FBE 525 - marshall inside . usc .edu

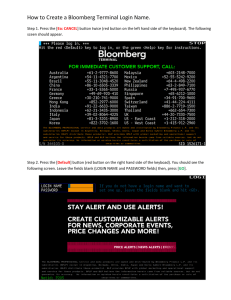

advertisement

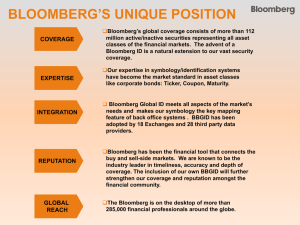

525 Week 9 Objectives FBE 525 - Class Objectives -- J. K. Dietrich Week 9 – October 19, 2006 (or Saturday, October 14, 2006) Dimensional Fund Advisors: 2002 – Discussion Questions This case describes a specific strategy in the asset-management business and introduces issues associated with product development, changing market structure, and the importance of implementation in realizing the most value from an approach. Some questions to keep in mind in analyzing the case are: 1) How does the history and evolution of DFA influence its “philosophy” and approach to developing a business strategy? 2) What is a product in the asset management business and what are examples of different product types? Compare DFA’s products to others in the asset-management business and what are their differences and similarities? How does “product design” and implementation strategy interact for DFA and other asset managers? 3) How does DFA define its market and what are its sources of competitive advantage? 4) What is happening to the demand for managed assets in the United States and in the world that affects the future market for asset-management products and, given this, how do you and DFA expect the market for these product to develop in the future? Bloomberg L. P. – Discussion Questions While the case writer is emphasizing human resource issues in this case, our purpose in discussing Bloomberg is to examine value creation in information-based financial services. Despite this disclaimer, human capital and labor are important in value production in this business and part of our focus will be to see what that means to a financial manager or strategist in this industry. The case is unique in providing an up-to-the-minute look at information services at the wholesale level. After analyzing and discussing this case, students should understand the relevance of information technology to financial services like securities and asset management services and have some understanding of issues in making profits in providing these services. Again, determinants of market power and competitive advantage are of substantial interest. Some general questions to keep in mind in reading the case are: 1) What is Bloomberg’s product and what value does that product have to customers? What is old and what is new in Bloomberg’s product? Who are its customers, how large is its market, and who are its competition? 2) What are the sources of revenues and costs for Bloomberg? Can you provide some rough estimates of the cost side over time? How is its historical model apt to be changed by technological change, if at all? 3) What are the factors affecting economies of scale and economies of scope for Bloomberg? Does Bloomberg experience the effects of either of these? 4) What are the strategic issues facing Bloomberg as discussed in the case? Given your personal experience with the industry or with related businesses, what are other strategic challenges for the firm? 525 Week 9 Objectives Suggested Wall Street Journal (WSJ) or other Articles October 9 , 2006 “PNC Nears $6 Billion Mercantile Deal” (A3) – Another bank merger, illustrating consolidation in banking in U.S. and possible reasons for value creation “Bad Loans Draw Bad Blood” (C1) – Risks in mortgage lending, including buying back soured loans, illustrates long-tailed credit risk from that business “NYSE’s Speed Test Starts Off Well” (C2) – Shortening of response time for transactions using electronics on traditional exchange may change order flows on oldest exchange October 10 , 2006 “Private-Equity Firms Face Anticompetitive Probe” (A3) – Possible litigation from auction and bidding processes followed by cozy private-equity firms’ relations “Sovereign to Force CEO to Resign In Compromise With Santander” (A3) – Another good story about how poor performance leads to changes in CEOs “Spitzer Aims At Another Mark: Fee Disclosure” (C1) – Regulation of asset-management firms conditions economic environment “Tracking the Numbers: PNC Merger May Put to the Test Regionals’ Ability to Compete” (C3) – Challenges to banks as business restructures “Moody’s, S&P Still Hold Advantage” (C5) – Discussion of credit-rating business provides insights into nature of important industry