ in Marie-Laure Djelic and Kerstin Sahlin-Andersson (eds.) Transnational Regulation in the Making, Cambridge: Cambridge University Press. Eckstein, Harry (1975), ‘Case Study an dTheory in political Science’, in Fred I. Greenstein and Nelson W. Polsby, eds., Handbook of Political Science, vol. 7, Stratgeies of Inquiry, AddisonWesley Publishing Company, pp. 79-137. Egeberg, Morten (2004), 'EU Institutions and the transformation of European Level Politics – How to understand profound change (if it occurs)’, ARENA Working Paper Series, 19/2004, Oslo: ARENA. 24 Martin Marcussen, March 2005 Eijfinger, Sylvester C. W., Jacob de Haan and Kees Koedijk (2002), ‘Small is beautiful: Measuring the research input and output of European Central bank’, European Journal of Political Economy, 18(2): 365-374. Farmer, David John (1995), The Language of Public Administration: Bureaucracy, Modernity and Postmodernity, Tuscaloosa, Ala.: University of Alabama Press. Flinders, Matthew and Jim Buller (2005), ‘Depolitisation, Democracy and Arena-Shifting’, paper prepared for the SCANCOIR/SOG Workshop on “Autonomization of the State: From Integrated Administrative Models to Single Purpose Organizations”, Stanford University, April 1-2. Goodfriend, Marvin, Reiner König, and Rafael Repullo (2004), ‘External Evaluation of the Economic Research Activities of the European Central Bank’, Frankfurt: ECB. Greider, William (1987), Secrets of the Temple – How the Federal Reserve Runs the Country. New York: Simon & Schuster. Haas, Ernst (1990), When Knowledge is Power – Three Models of Change in International Organizations, Berkeley: University of California Press. Haas, Peter (1992), “Introduction: Epistemic Communities and International Policy Coordination”, International Organization, 46(1): 1-35. Jacobsson, Erin E. (1979), A Life of Sound Money – Per Jacobsson. His Biography, Oxford: Clarendon Press. Marcussen, Martin (forthcoming), ‘The Transnational Network of Central Bankers’, in Marie-Laure Djelic and Kerstin Sahlin-Andersson (eds.) Transnational Regulation in the Making, Cambridge: Cambridge University Press. Ouchi, Willam G. (1980), ’Markets, Bureaucracies and Clans’, Administrative Science Quarterly, 25(1): 129-141. 25