Riskmetrics – Short course on risk management

advertisement

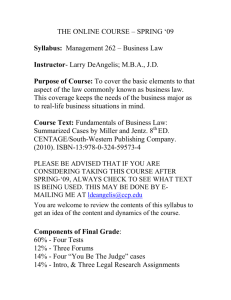

Spring 2005 Finance 4913/5550 - Advanced Risk Management Section 001 – TTH 9:00 – 10:15 BUS 123 Instructor – Office Phone E-Mail Course web site Related websites Syllabus Attachment Tim Krehbiel 104B BUS 744-8660 TLK@okstate.edu http://cba.okstate.edu/~tlk/ http://www.bus.okstate.edu/msqfe/ http://www.kiscommodities.com/ http://www.riskmetrics.com/ http://osu.okstate.edu/acadaffr/syllabusattachment.htm Office Hours (Tentative 1/5/05) Monday afternoon 2:00-3:30 Tuesday afternoon 2:00-3:30 Friday morning 9:00-10:30 Friday afternoon 2:00-3:30 Required Texts; Financial Risk Manager Handbook by Phillipe Jorion, 2nd edition, 2003 John Wiley and Sons Risk Management is the set of activities with objective to identify, evaluate and respond to risk exposures. Risk management has ascended in importance in recent decades due to technological progress, development of new markets and regulatory changes. Technological developments contributing to the risk management evolution include the quantum change in computing capabilities and development of models capable of isolating specific or firm wide risk exposures. Market developments contributing to the risk management evolution include the widespread application of securitization processes to the formerly bundled services of financial intermediaries and the development of derivative markets of all types. Deregulation of commodity markets has produced an environment similar to the financial services industry where each facet of previously bundled transactions can be disassembled into components. The unbundling of services/transactions has spurred the evolution of risk management as exposures to specific risks inherent in a position can be evaluated and transferred in markets specific to that risk exposure. Learning Objectives – Create an understanding of the use of financial contracts to reshape risk profiles. Refine understanding of risk evaluation techniques. Develop evaluation and problem solving skills. Develop analytical and communication skills. Course Calendar FIN 4913 Spring 2005 Date/Due Date Test #1 Test #2 Test #3 Quizzes/Assign Case Study Total Thursday February 17 Thursday March 31st Thursday May 5th 8:00-9:50 100 points 100 points 100 points 125 points 75 points 475points Spring 2005 – Advanced Risk Management Week 1 Week 2 Week 3 Week 4 Week 5 Week 6 Week 7 Week 8 Week 9 Spring Break Week 11 Week 12 Week 13 Week 14 Week 15 Week 16 Finals Week 10-Jan 17-Jan 24-Jan 31-Jan 7-Feb 14-Feb 21-Feb 28-Feb 7-Mar 14-Mar 21-Mar 28-Mar 4-Apr 11-Apr 18-Apr 25-Apr 2-May Chapter 2 Chapter 3 Chapter 4 Chapter 30 Chapter 31 Chapter 32 Chapter 11,12 Chapter 13 Chapter 14 Chapter 15,16 Chapter 17 Chapter 18.19 Chapter 20 Chapter 21 Chapter 22 Chapter 23 Test #1 Test #2 Test #3 Attendance Policy: You are expected to attend and take part in each class period. You are expected to actively participate in the class. Active participants are expected to: 1. 2. 3. 4. answer questions directed to the class, ask questions to clarify ideas, record notes, participate in activities with guest speakers. Active participation in class will improve your score on quizzes and exams. Bring your textbook to class. We will use material from the text during class. Bring to class the calculator you will use on exams. Most of the financial decisions we will investigate require that information be processed before effective decisions can be made. Bring an open and alert mind. “Minds are like parachutes they only work when they’re open.” You are expected to arrive in the classroom before the scheduled starting time. If you arrive late, enter the room quietly and do not disturb the other class participants. Exam/Quiz policy: You can prepare a 3”x5” note card for exams only. On this card you can write or print whatever course related material you would like. Each student is responsible for the advance preparation of his or her own card. All 3”x5” cards will be turned in with exams. If you can not take an exam at the scheduled time, contact me before the scheduled date of the exam. We will agree on a date for the makeup. Makeup exams will be completed before the graded test will be returned to the class. All test and quiz answers will be graded for correct punctuation and grammar. Test and quiz answers submitted by students that are simply copies of class notes or text material will receive zero credit. You must formulate your own answers from class and text materials. Quizzes: Quizzes/assignments will be announced periodically throughout the semester. No individual quiz/assignment will account for more than 40 points. Quizzes will be announced prior to the quiz date. The format of quizzes will vary depending on the subject matter to be tested. 3”x5” note cards are not permissible on quizzes. If you cannot take a quiz at the scheduled time, contact me before the scheduled date of the quiz. We will agree on a date for the makeup. Makeup quizzes will be completed before the graded quiz is returned to the class. Late work policy: Assignments/Case study are due in class on the due date indicated. Assignments/case study not turned in during class on the due date, are late. Late projects earn a maximum of 75% if turned in one calendar day late, 60% if turned in two-calendar days late, 50% if turned in three-calendar days late, zero if turned in more than three-calendar days late. Turn in all late assignments to, the Finance Department Unit Assistant, in Business 332A. Please ask her to record the date and time on the project. Academic dishonesty policy: Academic dishonesty will not be tolerated. If I suspect a problem during an exam I will warn then move the affected persons. Serious abuses will result in a zero for the test and initiation of University Academic Dishonesty procedures. Persons who submit answers to an essay exam question that are substantially similar in content will earn zeros on that portion of the exam. Persons who submit material for projects that is substantially similar in content will earn zeros for that project. Plagiarism: It is increasingly easy to gain access to the ideas of others. Using someone else’s ideas without providing proper citation is plagiarism. Plagiarism will not be tolerated. If your contribution to an assignment is assembling the thoughts of others and pasting them in the appropriate order let the reader know. This is a matter of professional ethics as well as a legal concern. Cite all sources from which material has been transferred substantially unedited to your own work. This includes web sites and other Internet sources as well as all printed resources. The objective of providing references is to allow the reader to locate each source. An appropriate citation format will provide all the relevant details to locate the cited work. In the circumstance in which you use the ideas, data, analysis, etc. produced by others, you become responsible for the accuracy and integrity of this material. As a professional practice it is wise to question the veracity of any resource on which you are basing your reputation. If/when plagiarism is identified in material submitted for grading; the affected portion of the assignment/test would earn a zero. Turabian, Kate L., A Manual for Writers of Term Papers, Theses, and Dissertations, The University of Chicago Press; is a valuable resource for determining the proper format for references. Disabilities: If any member of this class feels that he/she has a disability and needs special accommodations of any nature whatsoever, the instructor will work with you and the Office of Disabled Student Services, 326 Student Union, to provide reasonable accommodations to ensure that you have a fair opportunity to perform in this class. Please (1) advise the instructor of such disability and the desired accommodations at some point before, during, or immediately after the first scheduled class period and (2) contact the Office of disabled Student Services so that they can provide the required, written verification from that office to the instructor.