Fall 2008

advertisement

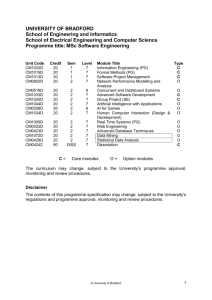

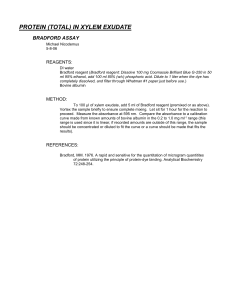

1 Accounting for Lawyers Fall 2008 Professor Steve Bradford Office: Room 216 South Phone: 472-1241 E-mail: sbradford1@unl.edu Web site: http://www.unl.edu/bradford/web.htm (Follow the Accounting for Lawyers link) BOOKS: The books for this course are: 1. (Required) David R. Herwitz & Matthew J. Barrett, Materials on Accounting for Lawyers (Unabridged 4th ed. 2006). 2. (Optional) C. Steven Bradford, Basic Accounting Principles for Lawyers (2008). CALCULATOR: You are required to purchase and bring to each class a simple calculator that can add, subtract, multiply, and divide. (I realize that laptop computers have a calculator function, but you will need a calculator for the exam and you’re not allowed to use your computer on the exam.) Calculators with more complex functions are acceptable, but a basic, cheap calculator is fine. More expensive calculators generally come in two types, business and scientific. The business type is more appropriate for lawyers. SCHEDULE: Mon. and Tues., 10:00-10:50 p.m. READING ASSIGNMENTS: A list of reading assignments for the year is attached. Note that part of your assignment is to review several audiovisual podcasts. You must review those podcasts prior to doing the homework. The assignments in the Bradford & Ames book are optional. The Bradford & Ames book attempts to present basic accounting concepts in fairly simple terms. It doesn’t include all of the detail you will find in the Herwitz & Barrett book, but it could help you understand some of the material in the Herwitz and Barrett book. For the first class, read the Preface (pp. v-xx) and pp. 1-17 of the Herwitz & Barrett book. For the second class, read pp. 17-28 of the Herwitz & Barrett book and complete problem 1.1A (to be turned in at the beginning of class). I will announce future assignments on a weekly basis. HOMEWORK: The Herwitz & Barrett book contains a number of problems designed to help you understand and apply the concepts discussed. I believe you will learn more if you complete these problems prior to our class discussion. Therefore, during the first part of the course, you are required to turn in several homework problems. Those homework problems are listed on the reading assignments. Do the best you can on these 2 problems. Your grade will not depend on whether your answers to these problems are correct. However, your grade will be lowered if you do not make an honest effort or do not turn in all of these problems in a complete, timely fashion. CLASS ATTENDANCE AND PARTICIPATION: I expect each of you to attend class regularly and punctually, prepared to participate in class discussions. If you do not attend class regularly, you will be dropped from the course without additional notice. Absences due to work assignments or job interviews are not excused. Similarly, in accordance with the policies adopted by the Law College’s clinical instructors, absences due to clinical assignments are not excused. Class attendance, preparation, and participation will be considered in determining your final grade. CELL PHONES AND PAGERS: The use of cell phones and pagers in class is prohibited. Any cell phones or pagers brought to class must be turned off before you enter the classroom. NOTEBOOK COMPUTERS: Notebook computers may be used in class only for purposes directly related to the class. Game playing, surfing the Internet, sending e-mail or instant messages, or doing any work not related to this class is prohibited. AUDIO OR VIDEO RECORDING: Classes may not be recorded, except in cases of special need with my prior permission. You may record makeup classes. EXAMINATION: The exam will be partially open book. You may use the books and handouts required for the course plus any materials, including notes and outlines, prepared exclusively by you. You may not use any other materials. I will discuss the exam in greater detail later in the semester. OFFICE HOURS: I have no formal office hours. Feel free to drop by at any time without an appointment. 3 Reading Assignments Unless otherwise indicated, assignments are in the Herwitz & Barrett book. Bradford indicates the corresponding pages in the optional Bradford book. Remember that the Bradford assignments are optional. A problem has to be turned in as homework only if it is specifically listed as homework. The on-line lectures are available on my web site. Please complete them before doing the homework assignments. Chapter 1 Introduction to Accounting A. Introduction Preface, v-xx 1-3 Bradford Chapter 1 B. The Balance Sheet 3-17 Bradford Chapter 2 C. Double-Entry Bookkeeping 17-28 On-line lecture: Double-Entry Bookkeeping Bradford Chapter 5 Homework Assignment: Problem 1.1A, 28-29 D. The Income Statement 31-42 On-line lecture: The Income Statement Bradford Chapter 3 Homework Assignment: Problem 1.2A, 42-43 E. Owner’s Equity 53-67 [Omit the problems on p. 55] Bradford Chapter 6 4 Problem 1.5A, p. 67 F. Accrual and Deferral 68-77 Problem 1.6A, p. 77 78-93 On-line lecture: Accrual Accounting Bradford Chapter 8 Homework Assignment: Problem 1.7A, 93 94-95 On-line lecture: Accounting for Income Taxes 95-104 Homework Assignment: Problem 1.8A, 104-106 G. Inventory 109-119 On-line lecture: Accounting for Inventory Bradford Chapter 10 Homework Assignment: Problem 1.9A, 120-121 H. Cash Flows 127-136 Problem 1.10A, 136-137 Bradford Chapter 12 I. Consolidated Financial Statements 139-146 Chapter 2 Accounting Principles and Auditing Standards A. Introduction 147-154 B. Generally Accepted Accounting Principles 5 181-187 (not including b on p. 187) 188-197 Bradford Chapter 13 C. Auditing and Internal Controls 198-211 (up to 5) 214-226 (to bottom of page) 234-239 (not including c) 243-261 Bradford Chapters 15 and 16 Chapter 6 Revenue Recognition and Issues Involving the Income Statement A. Introduction 513-524 B. Recognition of Revenues 525-536 (up to “The Numbers Game”) 546-547 569-573 583-586 (beginning at ¶ 3 on p. 583) 606-608 608-613 613-615 (up to 3) 619-624 624-627 (including only the first two ¶s on 627) 631-633 (up to 4) Problem 6.2A, 634 Problem 6.3, 634-635 C. Recognition of Expenses 647-651 Problem 6.5, 651 654-661 662-667 Problem 6.10A, 675 Homework Assignment: Problem 6.8, 668-669 (part (a) only) 6 Chapter 7 Contingencies A. Introduction 689-695 B. Accounting for Contingencies 695-712 and skim the disclosures on 712-716 Problem 7.1, 741-742 Bradford Chapter 11 C. Responses to Audit Inquiries 732-741 Chapter 8 Inventory A. Introduction Review 109-117 781-785 Bradford Chapter 10 B. The Costs to Include in Inventory 785-794 805-811 Problem 8.1A, 811-812 C. Methods for Allocating Inventory Costs 813-828, 835(section d) Homework Assignment: Problem 8.2A, 847; Problem 8.2B, 847-848 [For part (a) of Problem 8.2B, also compute gross profit under the average cost method.] D. The Lower-Of-Cost-or-Market Rule 835-841 7 E. Financial Statement Presentation and Disclosure 853-855 Chapter 9 Long-lived Assets and Intangibles A. Introduction 857-861 Bradford Chapter 9 B. Classification of Expenditures: Assets vs. Expenses 861-864, 871-874 Problem 9.1B, 875 Problem 9.1C, 875 C. Allocation of Capitalized Costs 876-881 (up to c), 882-883 883-891 Homework Assignment: Problem 9.2B, 895; Problem 9.3A, 896 D. Intangibles, Including Goodwill 904-909 Note 1, 917 Problem 9.6A, 924 (Note 2, 871-872, may help you with this problem.) Homework Assignment: Problem 9.7A, 925 E. Write-Downs and the “Big Bath” 934-945 8 Chapter 3 The Time Value of Money A. Introduction 297-299 B. Interest 299-302 C. Future Value 303-305 (up to b), 307 (beginning at 2)-311 Bradford Chapter 19 Homework Assignment: Problem 3.1A, 327 D. Present Value 312-322 Bradford Chapter 19 Homework Assignment: Problem 3.3A, 306 322-325 Homework Assignment: Problem 3.6A, 329-330 [Note: The annuity tables assume that payments are made at the end of each year. Notice that MBI’s proposal is to pay $20 million at the beginning of each year. You know that, because of the time value of money, a payment at the beginning of each year is worth more than a payment at the end of each year. Therefore, it’s not quite as simple as looking it up in the table. An adjustment needs to be made. Hint: A payment made at the very beginning of year 2 is identical to a payment made at the very end of year 1.]