Topic 1—Introduction

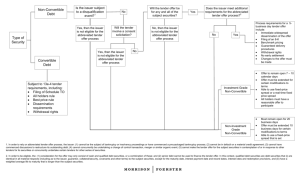

advertisement